This version of the form is not currently in use and is provided for reference only. Download this version of

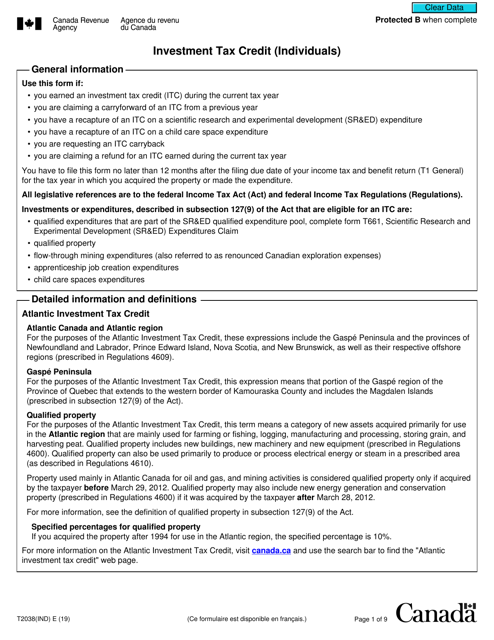

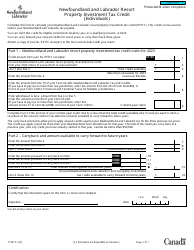

Form T2038(IND)

for the current year.

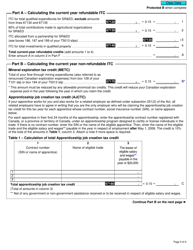

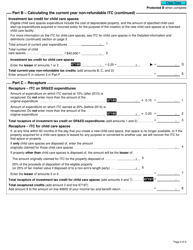

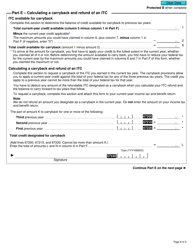

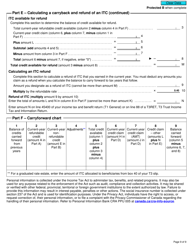

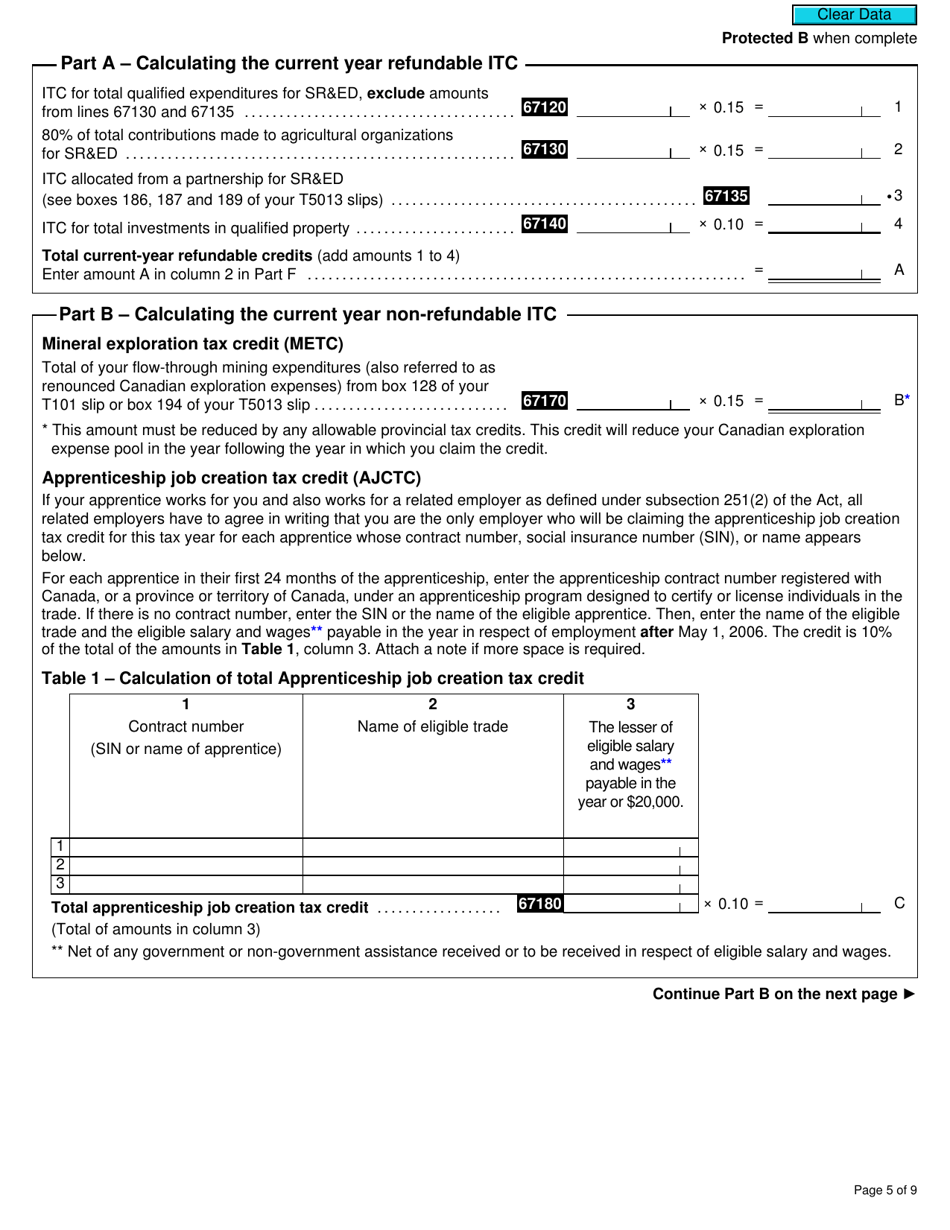

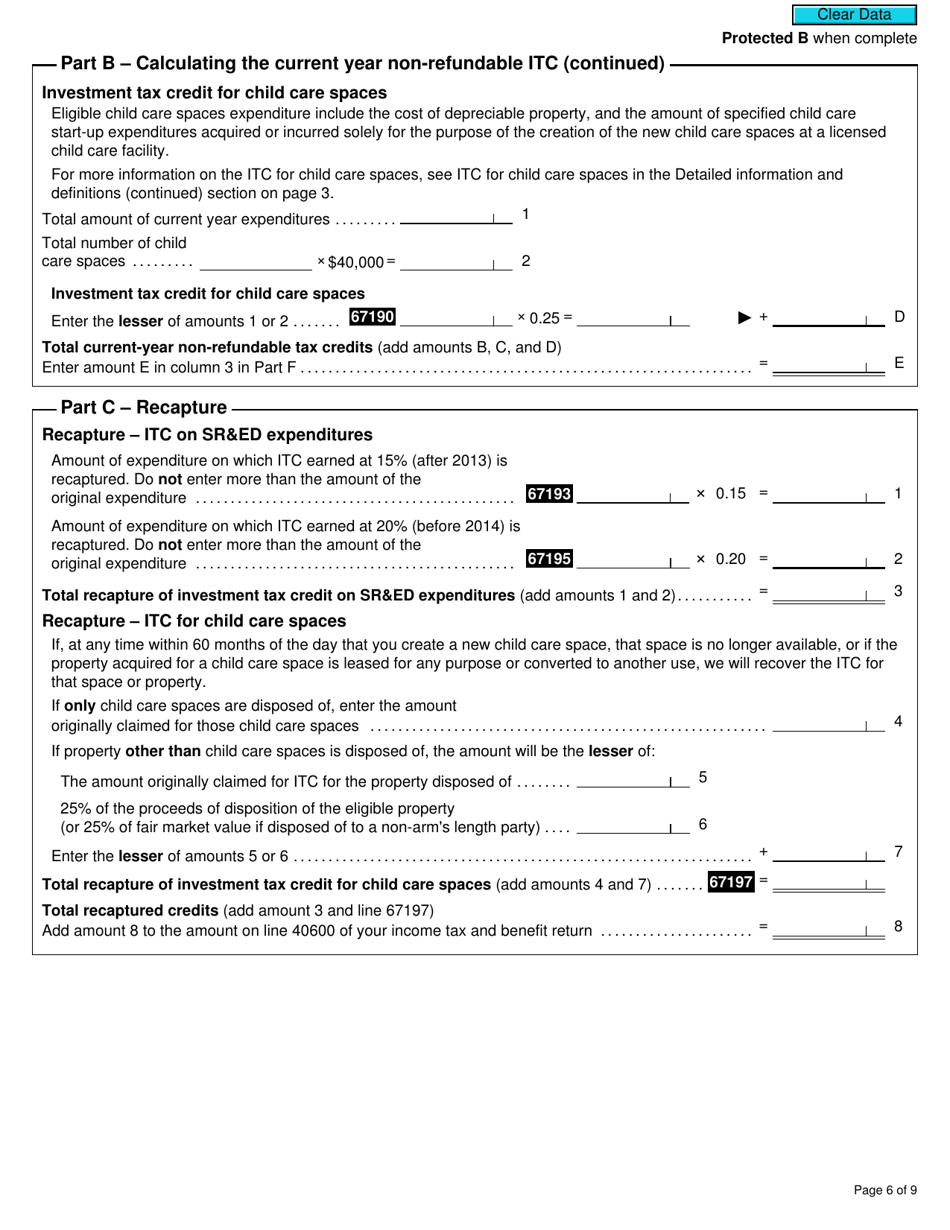

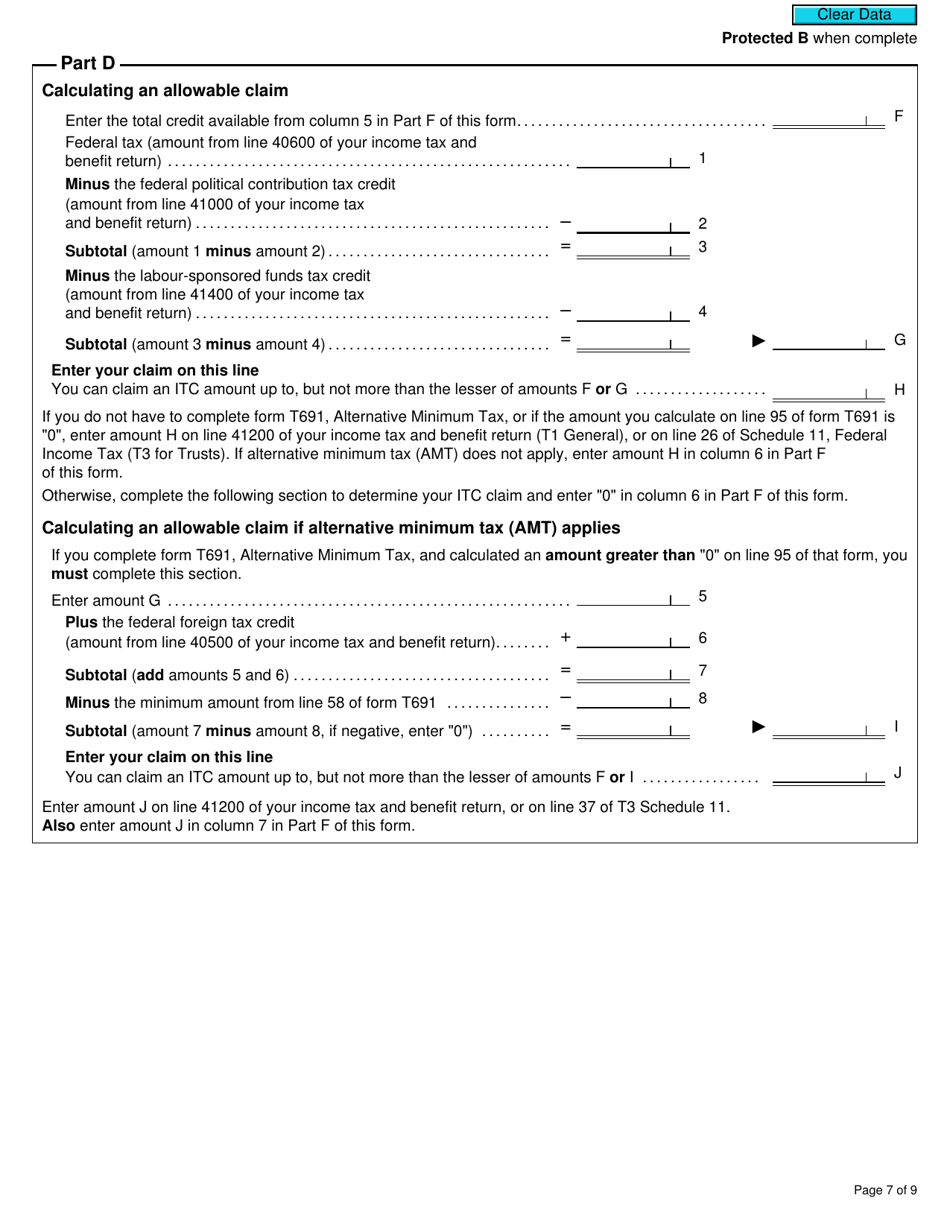

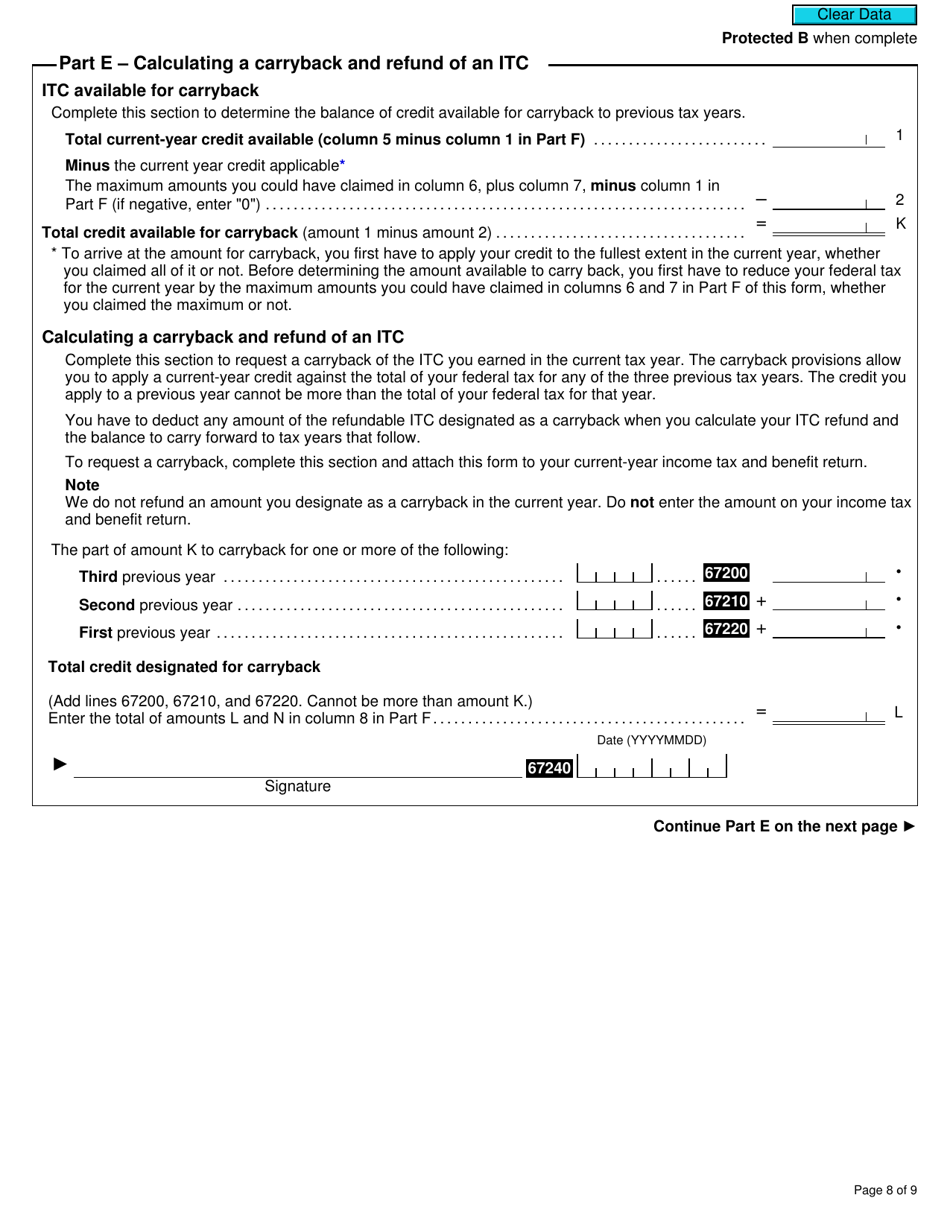

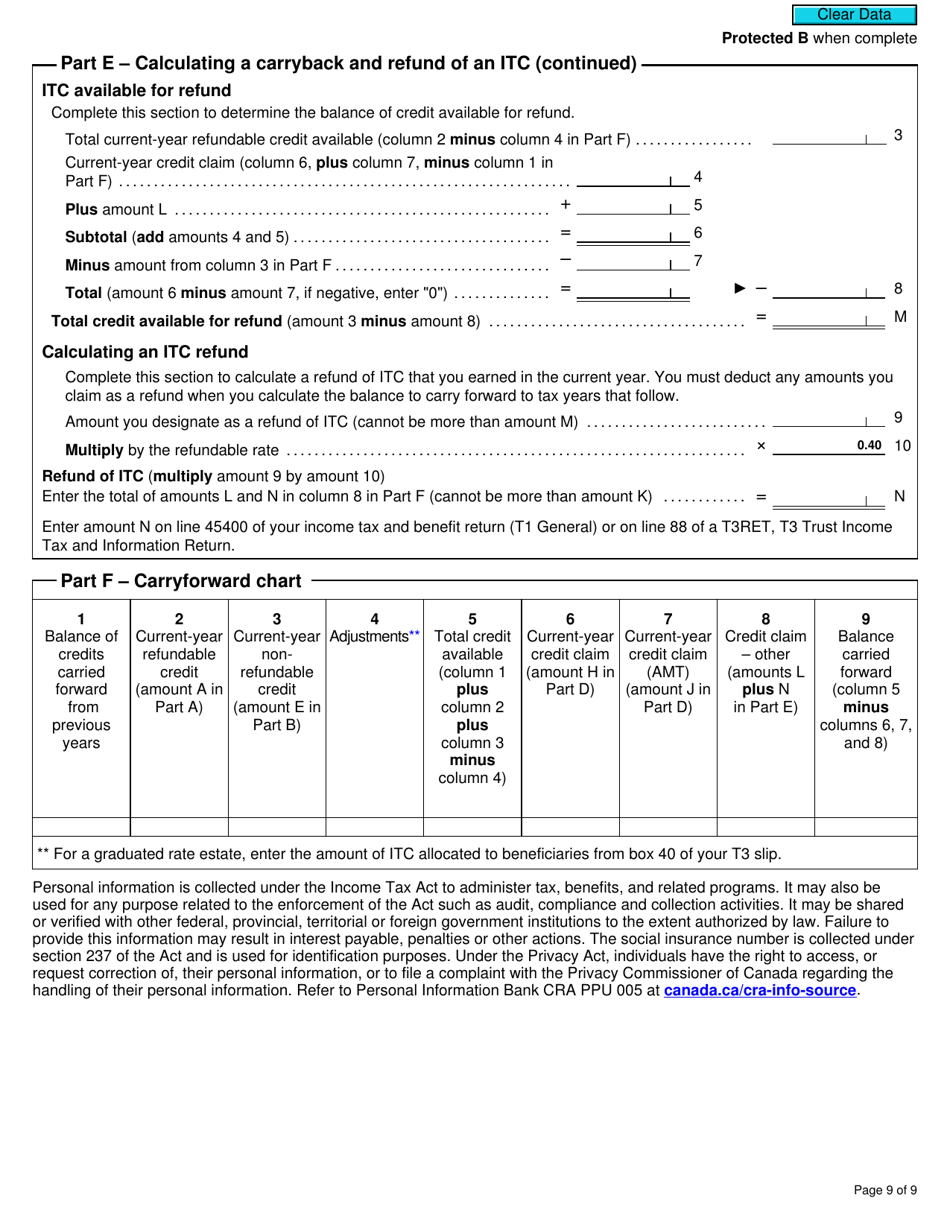

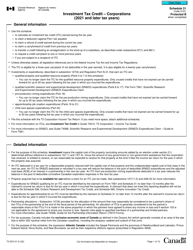

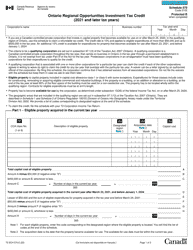

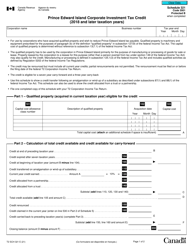

Form T2038(IND) Investment Tax Credit (Individuals) - Canada

Form T2038(IND) Investment Tax Credit (Individuals) in Canada is used to claim an investment tax credit for certain expenses related to investments. It is meant to reduce your overall tax liability by allowing you to claim a credit for eligible investments.

The Form T2038(IND) Investment Tax Credit (Individuals) in Canada is filed by individuals who are claiming an investment tax credit.

FAQ

Q: What is Form T2038(IND)?

A: Form T2038(IND) is a tax form used in Canada to claim the Investment Tax Credit for individuals.

Q: What is the Investment Tax Credit?

A: The Investment Tax Credit is a credit that allows individuals in Canada to reduce their taxes owed based on certain eligible investments.

Q: Who is eligible to claim the Investment Tax Credit?

A: Individuals in Canada who have made eligible investments may be eligible to claim the Investment Tax Credit.

Q: What are eligible investments?

A: Eligible investments include investments in certain types of properties, such as: eligible oil and gas properties, Canadian renewable and conservation expenses, and Canadian film or video production properties.

Q: How do I claim the Investment Tax Credit?

A: To claim the Investment Tax Credit, you need to complete and file Form T2038(IND) with the Canada Revenue Agency (CRA) along with your tax return.

Q: Are there any limitations on claiming the Investment Tax Credit?

A: Yes, there are certain limitations and restrictions on claiming the Investment Tax Credit. It is recommended to consult the official guidelines or a tax professional for specific details.