This version of the form is not currently in use and is provided for reference only. Download this version of

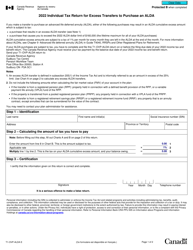

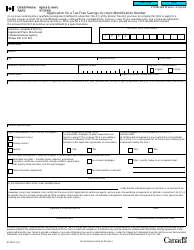

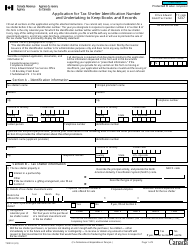

Form T1261

for the current year.

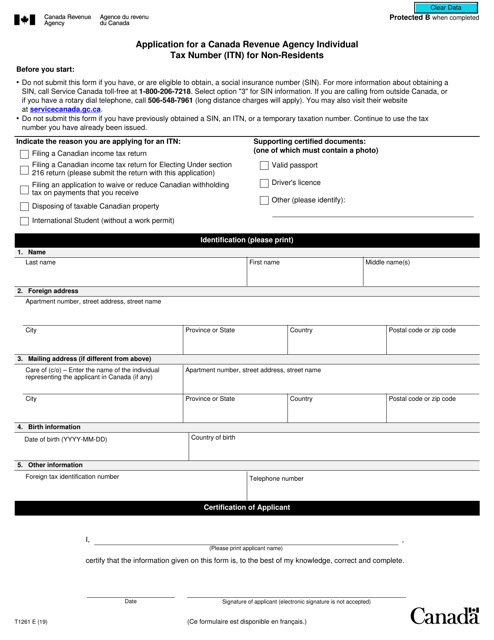

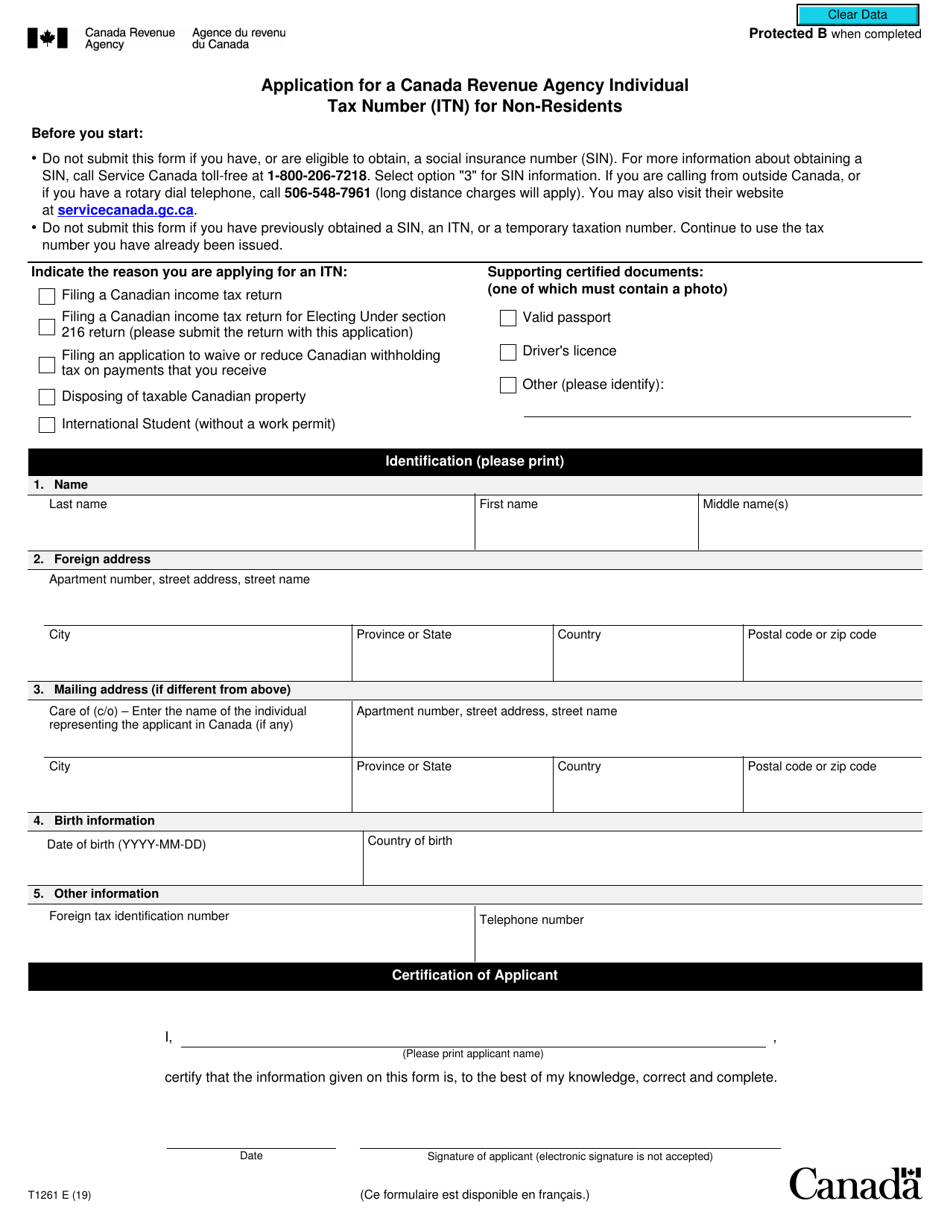

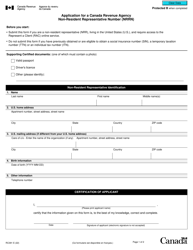

Form T1261 Application for a Canada Revenue Agency Individual Tax Number (Itn) for Non-residents - Canada

Form T1261, Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-residents, is used to apply for an Individual Tax Number (ITN) in Canada. This ITN is required by non-residents who need to report Canadian income or require a Canadian tax account.

The Form T1261 is filed by non-residents of Canada who need to obtain an Individual Tax Number (ITN) from the Canada Revenue Agency.

FAQ

Q: What is Form T1261?

A: Form T1261 is an application form for a Canada Revenue Agency Individual Tax Number (ITN) for non-residents.

Q: Who needs to fill out Form T1261?

A: Non-residents who are required to file a Canadian tax return or who need an ITN for other tax purposes need to fill out Form T1261.

Q: What information is required on Form T1261?

A: Form T1261 requires information such as personal details, residency status, and reasons for needing an ITN. It also requires supporting documentation, such as a valid passport or birth certificate, depending on the situation.

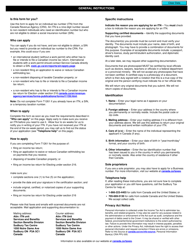

Q: How do I submit Form T1261?

A: You can submit Form T1261 by mail or by fax to the CRA. The form includes instructions on where to send it.

Q: How long does it take to process Form T1261?

A: Processing times for Form T1261 vary, but it generally takes several weeks. It's recommended to submit the form well in advance of any tax filing or other deadline.