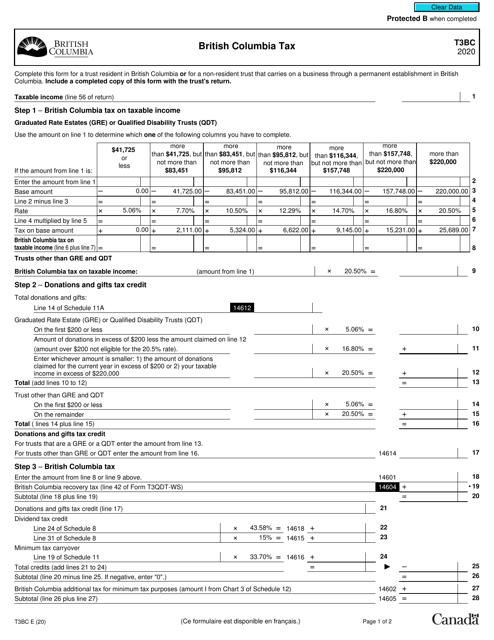

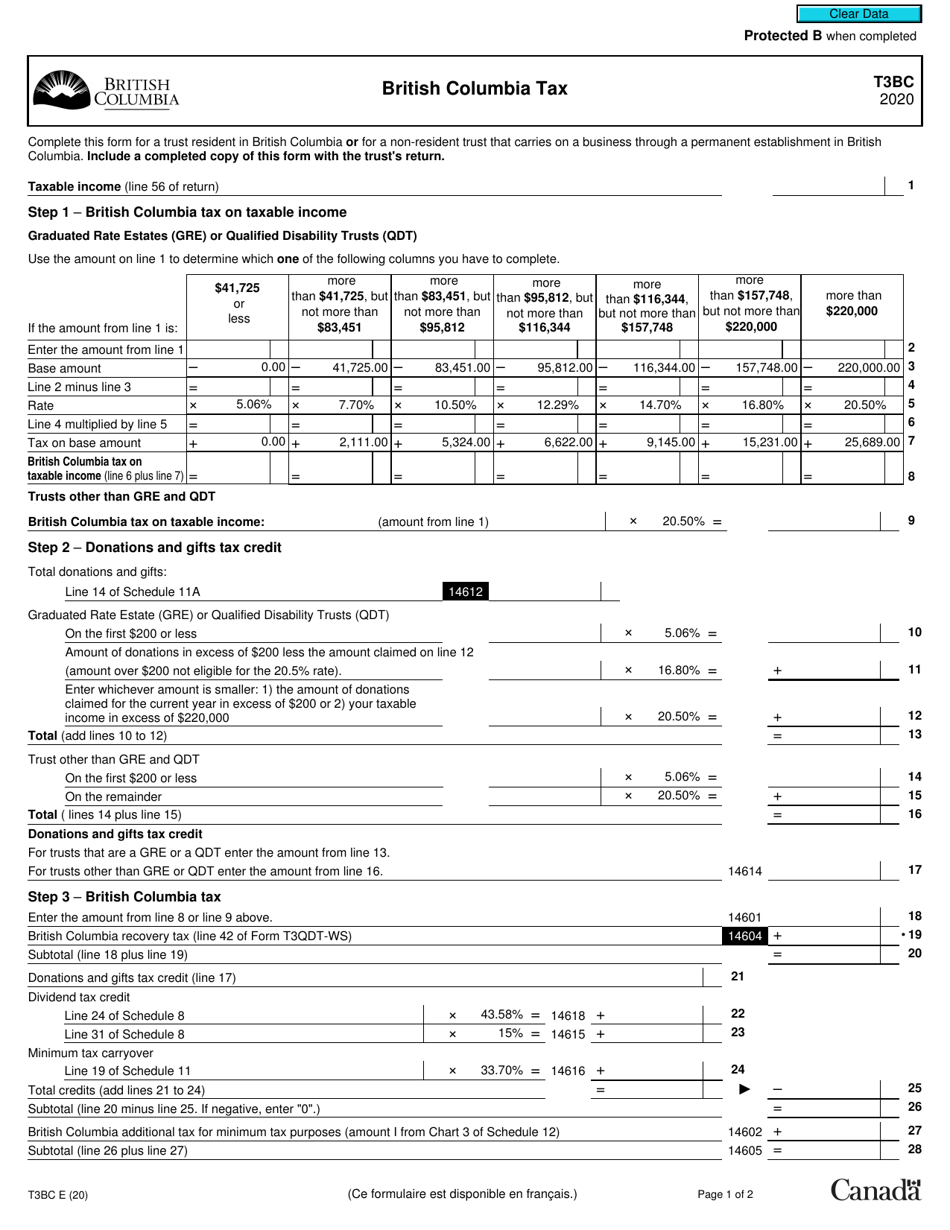

Form T3BC British Columbia Tax - Canada

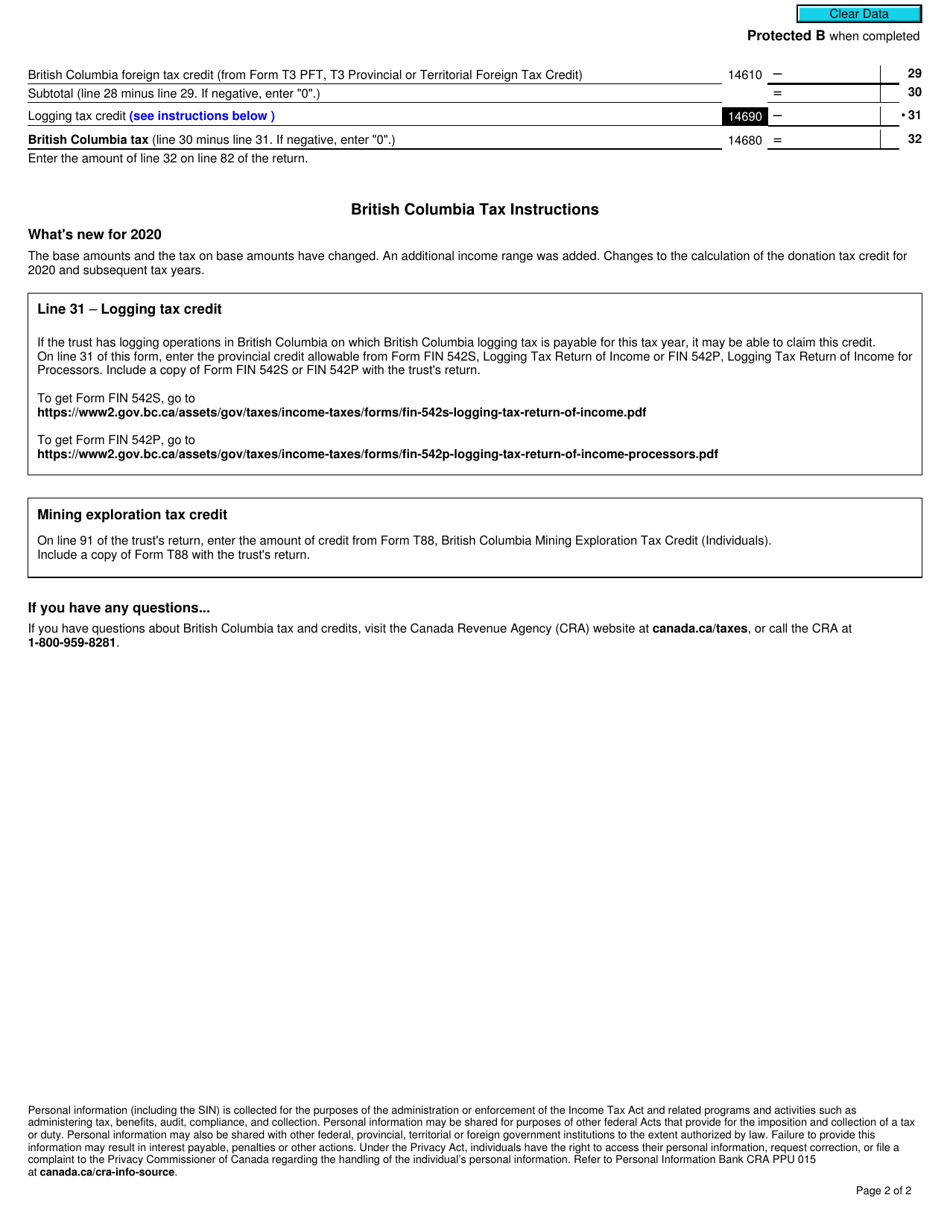

Form T3BC is used to report investment income earned by a trust located in British Columbia, Canada. This form is specifically for tax purposes and helps the taxpayer fulfill their obligations by reporting the relevant information.

The Form T3BC British Columbia Tax in Canada is typically filed by individuals or corporations who are residents of British Columbia and have taxable income in the province.

Form T3BC British Columbia Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3BC?

A: Form T3BC is the British Columbia Tax form used in Canada.

Q: Who needs to file Form T3BC?

A: Residents of British Columbia in Canada who have taxable income need to file Form T3BC.

Q: When is Form T3BC due?

A: Form T3BC is due on April 30th of each year.

Q: Do I need to submit any additional documents with Form T3BC?

A: Depending on your individual tax situation, you may need to submit additional documents, such as receipts or supporting documentation for certain deductions or credits.

Q: What happens if I don't file Form T3BC?

A: If you don't file Form T3BC by the deadline, you may face penalties and interest charges.

Q: Can I e-file Form T3BC?

A: Yes, you can e-file Form T3BC using certified tax preparation software or through a certified tax professional.

Q: Is Form T3BC only for British Columbia residents?

A: Yes, Form T3BC is specifically for residents of British Columbia in Canada.

Q: What information do I need to complete Form T3BC?

A: You will need information like your income, expenses, deductions, and credits to complete Form T3BC.