This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3 Schedule 8

for the current year.

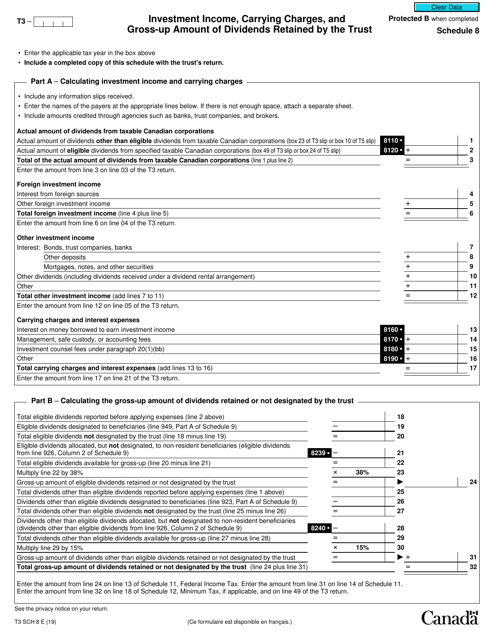

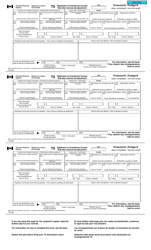

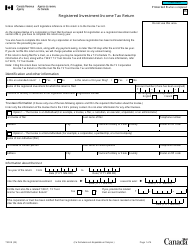

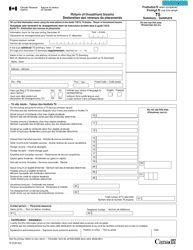

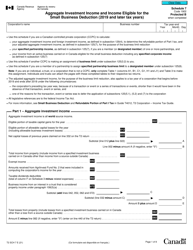

Form T3 Schedule 8 Investment Income, Carrying Charges, and Gross-Up Amount of Dividends Retained by the Trust - Canada

Form T3 Schedule 8 in Canada is used for reporting investment income, carrying charges, and the gross-up amount of dividends retained by the trust.

The trust files the Form T3 Schedule 8 Investment Income, Carrying Charges, and Gross-Up Amount of Dividends Retained by the Trust in Canada.

FAQ

Q: What is Form T3 Schedule 8?

A: Form T3 Schedule 8 is a tax form in Canada that is used to report investment income, carrying charges, and gross-up amount of dividends retained by the trust.

Q: What is investment income?

A: Investment income includes interest, dividends, capital gains, and other income earned from investments.

Q: What are carrying charges?

A: Carrying charges are expenses incurred to earn investment income, such as interest on money borrowed to invest.

Q: What is the gross-up amount of dividends?

A: The gross-up amount of dividends is the amount by which dividends received by the trust are increased for tax purposes.

Q: Why is it important to report investment income and carrying charges on Form T3 Schedule 8?

A: It is important to report investment income and carrying charges on Form T3 Schedule 8 to accurately calculate taxable income and determine the tax liability of the trust.

Q: Who should file Form T3 Schedule 8?

A: Form T3 Schedule 8 should be filed by trusts that have investment income, carrying charges, and gross-up amount of dividends to report.

Q: When is the deadline to file Form T3 Schedule 8?

A: The deadline to file Form T3 Schedule 8 is the same as the deadline for filing the T3 Trust Income Tax and Information Return, which is usually March 31st following the end of the tax year.

Q: Are there any penalties for not filing Form T3 Schedule 8?

A: Yes, there can be penalties for not filing Form T3 Schedule 8 or filing it late. It is important to file all required tax forms by the deadline to avoid penalties and interest charges.

Q: Can I e-file Form T3 Schedule 8?

A: Yes, Form T3 Schedule 8 can be e-filed using the Canada Revenue Agency's NETFILE system or through a certified tax software.