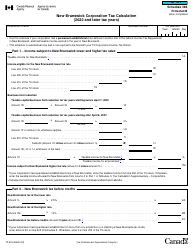

This version of the form is not currently in use and is provided for reference only. Download this version of

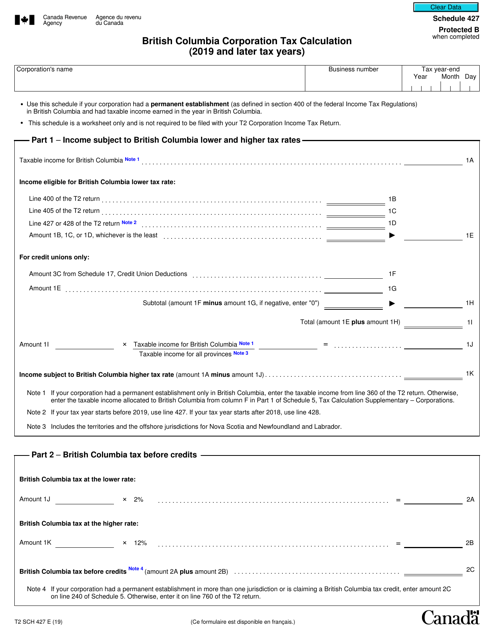

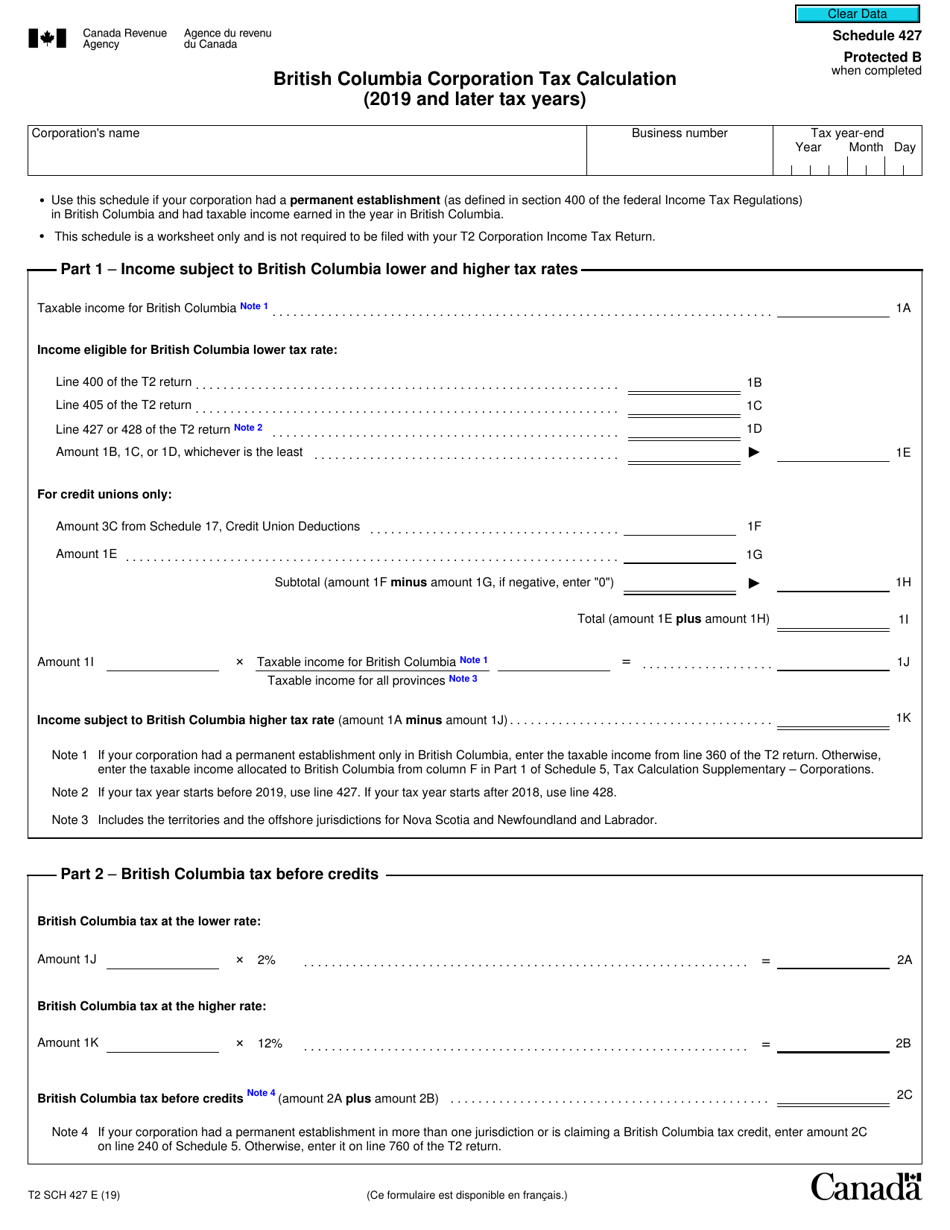

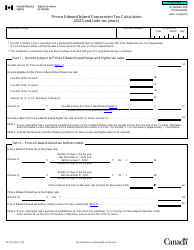

Form T2 Schedule 427

for the current year.

Form T2 Schedule 427 British Columbia Corporation Tax Calculation (2019 and Later Tax Years) - Canada

Form T2 Schedule 427 is used in Canada for calculating the corporation tax owed by British Columbia corporations for tax years beginning in 2019 and later. It helps businesses in British Columbia determine their tax liabilities based on their income, deductions, and credits.

The Form T2 Schedule 427 British Columbia Corporation Tax Calculation (2019 and Later Tax Years) in Canada is filed by British Columbia corporations.

FAQ

Q: What is Form T2 Schedule 427?

A: Form T2 Schedule 427 is a tax form used by British Columbia corporations to calculate their corporation tax for the 2019 and later tax years.

Q: Who needs to use Form T2 Schedule 427?

A: British Columbia corporations need to use Form T2 Schedule 427 to calculate their corporation tax for the 2019 and later tax years.

Q: What does Form T2 Schedule 427 calculate?

A: Form T2 Schedule 427 calculates the corporation tax owed by British Columbia corporations for the 2019 and later tax years.

Q: Are there any specific requirements to use Form T2 Schedule 427?

A: Yes, Form T2 Schedule 427 can only be used by British Columbia corporations for the 2019 and later tax years.

Q: Is there a deadline for submitting Form T2 Schedule 427?

A: Yes, there is a deadline for submitting Form T2 Schedule 427. The specific deadline depends on the fiscal year-end of the corporation.

Q: What happens if I don't submit Form T2 Schedule 427 on time?

A: If Form T2 Schedule 427 is not submitted on time, penalties and interest may be charged by the Canada Revenue Agency.

Q: Is there a fee for filing Form T2 Schedule 427?

A: No, there is no fee for filing Form T2 Schedule 427.

Q: Can I get help filling out Form T2 Schedule 427?

A: Yes, the Canada Revenue Agency provides resources and assistance to help corporations fill out Form T2 Schedule 427.