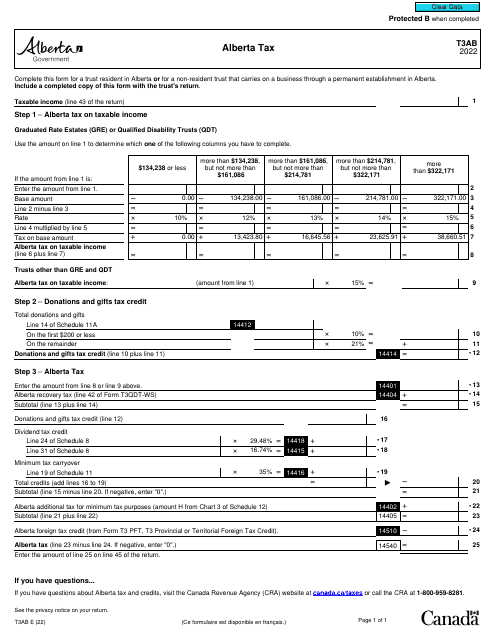

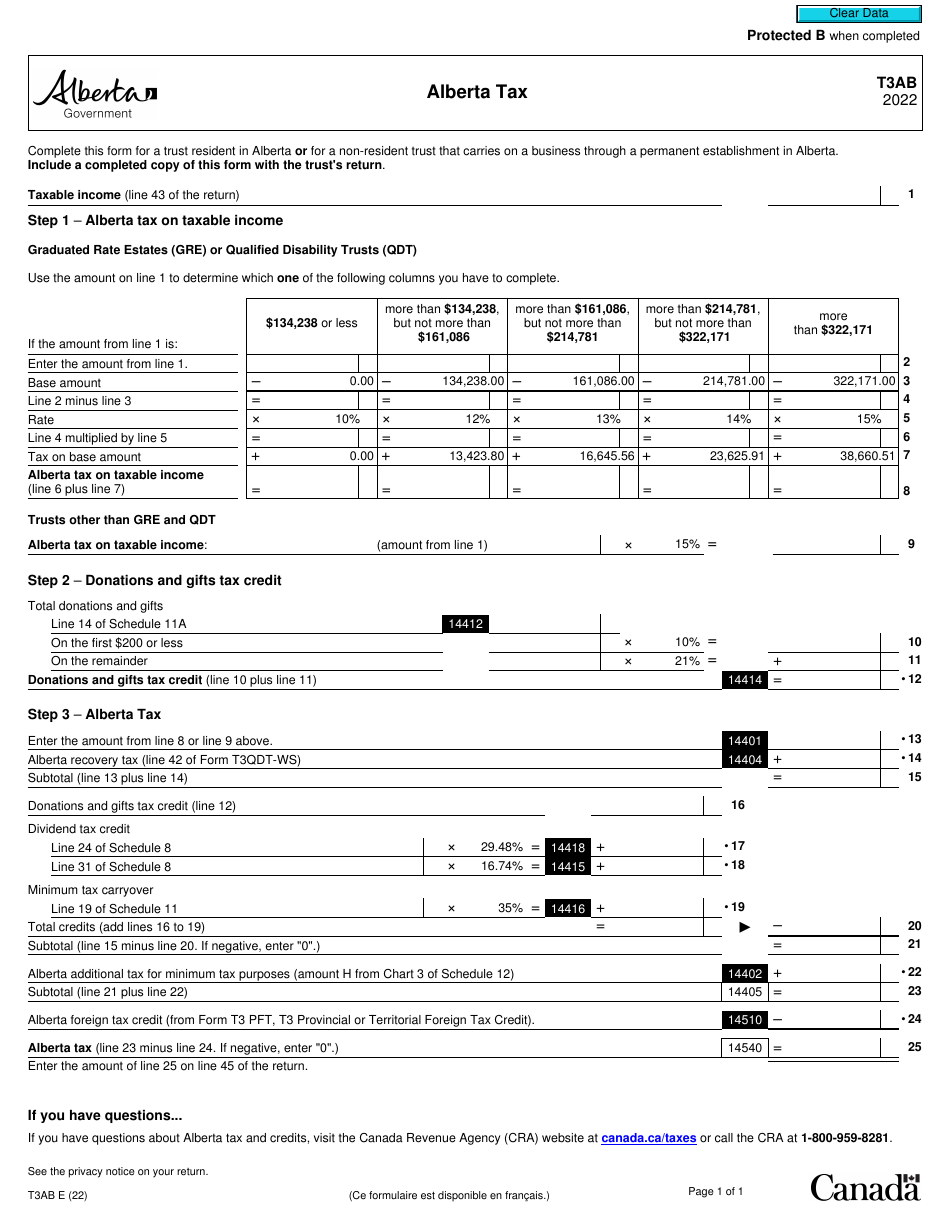

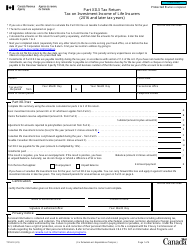

Form T3AB Alberta Tax - Canada

Form T3AB is not specific to Alberta, it is a tax form used in Canada for reporting and calculating the taxes owed on income earned by a trust. It is used to provide detailed information about the trust's income, deductions, and credits for a particular tax year.

The Form T3AB is filed by individuals or corporations who are filing an Alberta tax return in Canada.

Form T3AB Alberta Tax - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3AB?

A: Form T3AB is a tax form used in Alberta, Canada.

Q: Who needs to file Form T3AB?

A: Individuals and businesses in Alberta who have taxable income or are claiming tax credits need to file Form T3AB.

Q: What information is required on Form T3AB?

A: Form T3AB requires information about your income, deductions, and tax credits.

Q: When is the deadline to file Form T3AB?

A: The deadline to file Form T3AB is usually April 30th for individuals and June 15th for self-employed individuals.

Q: Are there any penalties for late filing of Form T3AB?

A: Yes, there may be penalties for late filing of Form T3AB, including interest charges on any outstanding tax owed.

Q: Do I need to include supporting documents with Form T3AB?

A: You may need to include supporting documents with Form T3AB, such as receipts or proof of deductions.

Q: What if I made a mistake on my Form T3AB?

A: If you made a mistake on your Form T3AB, you can file an amended return or contact the CRA for assistance.