This version of the form is not currently in use and is provided for reference only. Download this version of

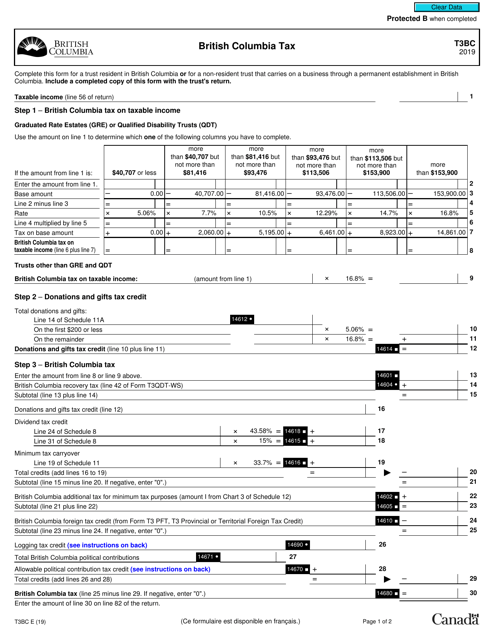

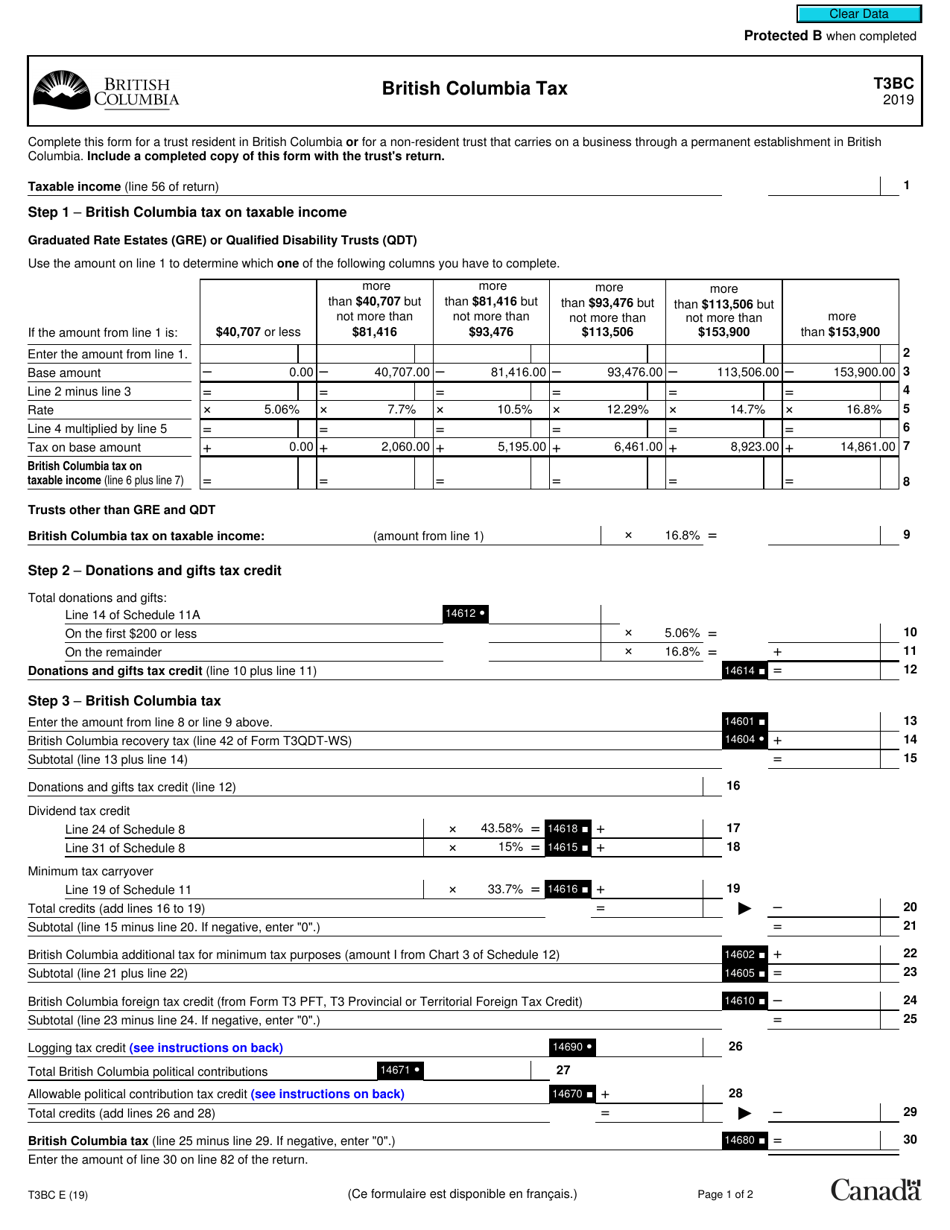

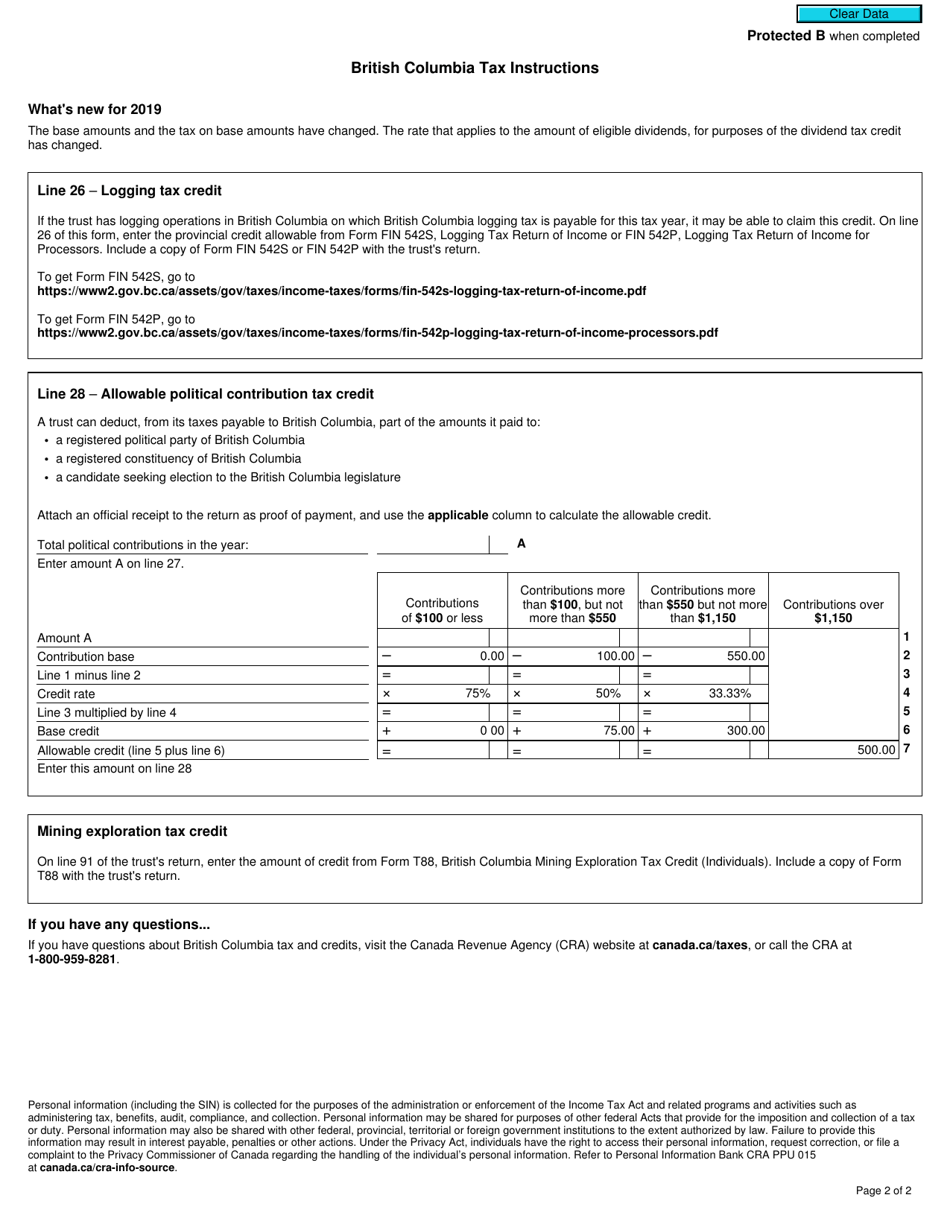

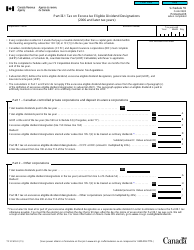

Form T3BC

for the current year.

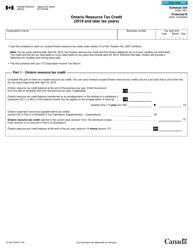

Form T3BC British Columbia Tax - Canada

Form T3BC is used by individuals or corporations in British Columbia, Canada, to report and pay provincial income tax. It is specifically designed for reporting income earned from a trust or an estate.

The Form T3BC, British Columbia Tax, is filed by individuals who are residents of British Columbia, Canada.

FAQ

Q: What is Form T3BC?

A: Form T3BC is a tax form used in British Columbia, Canada.

Q: Who needs to file Form T3BC?

A: Individuals who are residents of British Columbia and have taxable income must file Form T3BC.

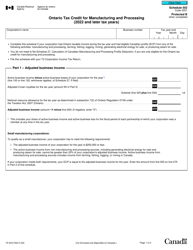

Q: What is the purpose of Form T3BC?

A: Form T3BC is used to calculate and report provincial income tax owed in British Columbia.

Q: When is the deadline to file Form T3BC?

A: The deadline to file Form T3BC is usually April 30th of the following year.

Q: Are there any penalties for late filing of Form T3BC?

A: Yes, if you file your Form T3BC late, you may have to pay penalties and interest on any amounts owing.

Q: Can I e-file Form T3BC?

A: Yes, you can e-file Form T3BC using approved tax software or through the CRA's NetFile service.