This version of the form is not currently in use and is provided for reference only. Download this version of

Form 1181E

for the current year.

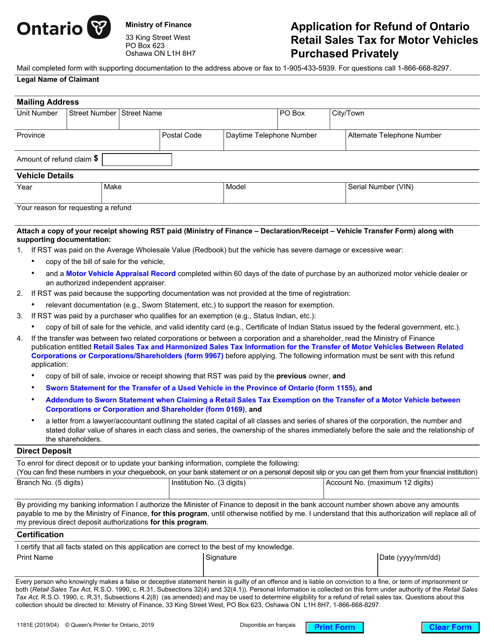

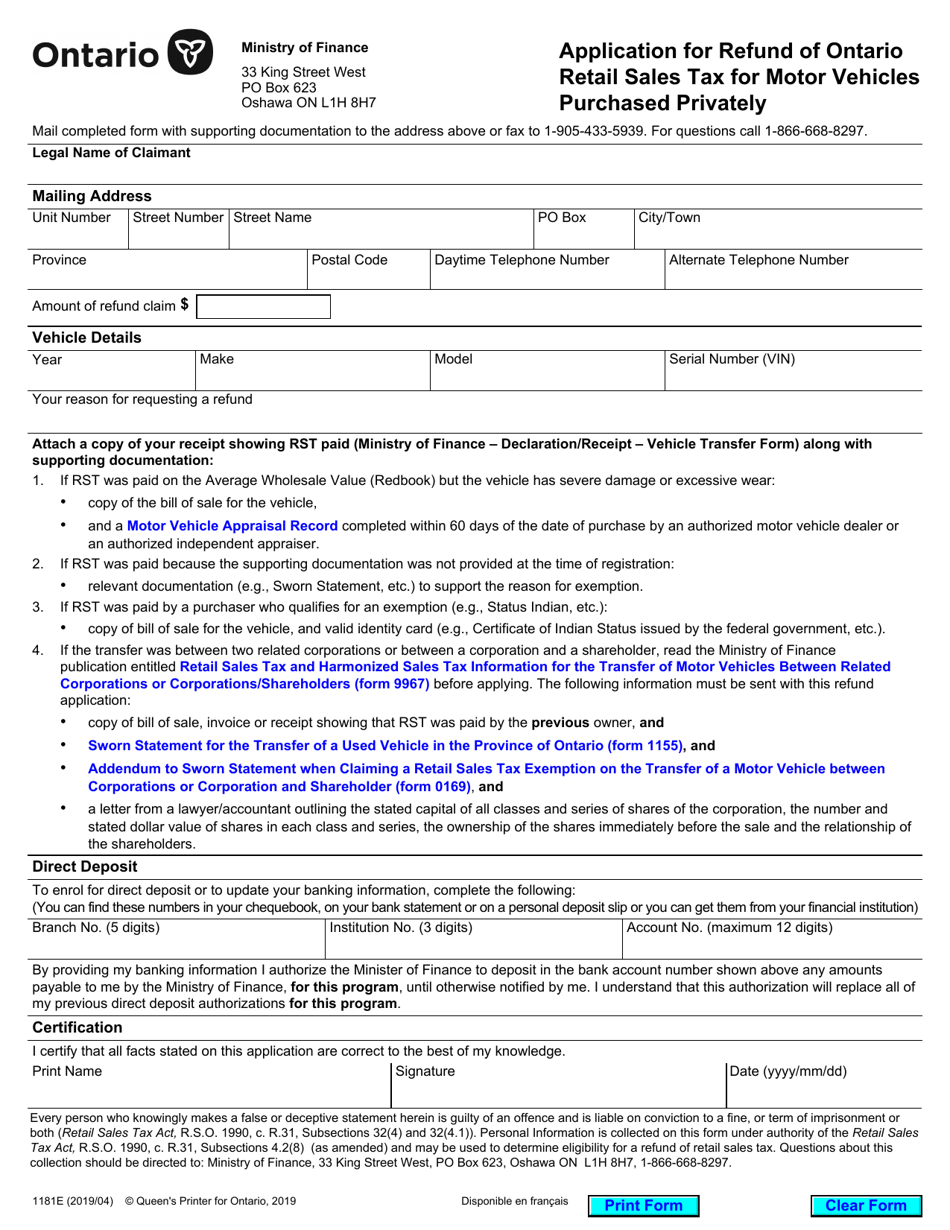

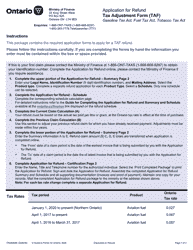

Form 1181E Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately - Ontario, Canada

Form 1181E, Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately, is used in Ontario, Canada to apply for a refund of the sales tax paid on a privately purchased motor vehicle.

The Form 1181E Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately is filed by the individual who purchased the motor vehicle privately in Ontario, Canada.

FAQ

Q: What is Form 1181E?

A: Form 1181E is the Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately.

Q: What is the purpose of Form 1181E?

A: The purpose of Form 1181E is to apply for a refund of the Ontario Retail Sales Tax paid on a motor vehicle purchased privately.

Q: Who can use Form 1181E?

A: Anyone who has purchased a motor vehicle privately in Ontario, Canada and wants to claim a refund on the Retail Sales Tax paid can use Form 1181E.

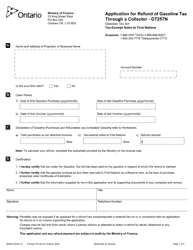

Q: What information do I need to provide on Form 1181E?

A: You will need to provide your personal information, details about the motor vehicle, proof of payment of the Retail Sales Tax, and any other required documentation.

Q: How long does it take to process a refund application using Form 1181E?

A: Processing times may vary, but it typically takes about 4 to 6 weeks to process a refund application using Form 1181E.

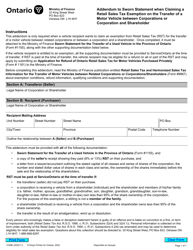

Q: Is there a deadline to submit Form 1181E?

A: Yes, you must submit Form 1181E within 4 years from the date of purchase of the motor vehicle.

Q: Are there any fees associated with submitting Form 1181E?

A: No, there are no fees associated with submitting Form 1181E for a refund of the Ontario Retail Sales Tax.

Q: Can I claim a refund for other taxes or fees paid on the motor vehicle?

A: No, Form 1181E is specifically for claiming a refund of the Ontario Retail Sales Tax only. Other taxes and fees are not eligible for a refund using this form.