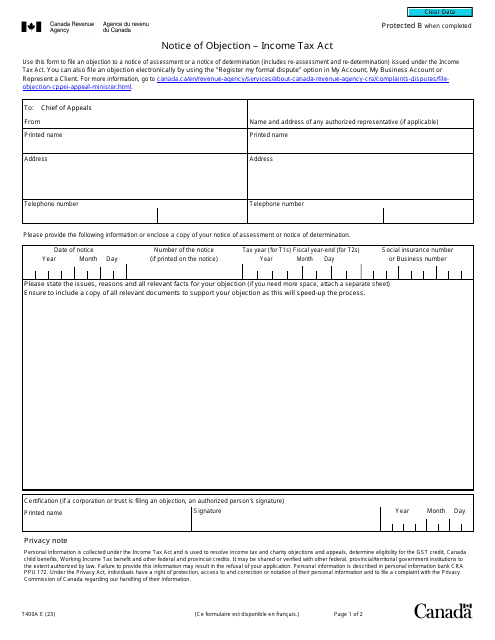

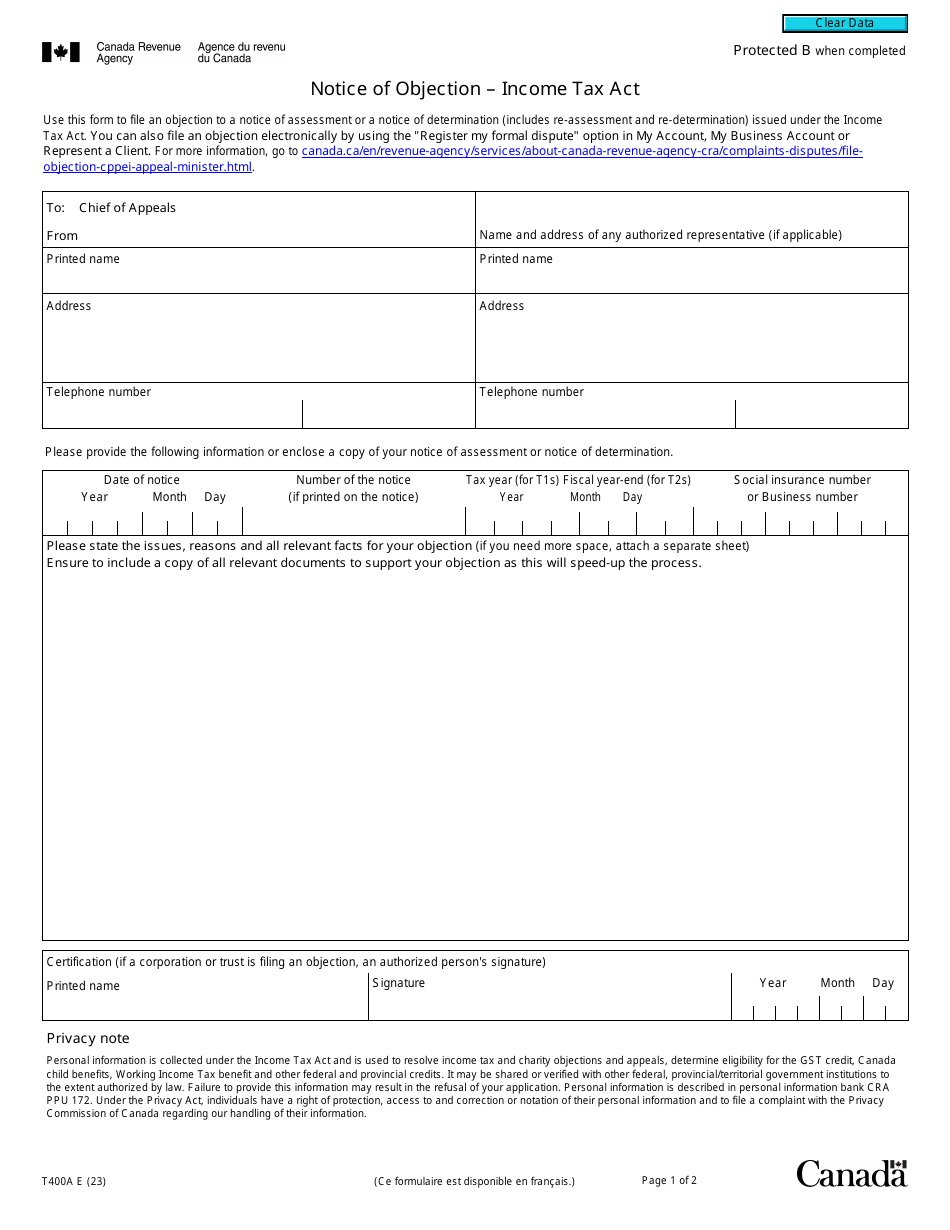

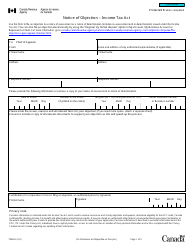

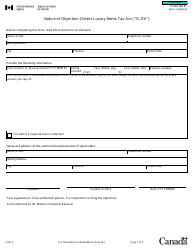

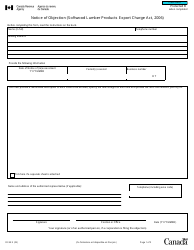

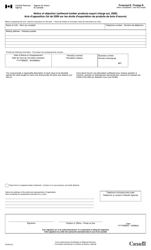

Form T400A Notice of Objection - Income Tax Act - Canada

Form T400A Notice of Objection is used in Canada to formally dispute a decision made by the Canada Revenue Agency (CRA) regarding an individual's income tax assessment. It allows taxpayers to object if they disagree with the CRA's assessment, reassessment, or determination.

The taxpayer files the Form T400A Notice of Objection under the Income Tax Act in Canada.

Form T400A Notice of Objection - Income Tax Act - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T400A?

A: Form T400A is a Notice of Objection used for objecting to an assessment or determination made under the Income Tax Act in Canada.

Q: When should I use Form T400A?

A: You should use Form T400A when you want to object to an assessment or determination made by the Canada Revenue Agency (CRA) regarding your income tax.

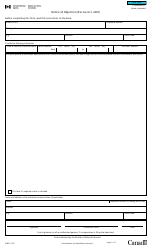

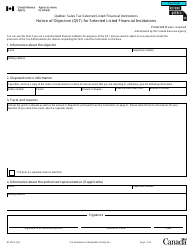

Q: What information do I need to provide on Form T400A?

A: On Form T400A, you need to provide your personal information, the specific grounds of your objection, the years or periods involved, and any relevant supporting documentation.

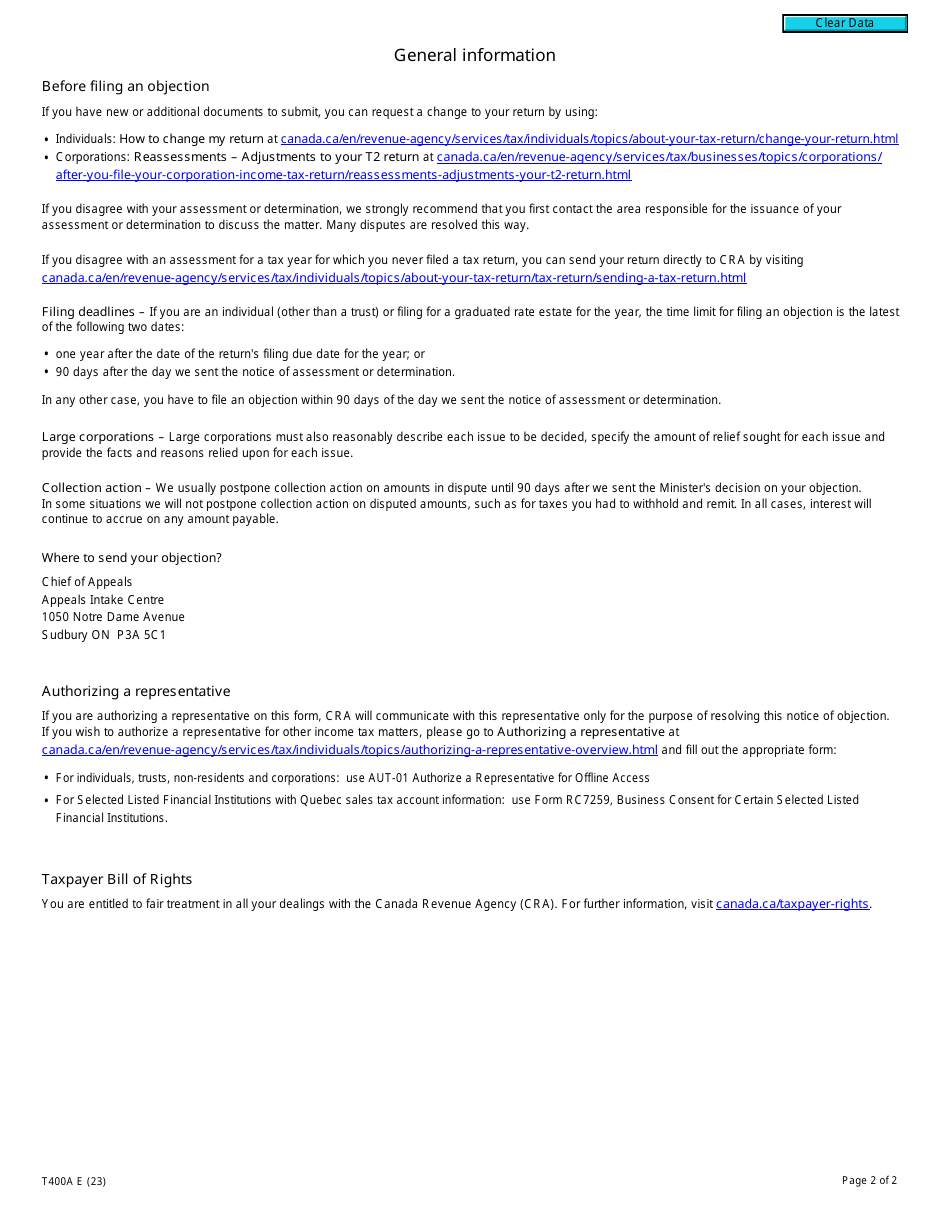

Q: What is the deadline for submitting Form T400A?

A: The deadline for submitting Form T400A is generally within 90 days from the date of the Notice of Assessment or Reassessment that you are objecting to. However, specific deadlines may vary depending on the circumstances.

Q: Do I need to pay a fee to submit Form T400A?

A: No, there is no fee required to submit Form T400A.

Q: What happens after I submit Form T400A?

A: After submitting Form T400A, the CRA will review your objection and respond to you with their decision. If you disagree with their decision, you may have further options for appeal.

Q: Can I get assistance with completing Form T400A?

A: Yes, you can seek assistance from a tax professional or a tax clinic to help you complete Form T400A and navigate the objection process.