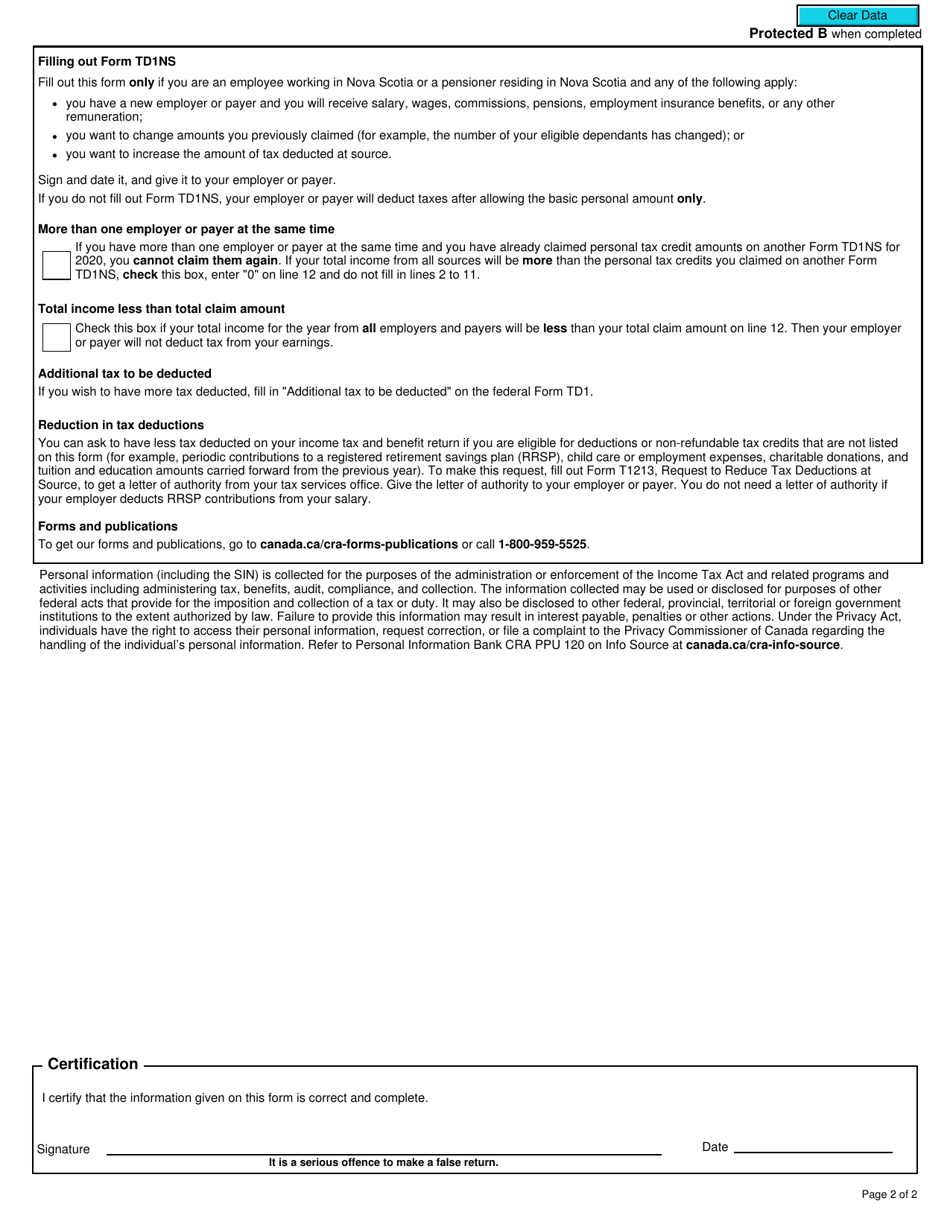

This version of the form is not currently in use and is provided for reference only. Download this version of

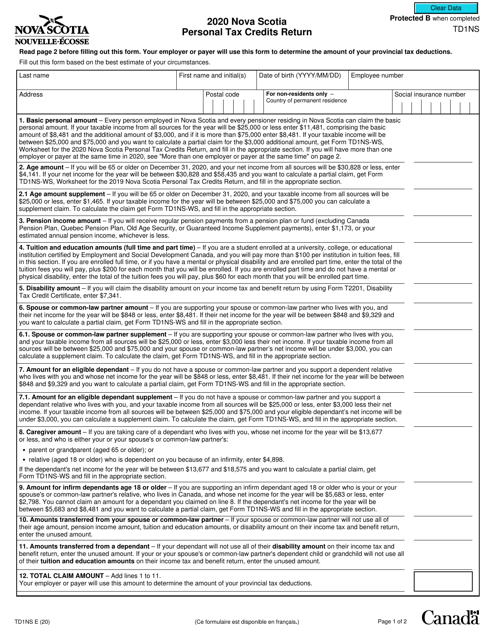

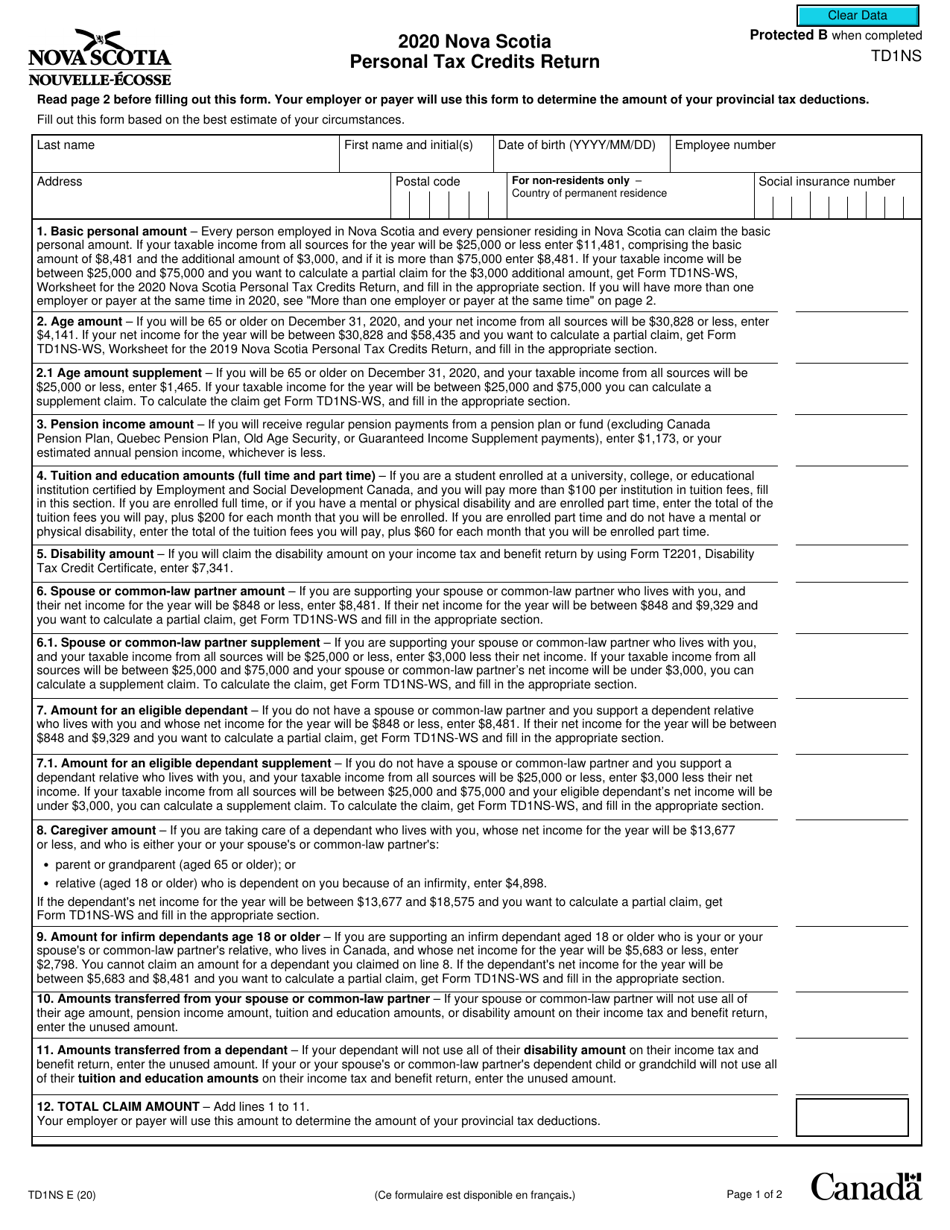

Form TD1NS

for the current year.

Form TD1NS Nova Scotia Personal Tax Credits Return - Canada

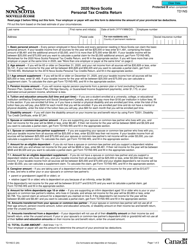

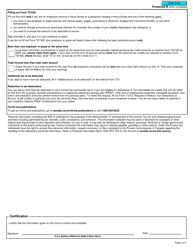

Form TD1NS, or the Nova Scotia Personal Tax Credits Return, is used by individuals who reside in Nova Scotia, Canada, to calculate the amount of provincial tax credits they are eligible to claim. This form is submitted to the Canada Revenue Agency (CRA) along with the federal TD1 form. By completing the TD1NS, individuals can ensure that the appropriate amount of provincial income tax is deducted from their pay.

The Form TD1NS Nova Scotia Personal Tax Credits Return in Canada is filed by individuals who want to claim additional tax credits specific to residents of Nova Scotia.

FAQ

Q: What is Form TD1NS?

A: Form TD1NS is the Nova Scotia Personal Tax Credits Return for residents of Nova Scotia in Canada.

Q: Who should complete Form TD1NS?

A: Residents of Nova Scotia in Canada should complete Form TD1NS.

Q: What is the purpose of Form TD1NS?

A: The purpose of Form TD1NS is to determine the amount of income tax to be deducted from an individual's pay.

Q: When should Form TD1NS be completed?

A: Form TD1NS should be completed when you start a new job or wish to change your federal or provincial tax deductions.

Q: Can Form TD1NS be used by non-residents of Nova Scotia?

A: No, Form TD1NS is specifically for residents of Nova Scotia.

Q: Are there any other provincial-specific tax credit forms in Canada?

A: Yes, each province and territory in Canada has its own tax credit form, similar to Form TD1NS for Nova Scotia.