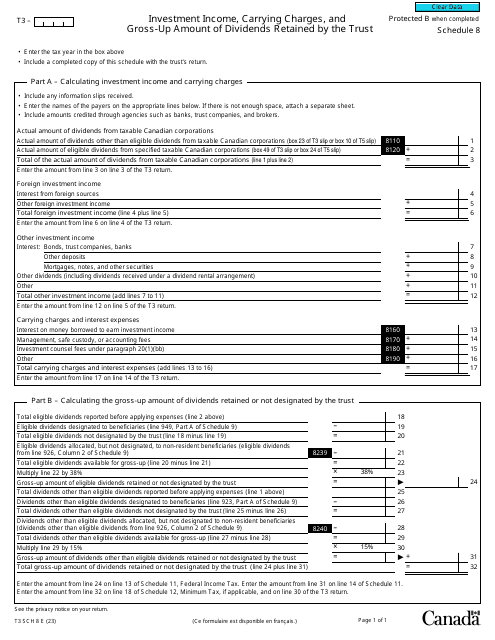

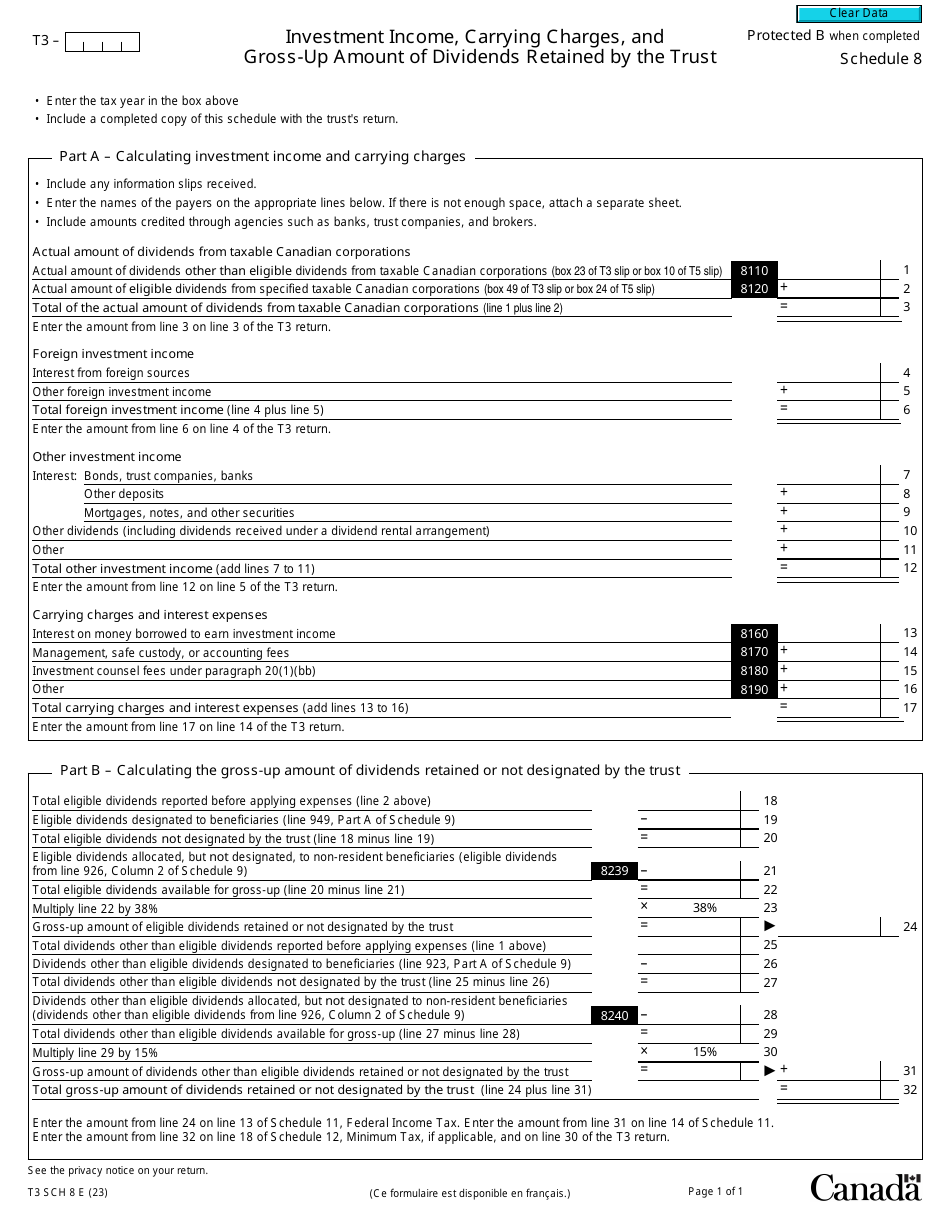

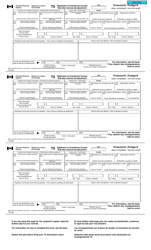

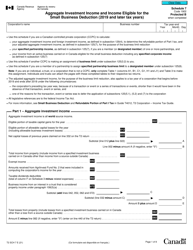

Form T3 Schedule 8 Investment Income, Carrying Charges, and Gross-Up Amount of Dividends Retained by the Trust - Canada

Form T3 Schedule 8 in Canada is used to report investment income, carrying charges, and the gross-up amount of dividends retained by a trust. This information is necessary for calculating the trust's taxable income.

The trust, specifically a Canadian trust, files the Form T3 Schedule 8 for reporting investment income, carrying charges, and the gross-up amount of dividends retained by the trust in Canada.

Form T3 Schedule 8 Investment Income, Carrying Charges, and Gross-Up Amount of Dividends Retained by the Trust - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3 Schedule 8?

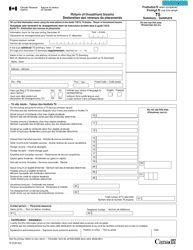

A: Form T3 Schedule 8 is used in Canada to report investment income, carrying charges, and the gross-up amount of dividends retained by the trust.

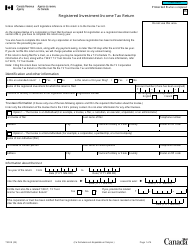

Q: What does Form T3 Schedule 8 include?

A: Form T3 Schedule 8 includes information about investment income earned by the trust, carrying charges associated with the investments, and the gross-up amount of dividends.

Q: What are investment income and carrying charges?

A: Investment income refers to income earned from investments such as dividends, interest, and capital gains. Carrying charges are expenses incurred in earning investment income, such as fees for investment advice or safe deposit boxrental fees.

Q: What is the gross-up amount of dividends?

A: The gross-up amount of dividends is the amount by which eligible dividends received by the trust are increased to account for the tax credit available to shareholders.

Q: Why is Form T3 Schedule 8 important?

A: Form T3 Schedule 8 is important because it provides the necessary information for calculating the trust's taxable income and any tax credits or deductions that may be claimed.