This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2205

for the current year.

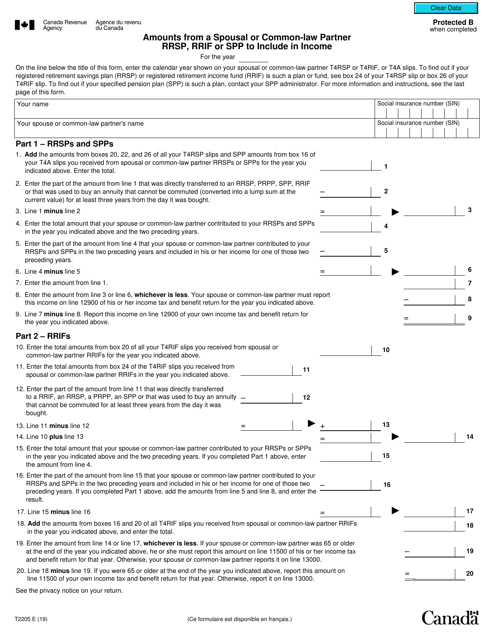

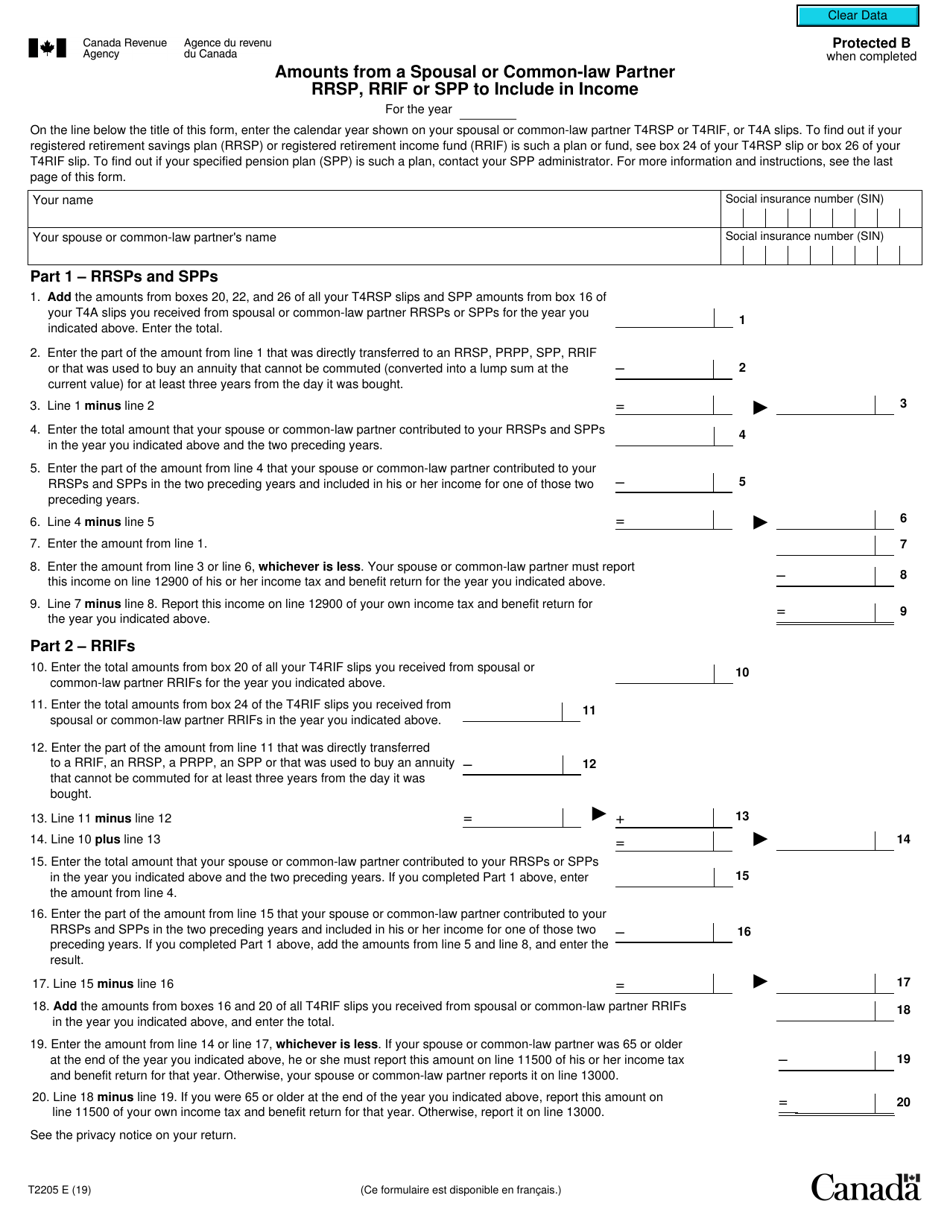

Form T2205 Amounts From a Spousal or Common-Law Partner Rrsp, Rrif or Spp to Include in Income - Canada

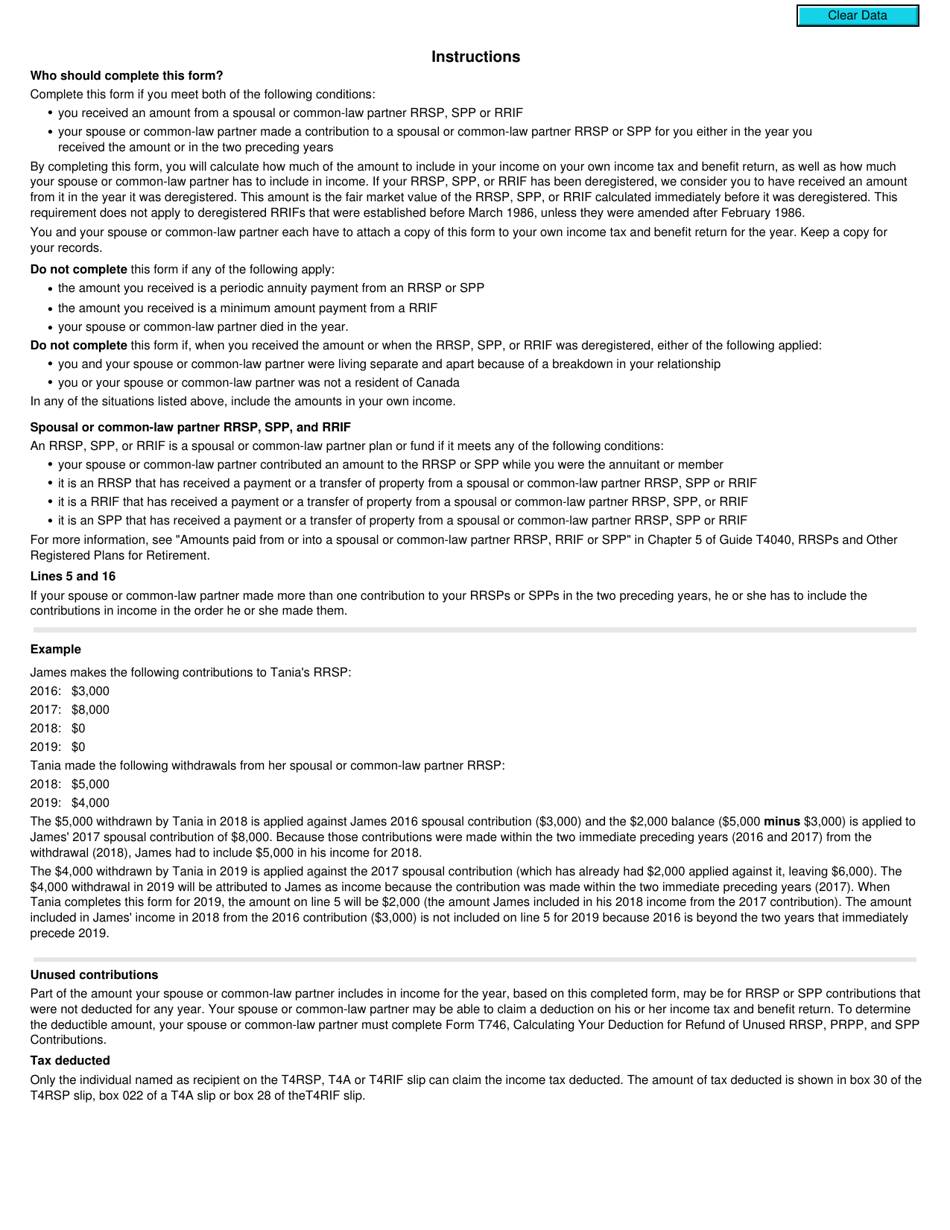

Form T2205 - Amounts From a Spousal or Common-Law Partner RRSP, RRIF, or SPP to Include in Income is used in Canada to report income received from a spousal or common-law partner's registered retirement savings plan (RRSP), registered retirement income fund (RRIF), or specified pension plan (SPP). This form helps determine the amount that needs to be included in your income for tax purposes.

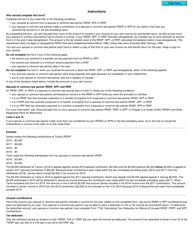

The taxpayer who has received the amounts from a spousal or common-law partner RRSP, RRIF, or SPP is required to file the Form T2205 to include it in their income.

FAQ

Q: What is Form T2205?

A: Form T2205 is a form used in Canada to report amounts from a spousal or common-law partner RRSP, RRIF or SPP (specified pension plan) to include in income.

Q: Who needs to use Form T2205?

A: Form T2205 is used by individuals in Canada who received amounts from their spouse or common-law partner's RRSP, RRIF or SPP and need to include those amounts in their income.

Q: What is RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a Canadian government-approved investment vehicle that allows individuals to save for retirement while providing tax benefits.

Q: What is RRIF?

A: RRIF stands for Registered Retirement Income Fund. It is a retirement savings vehicle in Canada where funds from an RRSP are transferred to provide a steady stream of retirement income.

Q: What is SPP?

A: SPP stands for Specified Pension Plan. It is a type of pension plan that provides retirement income to individuals in Canada.

Q: Why do I need to include amounts from a spousal or common-law partner's RRSP, RRIF or SPP in my income?

A: The amounts from a spousal or common-law partner's RRSP, RRIF or SPP that you received are taxable and need to be reported as part of your income for the tax year.

Q: How do I fill out Form T2205?

A: To fill out Form T2205, you will need to provide your personal information, details about the amounts received, and calculate the taxable amount to include in your income.

Q: What if I make a mistake on Form T2205?

A: If you make a mistake on Form T2205, you may need to correct it by submitting an amended form or contacting the Canada Revenue Agency for assistance.

Q: When is the deadline to file Form T2205?

A: Form T2205 should be filed with your annual tax return, which is typically due by April 30th of the following year in Canada.