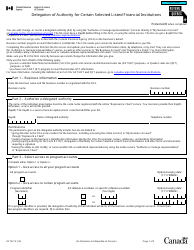

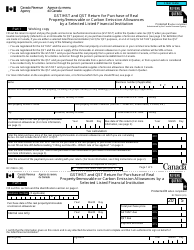

This version of the form is not currently in use and is provided for reference only. Download this version of

Form D (PFA713)

for the current year.

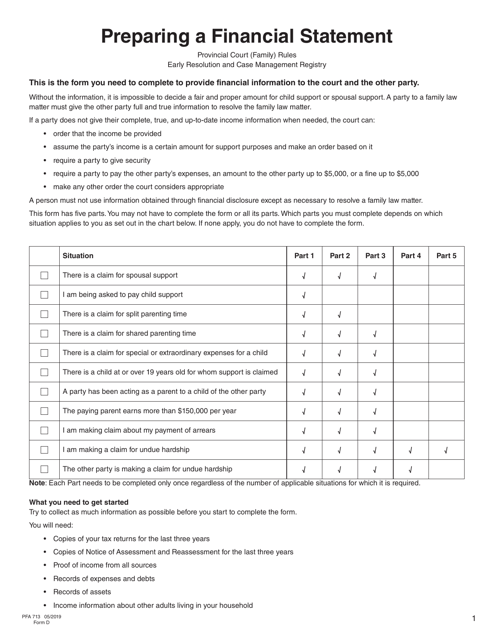

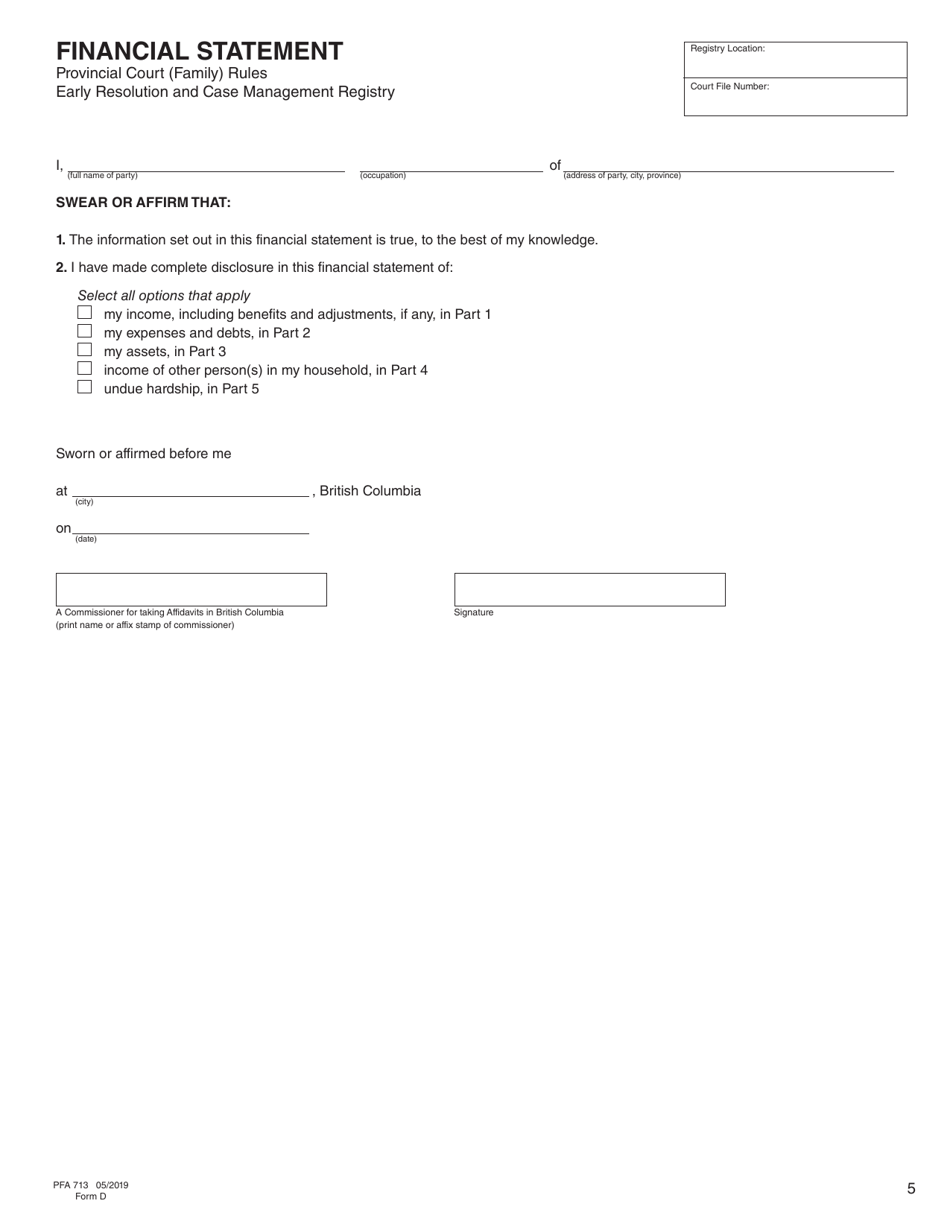

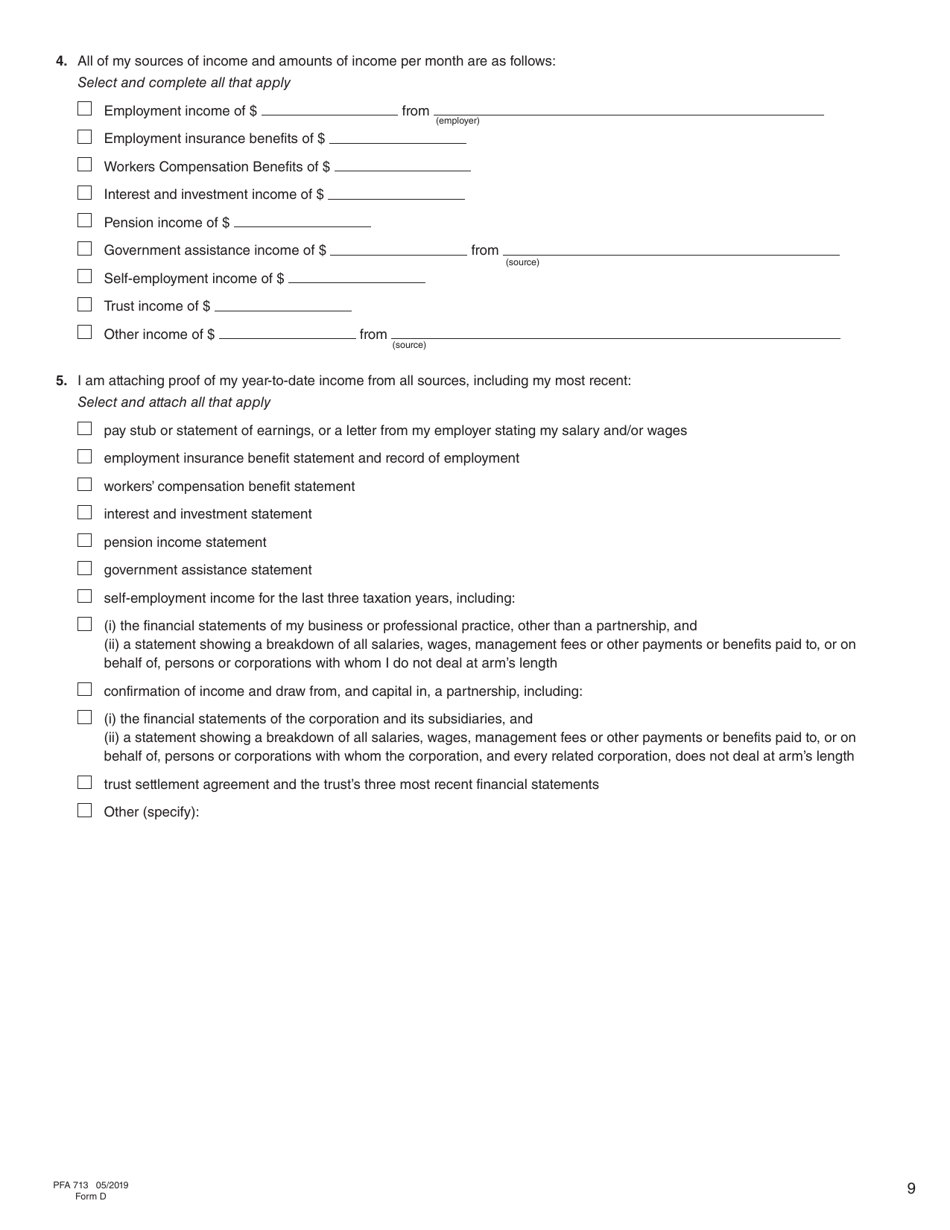

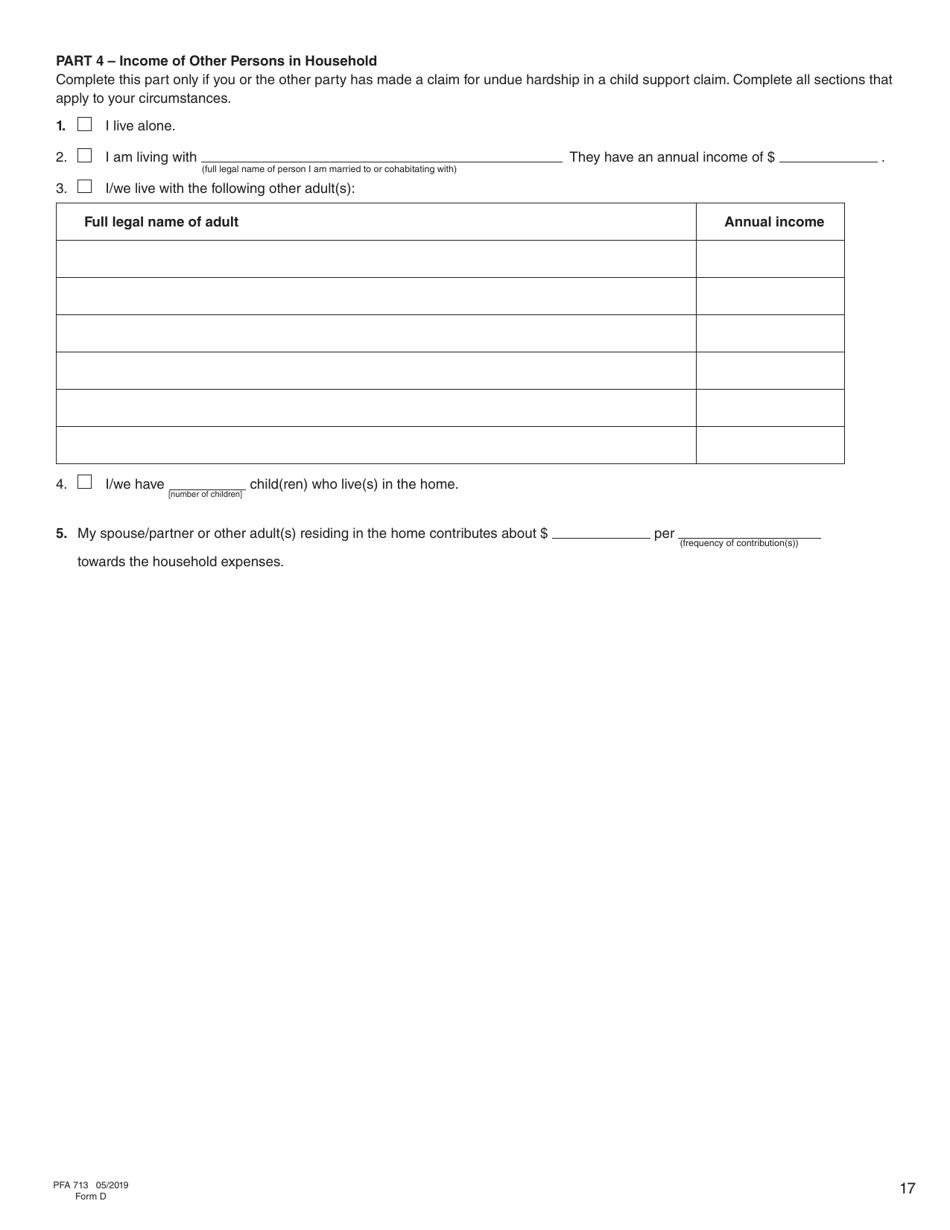

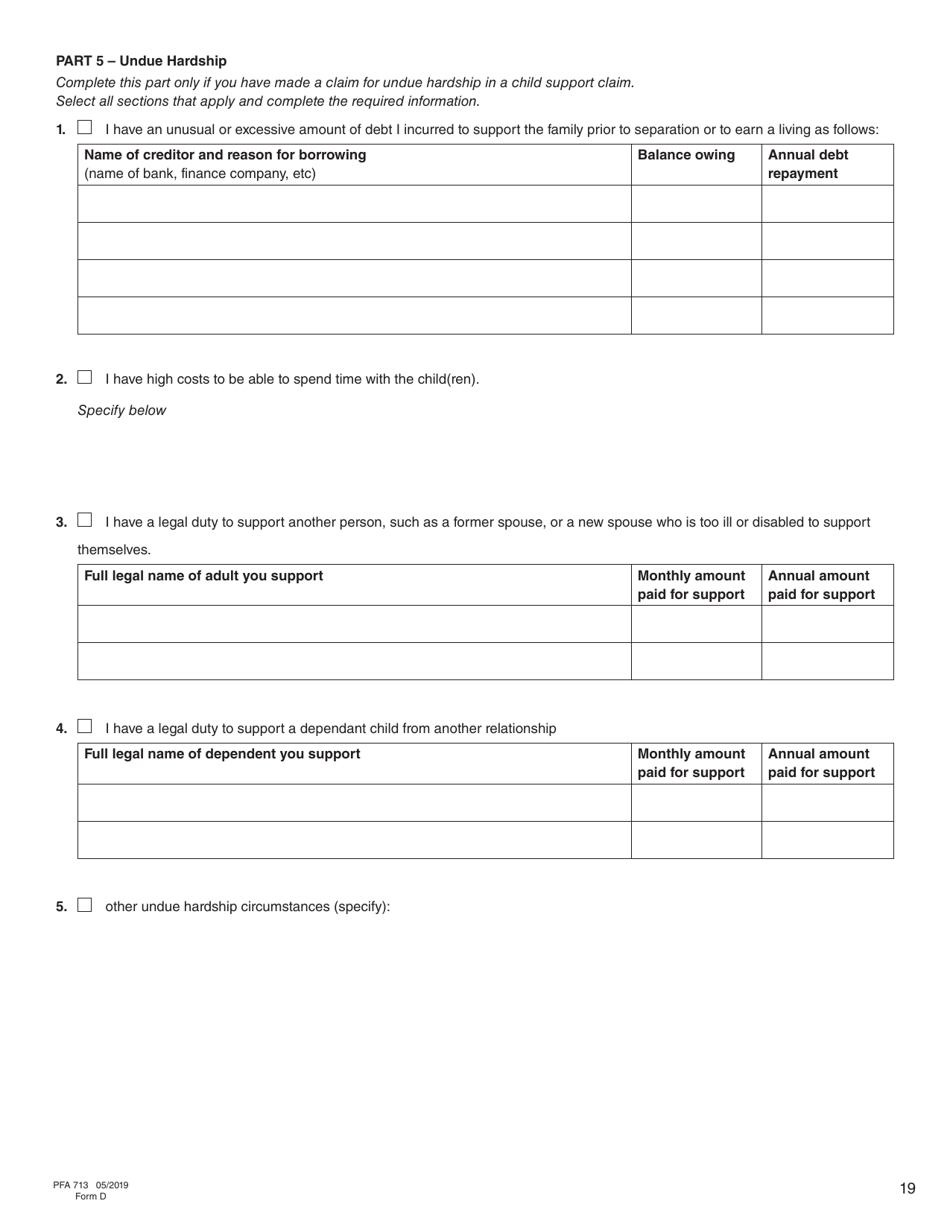

Form D (PFA713) Financial Statement - British Columbia, Canada

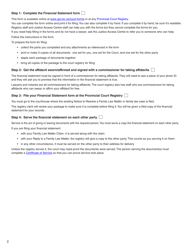

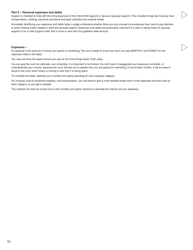

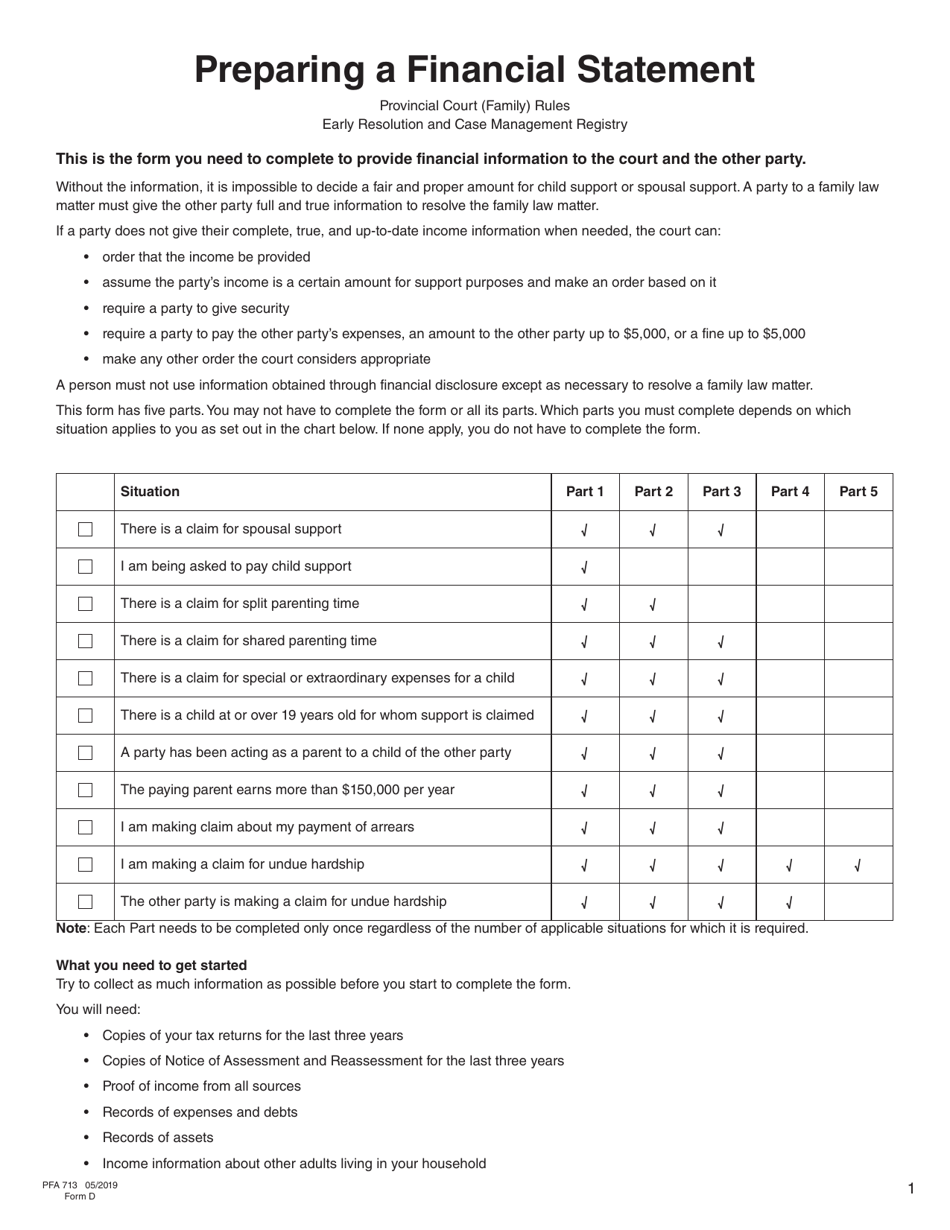

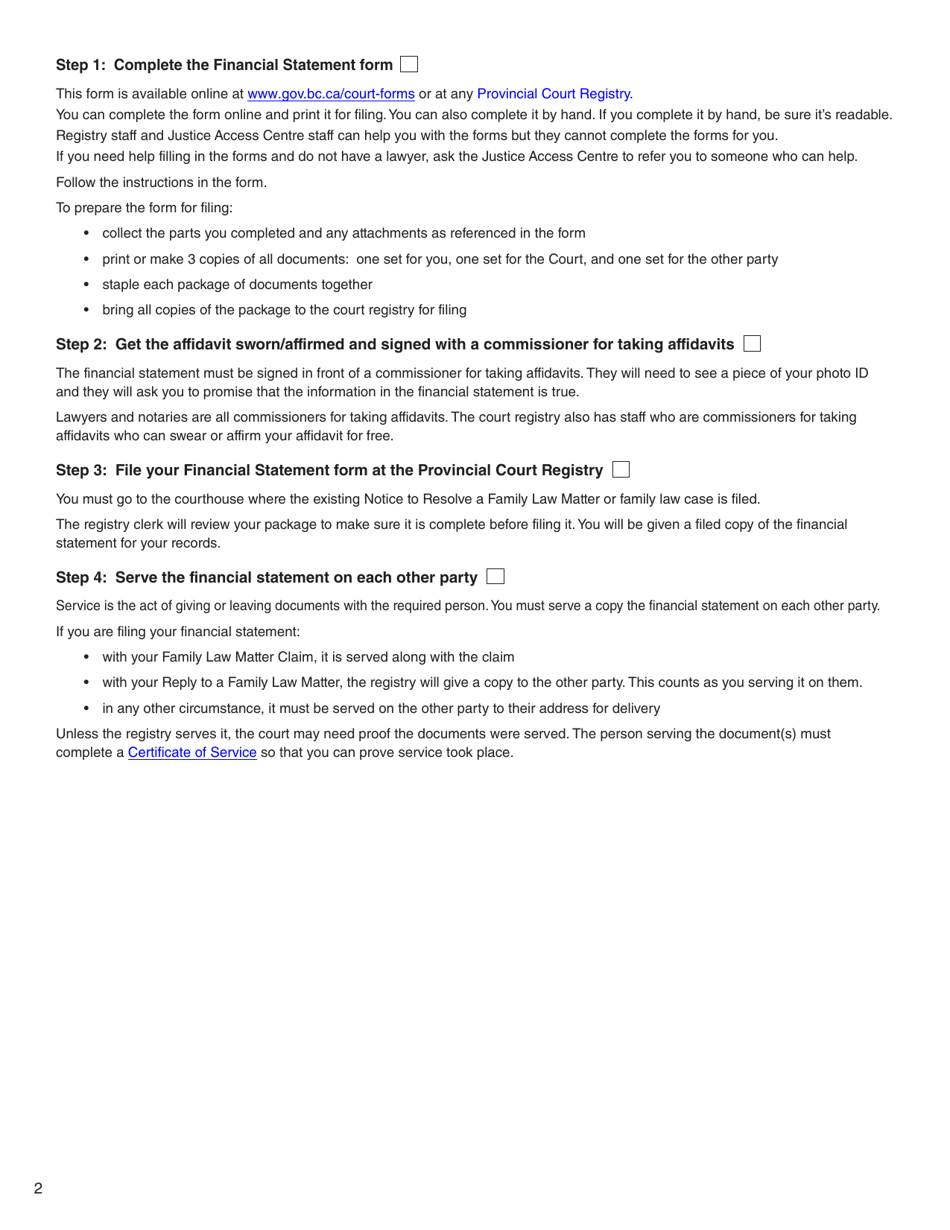

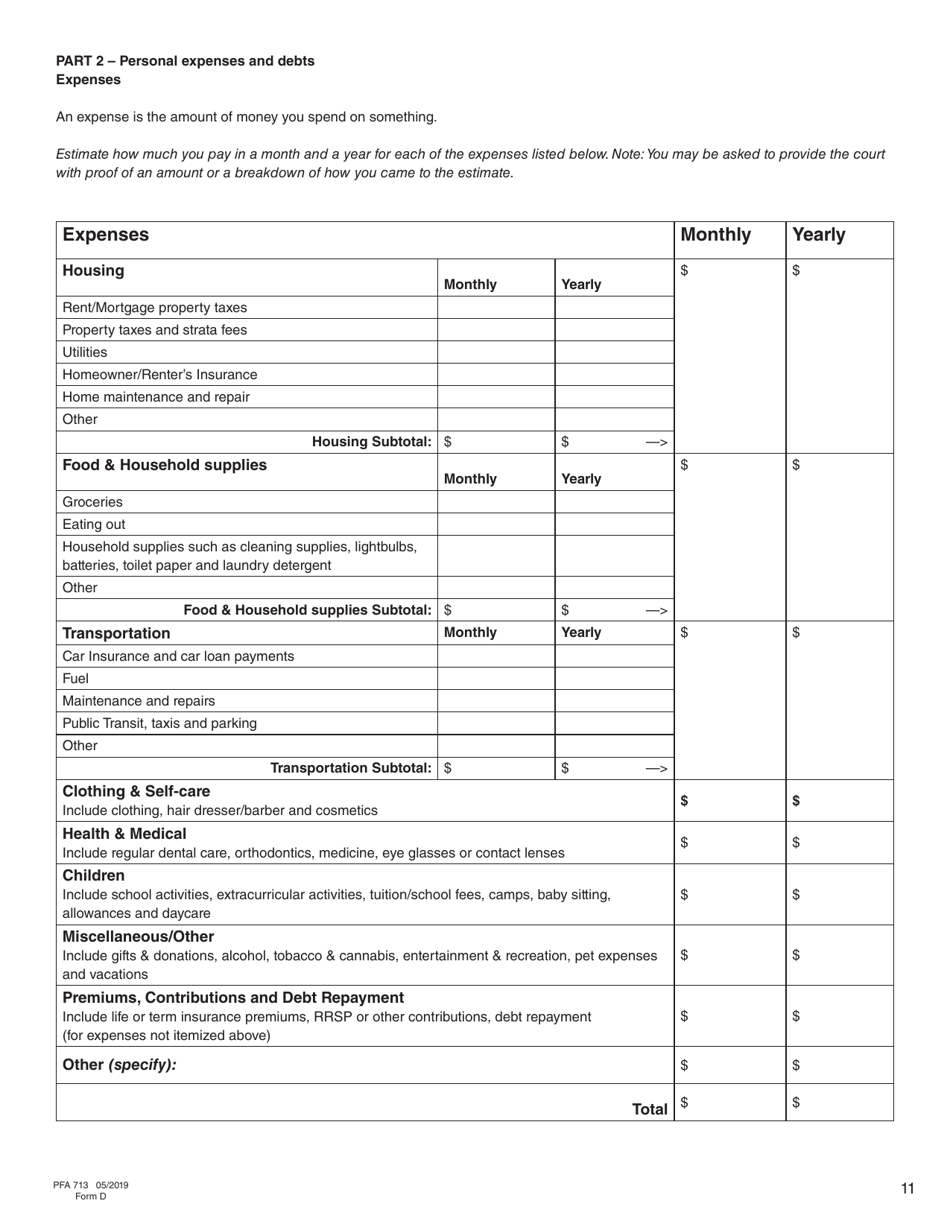

Form D (PFA713) Financial Statement is used in British Columbia, Canada for individuals to provide detailed information about their financial situation during a legal process, such as divorce or separation. It helps the court in assessing matters related to property division, child support, and spousal support.

The Form D (PFA713) Financial Statement in British Columbia, Canada is typically filed by individuals who are involved in a legal proceeding such as a divorce or separation and need to disclose their financial information to the court.

FAQ

Q: What is Form D (PFA713)?

A: Form D (PFA713) is a Financial Statement used in British Columbia, Canada.

Q: Who uses Form D (PFA713)?

A: Form D (PFA713) is used by individuals in British Columbia, Canada to provide a detailed summary of their financial situation.

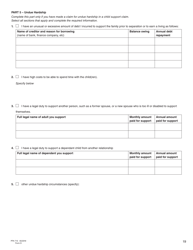

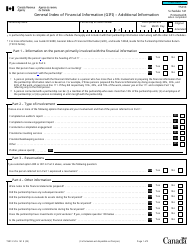

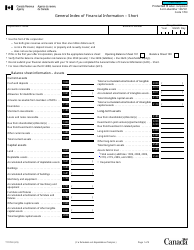

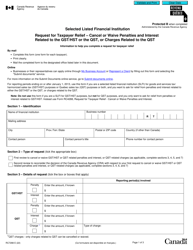

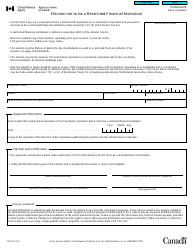

Q: What information is included in Form D (PFA713)?

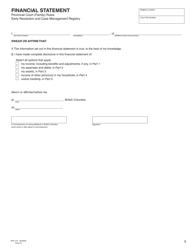

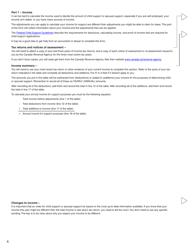

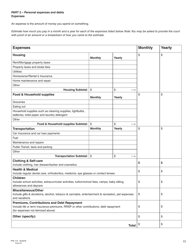

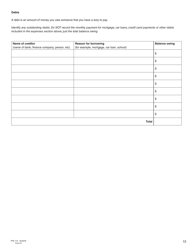

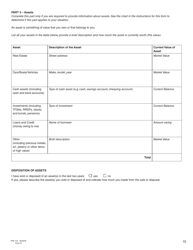

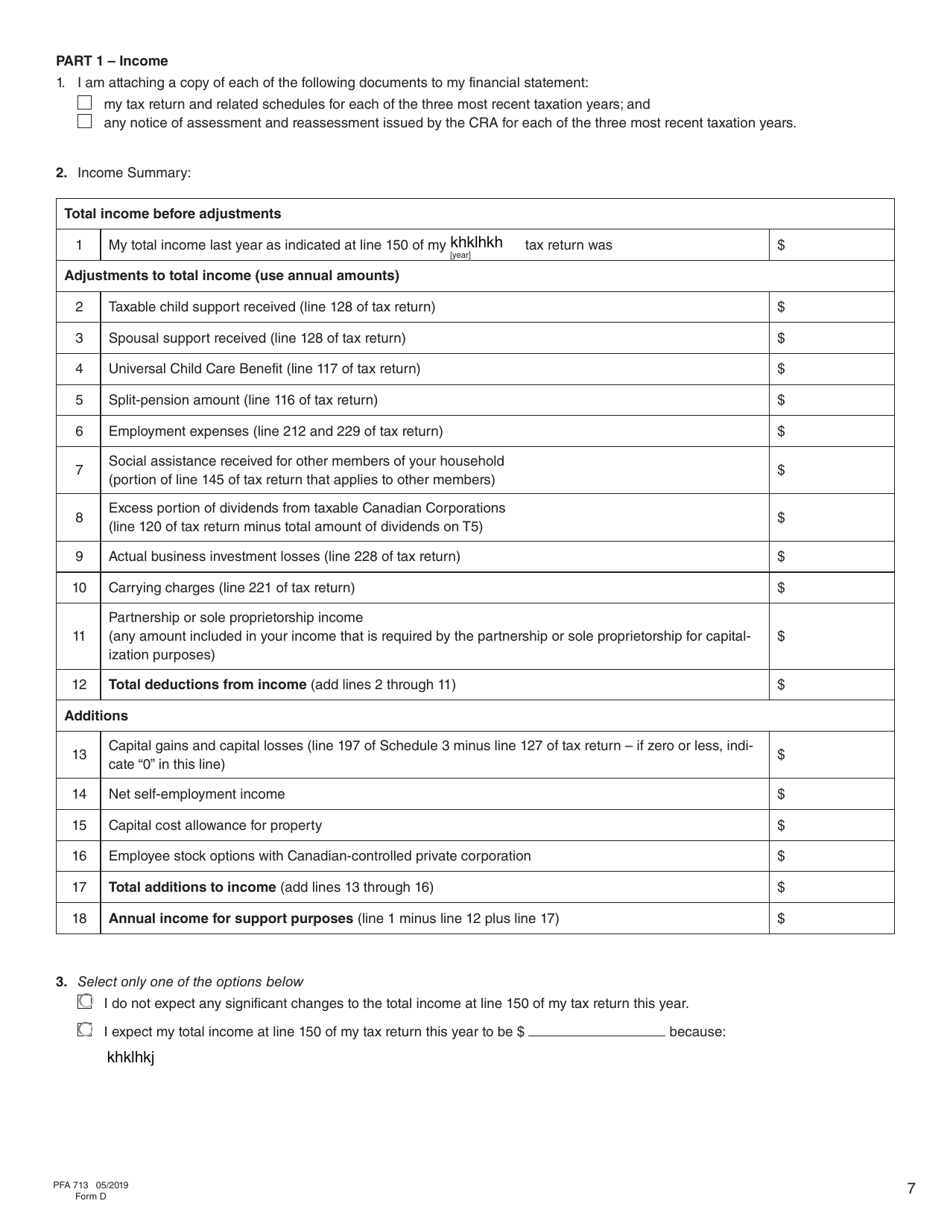

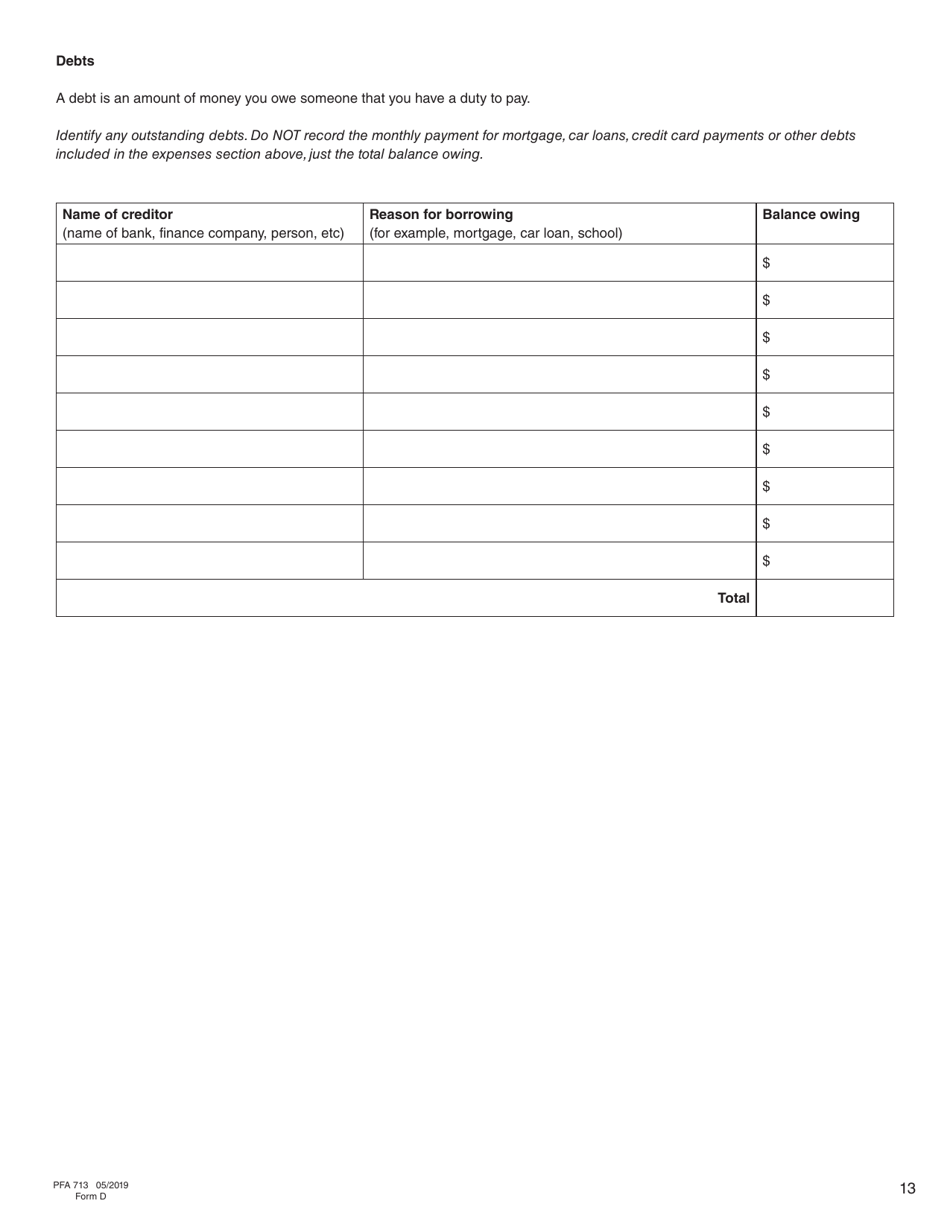

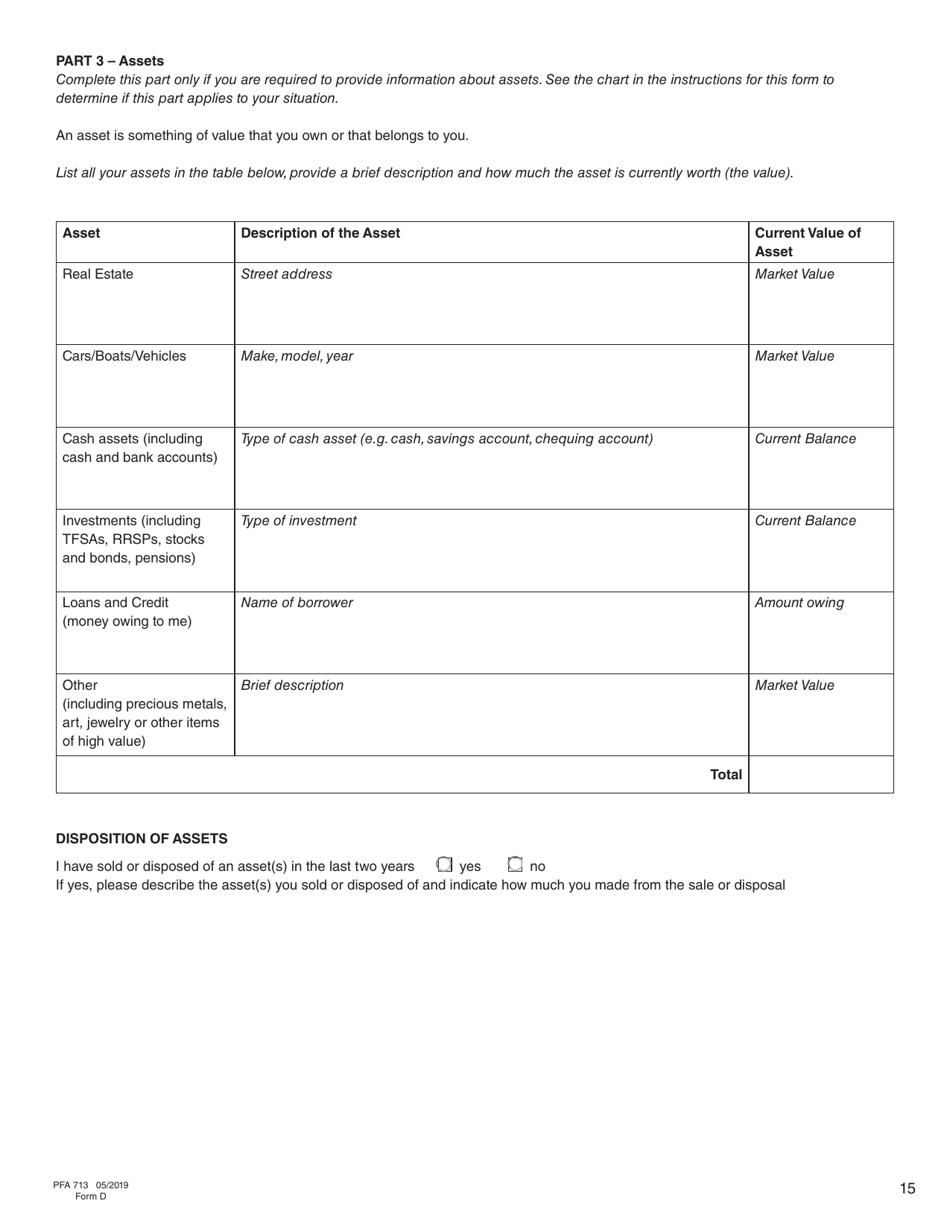

A: Form D (PFA713) includes details about a person's income, expenses, assets, and liabilities.

Q: Why is Form D (PFA713) important?

A: Form D (PFA713) is important because it provides a comprehensive snapshot of a person's financial situation, which can be used in legal proceedings such as divorce or child support cases.