This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2152 Schedule 1

for the current year.

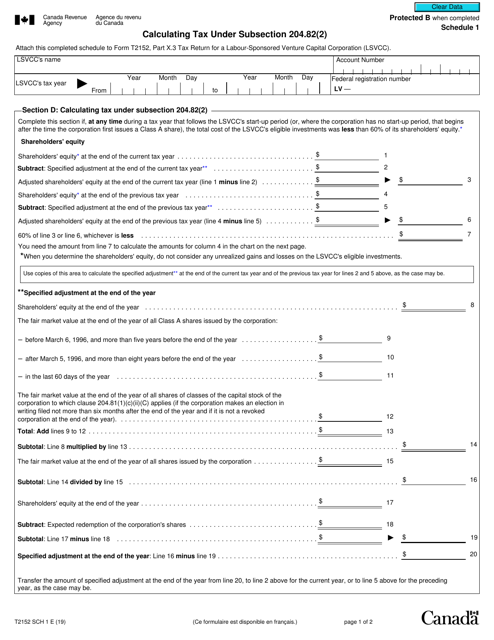

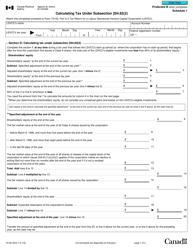

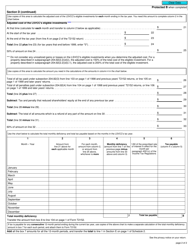

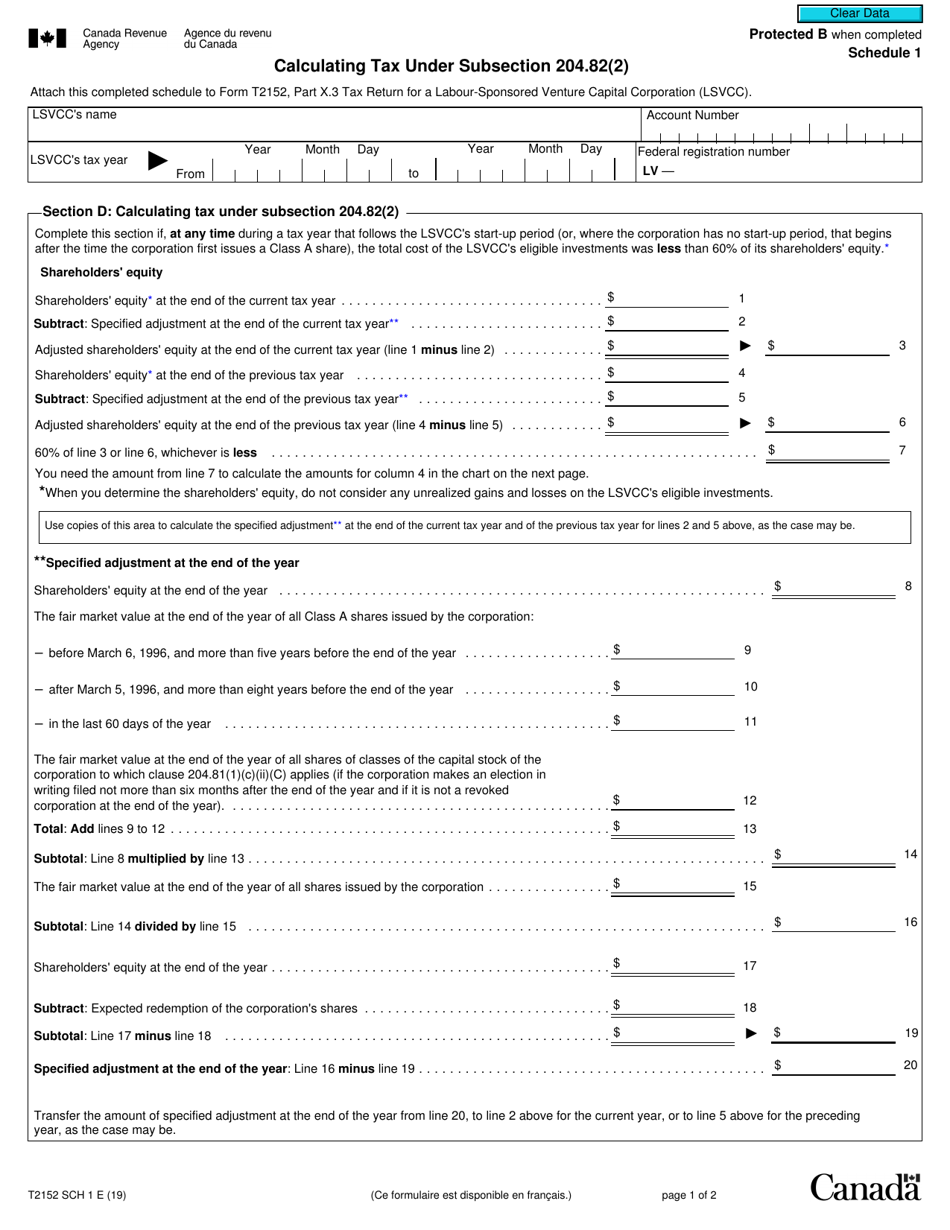

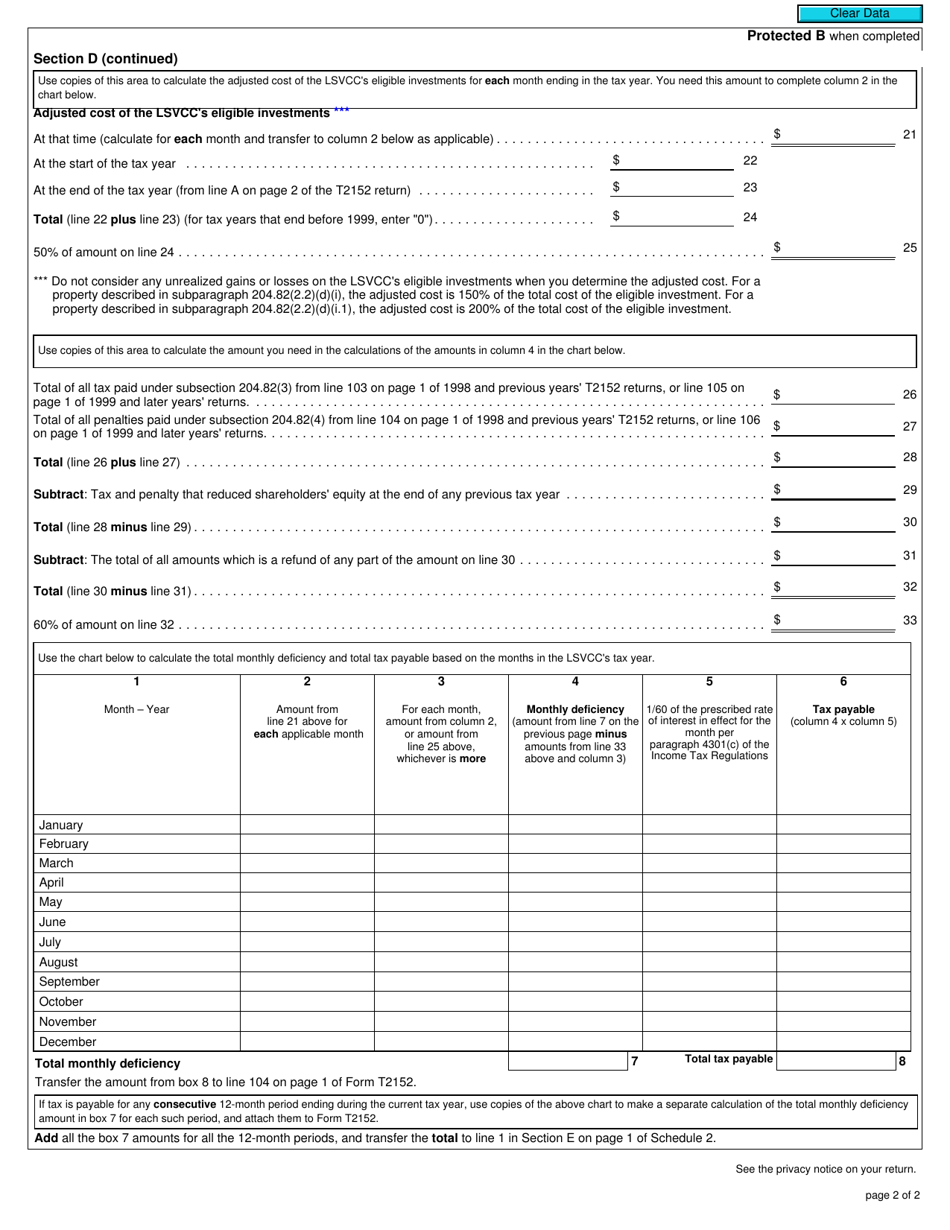

Form T2152 Schedule 1 Calculating Tax Under Subsection 204.82(2) - Canada

Form T2152 Schedule 1, Calculating Tax Under Subsection 204.82(2), is used in Canada for calculating tax payable under subsection 204.82(2). It is specifically designed for individuals who earned income from certain prescribed activities in a designated remote area of the country. This form helps determine the tax amount to be paid based on the specific provisions outlined in subsection 204.82(2) of the Canadian tax law.

The individual taxpayer would file Form T2152 Schedule 1 Calculating Tax Under Subsection 204.82(2) in Canada.

FAQ

Q: What is Form T2152?

A: Form T2152 is a tax form used in Canada to calculate tax under subsection 204.82(2) of the Income Tax Act.

Q: What is Schedule 1?

A: Schedule 1 is a section of the tax form that deals with calculating tax under subsection 204.82(2).

Q: What is subsection 204.82(2)?

A: Subsection 204.82(2) is a specific provision of the Income Tax Act in Canada that relates to tax calculation.

Q: How do I use Form T2152?

A: To use Form T2152, you need to follow the instructions on the form and input the necessary information to calculate tax under subsection 204.82(2).

Q: Do I need to use Form T2152?

A: You may need to use Form T2152 if you have specific tax calculations to make under subsection 204.82(2) of the Income Tax Act.

Q: Is Form T2152 only for residents of Canada?

A: Yes, Form T2152 is specifically designed for Canadian residents and is used for tax calculations in Canada.

Q: Are there any penalties for incorrect calculations on Form T2152?

A: There may be penalties for incorrect calculations on Form T2152, so it is important to ensure accuracy when completing the form.

Q: Can I e-file Form T2152?

A: At the time of this document, Form T2152 cannot be e-filed. It must be printed and mailed to the Canada Revenue Agency (CRA).