This version of the form is not currently in use and is provided for reference only. Download this version of

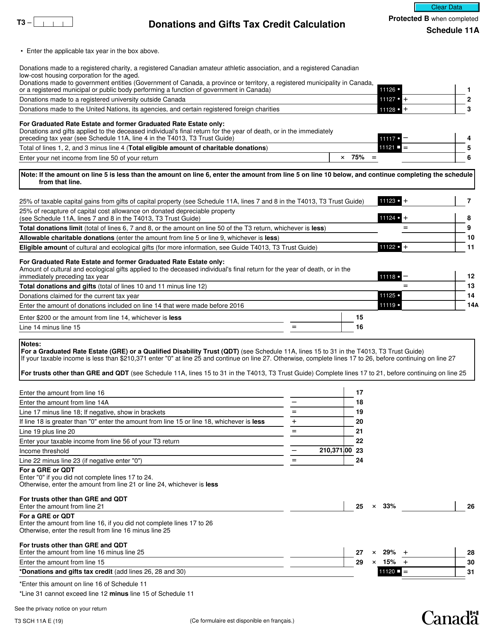

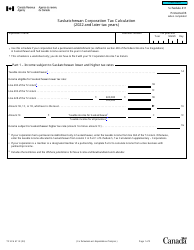

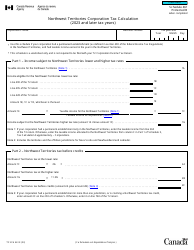

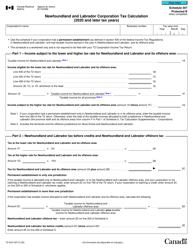

Form T3 Schedule 11A

for the current year.

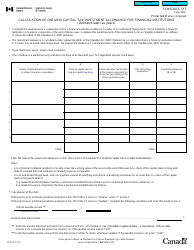

Form T3 Schedule 11A Donations and Gifts Tax Credit Calculation - Canada

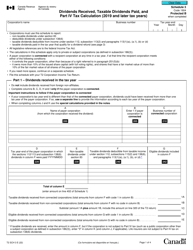

Form T3 Schedule 11A is used in Canada to calculate the tax credit for donations and gifts made by a trust in relation to its income tax return. It is specifically designed for trusts that are required to file a T3 return. The form helps determine the amount of tax credit that the trust can claim based on the donations and gifts it has made.

Individuals who have made donations and gifts in Canada can file the Form T3 Schedule 11A Donations and Gifts Tax Credit Calculation.

FAQ

Q: What is Form T3 Schedule 11A?

A: Form T3 Schedule 11A is a tax form used in Canada to calculate donations and gifts tax credit.

Q: What is the purpose of Form T3 Schedule 11A?

A: The purpose of Form T3 Schedule 11A is to determine the amount of tax credit you can claim for donations and gifts made.

Q: What information is required to complete Form T3 Schedule 11A?

A: To complete Form T3 Schedule 11A, you will need information such as the name of the donee organization, the amount of the donation or gift, and any relevant receipts or documents.

Q: Can anyone claim a tax credit for donations and gifts?

A: No, in order to claim a tax credit for donations and gifts, you must meet certain eligibility criteria. It is recommended to consult the CRA guidelines or a tax professional for more information.

Q: Is there a deadline for filing Form T3 Schedule 11A?

A: Yes, Form T3 Schedule 11A must be filed along with your annual income tax return by the deadline specified by the CRA.

Q: What happens if I make a mistake on Form T3 Schedule 11A?

A: If you make a mistake on Form T3 Schedule 11A, you may need to file an amended return or contact the CRA for guidance on how to correct the error.

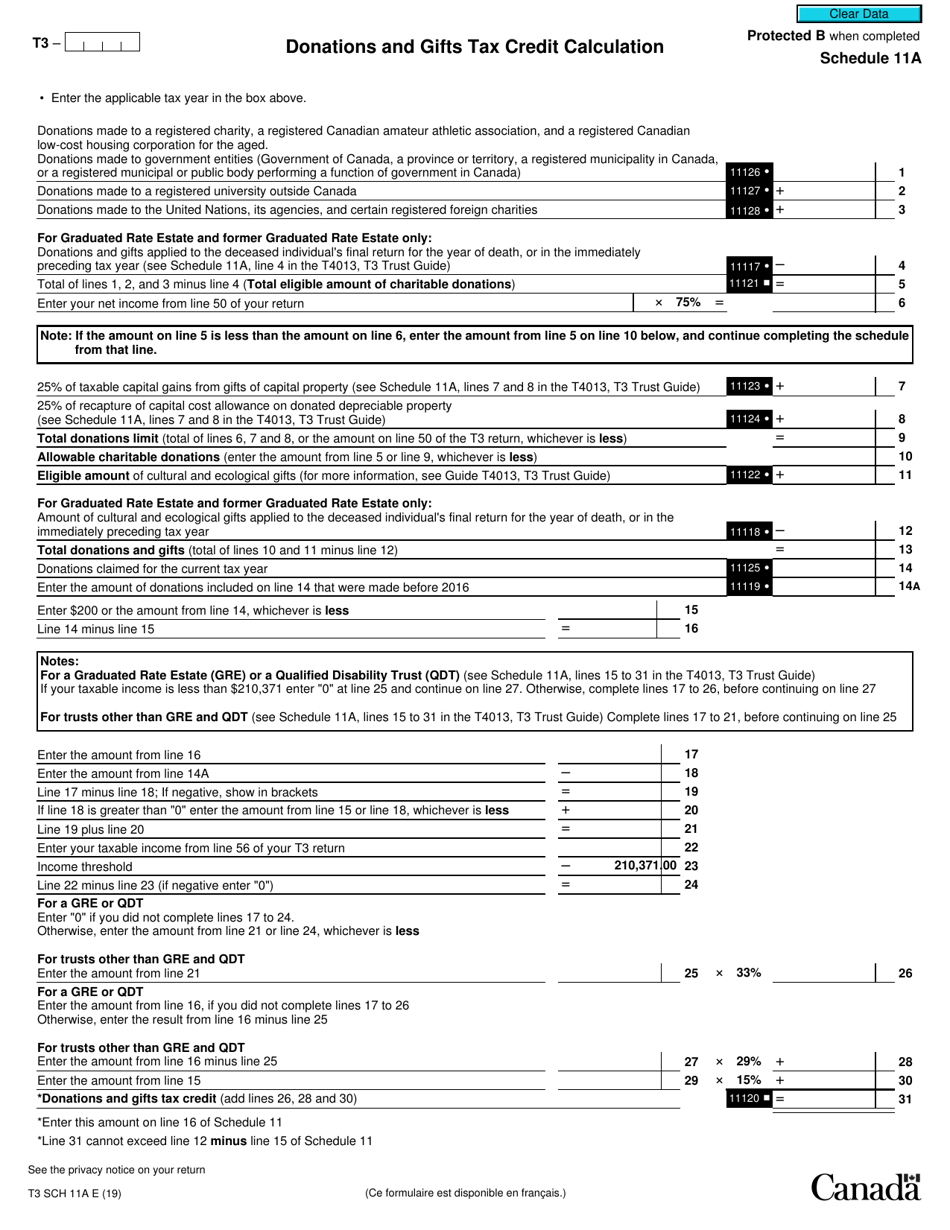

Q: Can I carry forward unused donations and gifts tax credit?

A: Yes, in some cases you may be able to carry forward unused donations and gifts tax credit to future years. Consult the CRA guidelines for more information.

Q: Do I need to include supporting documents with Form T3 Schedule 11A?

A: Yes, you should keep and include supporting documents such as donation receipts, certificates, or acknowledgments with Form T3 Schedule 11A to substantiate your claims.