This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1229

for the current year.

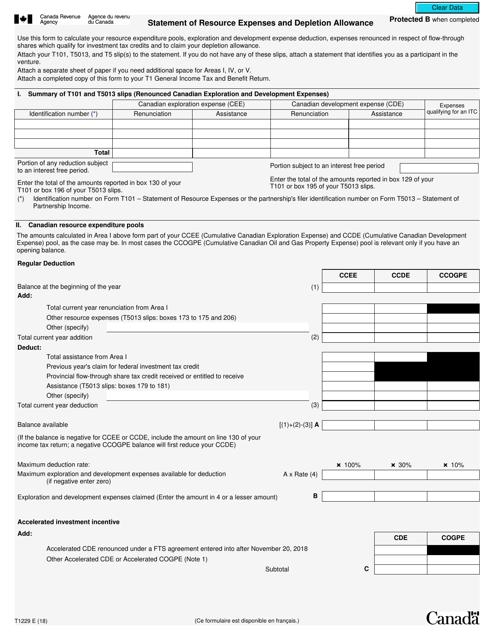

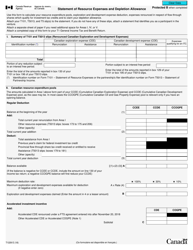

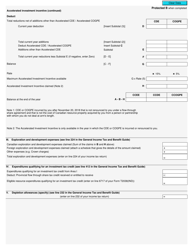

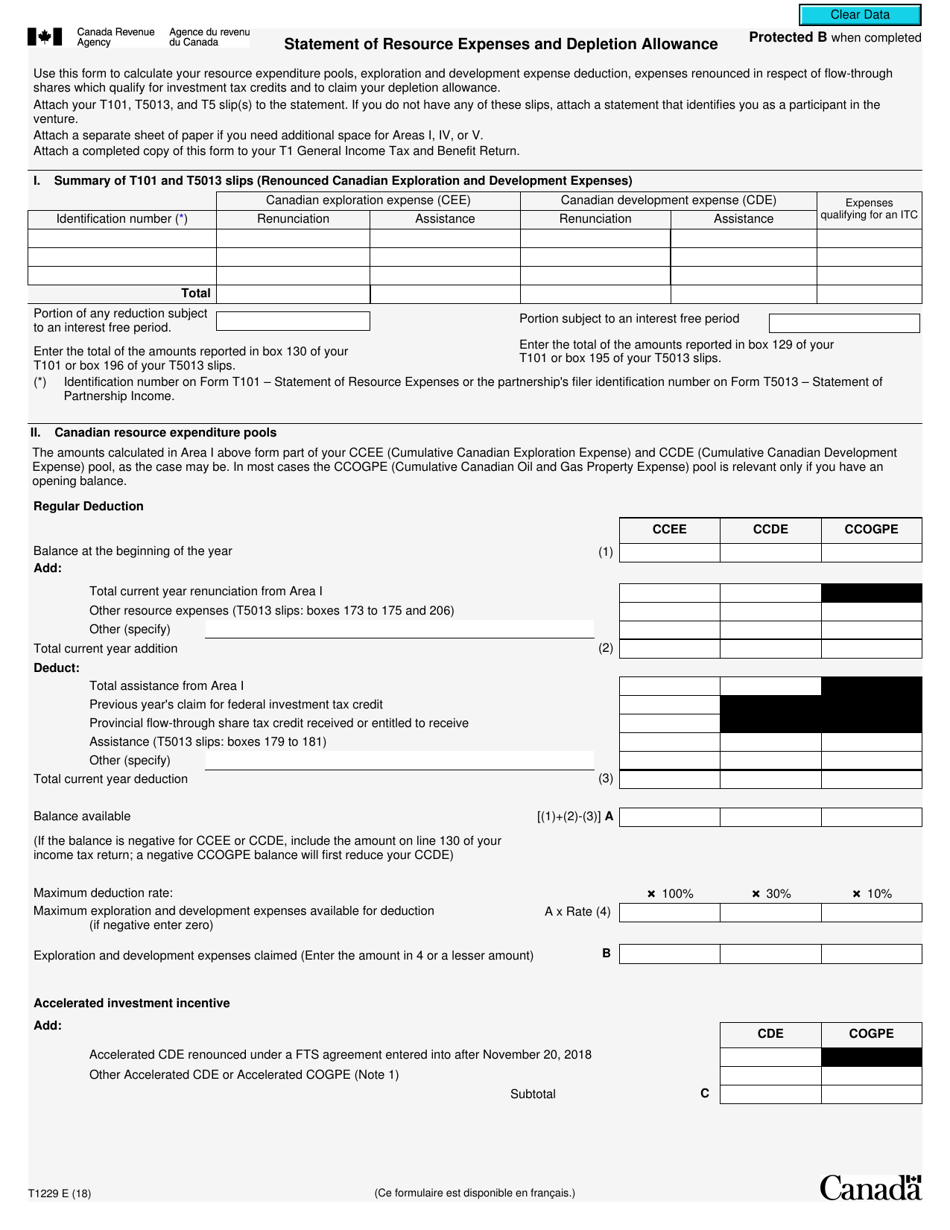

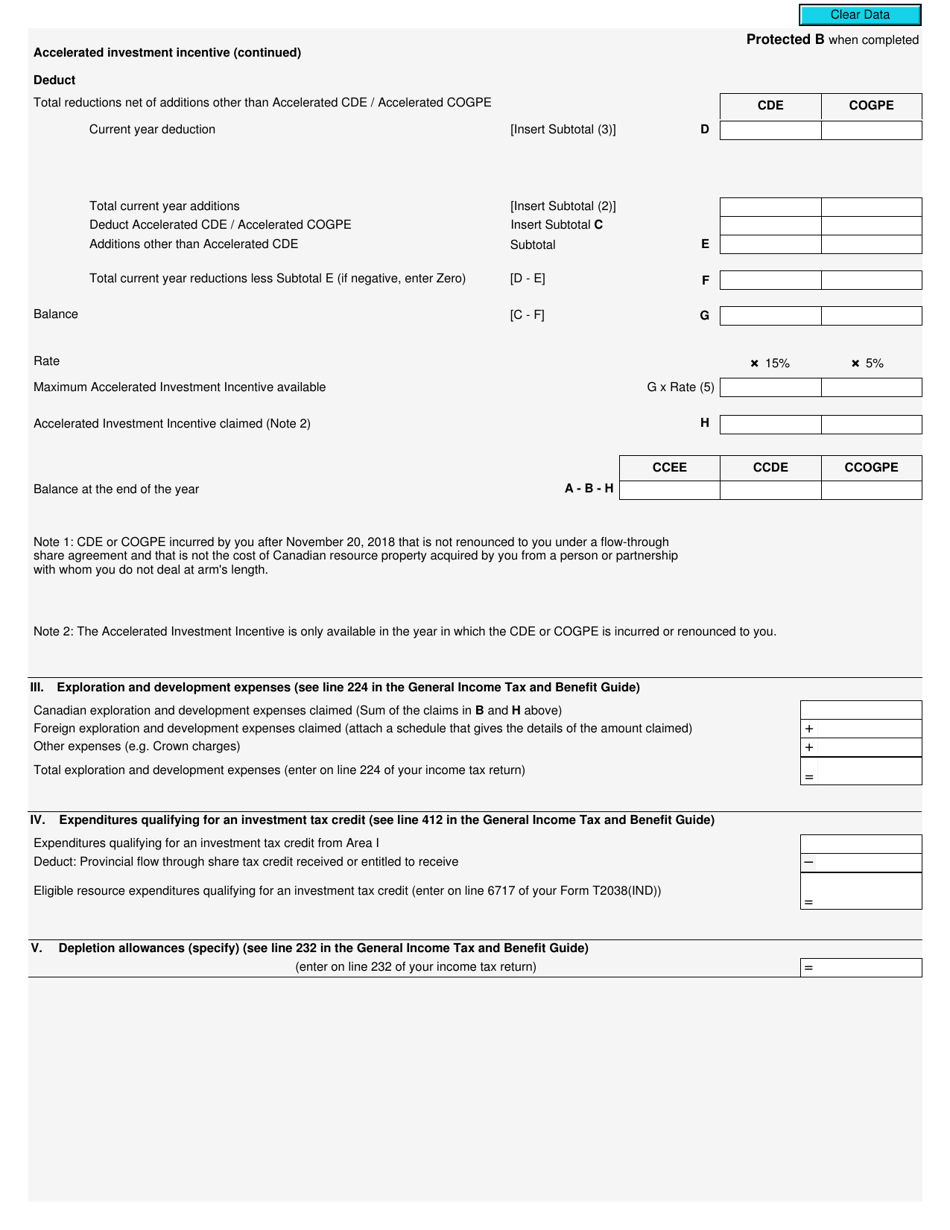

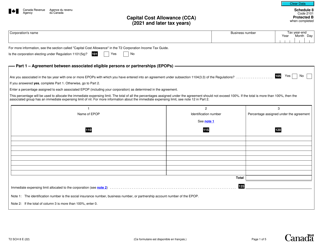

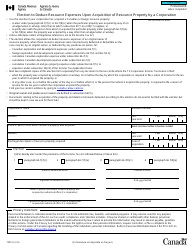

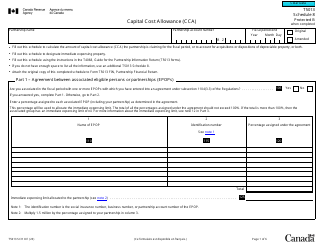

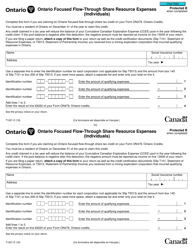

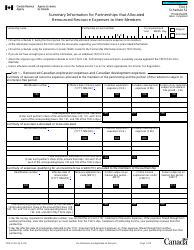

Form T1229 Statement of Resource Expenses and Depletion Allowance - Canada

Form T1229 Statement of Resource Expenses and Depletion Allowance in Canada is used to report expenses related to exploring and developing mines, oil wells, and other natural resource properties. This form is used to calculate and claim depletion deductions against income earned from the extraction of these resources.

The Form T1229 is typically filed by individuals or corporations in Canada who have resource expenses and depletion allowance to claim on their tax returns.

FAQ

Q: What is Form T1229?

A: Form T1229 is the Statement of Resource Expenses and Depletion Allowance in Canada.

Q: What does Form T1229 measure?

A: Form T1229 measures resource expenses and depletion allowance related to natural resources in Canada.

Q: Who needs to file Form T1229?

A: Individuals and corporations engaged in resource activities in Canada need to file Form T1229.

Q: What are resource expenses?

A: Resource expenses are costs related to exploring, developing, and producing natural resources.

Q: What is depletion allowance?

A: Depletion allowance is a deduction for the depletion of natural resources.

Q: Is Form T1229 only for residents of Canada?

A: No, Form T1229 is applicable to both residents and non-residents of Canada engaged in resource activities.