This version of the form is not currently in use and is provided for reference only. Download this version of

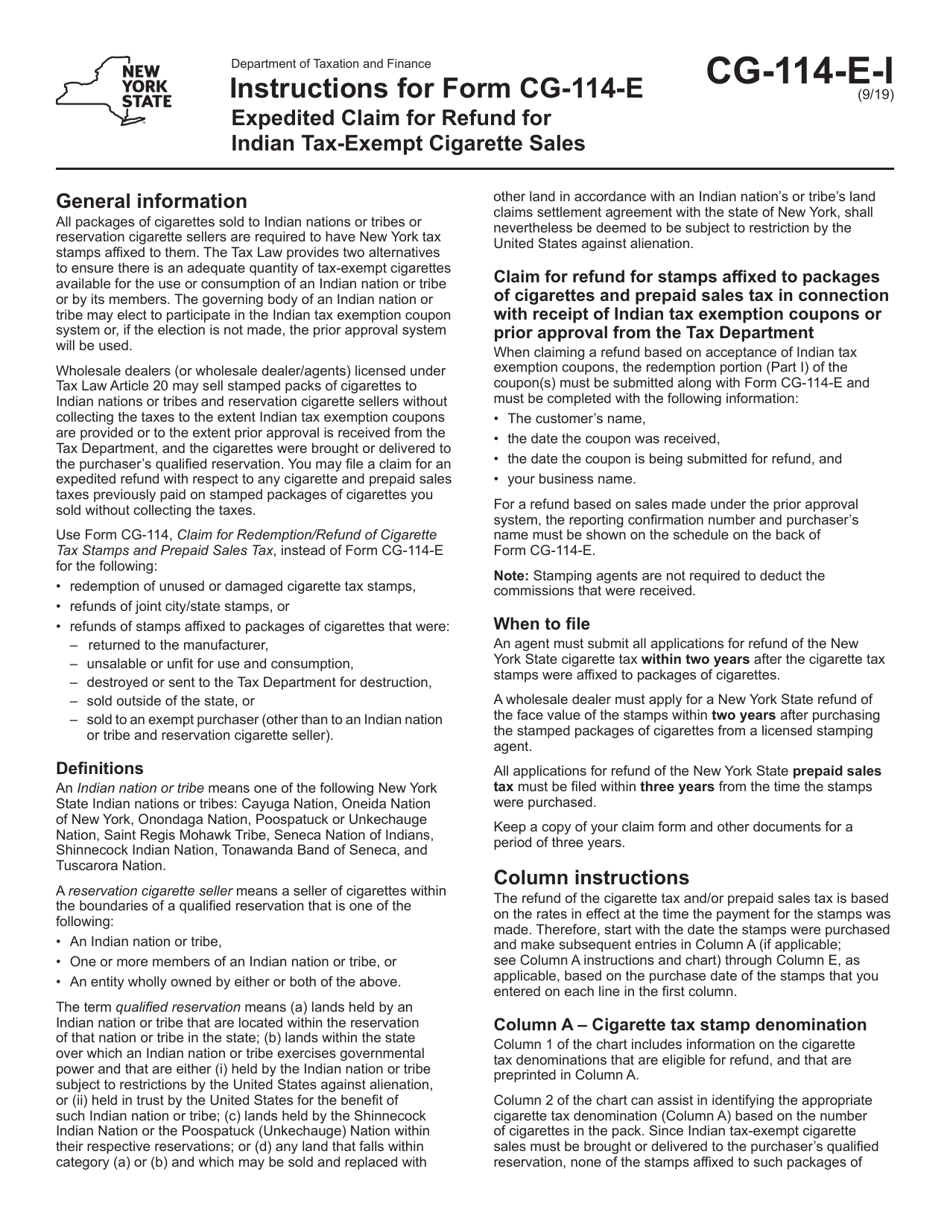

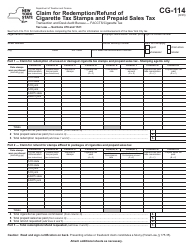

Instructions for Form CG-114-E

for the current year.

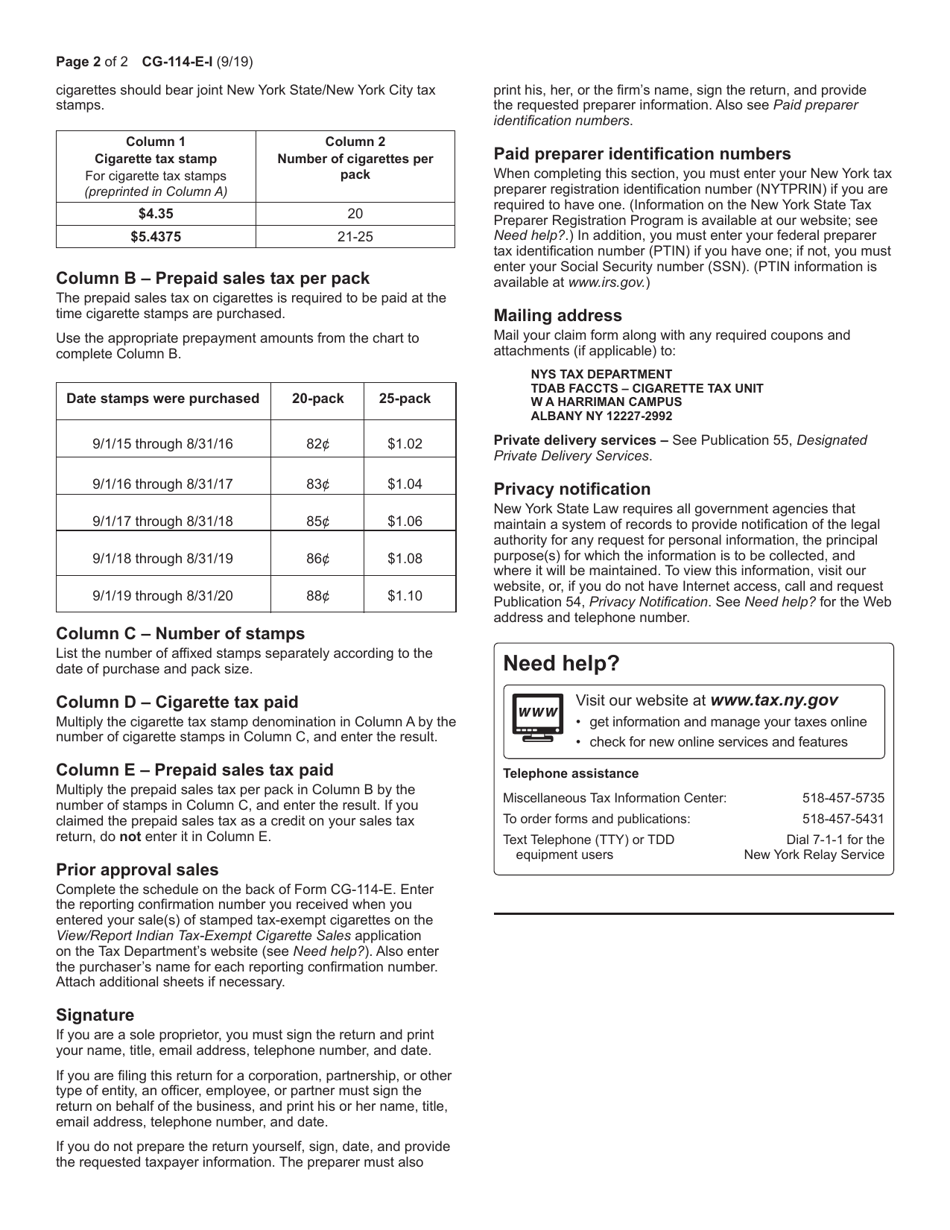

Instructions for Form CG-114-E Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales - New York

This document contains official instructions for Form CG-114-E , Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CG-114-E is available for download through this link.

FAQ

Q: What is Form CG-114-E?

A: Form CG-114-E is a form used to file an Expedited Claim for Refund for Indian Tax-Exempt Cigarette Sales in New York.

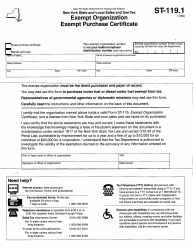

Q: Who can use Form CG-114-E?

A: This form can be used by Indian tribes or tribal retailers who are exempt from paying taxes on cigarette sales.

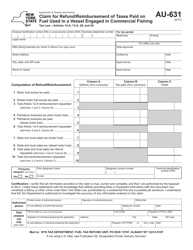

Q: What is the purpose of Form CG-114-E?

A: The purpose of this form is to claim a refund for taxes paid on cigarette sales that are exempt for Indian tribes or tribal retailers.

Q: How do I fill out Form CG-114-E?

A: You need to provide information about the Indian tribe, tribal retailer, and the exempt cigarette sales on the form.

Q: Is there a deadline for filing Form CG-114-E?

A: Yes, the form must be filed within two years from the end of the calendar year in which the tax was paid.

Q: How long does it take to process the claim?

A: The processing time for the claim can vary, but it typically takes several months.

Instruction Details:

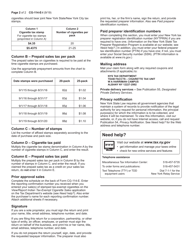

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.