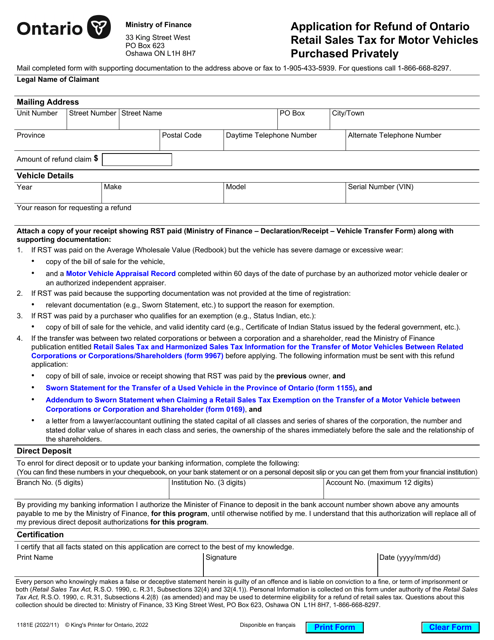

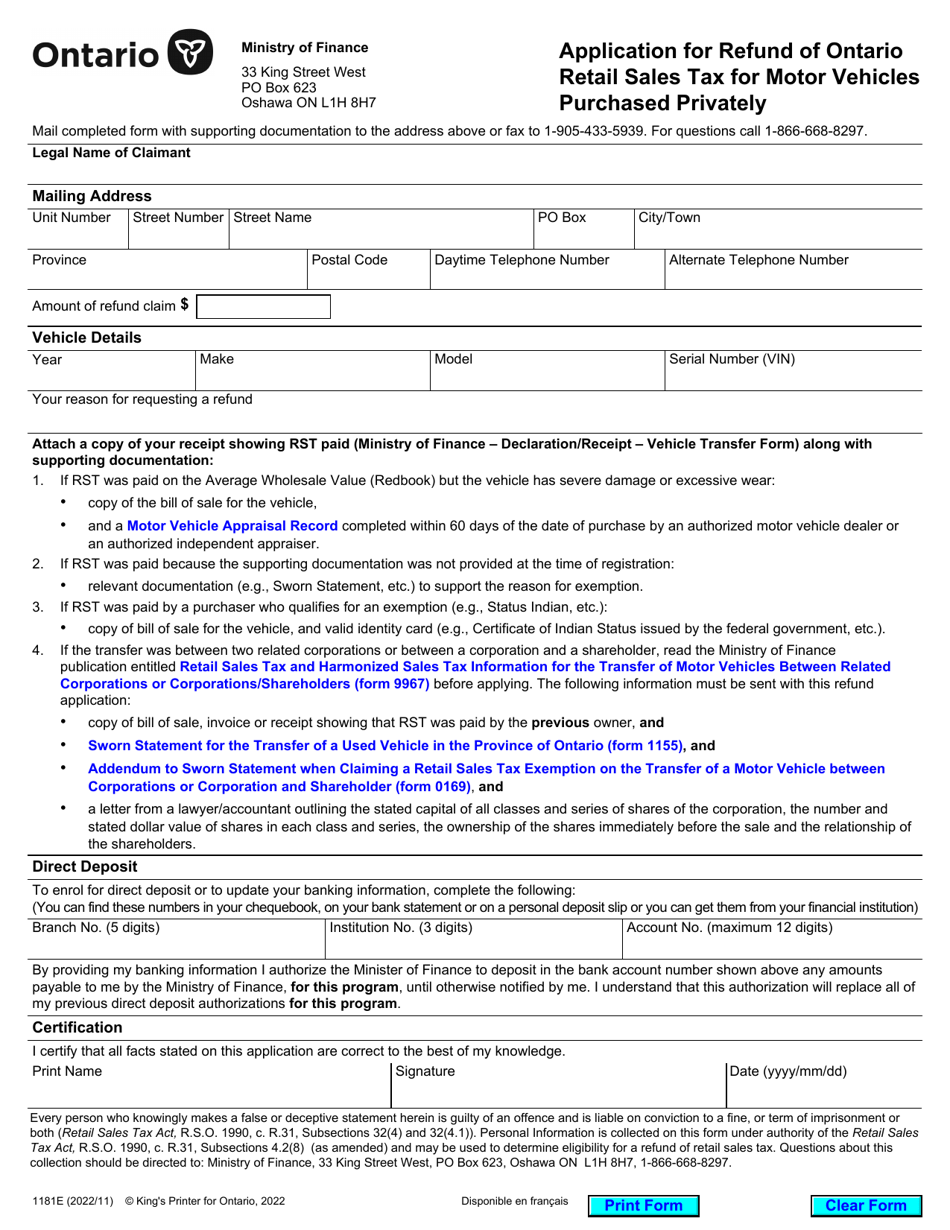

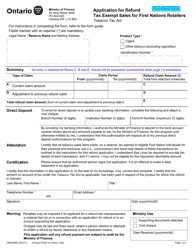

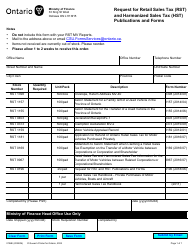

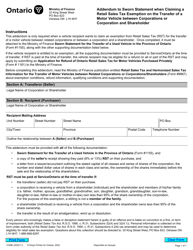

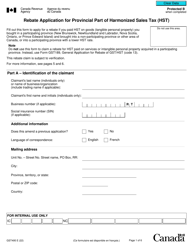

Form 1181E Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately - Ontario, Canada

Form 1181E is used in Ontario, Canada, to apply for a refund of the Retail Sales Tax (RST) paid on the purchase of motor vehicles from private sellers. It allows individuals to claim a refund for the RST they paid when buying a motor vehicle privately.

The Form 1181E Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately is filed by the individual who purchased the motor vehicle privately in Ontario, Canada.

Form 1181E Application for Refund of Ontario Retail Sales Tax for Motor Vehicles Purchased Privately - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 1181E? A: Form 1181E is an application for refund of Ontario Retail Sales Tax for motor vehicles purchased privately.

Q: Who can use Form 1181E? A: Individuals who have purchased motor vehicles privately in Ontario and want to apply for a refund of the Retail Sales Tax can use Form 1181E.

Q: What is the purpose of Form 1181E? A: The purpose of Form 1181E is to apply for a refund of the Ontario Retail Sales Tax paid on a motor vehicle purchased privately in Ontario.

Q: What information do I need to provide on Form 1181E? A: You will need to provide information such as your name, address, vehicle details, and proof of payment to complete Form 1181E.

Q: How do I submit Form 1181E? A: You can submit Form 1181E by mail or in person at the Ministry of Finance office.

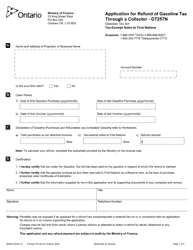

Q: How long does it take to process Form 1181E? A: Processing times may vary, but it usually takes approximately 4-6 weeks to process Form 1181E.

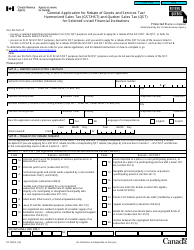

Q: Can I apply for a refund if I purchased a motor vehicle from a dealer? A: No, Form 1181E is specifically for motor vehicles purchased privately. If you purchased a vehicle from a dealer, you should contact the dealer for refund options.

Q: Is there a deadline to submit Form 1181E? A: Yes, Form 1181E must be submitted within four years from the date of purchase.

Q: What if my application is approved? A: If your application is approved, you will receive a refund of the Ontario Retail Sales Tax paid on the motor vehicle.

Q: What if my application is denied? A: If your application is denied, you can contact the Ministry of Finance for more information on the denial and appeal process.