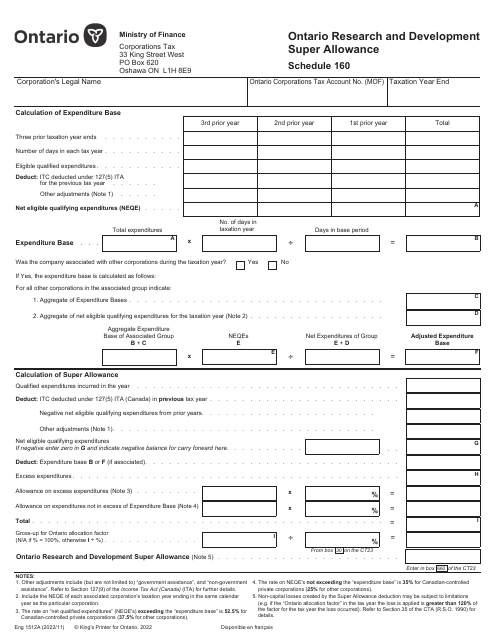

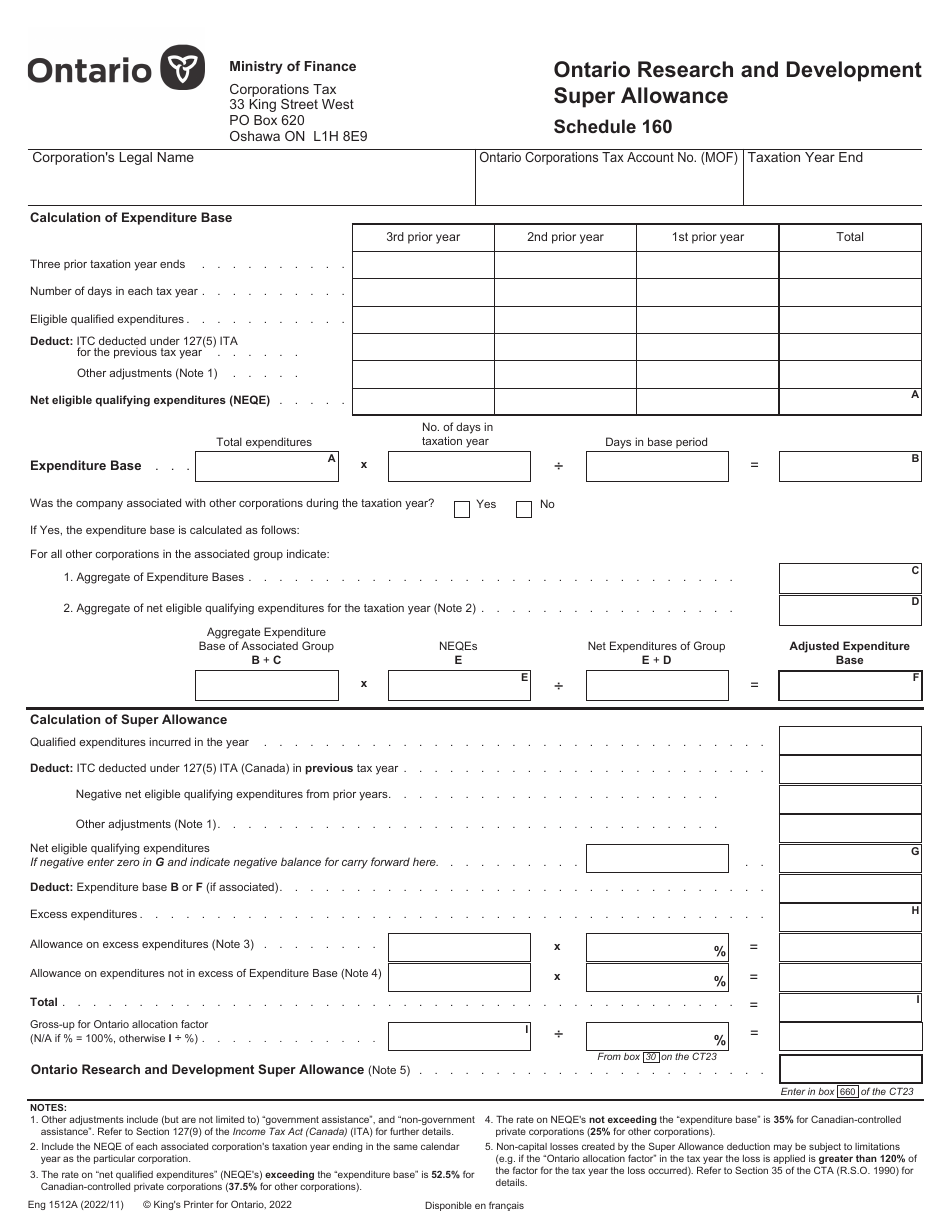

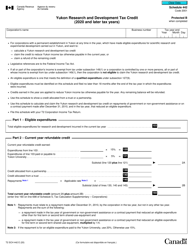

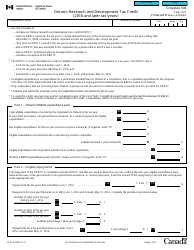

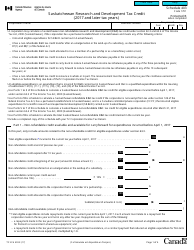

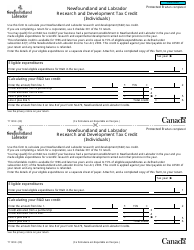

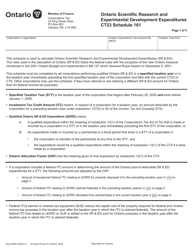

Form 1512A Schedule 160 Ontario Research and Development Super Allowance - Ontario, Canada

Form 1512A Schedule 160 Ontario Research and Development Super Allowance is a form used in Ontario, Canada to claim the Ontario Research and Development Super Allowance. This program provides additional tax credits and deductions for businesses that invest in research and development activities in Ontario.

The Form 1512A Schedule 160 Ontario Research and Development Super Allowance in Ontario, Canada is filed by corporations that are eligible for the research and development super allowance program.

Form 1512A Schedule 160 Ontario Research and Development Super Allowance - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 1512A Schedule 160? A: Form 1512A Schedule 160 is a tax form used in Ontario, Canada.

Q: What is the Ontario Research and Development Super Allowance? A: The Ontario Research and Development Super Allowance is a tax incentive program in Ontario, Canada aimed at encouraging research and development activities.

Q: Who is eligible for the Ontario Research and Development Super Allowance? A: Eligible individuals and corporations engaged in research and development activities in Ontario may be eligible for the Super Allowance.

Q: What is the purpose of Form 1512A Schedule 160? A: Form 1512A Schedule 160 is used to claim the Ontario Research and Development Super Allowance.

Q: Are there any specific requirements for claiming the Ontario Research and Development Super Allowance? A: Yes, there are specific requirements and eligibility criteria that must be met in order to claim the Super Allowance. These may include maintaining appropriate records, meeting research and development expenditure thresholds, and complying with certain reporting requirements.