This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3NB-SBI

for the current year.

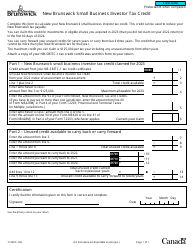

Form T3NB-SBI T3 New Brunswick Small Business Investor Tax Credit - Canada

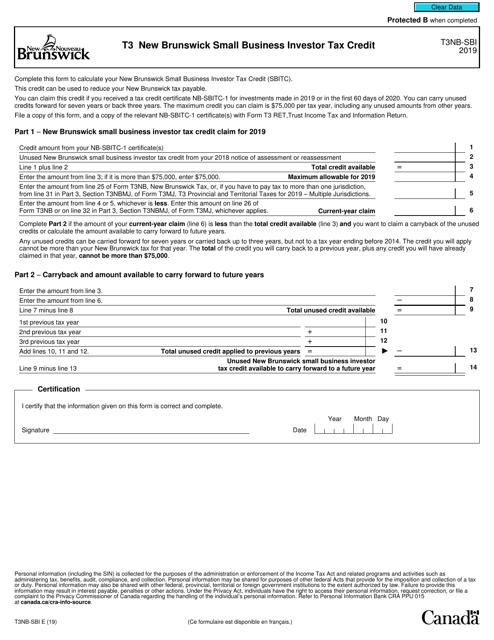

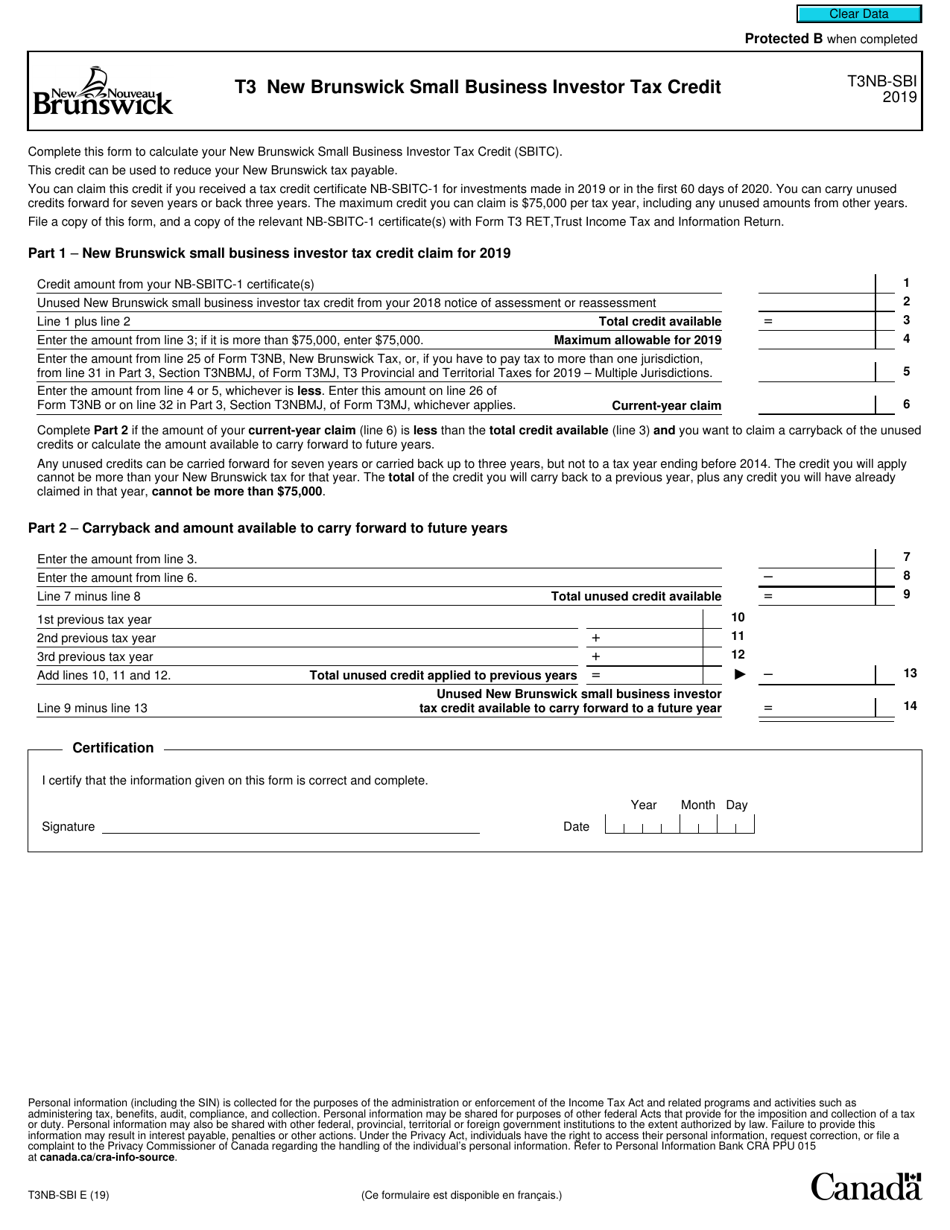

Form T3NB-SBI is a tax form in Canada specifically designed for claiming the New Brunswick Small Business Investor Tax Credit. This credit is available to individuals who invest in eligible small businesses in New Brunswick, Canada. The purpose of this form is to report and claim the tax credit that can help reduce your overall tax liability.

The Form T3NB-SBI is filed by the individual or corporation who claims the New Brunswick Small Business Investor Tax Credit in Canada.

FAQ

Q: What is Form T3NB-SBI?

A: Form T3NB-SBI is a tax form used in Canada for claiming the New Brunswick Small Business Investor Tax Credit.

Q: What is the New Brunswick Small Business Investor Tax Credit?

A: The New Brunswick Small Business Investor Tax Credit is a tax incentive program offered by the government of New Brunswick to encourage investment in small businesses.

Q: Who is eligible for the New Brunswick Small Business Investor Tax Credit?

A: Individuals who invest in eligible small businesses in New Brunswick may be eligible for the tax credit.

Q: What is the purpose of the New Brunswick Small Business Investor Tax Credit?

A: The purpose of the tax credit is to stimulate economic growth and job creation in New Brunswick by providing an incentive for individuals to invest in small businesses.

Q: How does the New Brunswick Small Business Investor Tax Credit work?

A: Investors who meet the eligibility criteria can claim a non-refundable tax credit for a percentage of their investment in eligible small businesses.

Q: Are there any deadlines for claiming the New Brunswick Small Business Investor Tax Credit?

A: The specific deadlines for claiming the tax credit may vary. It is important to consult the CRA or a tax professional for the most up-to-date information.

Q: Can the New Brunswick Small Business Investor Tax Credit be carried forward or transferred?

A: The tax credit may be carried forward for up to seven years and may be transferred to a spouse or common-law partner.

Q: Are there any limitations or conditions for claiming the New Brunswick Small Business Investor Tax Credit?

A: Yes, there are certain limitations and conditions that must be met in order to claim the tax credit. These may include requirements related to the type of business and the investment amount.

Q: Is the New Brunswick Small Business Investor Tax Credit available in other provinces?

A: No, the tax credit is specific to New Brunswick and is not available in other provinces.