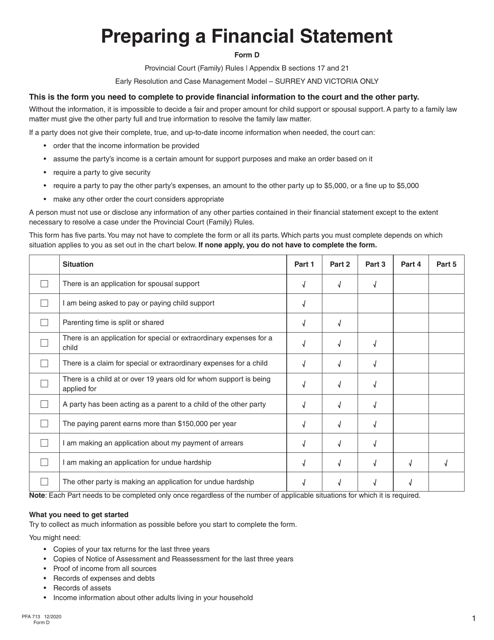

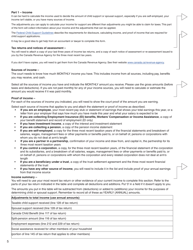

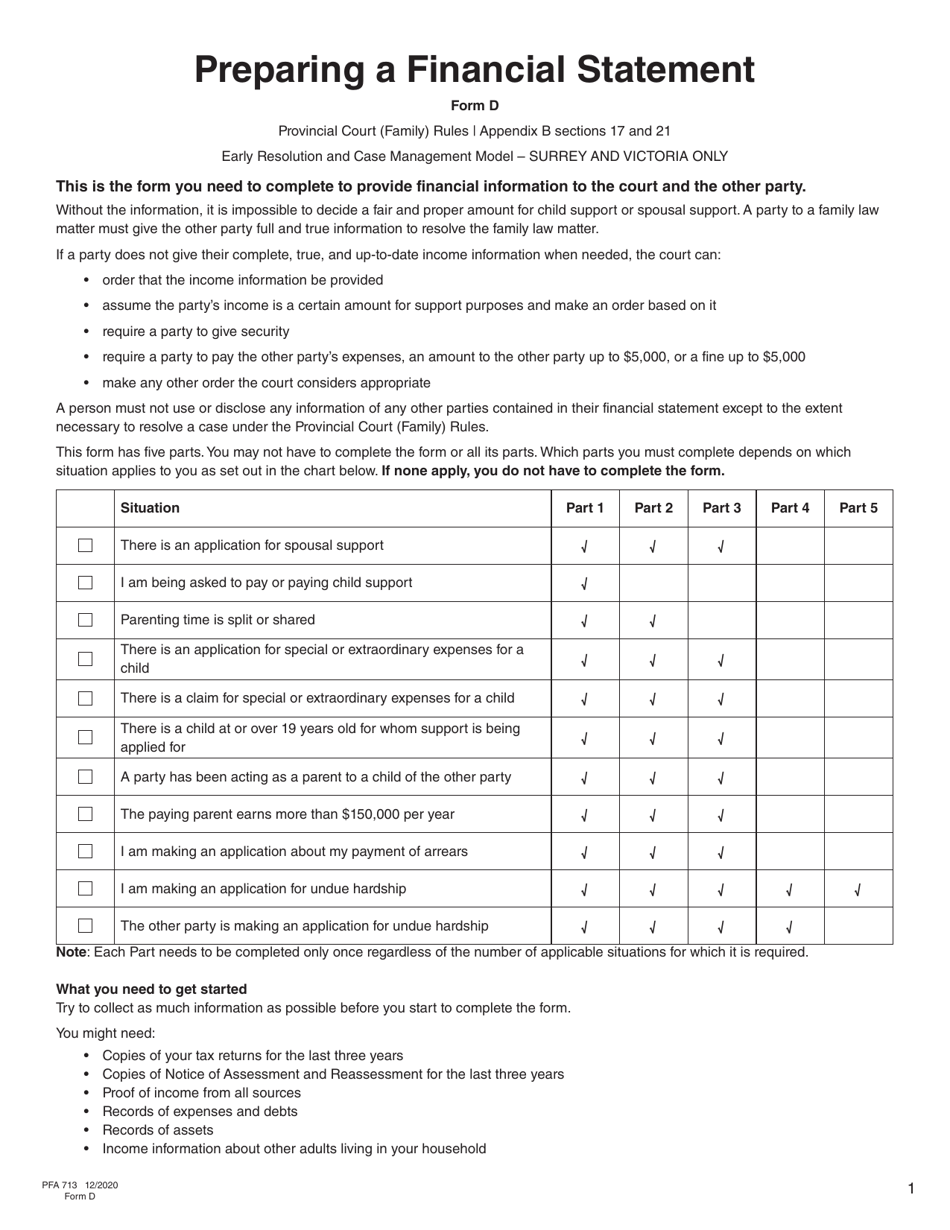

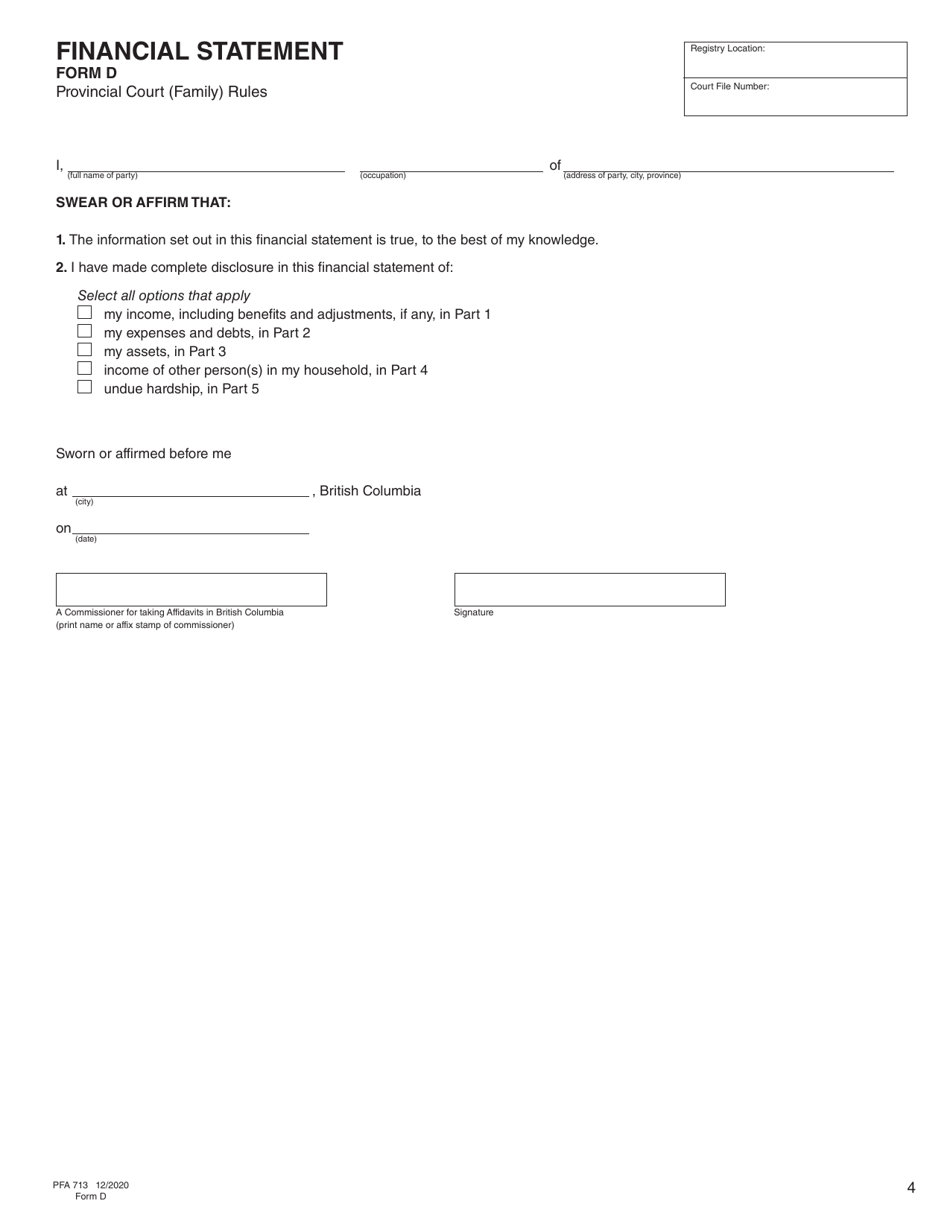

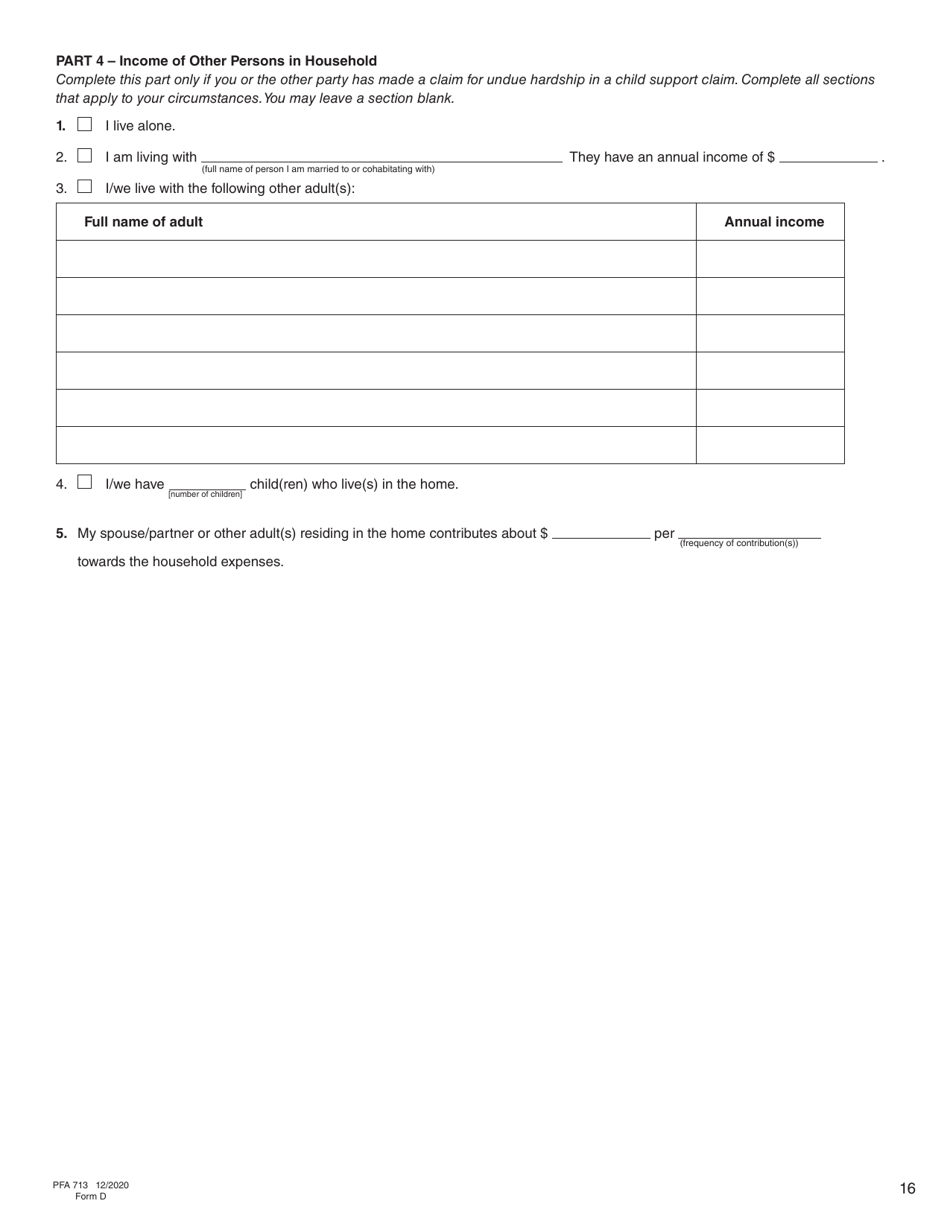

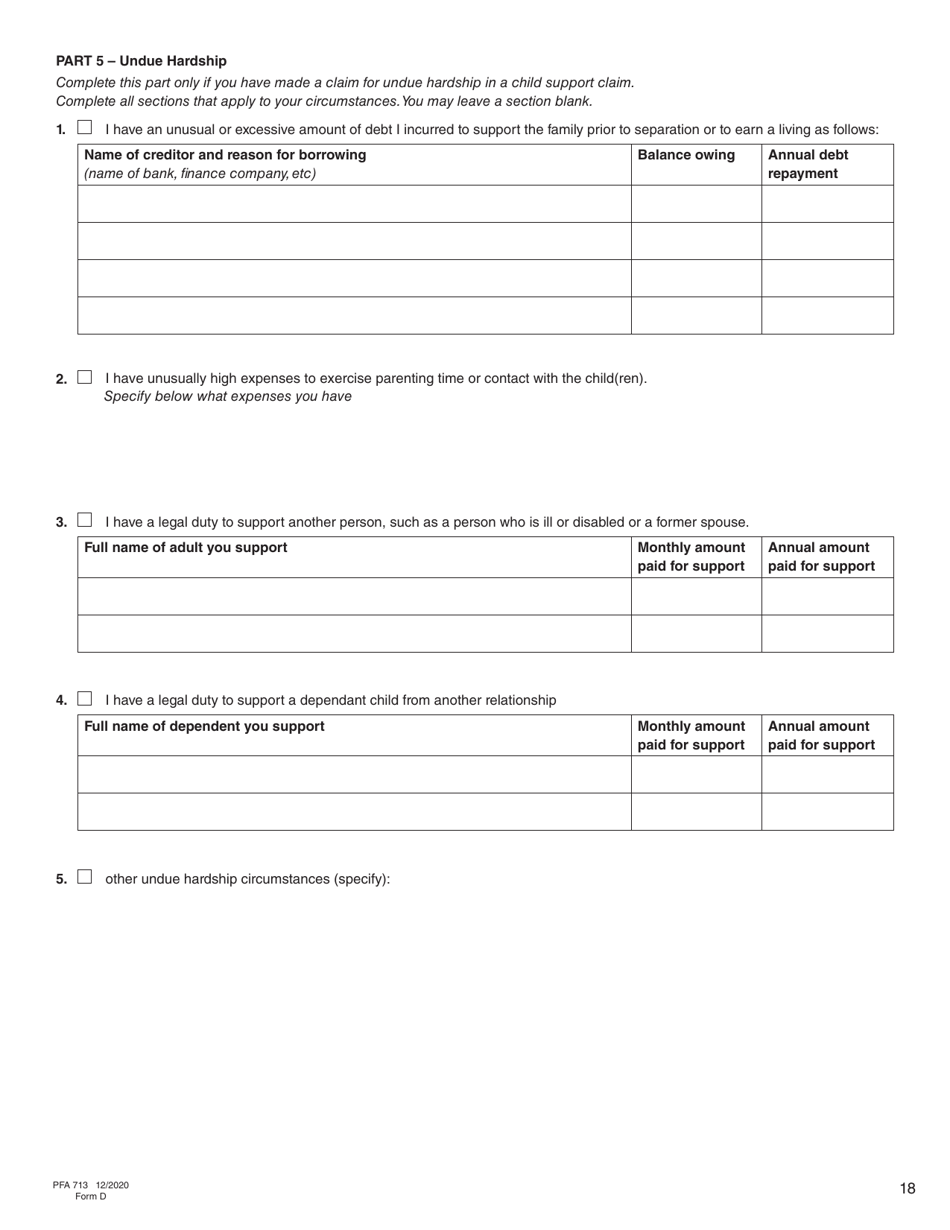

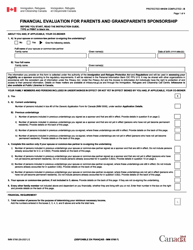

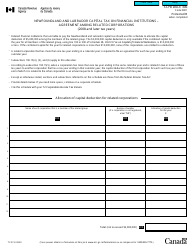

Form D (PFA713) Financial Statement - British Columbia, Canada

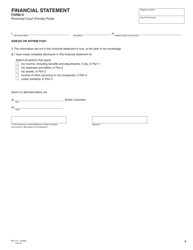

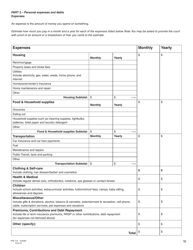

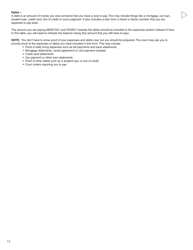

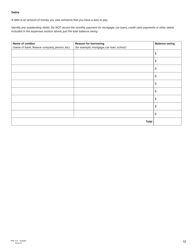

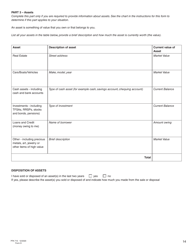

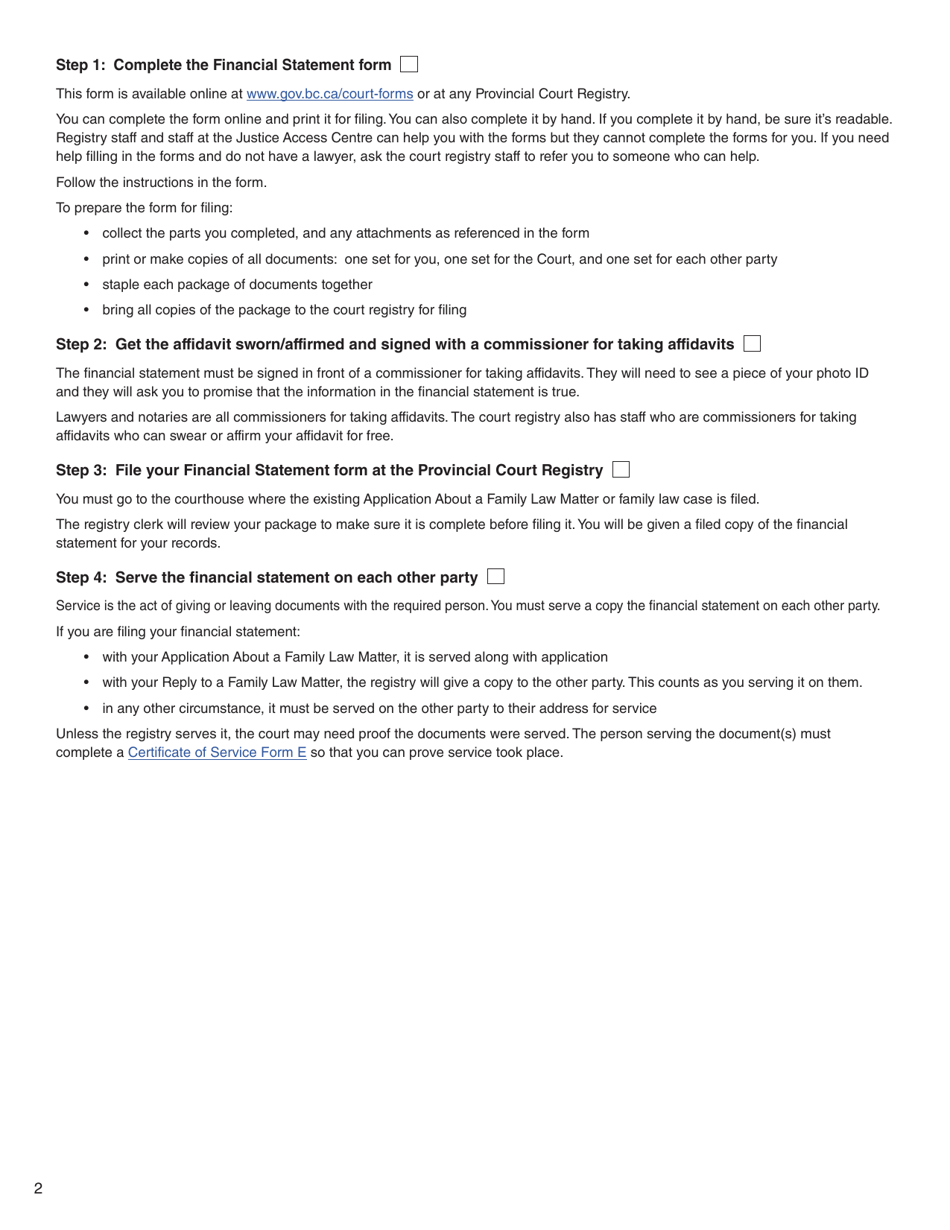

Form D (PFA713) Financial Statement is used in British Columbia, Canada for filing financial information during court proceedings related to family law matters, such as divorce, child support, and spousal support. It provides a detailed breakdown of a person's income, expenses, assets, and liabilities.

The Form D (PFA713) Financial Statement in British Columbia, Canada is typically filed by individuals or businesses involved in a court proceeding related to family law matters, such as separation or divorce.

Form D (PFA713) Financial Statement - British Columbia, Canada - Frequently Asked Questions (FAQ)

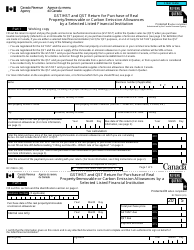

Q: What is Form D (PFA713) Financial Statement?

A: Form D (PFA713) Financial Statement is a document used in British Columbia, Canada to disclose financial information in legal proceedings.

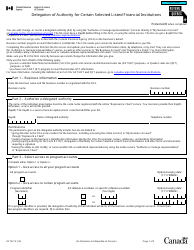

Q: Who needs to fill out Form D (PFA713) Financial Statement?

A: Individuals involved in legal proceedings in British Columbia, Canada may be required to fill out Form D (PFA713) Financial Statement.

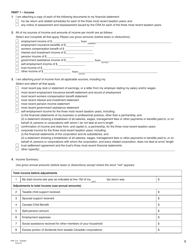

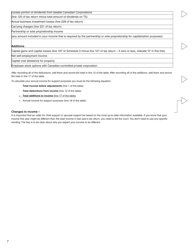

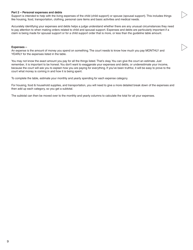

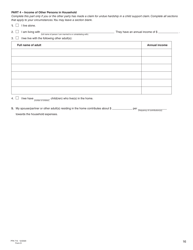

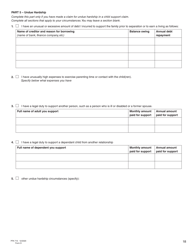

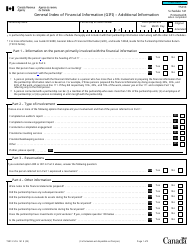

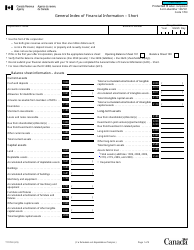

Q: What information is included in Form D (PFA713) Financial Statement?

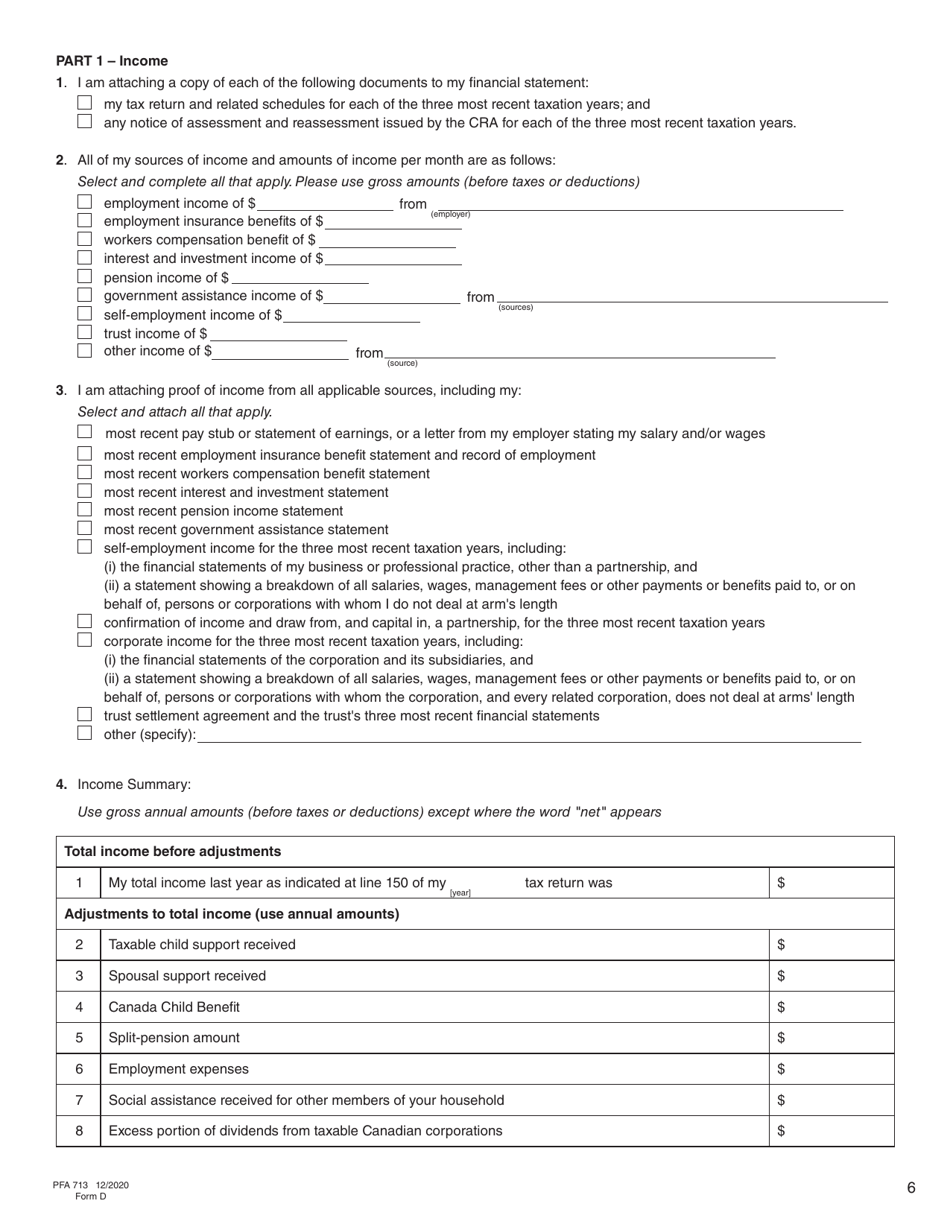

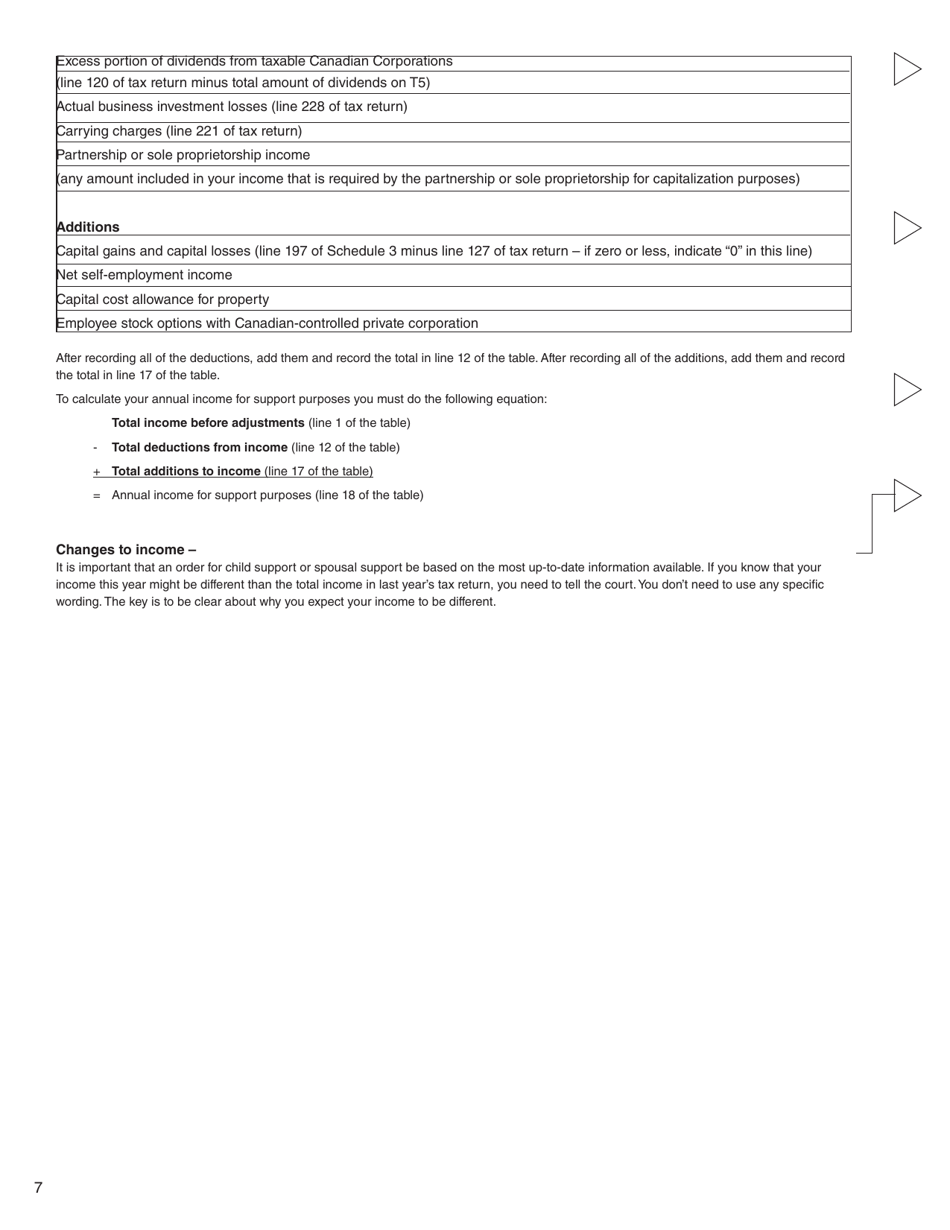

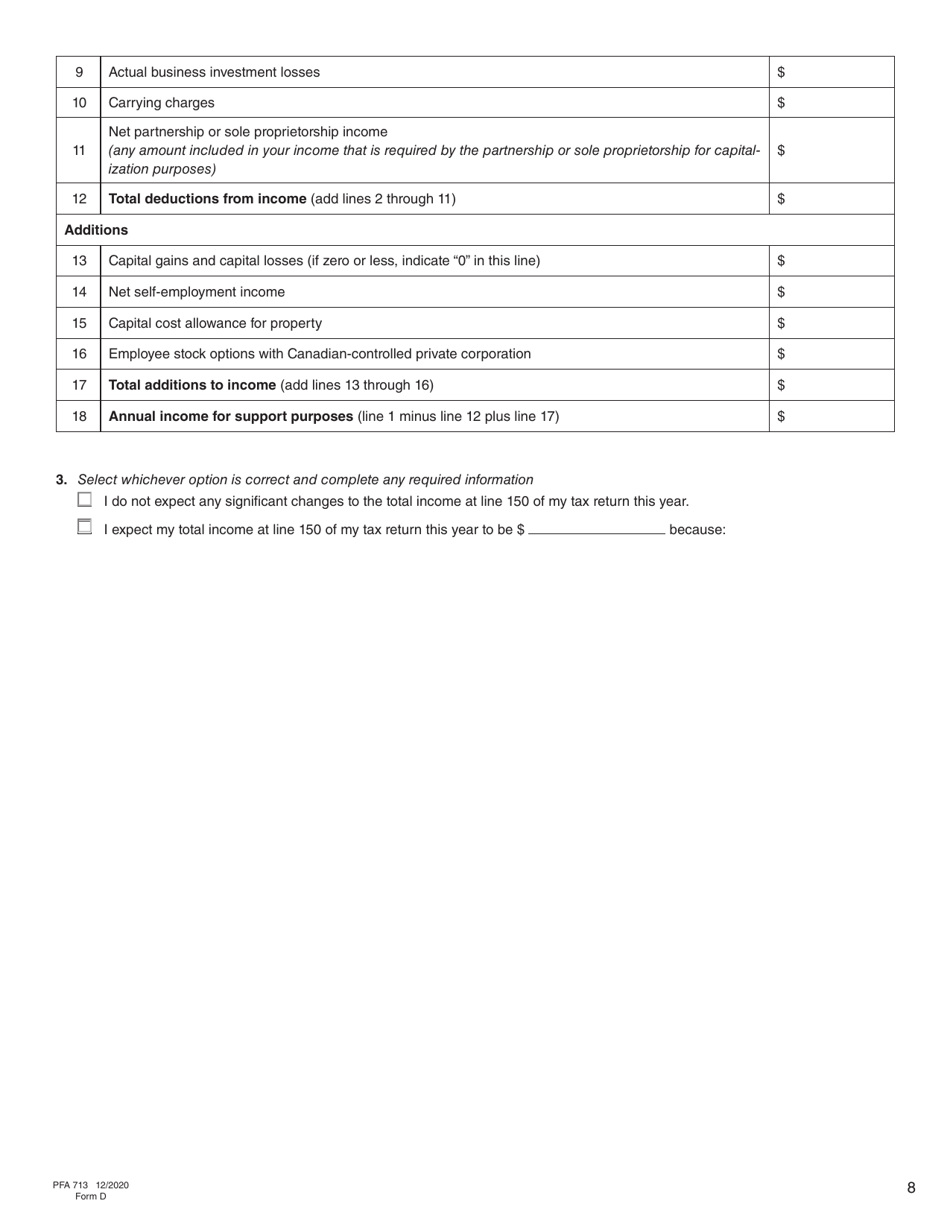

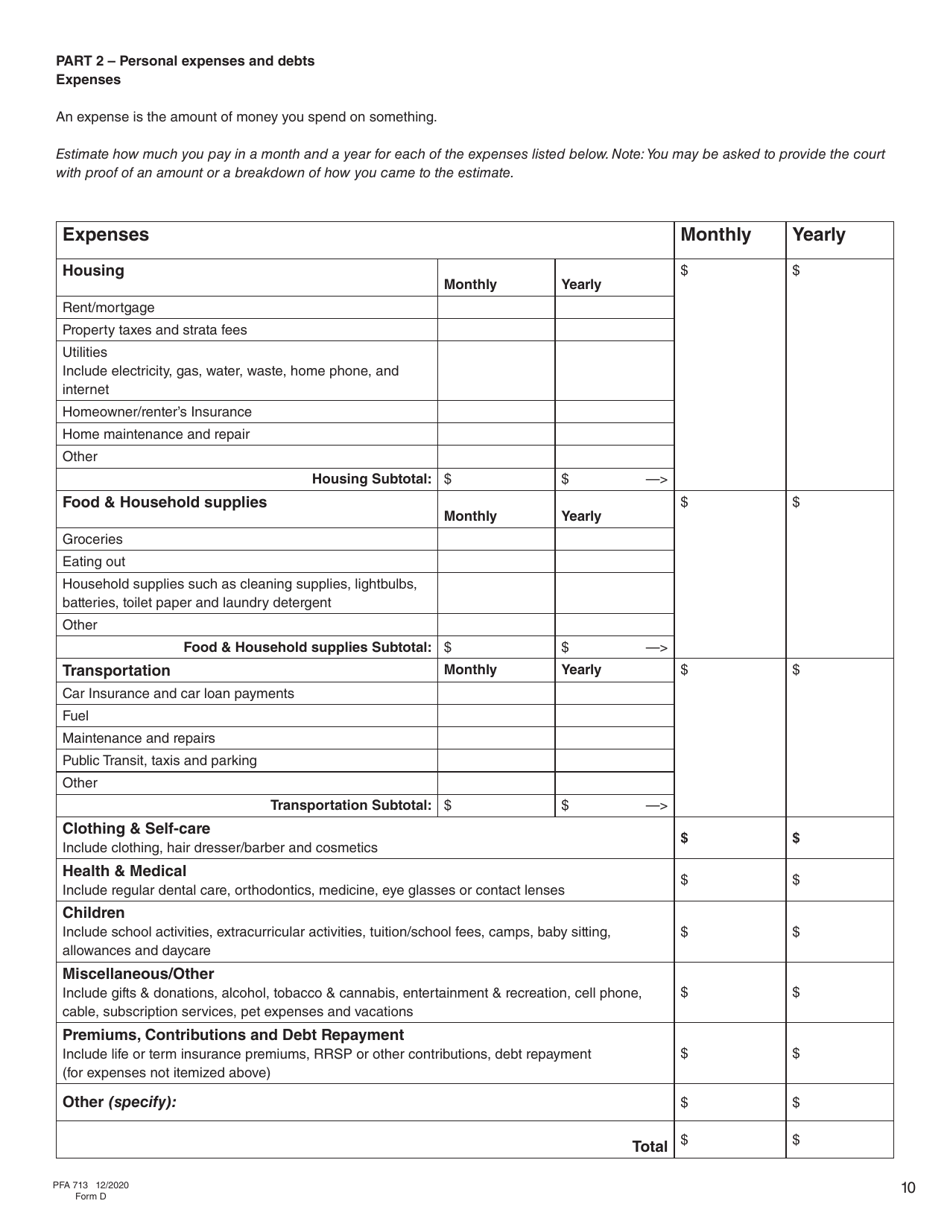

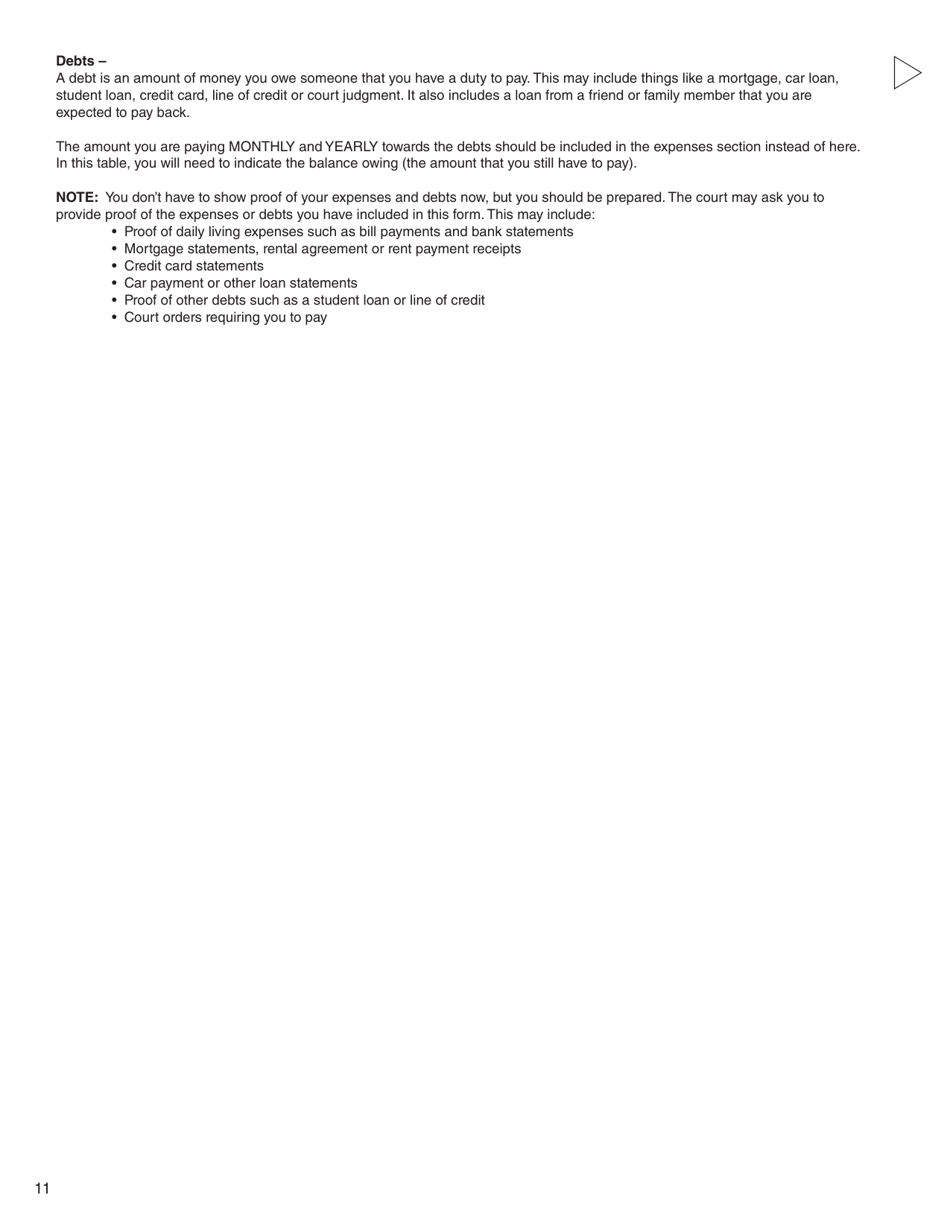

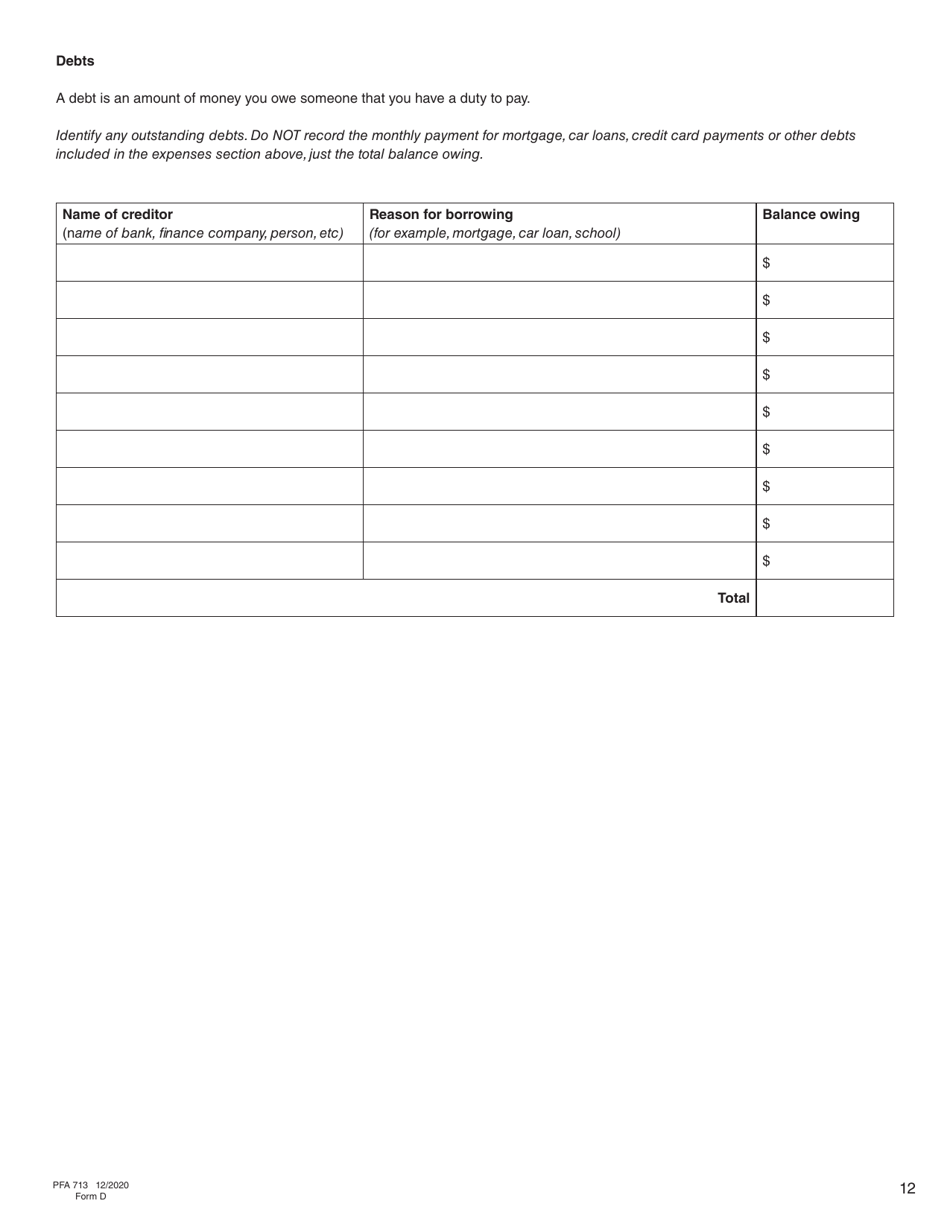

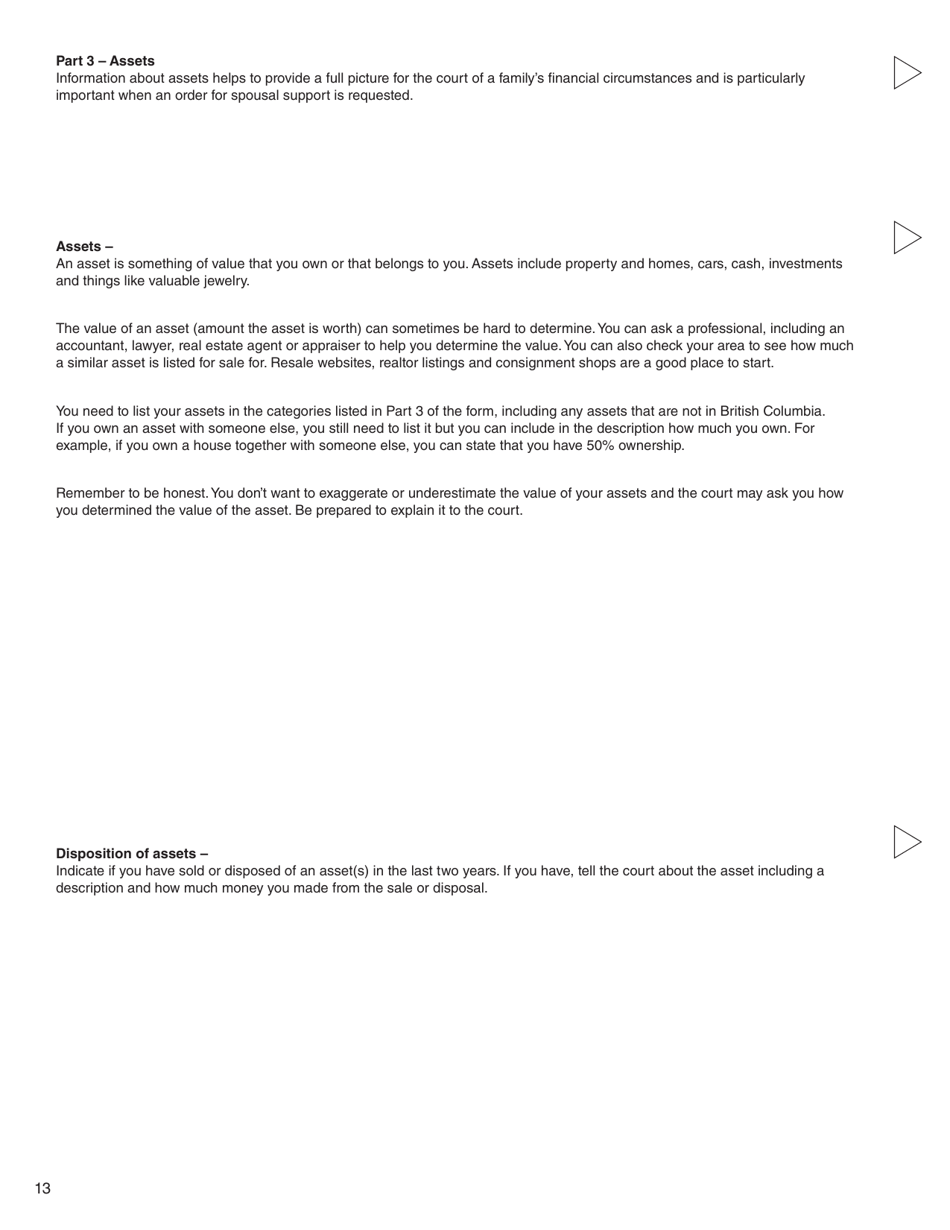

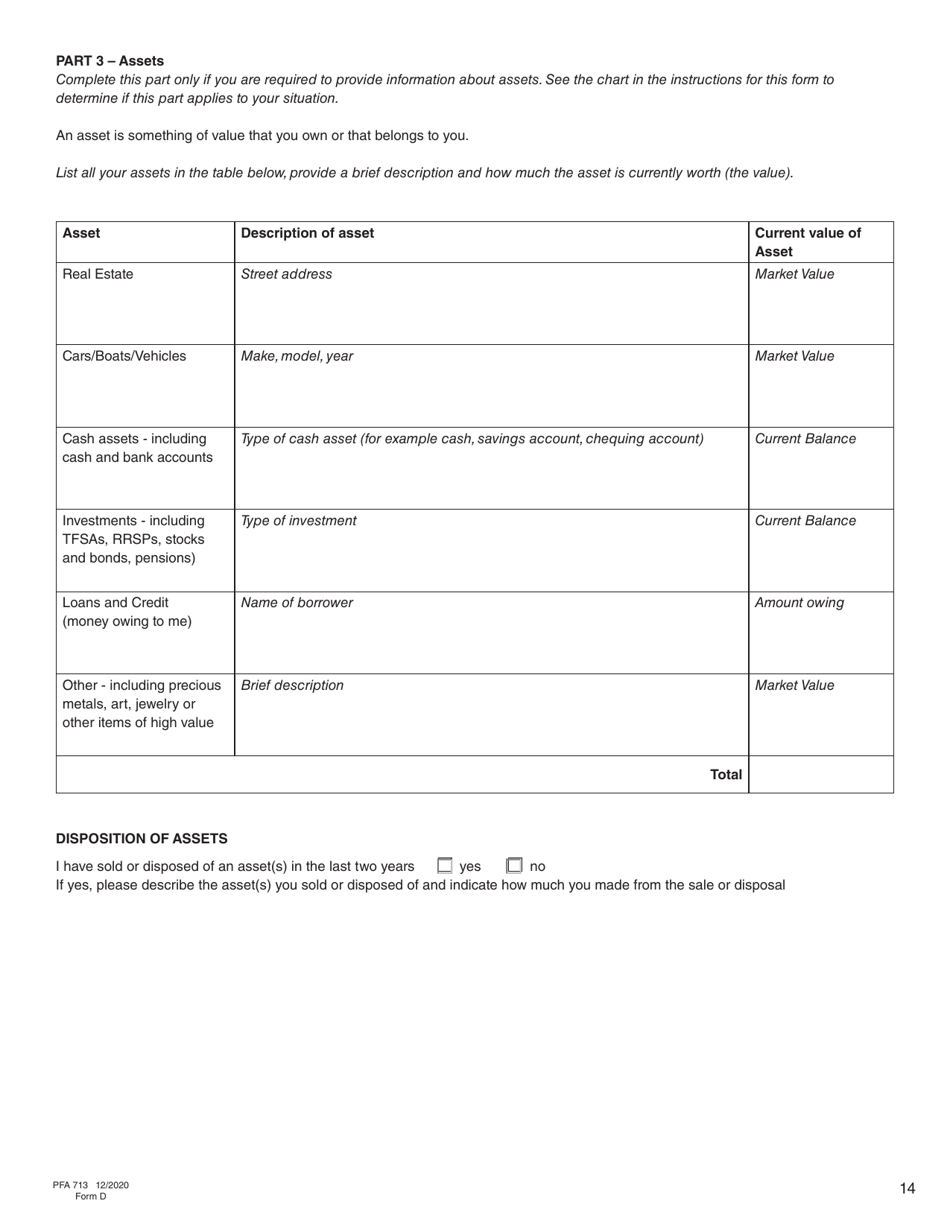

A: Form D (PFA713) Financial Statement includes details about the individual's income, expenses, assets, and liabilities.

Q: Why is Form D (PFA713) Financial Statement important?

A: Form D (PFA713) Financial Statement is important because it provides a comprehensive overview of an individual's financial situation, which may be relevant in legal proceedings.