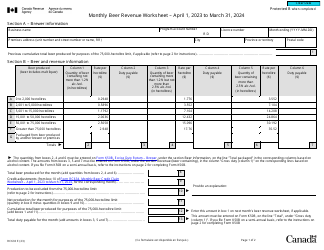

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC633

for the current year.

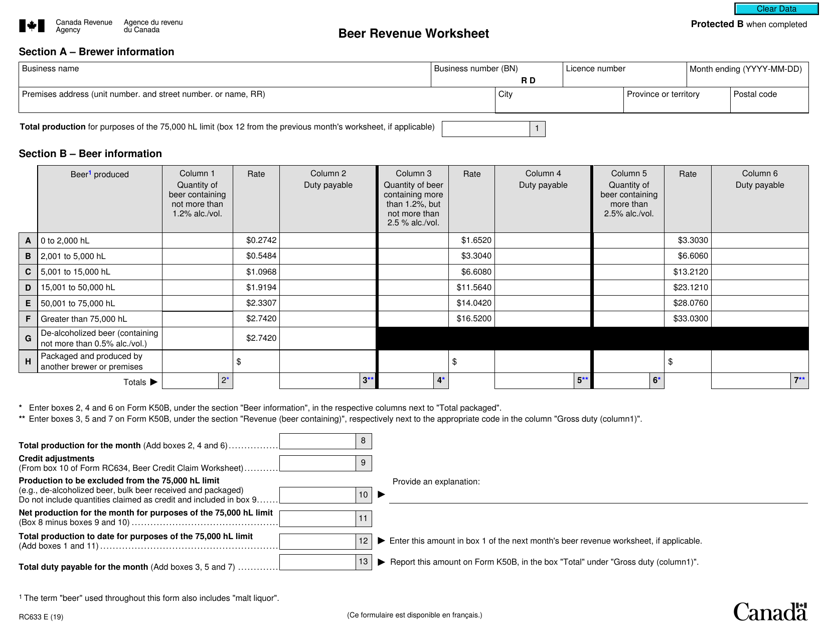

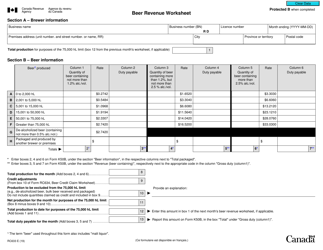

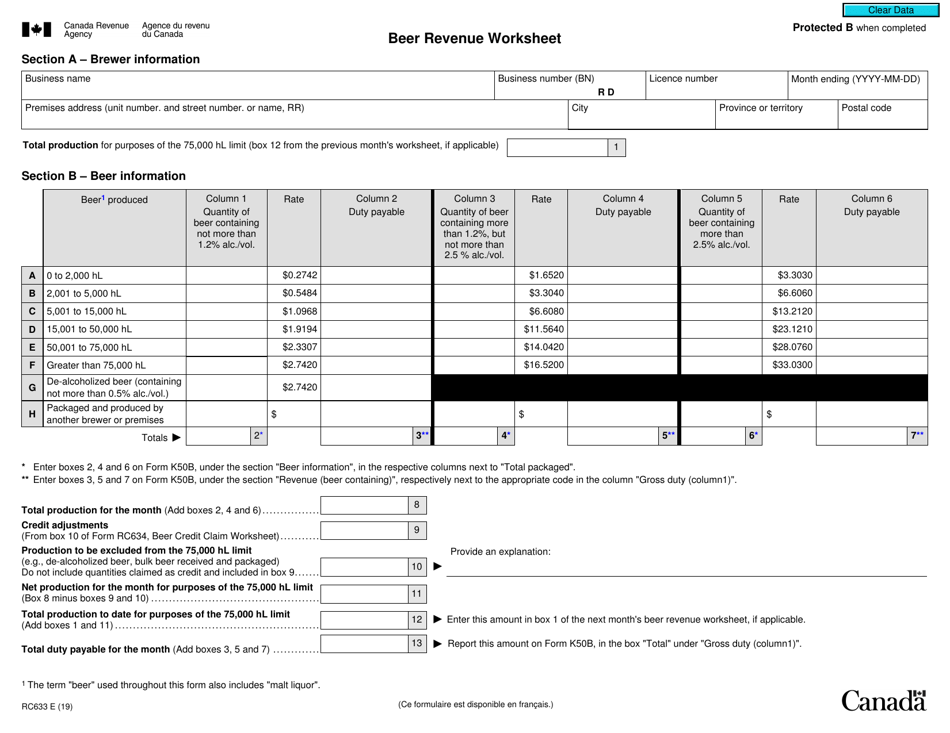

Form RC633 Beer Revenue Worksheet - Canada

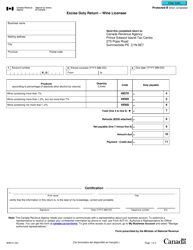

Form RC633 Beer Revenue Worksheet is used by breweries in Canada to report their monthly beer production, sales, and revenue information to the Canadian government. It helps in calculating the amount of excise tax that needs to be paid on beer production and sales.

The Form RC633 Beer Revenue Worksheet in Canada is filed by breweries and beer manufacturers.

FAQ

Q: What is Form RC633?

A: Form RC633 is the Beer Revenue Worksheet used in Canada.

Q: What is the purpose of Form RC633?

A: The purpose of Form RC633 is to calculate and report the beer revenue for a specific period in Canada.

Q: Who needs to fill out Form RC633?

A: Businesses engaged in the production, distribution, or sale of beer in Canada need to fill out Form RC633.

Q: What information is required on Form RC633?

A: Form RC633 requires information such as beer sales volume, beer sales revenue, and details of taxable and non-taxable sales.

Q: When is Form RC633 due?

A: Form RC633 is generally due on or before the last day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form RC633?

A: Yes, there can be penalties for not filing Form RC633 or for filing it late. It is important to meet the filing deadline to avoid penalties.

Q: What should I do if I have questions or need assistance with Form RC633?

A: If you have questions or need assistance with Form RC633, you can contact the CRA or consult a tax professional.

Q: Is Form RC633 applicable only in Canada?

A: Yes, Form RC633 is specific to Canada and is used for reporting beer revenue in the country.