This version of the form is not currently in use and is provided for reference only. Download this version of

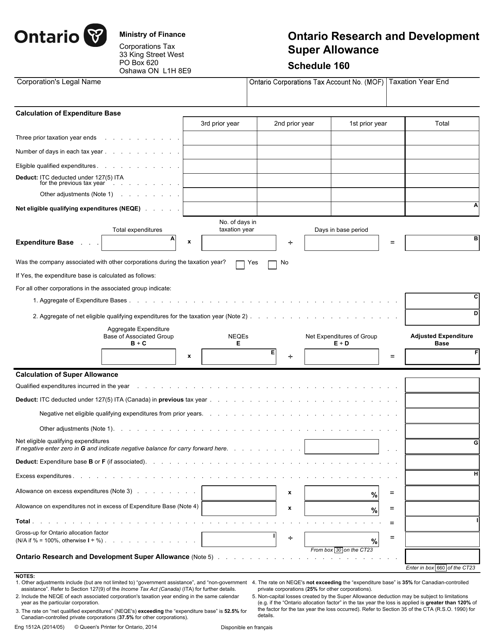

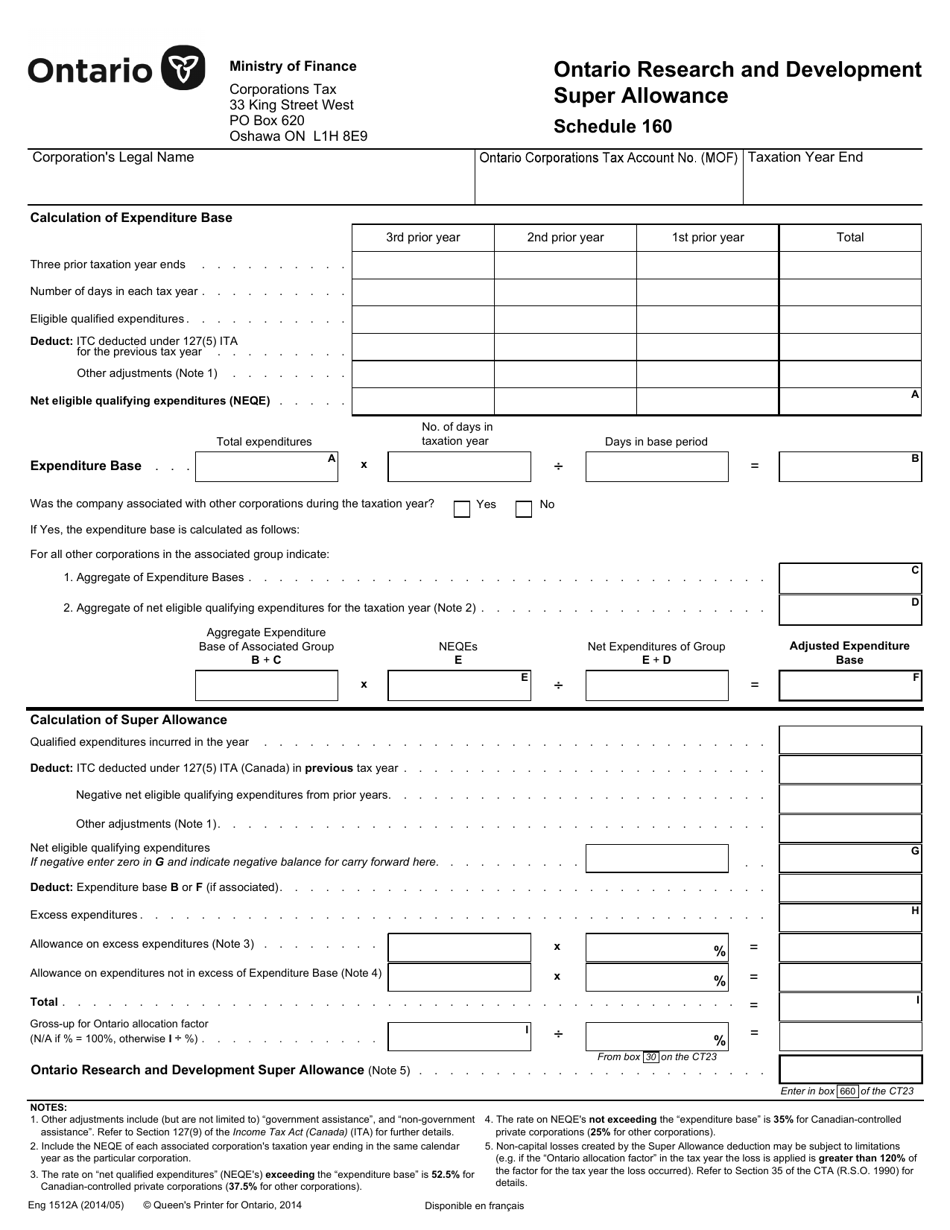

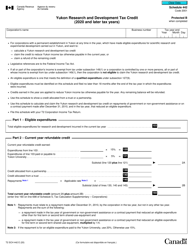

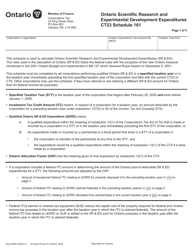

Form 1512A Schedule 160

for the current year.

Form 1512A Schedule 160 Ontario Research and Development Super Allowance - Ontario, Canada

Form 1512A Schedule 160 Ontario Research and Development Super Allowance is used for claiming the Ontario Research and Development Super Allowance in Ontario, Canada. This Super Allowance is a tax incentive program aimed at encouraging research and development activities by providing eligible businesses with an additional deduction on qualifying R&D expenditures.

The Form 1512A Schedule 160 Ontario Research and Development Super Allowance in Ontario, Canada is filed by taxpayers who are claiming the super allowance for research and development activities in Ontario.

FAQ

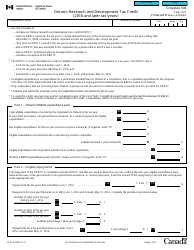

Q: What is Form 1512A Schedule 160?

A: Form 1512A Schedule 160 is a tax form used in Ontario, Canada.

Q: What is the Ontario Research and Development Super Allowance?

A: The Ontario Research and Development Super Allowance is a tax credit provided to businesses in Ontario, Canada for eligible research and development expenses.

Q: Who is eligible for the Ontario Research and Development Super Allowance?

A: Businesses in Ontario, Canada that incur eligible research and development expenses may be eligible for the Ontario Research and Development Super Allowance.

Q: What is the purpose of Form 1512A Schedule 160?

A: Form 1512A Schedule 160 is used to report information related to the Ontario Research and Development Super Allowance.