This version of the form is not currently in use and is provided for reference only. Download this version of

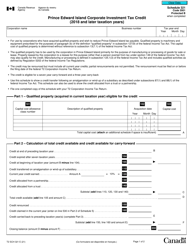

Form T2 Schedule 31

for the current year.

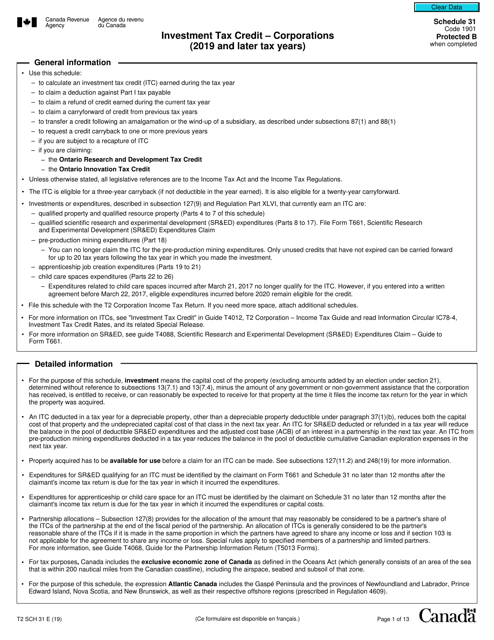

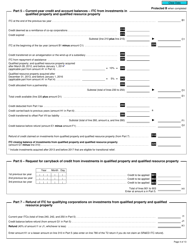

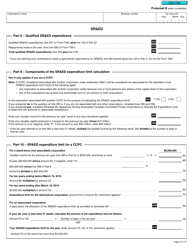

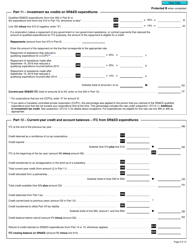

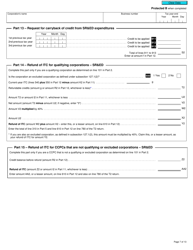

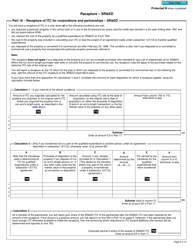

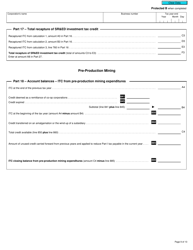

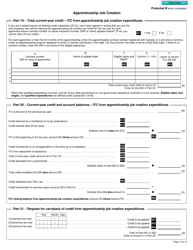

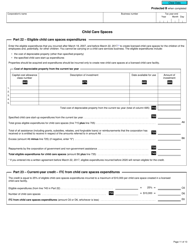

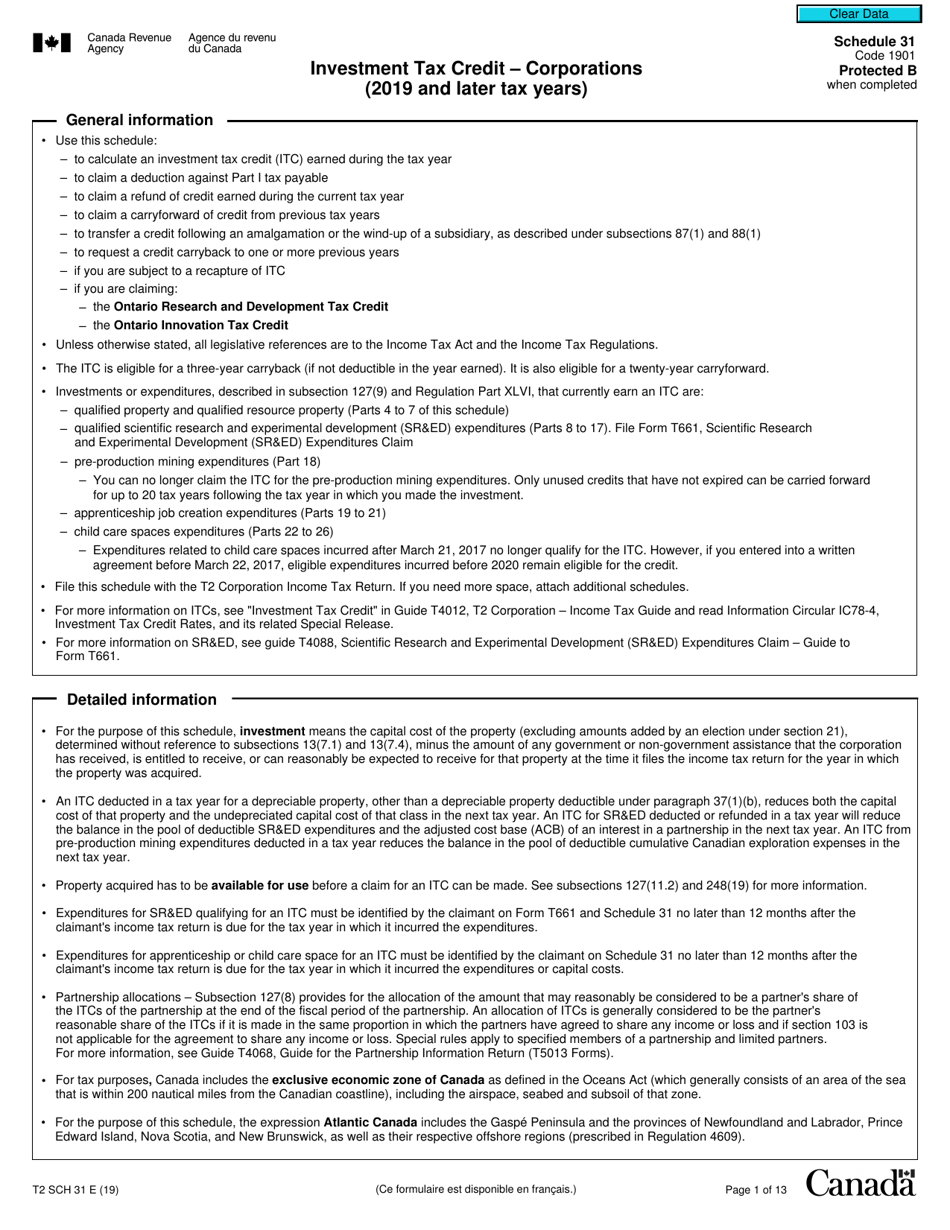

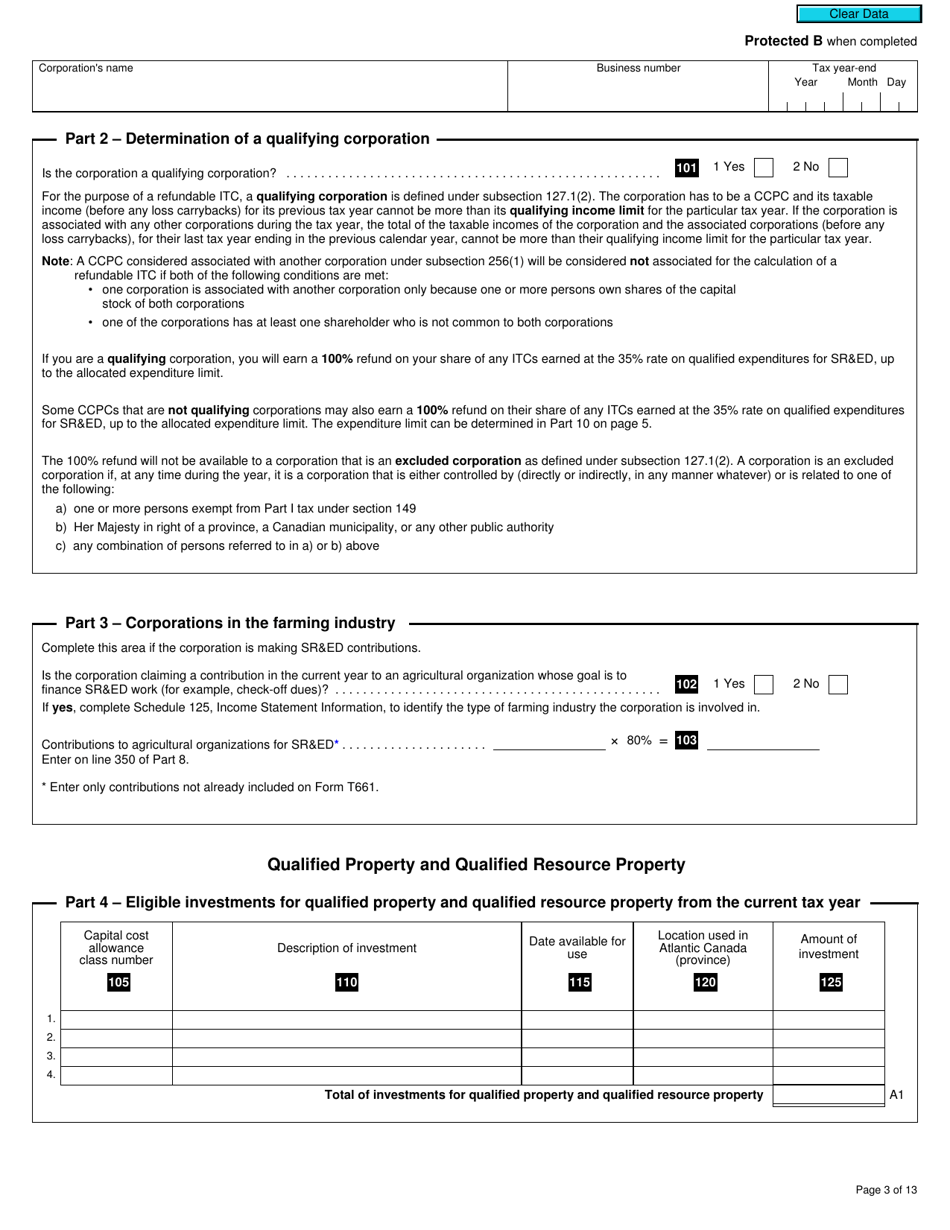

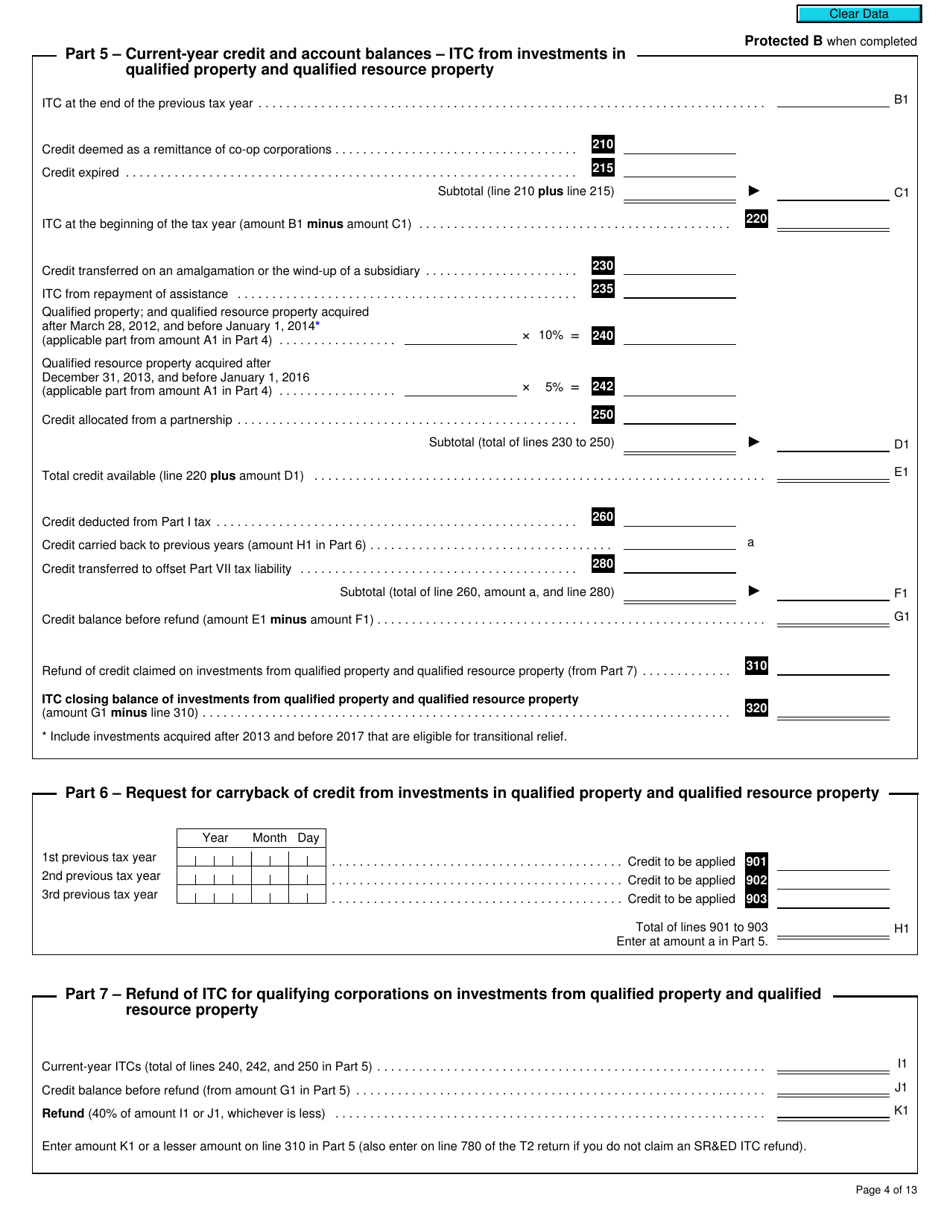

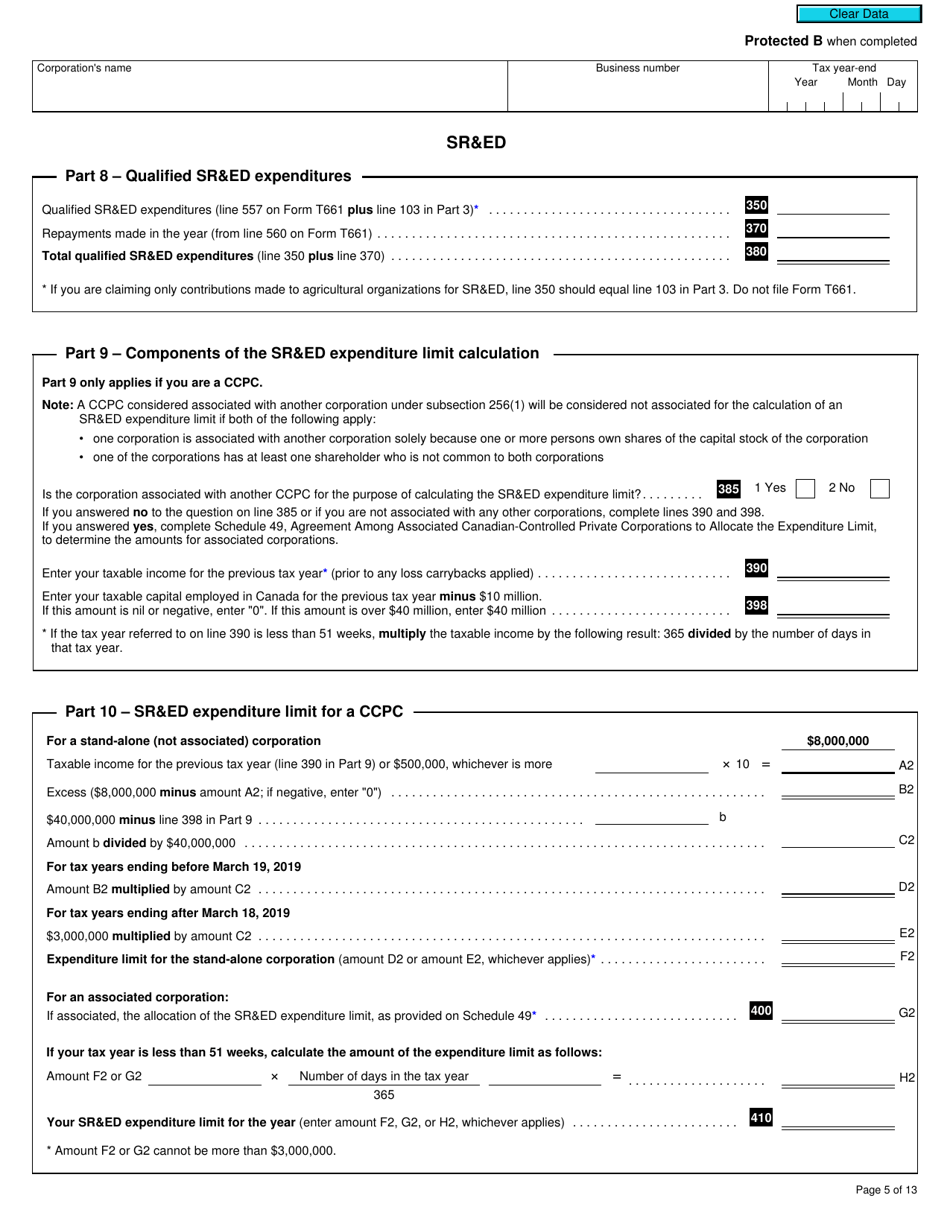

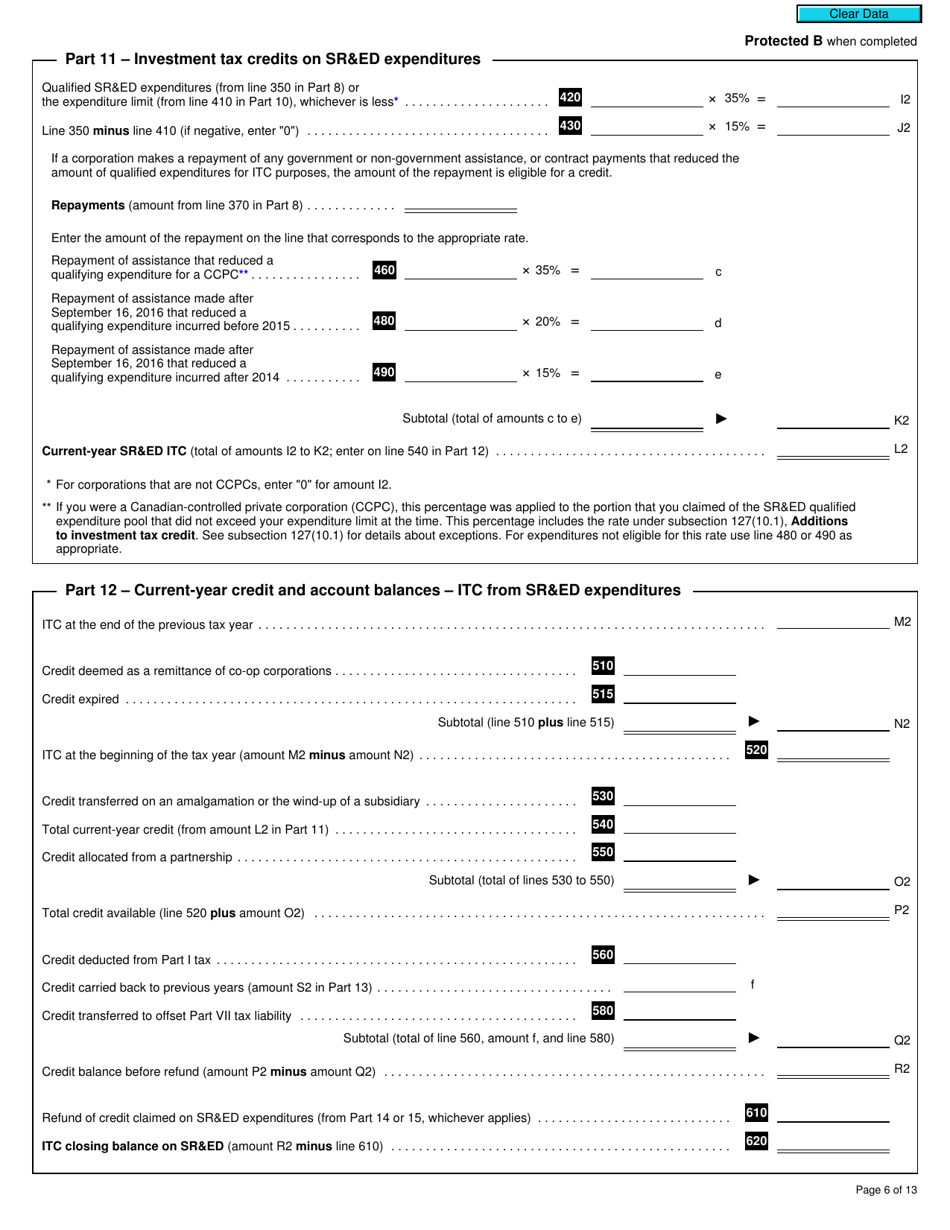

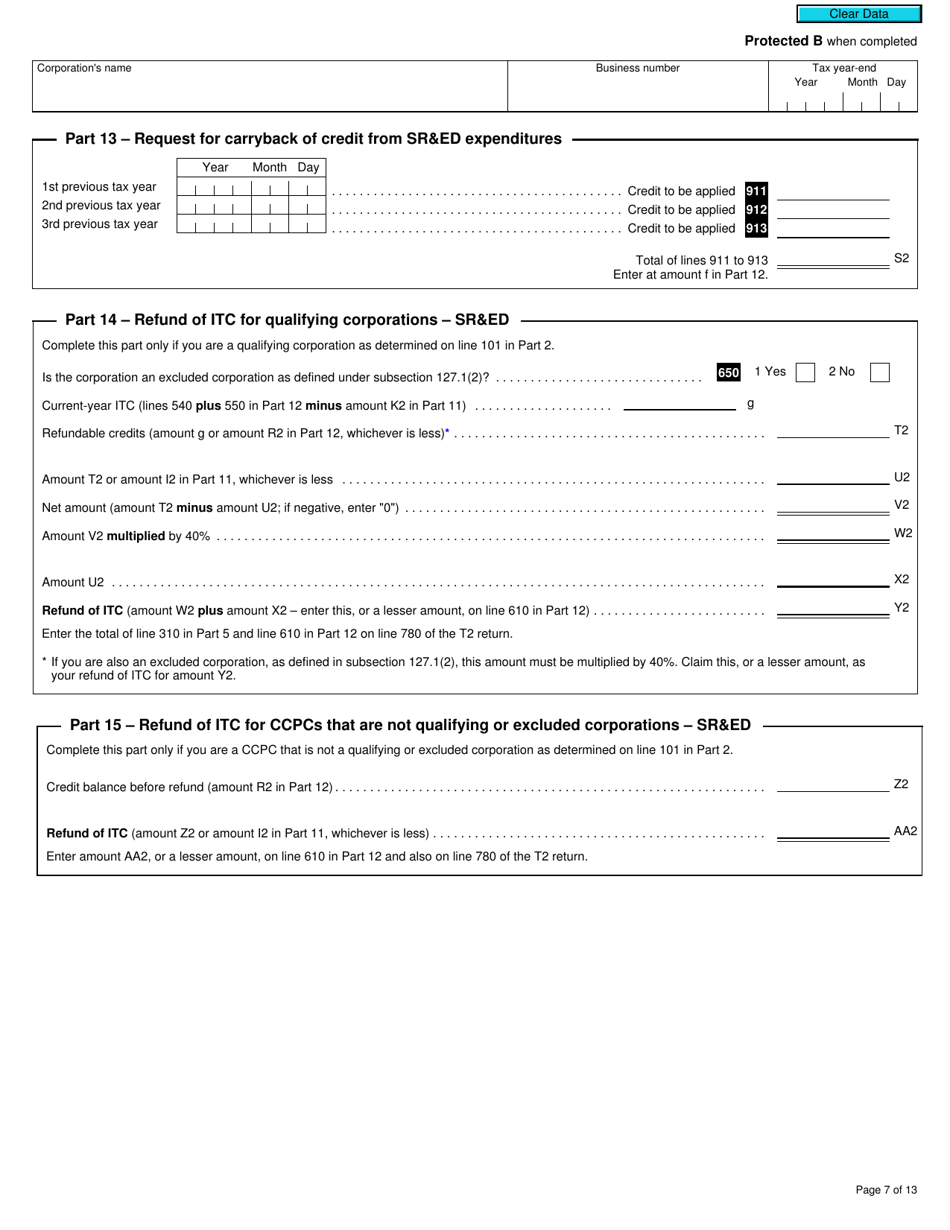

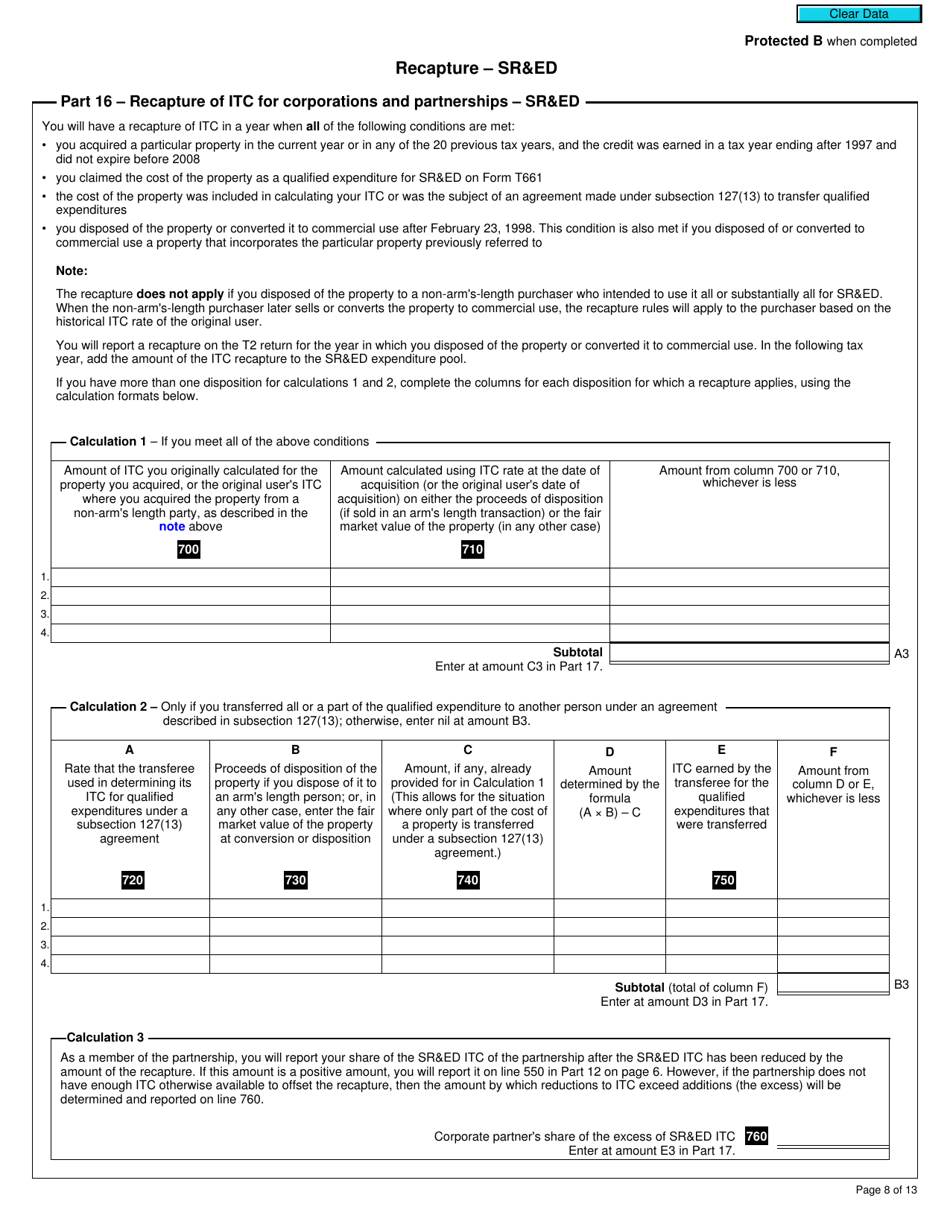

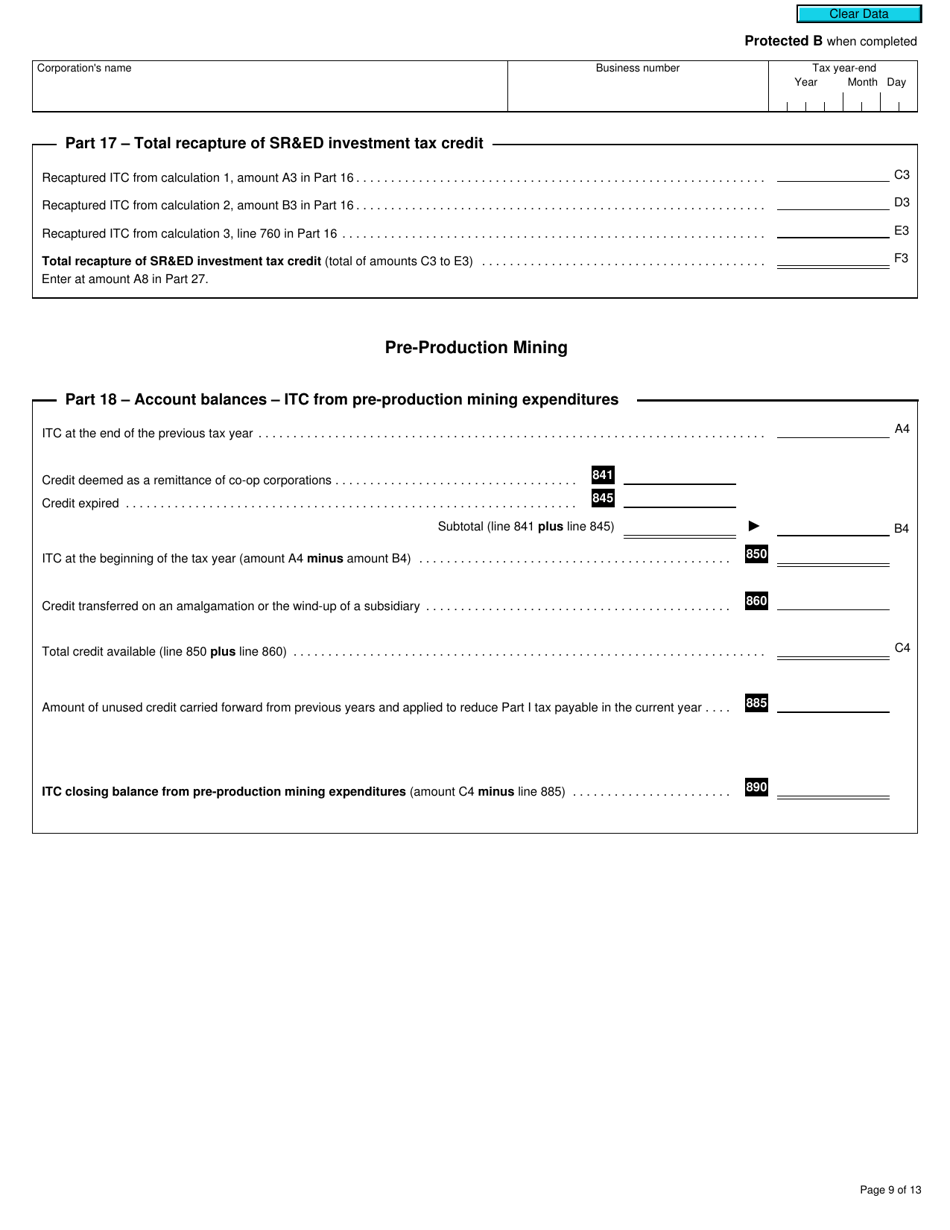

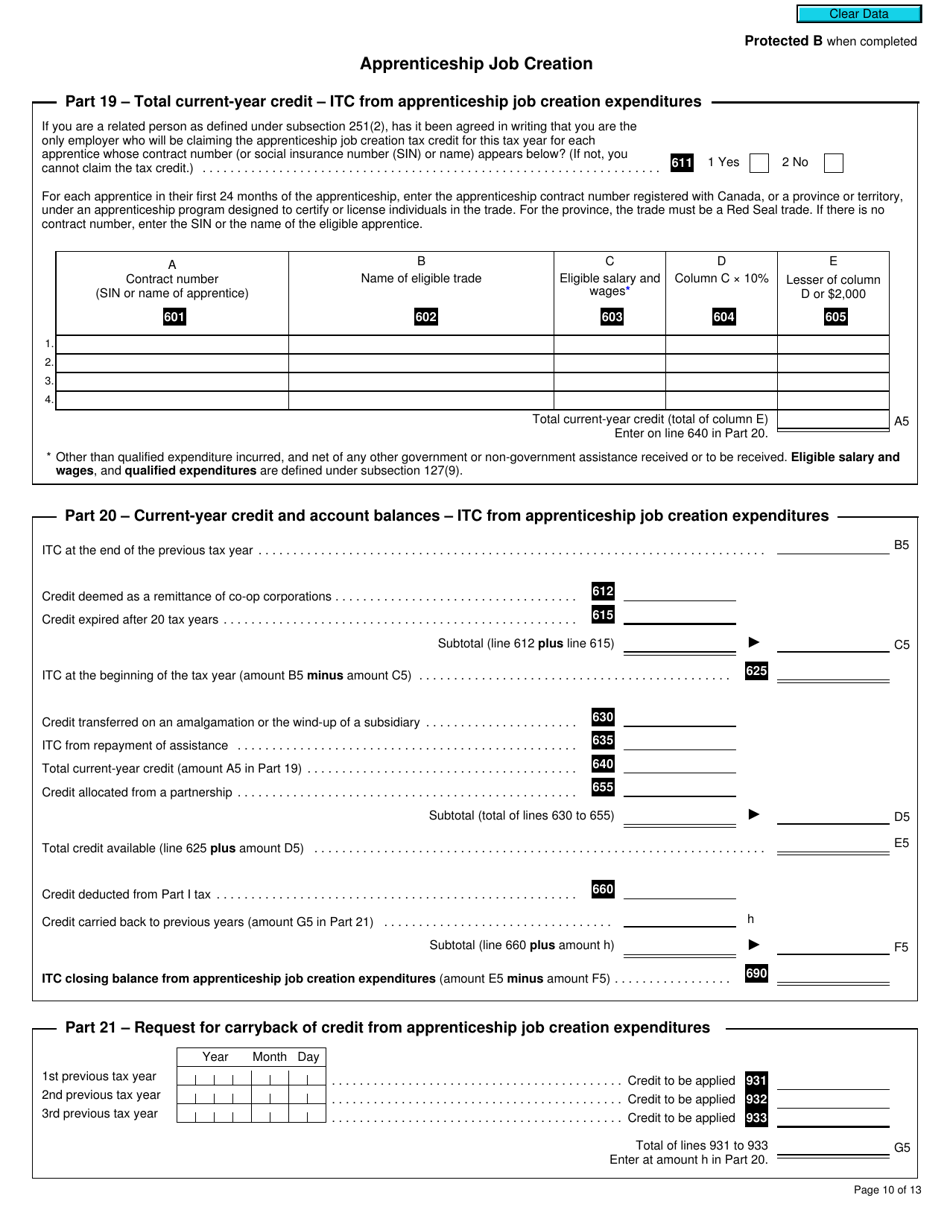

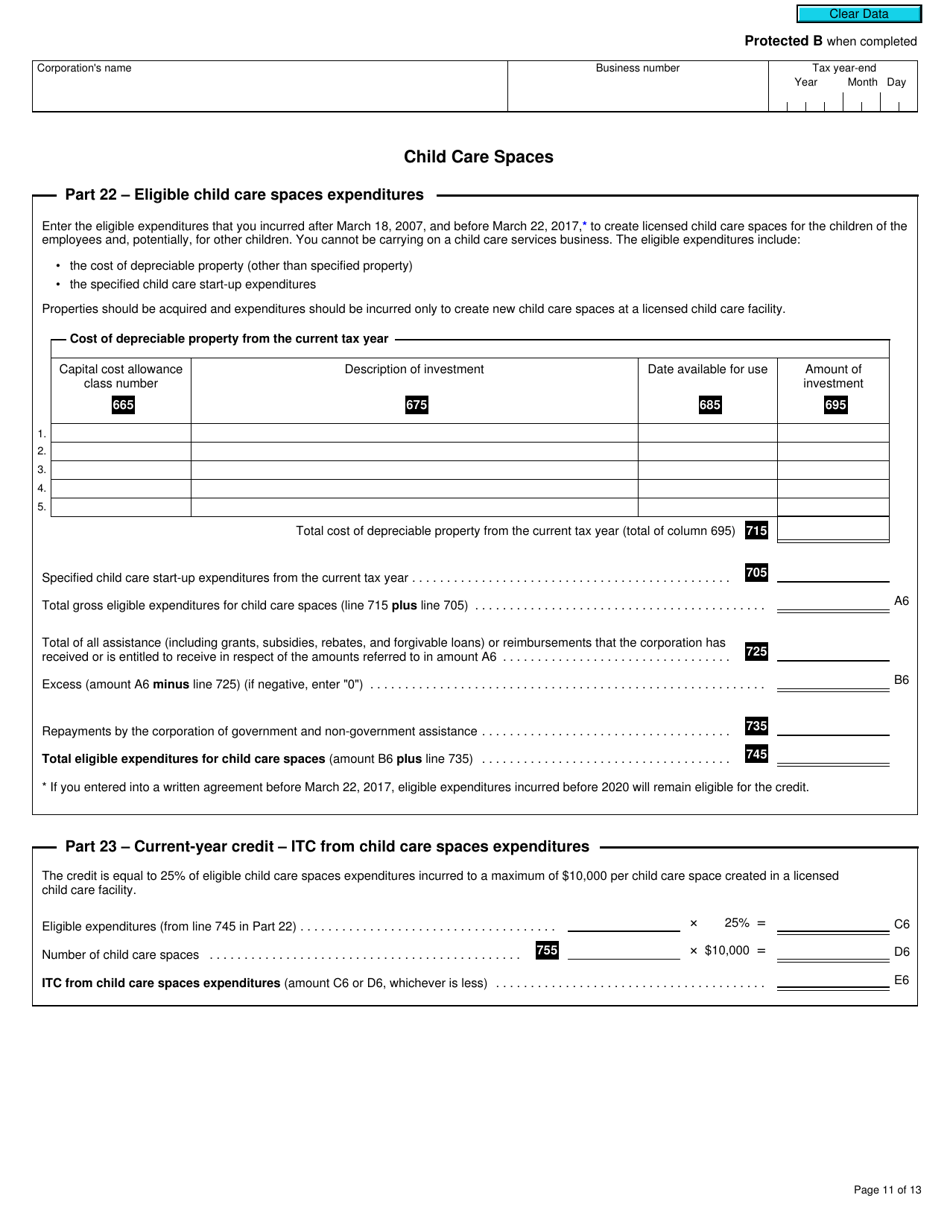

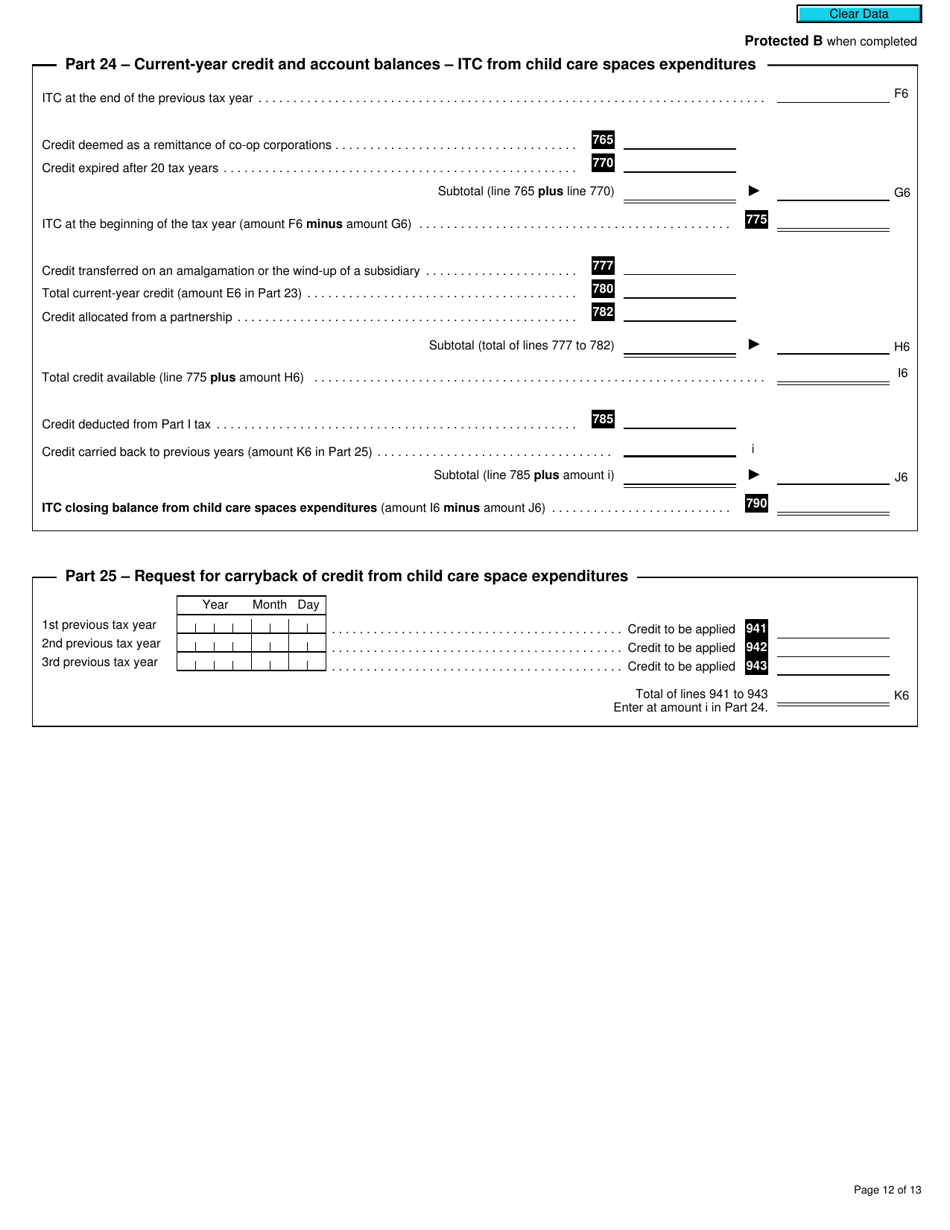

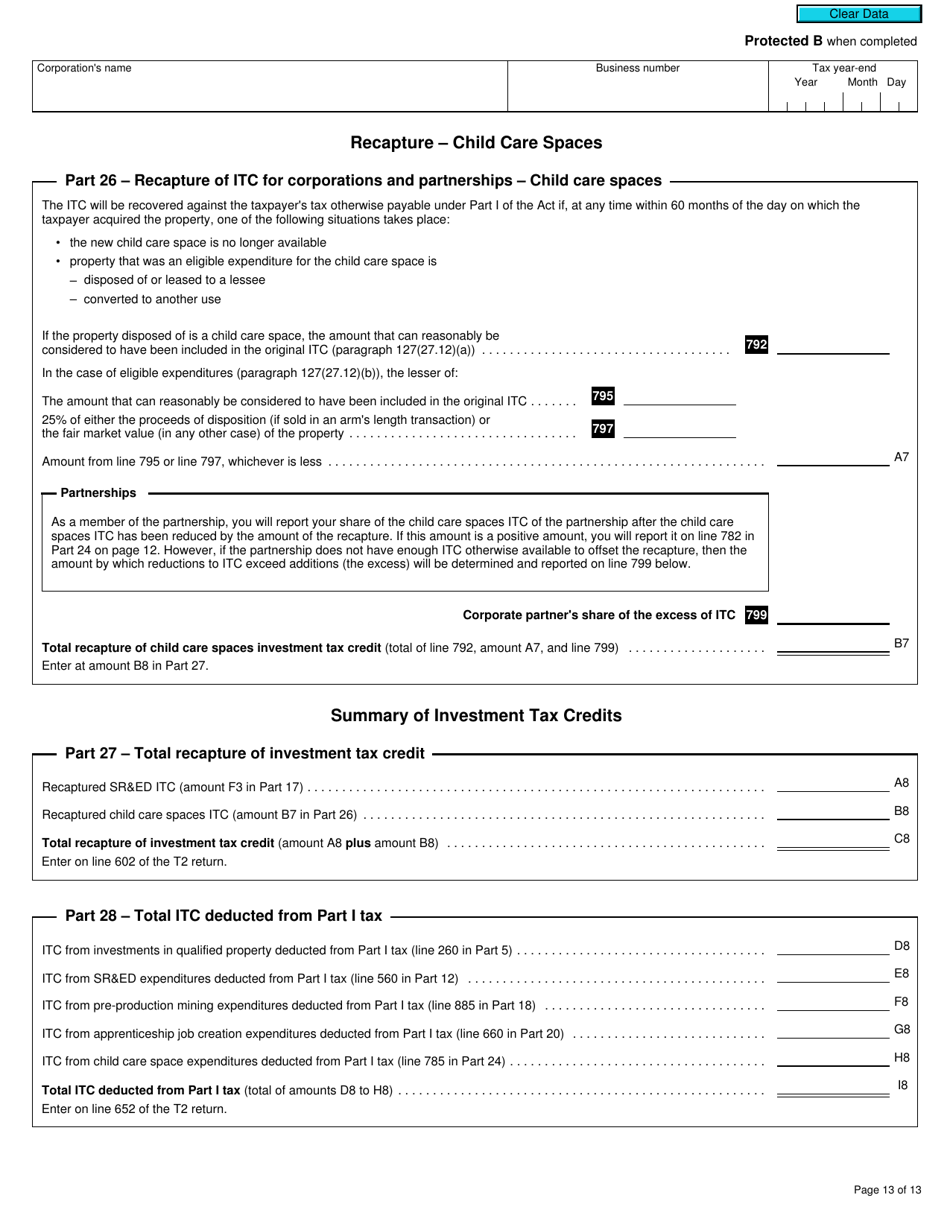

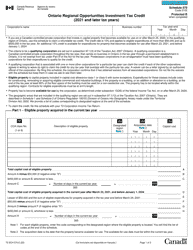

Form T2 Schedule 31 Investment Tax Credit - Corporations (2019 and Later Tax Years) - Canada

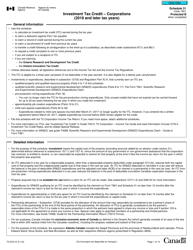

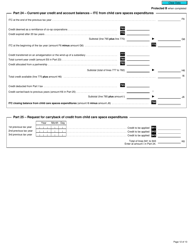

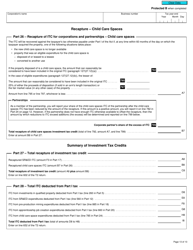

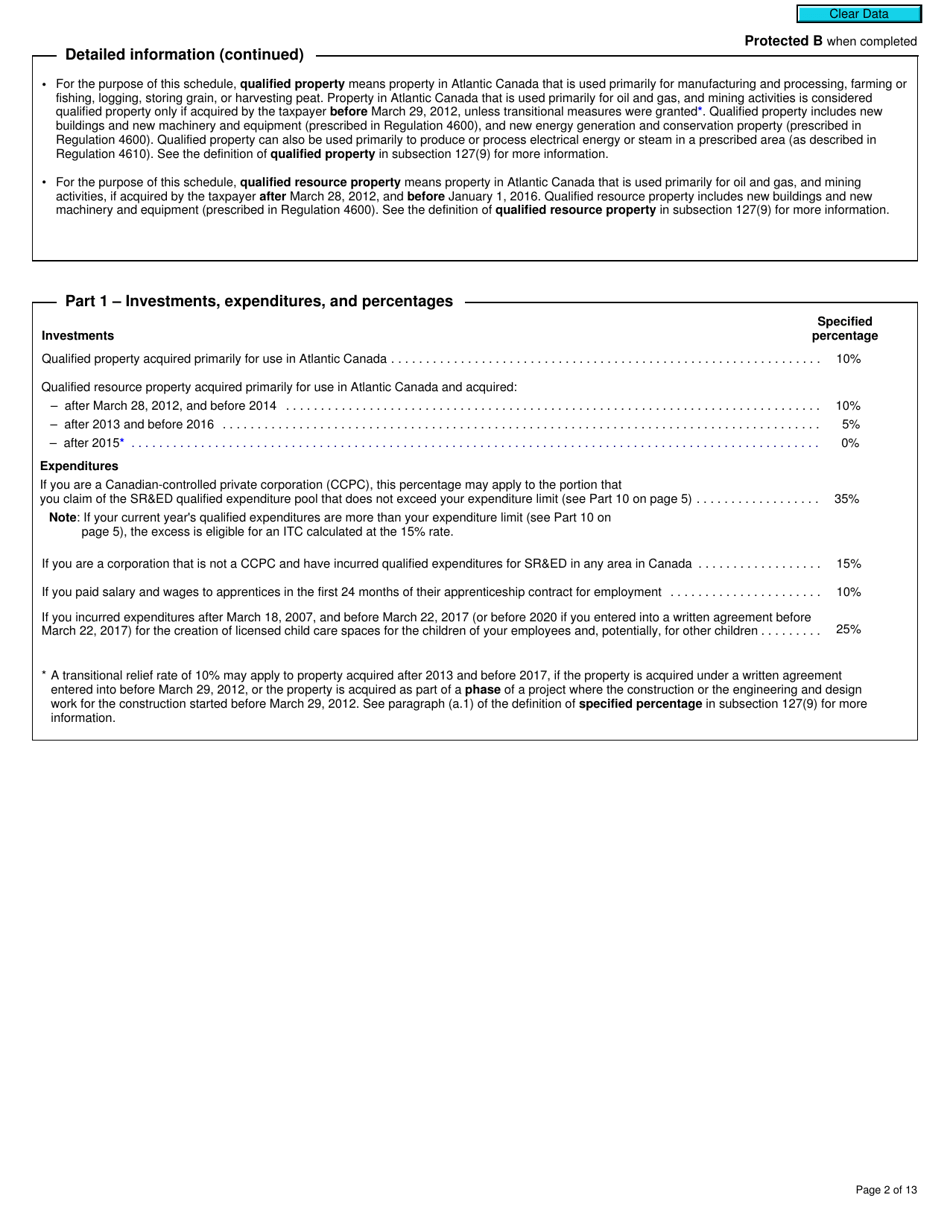

Form T2 Schedule 31, Investment Tax Credit - Corporations, is used by Canadian corporations to claim investment tax credits for eligible expenses incurred in certain economic regions or sectors. This form is applicable for the tax years 2019 and later.

The corporation filing the tax return in Canada files the Form T2 Schedule 31 Investment Tax Credit.

FAQ

Q: What is Form T2 Schedule 31?

A: Form T2 Schedule 31 is a form used by corporations in Canada to claim the Investment Tax Credit.

Q: What is the Investment Tax Credit?

A: The Investment Tax Credit is a tax incentive provided by the Canadian government to encourage businesses to invest in certain assets.

Q: Who can use Form T2 Schedule 31?

A: Corporations in Canada that are eligible for the Investment Tax Credit can use Form T2 Schedule 31 to claim the credit.

Q: What tax years does Form T2 Schedule 31 apply to?

A: Form T2 Schedule 31 applies to tax years starting in 2019 and later.

Q: What information is required on Form T2 Schedule 31?

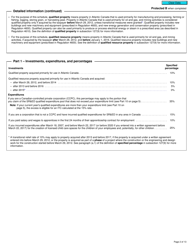

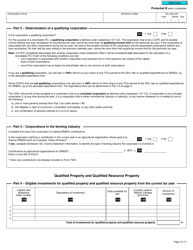

A: Form T2 Schedule 31 requires information about the eligible property, the amount of the investment, and the calculation of the credit.

Q: How do I submit Form T2 Schedule 31?

A: Form T2 Schedule 31 should be included with the corporation's T2 tax return and filed with the Canada Revenue Agency (CRA).

Q: Is there a deadline for filing Form T2 Schedule 31?

A: The deadline for filing Form T2 Schedule 31 is generally the same as the deadline for filing the corporation's T2 tax return, which is six months after the end of the tax year.

Q: Can I carry forward unused Investment Tax Credits?

A: Yes, unused Investment Tax Credits can be carried forward to future tax years.

Q: Are there any limitations or restrictions on claiming the Investment Tax Credit?

A: Yes, there may be limitations and restrictions on claiming the Investment Tax Credit, such as certain types of property not being eligible or limits based on the size or type of business.