This version of the form is not currently in use and is provided for reference only. Download this version of

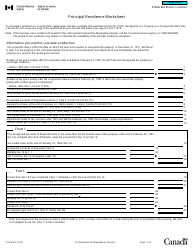

Form T3QDT-WS

for the current year.

Form T3QDT-WS Recovery Tax Worksheet - Canada

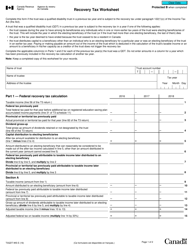

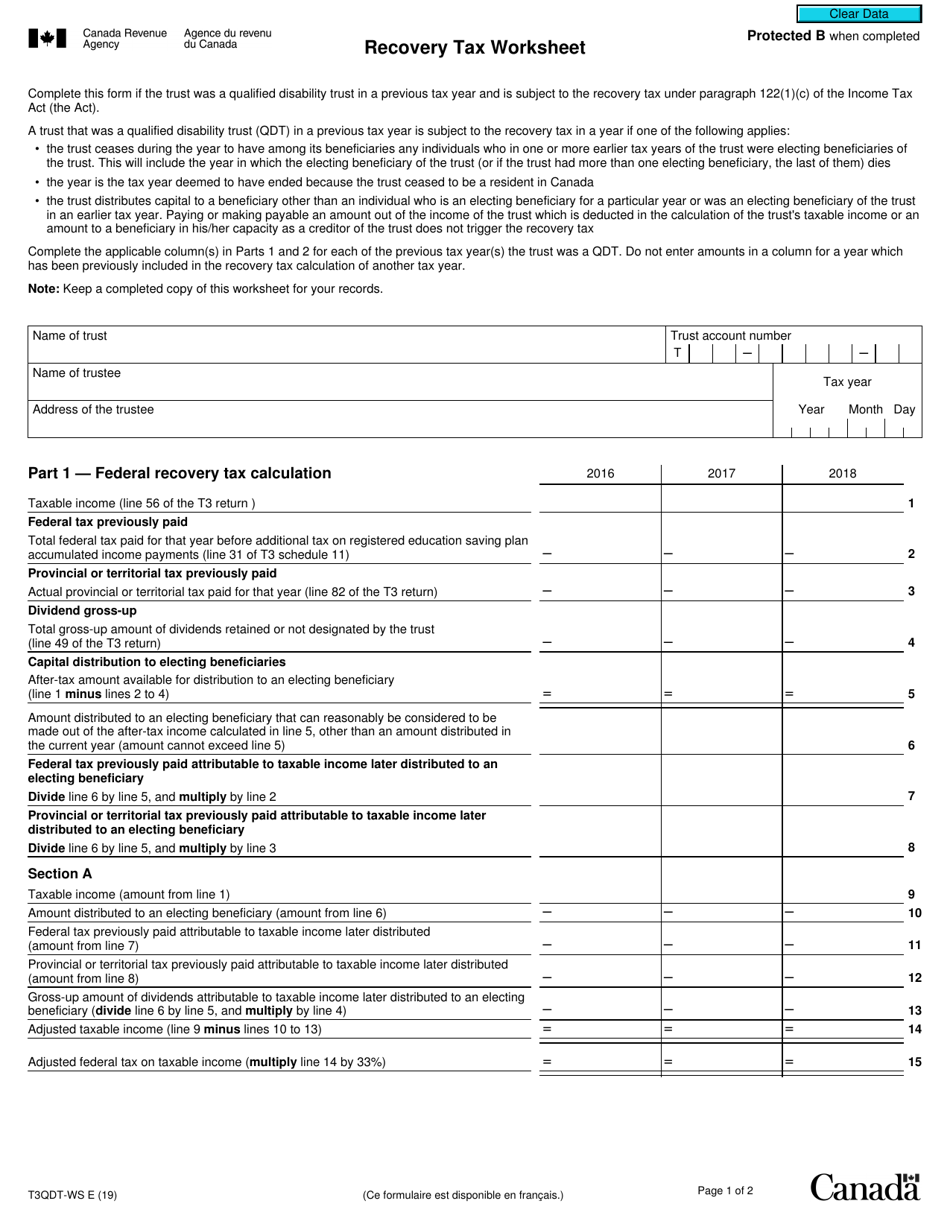

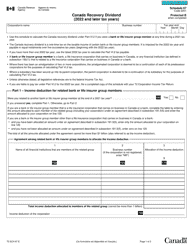

Form T3QDT-WS Recovery Tax Worksheet in Canada is used to calculate the recovery tax payable by qualified disability trust (QDT) beneficiaries. It helps determine the additional taxes owed on any accumulated income in the trust that is expected to be distributed to the beneficiaries.

The Form T3QDT-WS Recovery Tax Worksheet is filed by individuals or businesses in Canada who are claiming a recovery tax.

FAQ

Q: What is Form T3QDT-WS Recovery Tax Worksheet?

A: Form T3QDT-WS Recovery Tax Worksheet is a tax form used in Canada to calculate and determine the amount of recovery tax owed.

Q: Who needs to use Form T3QDT-WS Recovery Tax Worksheet?

A: Individuals in Canada who are subject to the recovery tax and need to calculate the amount owed.

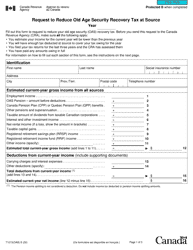

Q: What is the purpose of the recovery tax in Canada?

A: The recovery tax is a progressive tax system in Canada that helps recover Old Age Security (OAS) benefits from high-income individuals.

Q: How do I fill out Form T3QDT-WS Recovery Tax Worksheet?

A: You need to follow the instructions provided on the form and enter the required information accurately, such as your income and the applicable tax rates.

Q: What happens if I fail to file Form T3QDT-WS Recovery Tax Worksheet?

A: Failing to file Form T3QDT-WS Recovery Tax Worksheet or paying the owed recovery tax may result in penalties and interest charges.

Q: Is Form T3QDT-WS Recovery Tax Worksheet the same as my regular income tax return?

A: No, Form T3QDT-WS Recovery Tax Worksheet is a separate form used specifically for calculating and determining the recovery tax owed.

Q: Can I file Form T3QDT-WS Recovery Tax Worksheet electronically?

A: Yes, you can file Form T3QDT-WS Recovery Tax Worksheet electronically using NETFILE or through a certified tax software.

Q: When is the deadline to file Form T3QDT-WS Recovery Tax Worksheet?

A: The deadline to file Form T3QDT-WS Recovery Tax Worksheet is the same as the deadline for your regular income tax return, usually April 30th for most individuals.