This version of the form is not currently in use and is provided for reference only. Download this version of

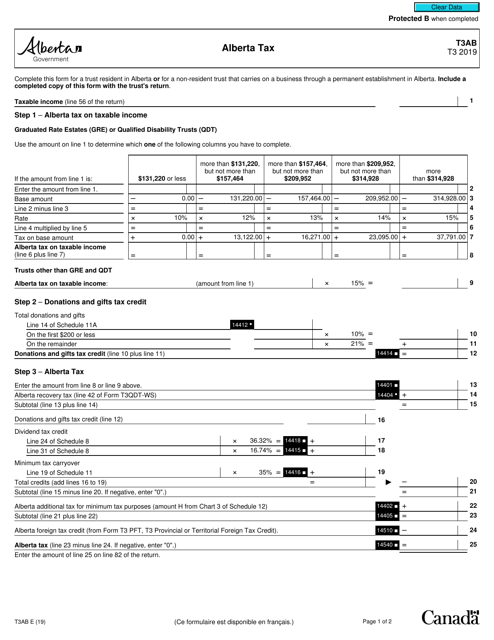

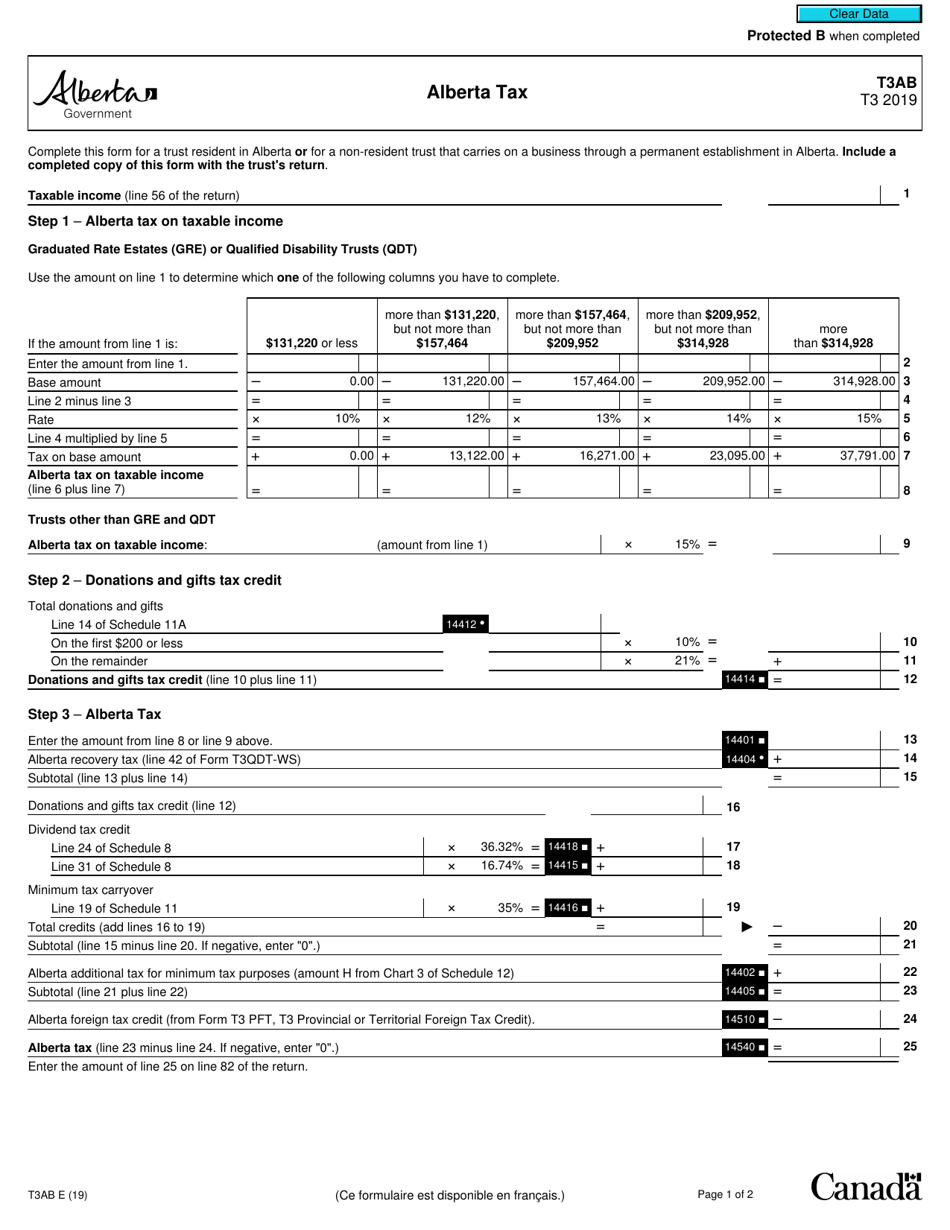

Form T3AB

for the current year.

Form T3AB Alberta Tax - Canada

Form T3AB is used for filing Alberta income tax return for trusts in Canada. This form is specifically for reporting income, deductions, and tax owed by trusts in the province of Alberta.

The Form T3AB Alberta Tax in Canada is generally filed by individuals or corporations who have taxable income in the province of Alberta.

FAQ

Q: What is Form T3AB?

A: Form T3AB is a tax form used in Alberta, Canada.

Q: Who needs to file Form T3AB?

A: Individuals and businesses in Alberta who have taxable income need to file Form T3AB.

Q: What is the purpose of Form T3AB?

A: Form T3AB is used to report and calculate the amount of tax owed in Alberta.

Q: When is the deadline for filing Form T3AB?

A: The deadline for filing Form T3AB varies, but it is typically April 30th of each year.

Q: Are there any penalties for late or incorrect filing of Form T3AB?

A: Yes, there may be penalties for late or incorrect filing of Form T3AB. It is important to file accurately and on time.

Q: Is Form T3AB specific to Alberta?

A: Yes, Form T3AB is specific to Alberta and is used to report provincial taxes.

Q: Can I use Form T3AB for federal taxes?

A: No, Form T3AB is specific to Alberta provincial taxes. You will need to use the appropriate federal tax form for your federal taxes.