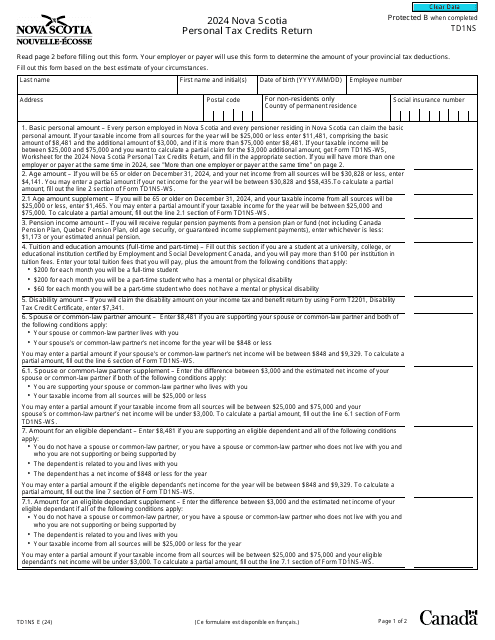

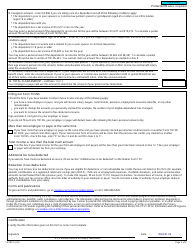

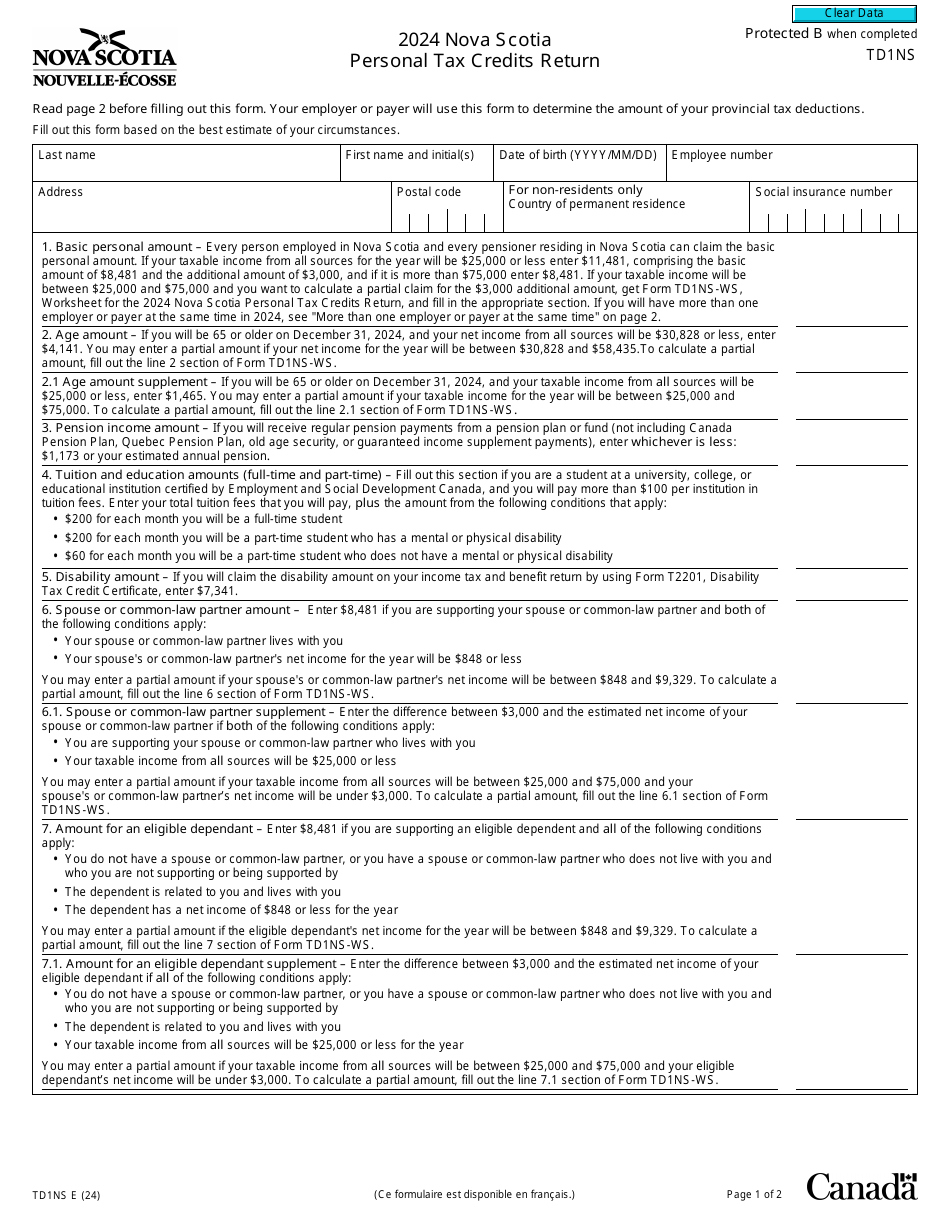

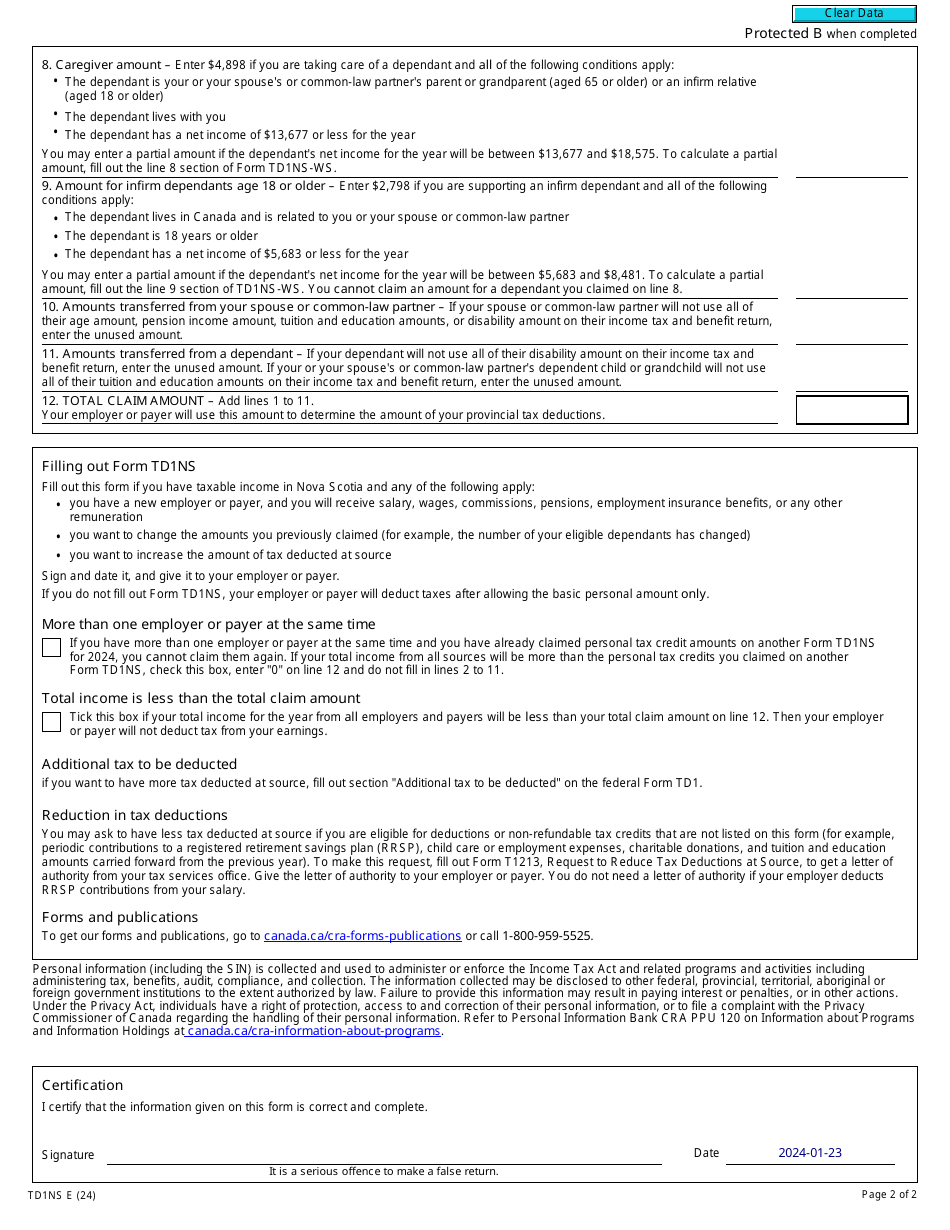

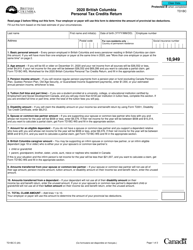

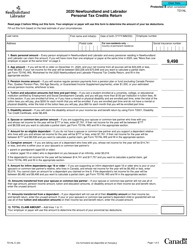

Form TD1NS Nova Scotia Personal Tax Credits Return - Canada

Form TD1NS, Nova Scotia Personal Tax Credits Return, is used by individuals who reside in the province of Nova Scotia in Canada to declare any additional tax credit amounts that they may be eligible for. It allows individuals to claim and optimize their personal tax credits, resulting in potential reductions in the amount of tax owed.

In Canada, the Form TD1NS Nova Scotia Personal Tax Credits Return is filed by individuals who are residents of Nova Scotia.

Form TD1NS Nova Scotia Personal Tax Credits Return - Canada - Frequently Asked Questions (FAQ)

Q: What is a TD1NS form? A: The TD1NS form is the Nova Scotia Personal Tax Credits Return form.

Q: What is the purpose of the TD1NS form? A: The purpose of the TD1NS form is to determine the amount of personal tax credits that can be claimed on your income tax return in Nova Scotia.

Q: Who should fill out the TD1NS form? A: Residents of Nova Scotia who want to claim personal tax credits on their income tax return should fill out the TD1NS form.

Q: Is the TD1NS form necessary? A: The TD1NS form is not necessary for everyone, but it is recommended for residents of Nova Scotia who want to claim personal tax credits.

Q: How often should I fill out the TD1NS form? A: You should only fill out the TD1NS form when your personal tax situation changes, such as starting a new job or having a change in your financial situation.

Q: Can I claim tax credits without filling out the TD1NS form? A: No, you need to fill out the TD1NS form in order to claim personal tax credits on your income tax return in Nova Scotia.

Q: What are some common personal tax credits that can be claimed on the TD1NS form? A: Some common personal tax credits that can be claimed on the TD1NS form include the basic personal amount, spousal amount, and disability amount.

Q: Can I make changes to my TD1NS form throughout the year? A: Yes, you can make changes to your TD1NS form throughout the year if your personal tax situation changes.

Q: Do I need to submit the TD1NS form to my employer? A: Yes, you need to submit the TD1NS form to your employer so they can determine the amount of tax to withhold from your pay based on your claimed personal tax credits.