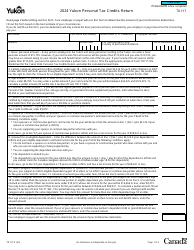

This version of the form is not currently in use and is provided for reference only. Download this version of

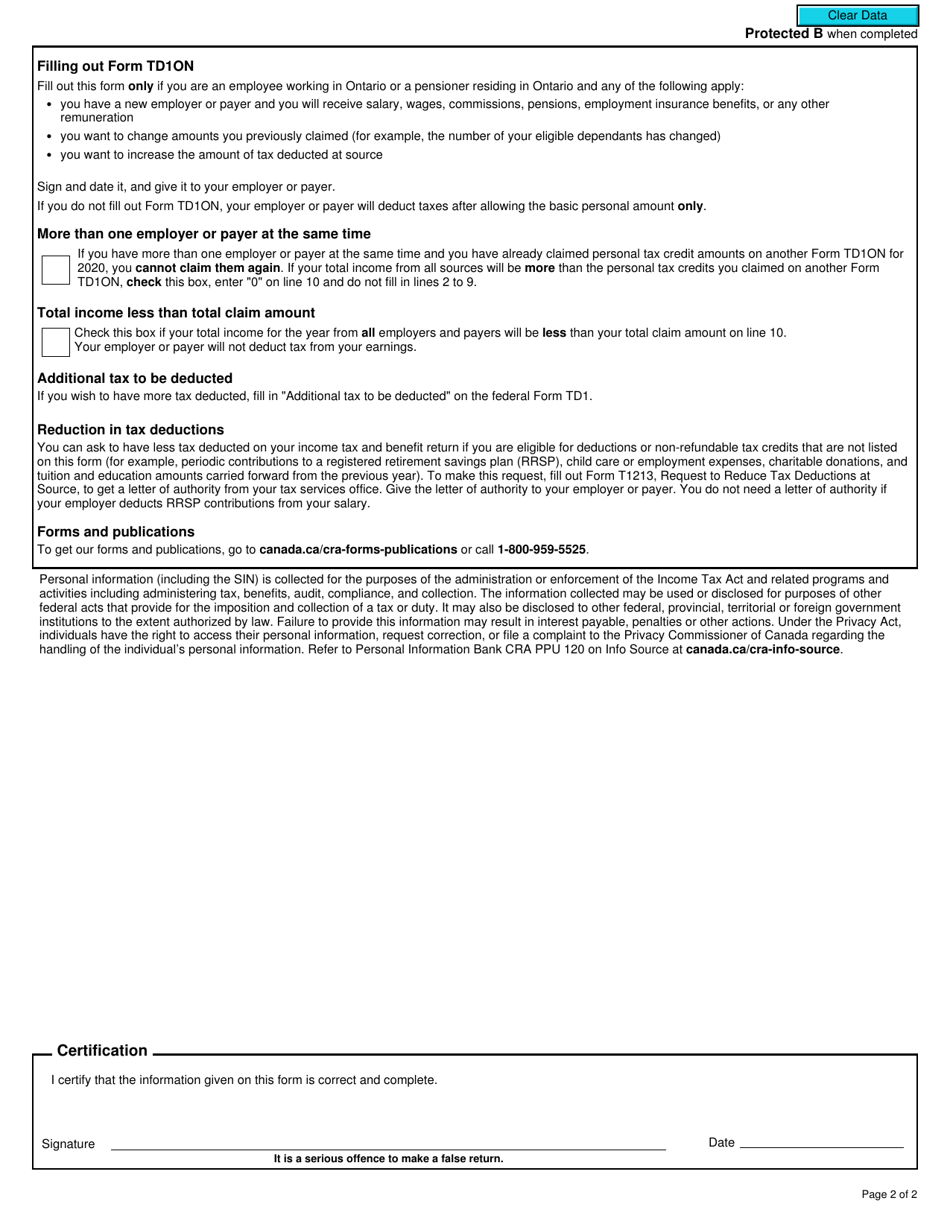

Form TD1ON

for the current year.

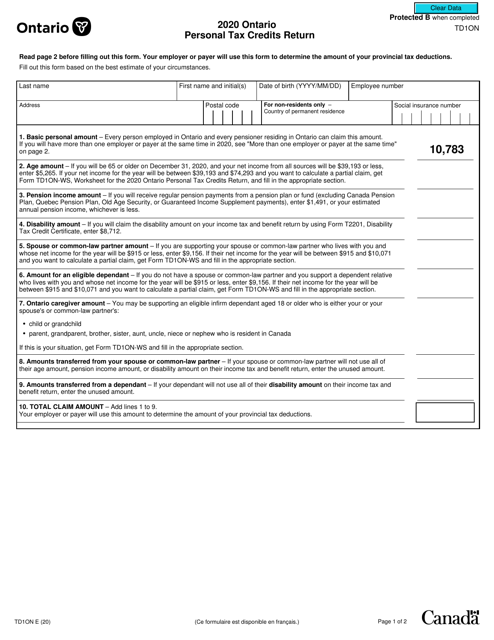

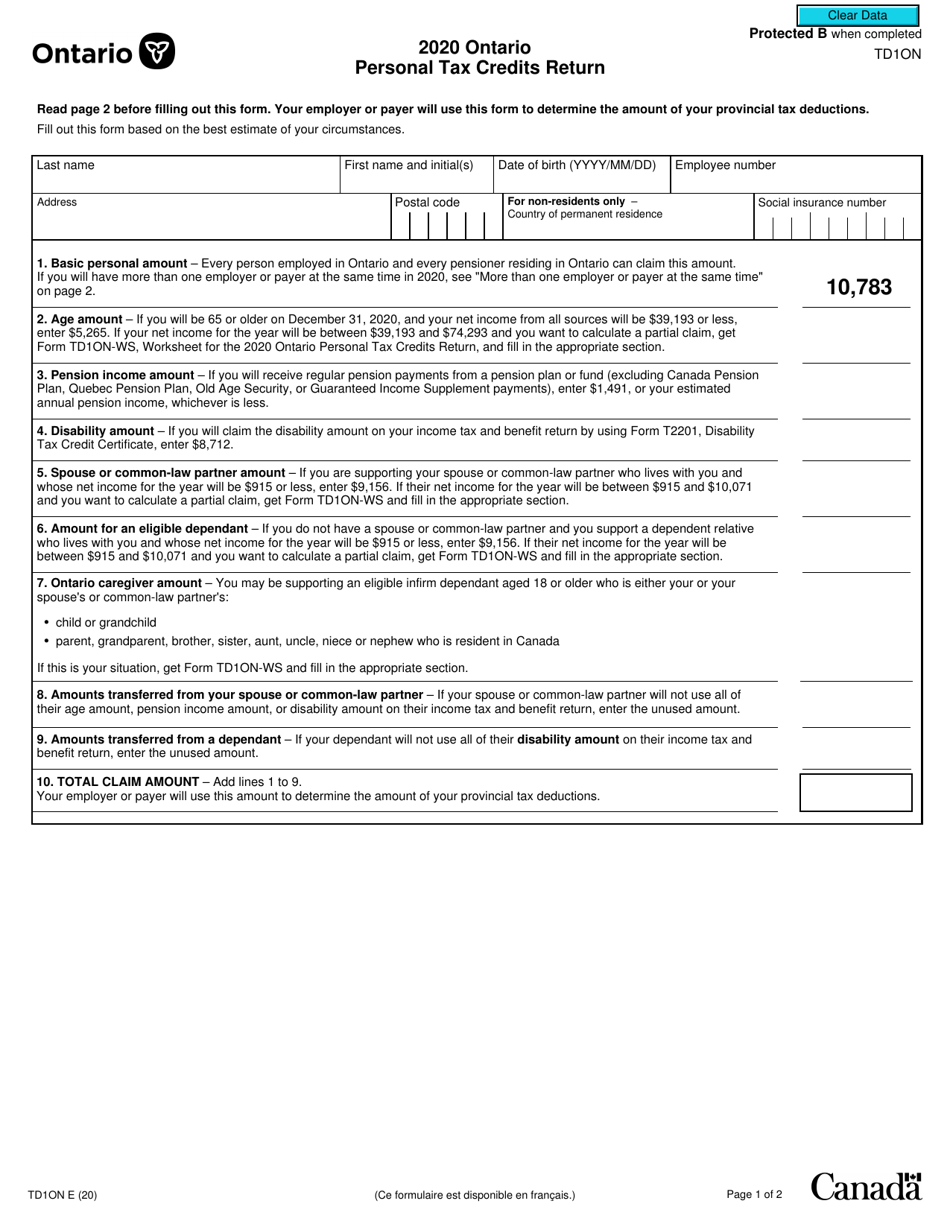

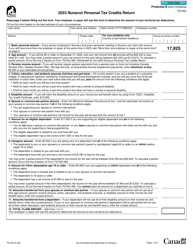

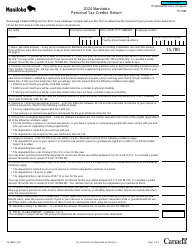

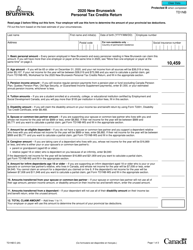

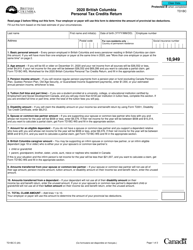

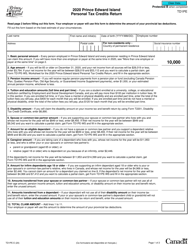

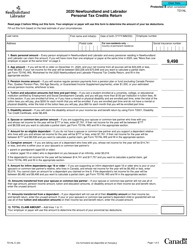

Form TD1ON Ontario Personal Tax Credits Return - Canada

Form TD1ON Ontario Personal Tax Credits Return is used by individuals who reside in Ontario, Canada to determine the amount of personal tax credits they are eligible to claim on their income tax return. This form helps employers calculate the correct amount of tax to deduct from their employees' income.

The Form TD1ON Ontario Personal Tax Credits Return in Canada is typically filed by individuals who reside in the province of Ontario.

FAQ

Q: What is Form TD1ON?

A: Form TD1ON is the Ontario Personal Tax Credits Return form in Canada.

Q: What is the purpose of Form TD1ON?

A: The purpose of Form TD1ON is to determine the amount of income tax to be deducted from an individual's pay in Ontario.

Q: Do I need to fill out Form TD1ON?

A: If you are an employee working in Ontario, you should fill out Form TD1ON to ensure the correct amount of income tax is deducted from your pay.

Q: What information is required on Form TD1ON?

A: Form TD1ON requires you to provide your personal information, such as your name, Social Insurance Number, and employment information. It also includes a section where you can claim various tax credits.

Q: What are personal tax credits?

A: Personal tax credits are deductions that reduce the amount of income tax you owe. They include credits for things like basic personal amount, age amount, and tuition fees.

Q: Can I claim personal tax credits on Form TD1ON?

A: Yes, you can claim personal tax credits on Form TD1ON. The form includes sections where you can indicate your eligibility for different tax credits.

Q: How often do I need to fill out Form TD1ON?

A: You should fill out Form TD1ON when you start a new job or when there are changes to your personal or employment situation that may affect your tax credits.

Q: Do I need to submit Form TD1ON to the CRA?

A: No, you do not need to submit Form TD1ON to the CRA. You should keep a copy for your records and provide a completed copy to your employer.

Q: What happens if I don't fill out Form TD1ON?

A: If you do not fill out Form TD1ON, your employer will deduct the default amount of income tax from your pay, which may result in either owing more tax at the end of the year or receiving a larger tax refund.