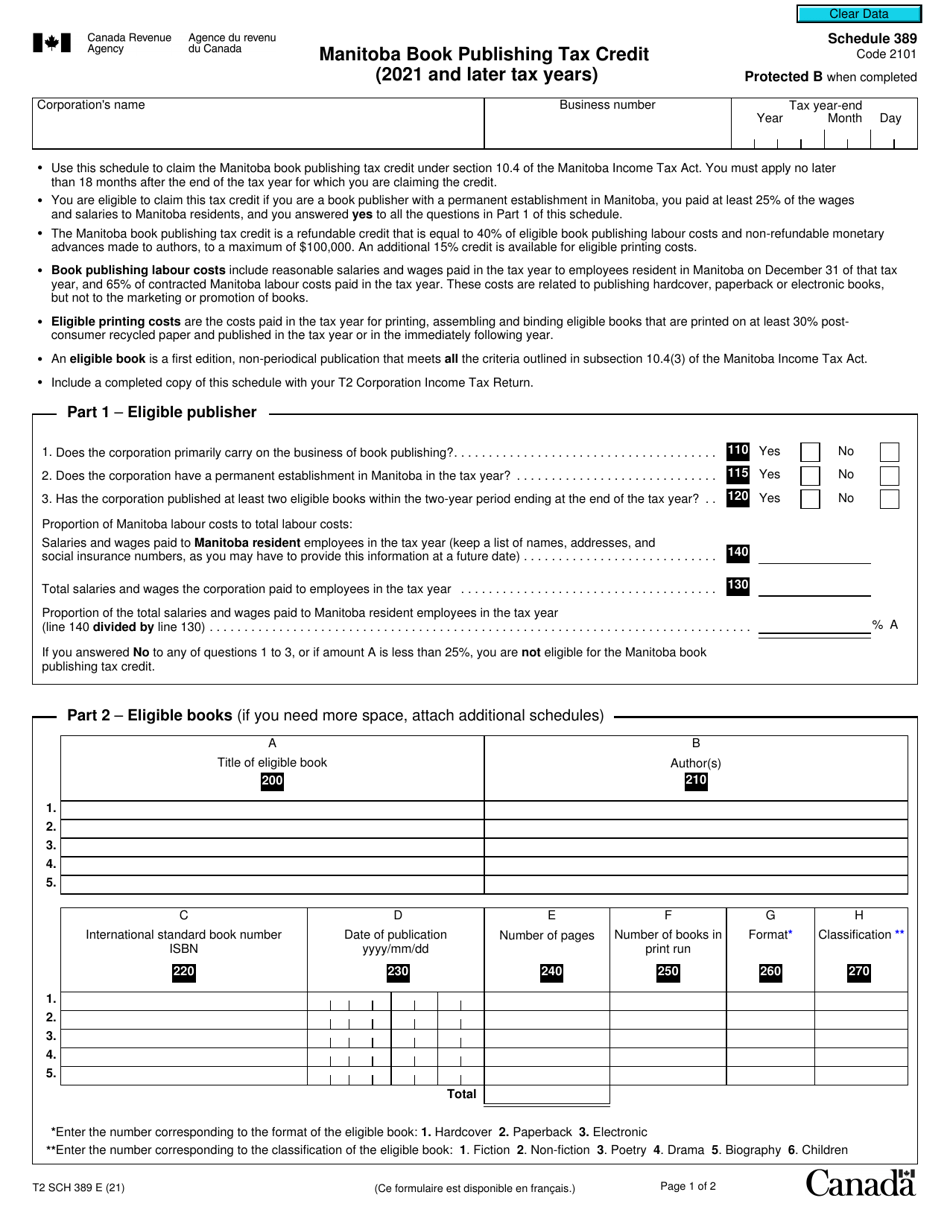

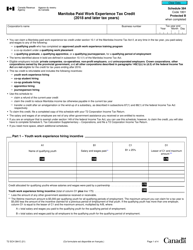

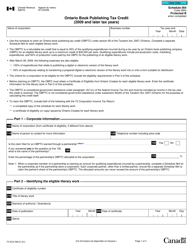

Form T2 Schedule 389 Manitoba Book Publishing Tax Credit (2021 and Later Tax Years) - Canada

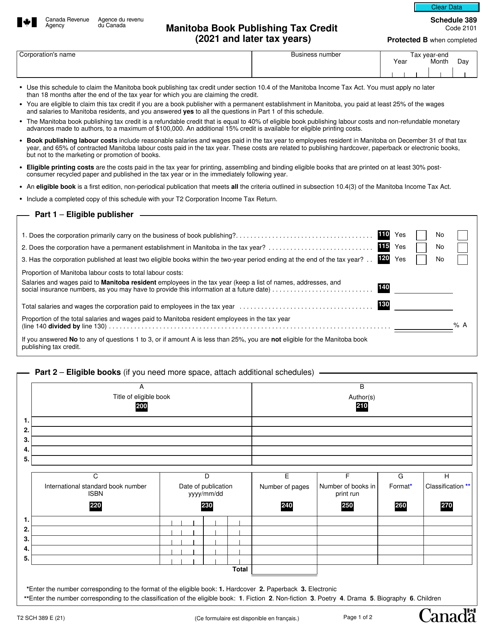

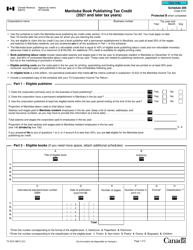

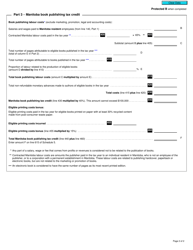

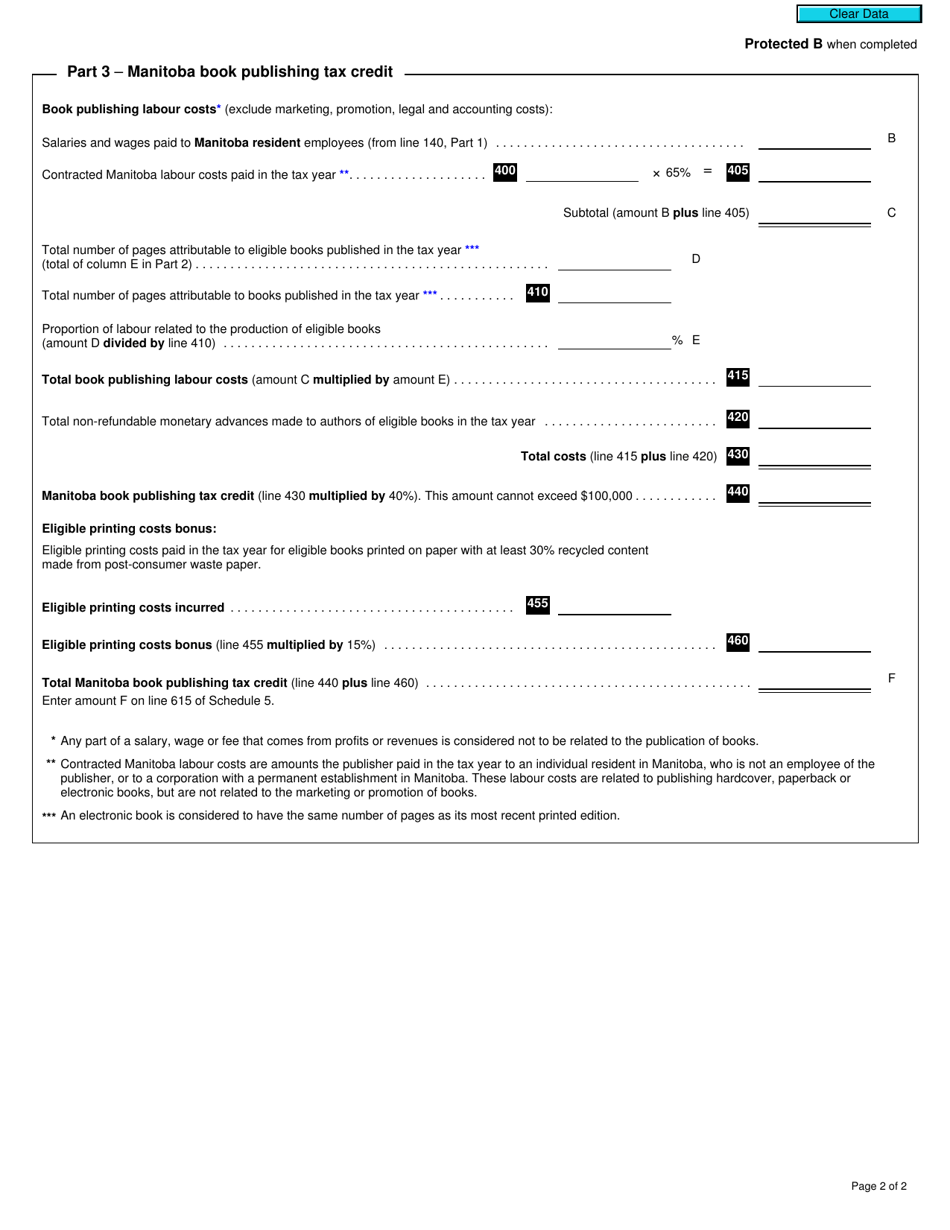

Form T2 Schedule 389, also known as the Manitoba Book Publishing Tax Credit, is a tax form used in Canada. This form is specific to the province of Manitoba and is used by book publishers to claim a tax credit for eligible book publishing activities. The tax credit is designed to support and encourage the growth of the book publishing industry in Manitoba. It allows publishers to claim a credit based on a percentage of their eligible Manitoba book publishing expenditures. The specific details and eligibility criteria for claiming this tax credit can be found in the instructions accompanying the form.

The Form T2 Schedule 389 Manitoba Book Publishing Tax Credit in Canada is typically filed by eligible corporations engaged in book publishing activities in the province of Manitoba. The purpose of this tax credit is to provide financial support to encourage and promote the book publishing industry in Manitoba.

Form T2 Schedule 389 Manitoba Book Publishing Tax Credit (2021 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 389?

A: Form T2 Schedule 389 is a tax form used in Canada to claim the Manitoba Book Publishing Tax Credit.

Q: What is the Manitoba Book Publishing Tax Credit?

A: The Manitoba Book Publishing Tax Credit is a tax incentive offered by the government of Manitoba in Canada to support the book publishing industry in the province.

Q: Who is eligible to claim the Manitoba Book Publishing Tax Credit?

A: Eligible entities, such as corporations or individuals, involved in book publishing in Manitoba may be eligible to claim the tax credit.

Q: How does the Manitoba Book Publishing Tax Credit work?

A: The tax credit is calculated based on eligible book publishing expenditures incurred in Manitoba. The credit is equal to a percentage of those expenditures.

Q: What are eligible book publishing expenditures?

A: Eligible book publishing expenditures include certain costs related to the production and distribution of books, such as printing, editing, marketing, and promotion expenses.

Q: What is the purpose of the Manitoba Book Publishing Tax Credit?

A: The purpose of the tax credit is to provide financial support to the book publishing industry in Manitoba, encouraging the creation and distribution of Canadian books.

Q: How do I claim the Manitoba Book Publishing Tax Credit?

A: To claim the tax credit, you need to complete Form T2 Schedule 389 and include it with your corporation or personal income tax return for the relevant tax year.

Q: Are there any deadlines for claiming the Manitoba Book Publishing Tax Credit?

A: Yes, the tax credit must be claimed within certain time limits specified by the Canada Revenue Agency. It is advisable to consult the agency's guidelines or a tax professional for specific deadlines.

Q: Can I claim the Manitoba Book Publishing Tax Credit for previous tax years?

A: Yes, the tax credit can be claimed for previous tax years, as long as you meet the eligibility criteria and file the necessary forms for those years.