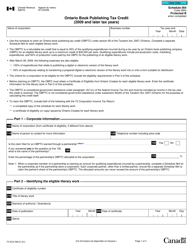

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 389

for the current year.

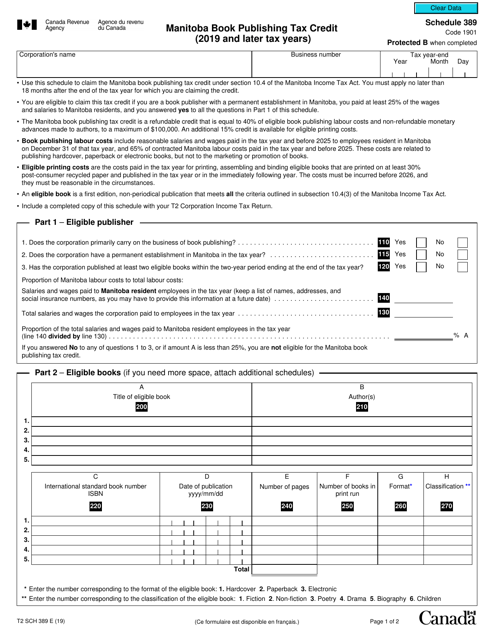

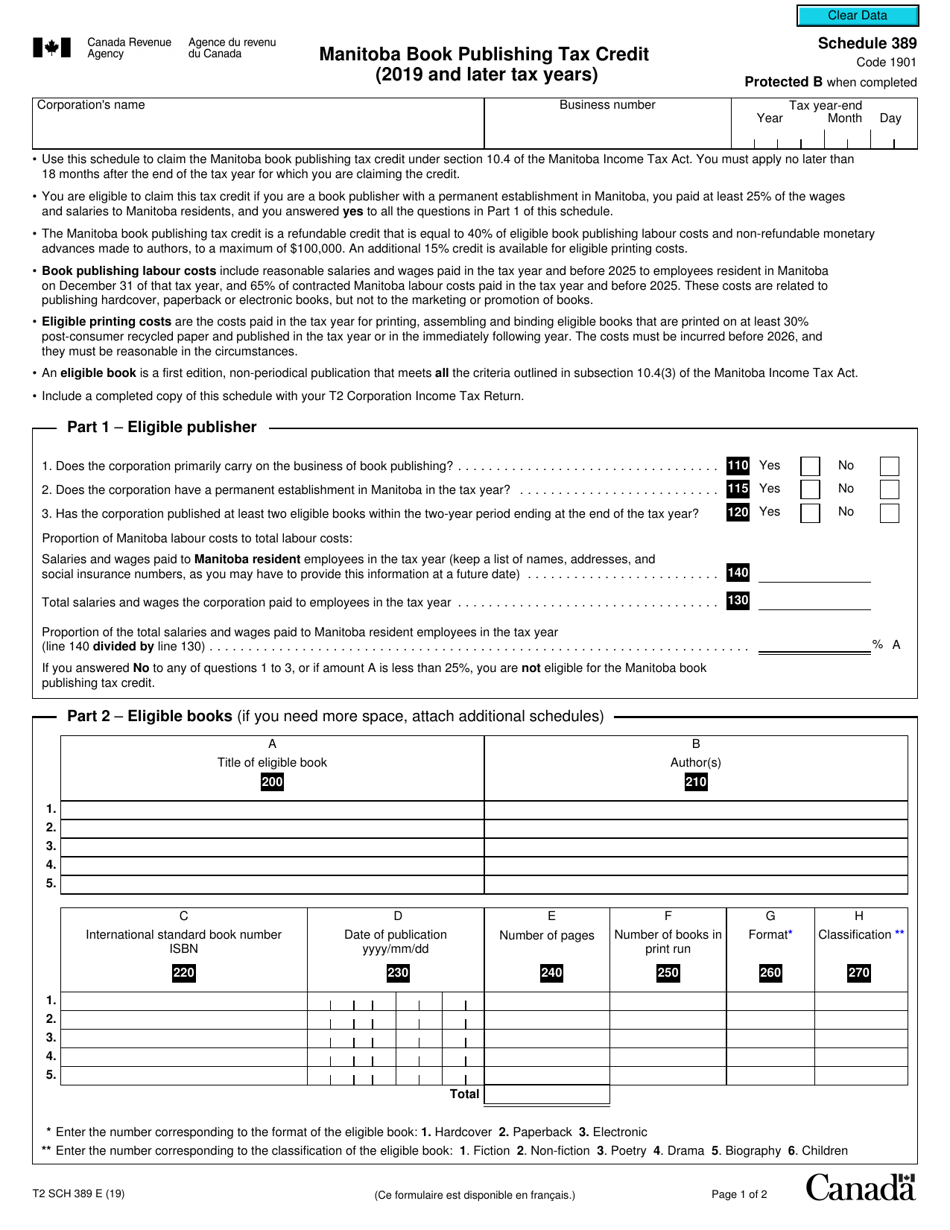

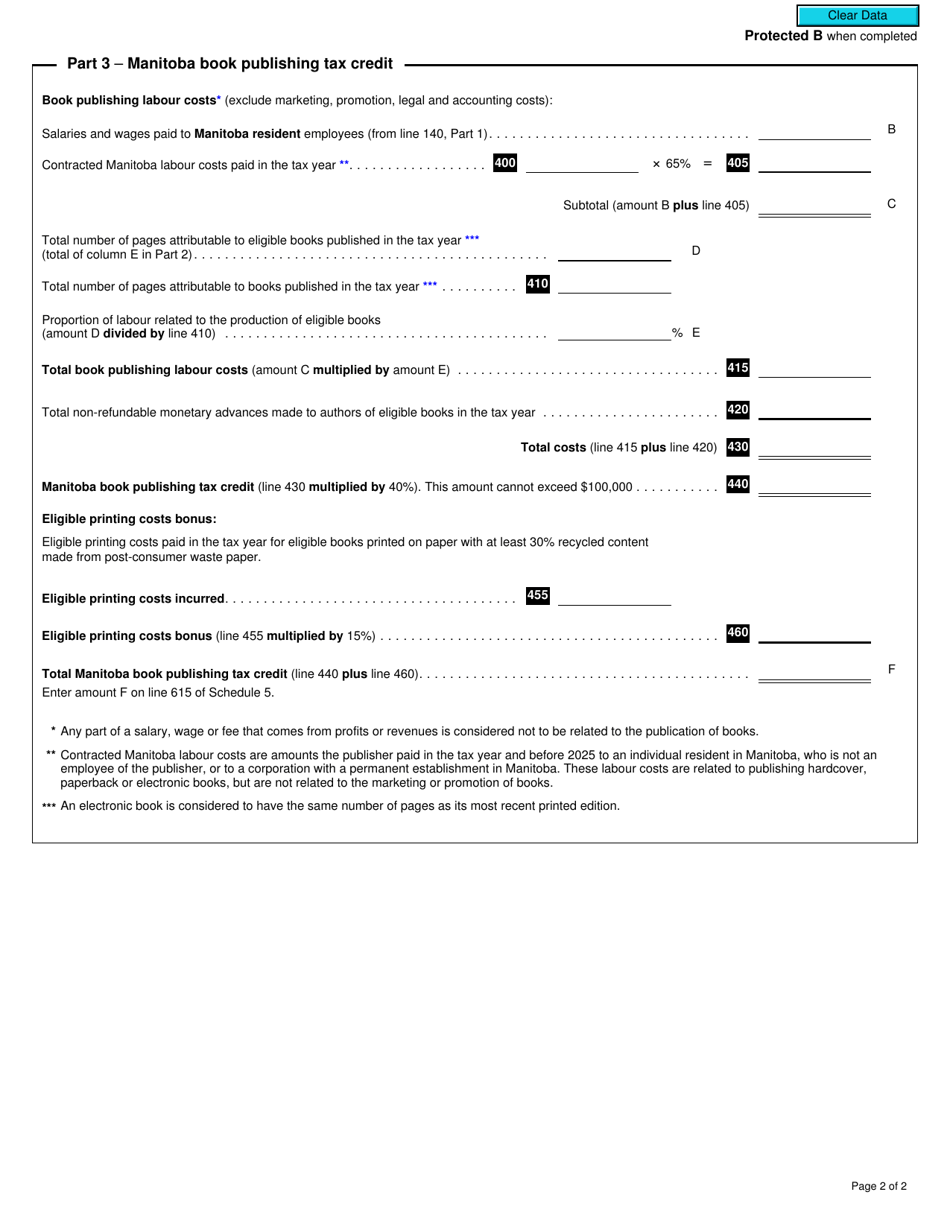

Form T2 Schedule 389 Manitoba Book Publishing Tax Credit (2019 and Later Tax Years) - Canada

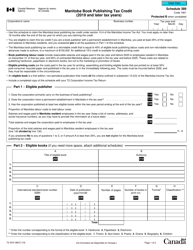

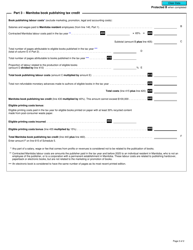

Form T2 Schedule 389 is used in Canada for claiming the Manitoba Book Publishing Tax Credit. It is applicable for the tax years 2019 and later. This tax credit is designed to support the Manitoba book publishing industry.

The Form T2 Schedule 389 Manitoba Book Publishing Tax Credit in Canada is typically filed by eligible corporations engaged in book publishing activities in Manitoba.

FAQ

Q: What is Form T2 Schedule 389?

A: Form T2 Schedule 389 is a tax form used in Canada for claiming the Manitoba Book Publishing Tax Credit.

Q: What is the purpose of the Manitoba Book Publishing Tax Credit?

A: The Manitoba Book Publishing Tax Credit is designed to support the book publishing industry in Manitoba by providing tax credits to eligible publishers.

Q: Who is eligible for the Manitoba Book Publishing Tax Credit?

A: Eligible publishers in Manitoba can claim the tax credit if they meet the specific criteria outlined by the Canada Revenue Agency.

Q: What tax years does Form T2 Schedule 389 apply to?

A: Form T2 Schedule 389 applies to tax years starting from 2019 and onwards.

Q: How do I complete Form T2 Schedule 389?

A: You need to provide the necessary information about your publishing activities in Manitoba, as outlined in the form's instructions.

Q: Are there any deadlines for filing Form T2 Schedule 389?

A: The deadline for filing Form T2 Schedule 389 is usually the same as the filing deadline for your corporate tax return. However, it's recommended to check the specific deadline for the tax year in question.

Q: What other forms or documents do I need to include with Form T2 Schedule 389?

A: You may need to include additional supporting documents such as financial statements or other forms as requested by the Canada Revenue Agency.

Q: Can I claim the Manitoba Book Publishing Tax Credit if I am not a publisher?

A: No, the Manitoba Book Publishing Tax Credit is specifically designed for eligible publishers in Manitoba.

Q: How much is the tax credit for the Manitoba Book Publishing Tax Credit?

A: The amount of tax credit that can be claimed varies and depends on the specific criteria outlined by the Canada Revenue Agency.