This version of the form is not currently in use and is provided for reference only. Download this version of

Form T400A

for the current year.

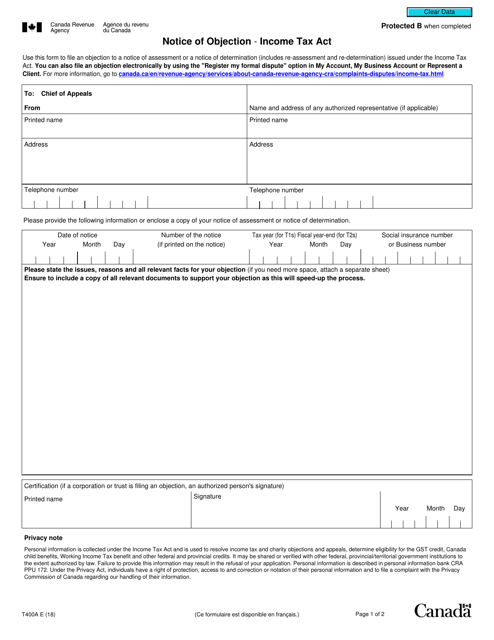

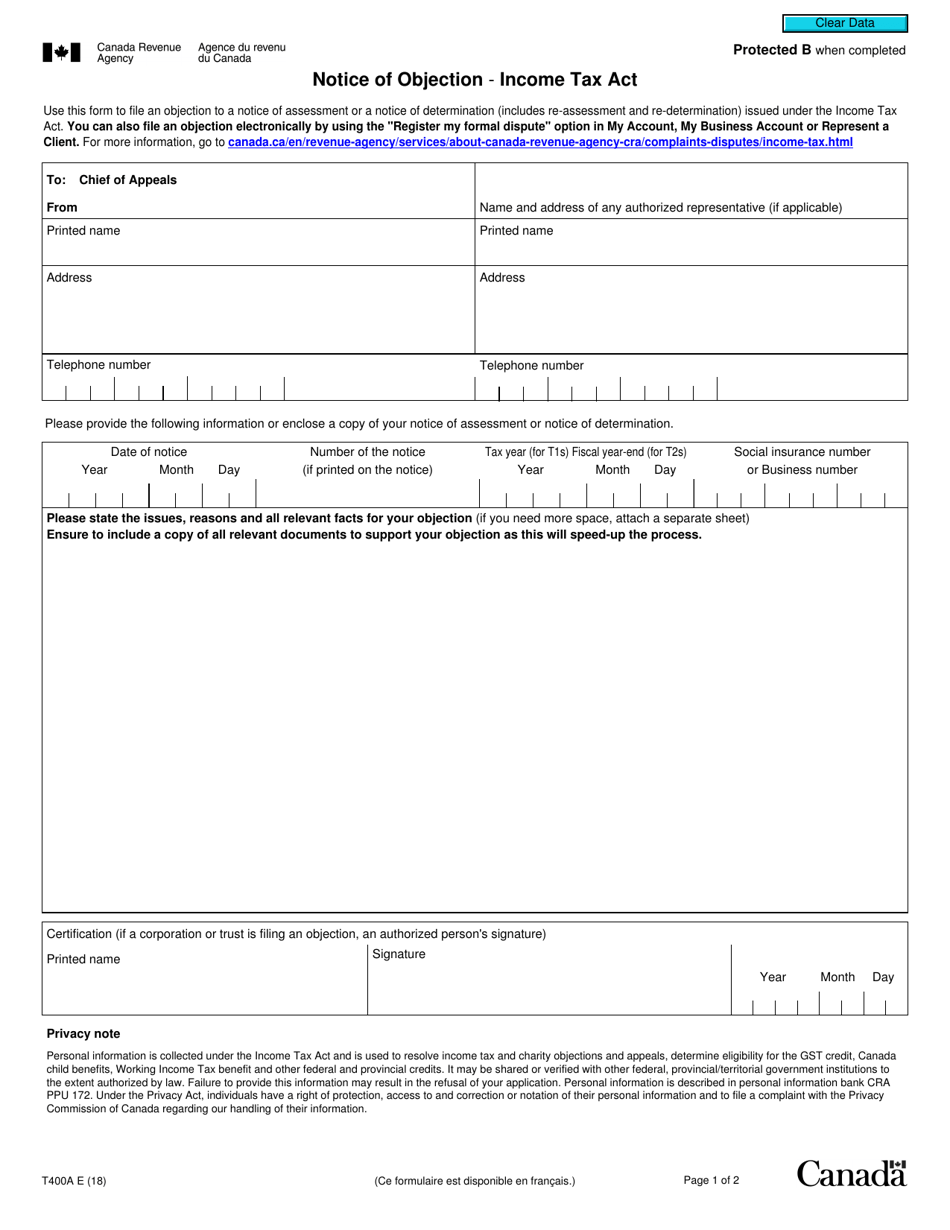

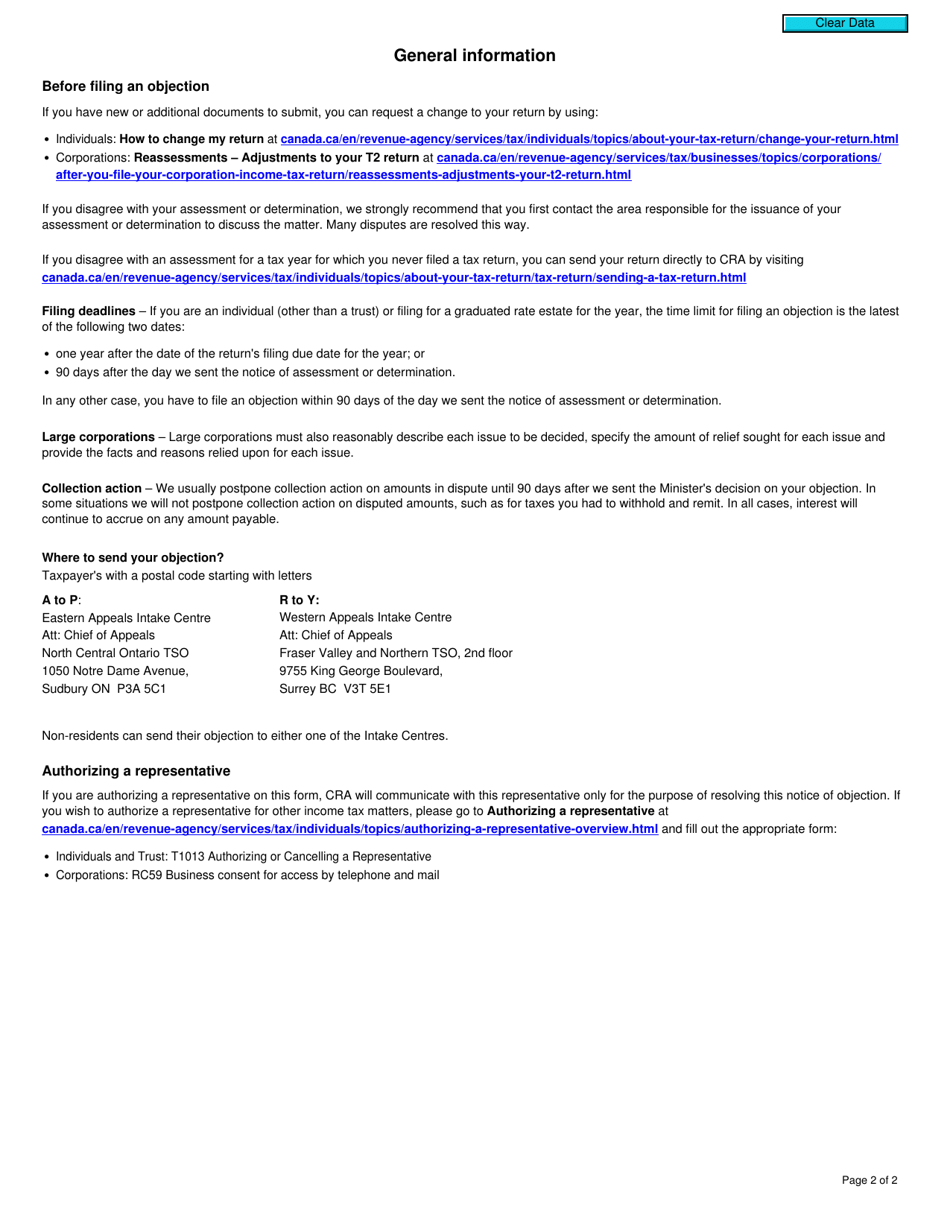

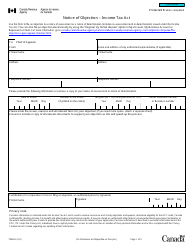

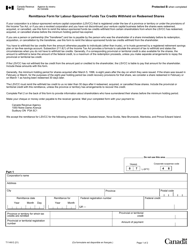

Form T400A Notice of Objection - Income Tax Act - Canada

Form T400A Notice of Objection is used in Canada for taxpayers to object or dispute an assessment or decision made by the Canada Revenue Agency (CRA) regarding their income tax.

The Form T400A Notice of Objection - Income Tax Act - Canada is filed by individuals or businesses who wish to dispute their income tax assessment.

FAQ

Q: What is Form T400A?

A: Form T400A is a Notice of Objection used for filing an objection to an assessment issued under the Income Tax Act in Canada.

Q: What is the Income Tax Act?

A: The Income Tax Act is a federal law in Canada that governs the taxation of individuals and corporations.

Q: When should I use Form T400A?

A: You should use Form T400A when you disagree with a tax assessment and want to formally object to it.

Q: What information is required on Form T400A?

A: Form T400A requires you to provide your personal information, details of the assessment you are objecting to, the grounds of your objection, and any supporting documentation.

Q: What happens after I submit Form T400A?

A: After you submit Form T400A, the Canada Revenue Agency will review your objection and may schedule a hearing to resolve the dispute.