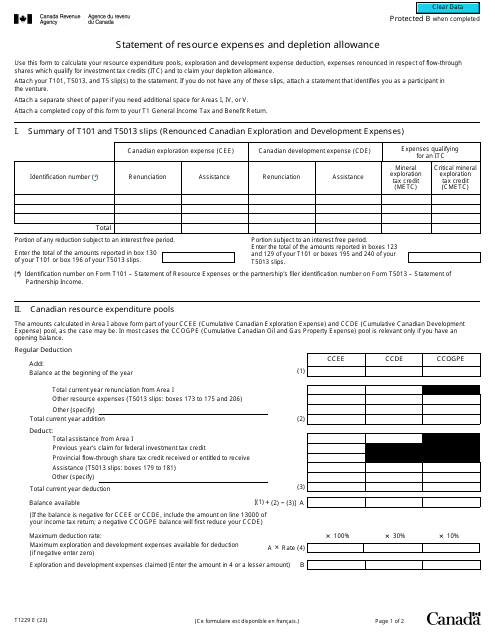

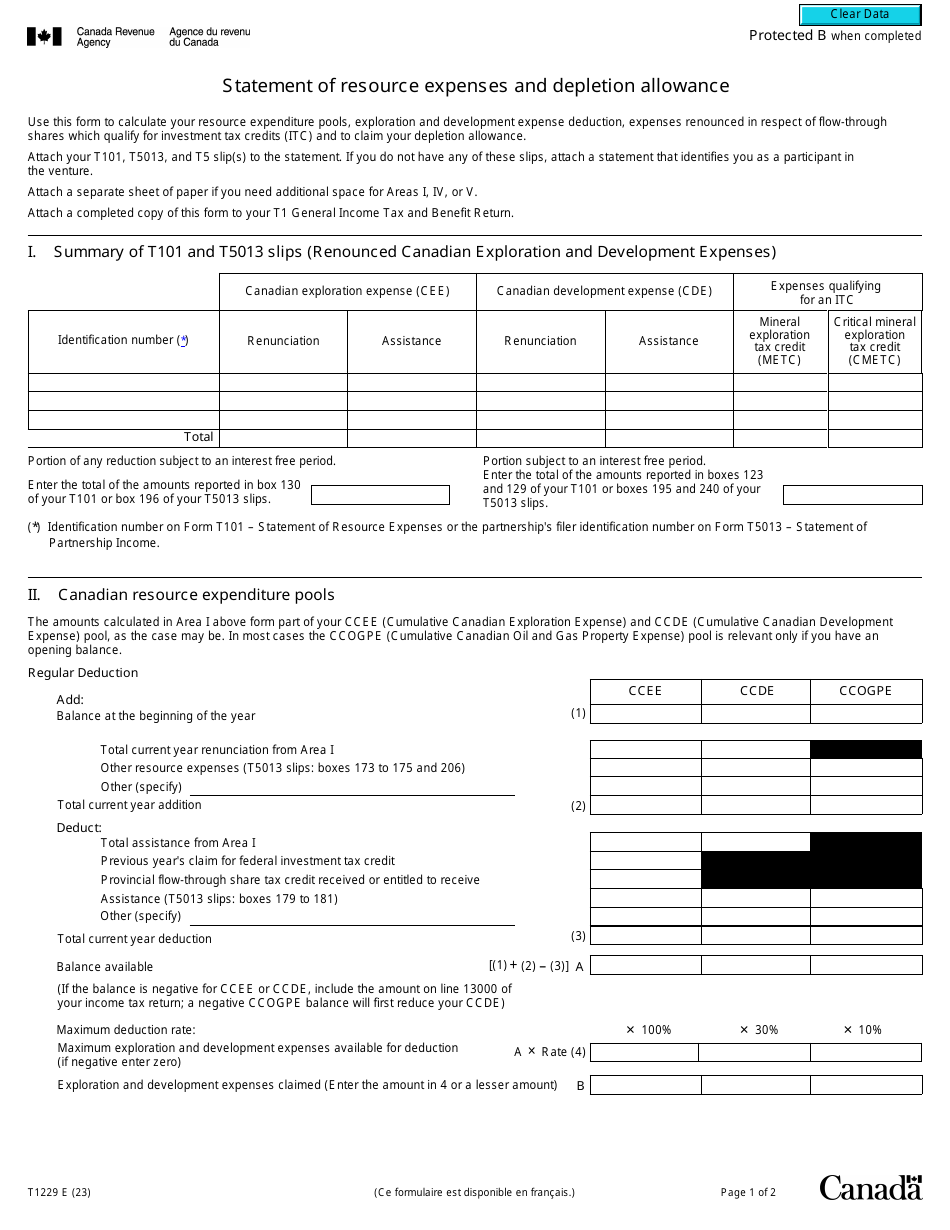

Form T1229 Statement of Resource Expenses and Depletion Allowance - Canada

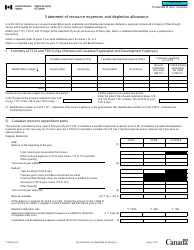

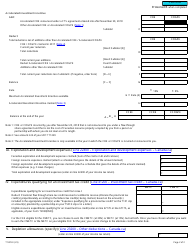

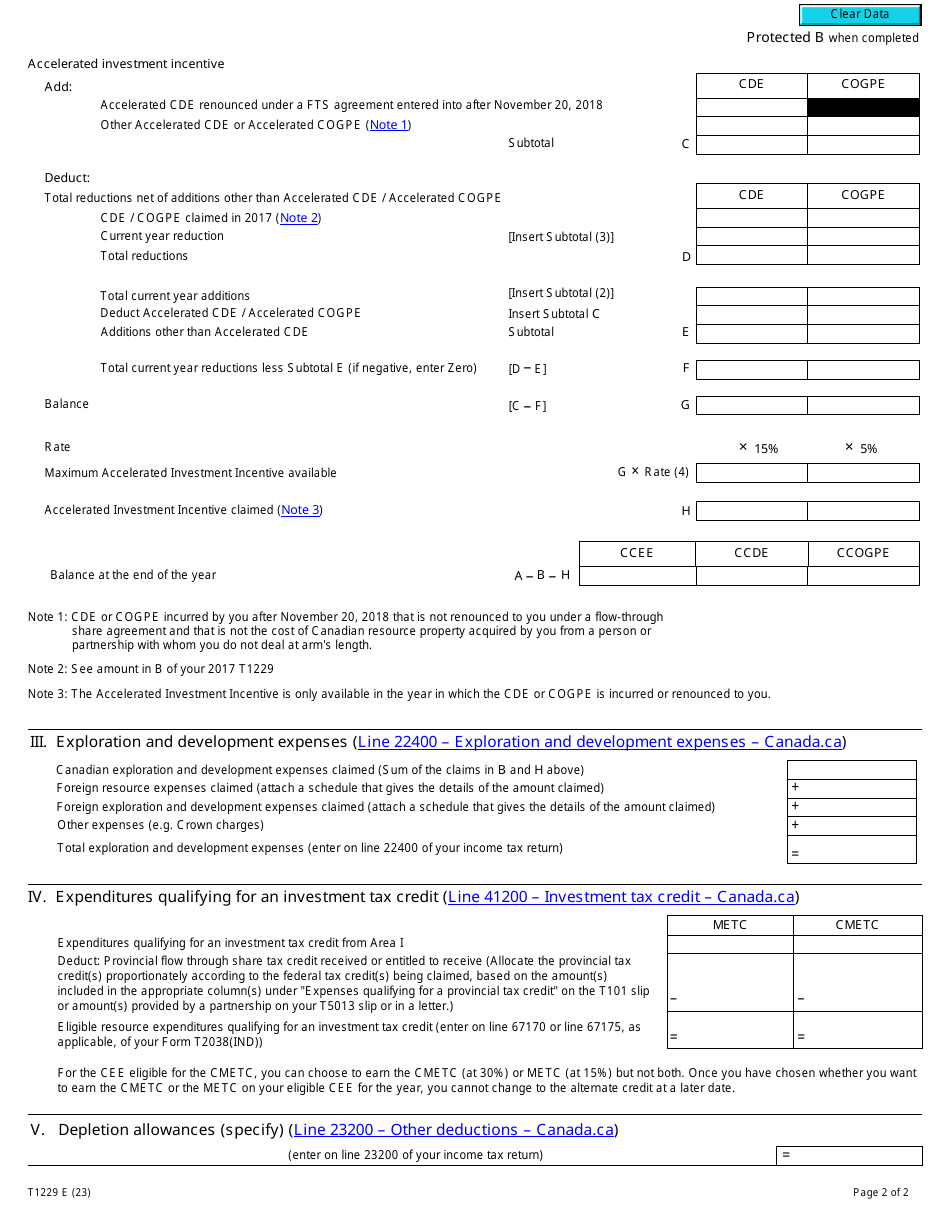

The Form T1229 Statement of Resource Expenses and Depletion Allowance in Canada is used to report resource expenses and depletion allowance related to natural resource properties. It helps individuals and companies claim deductions and allowances for expenses and depletion associated with the exploration and development of mineral, petroleum, and timber resources.

The Form T1229 Statement of Resource Expenses and Depletion Allowance in Canada is filed by individuals or businesses engaged in resource-related activities, such as mining or oil and gas exploration.

Form T1229 Statement of Resource Expenses and Depletion Allowance - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1229?

A: Form T1229 is the Statement of Resource Expenses and Depletion Allowance in Canada.

Q: What is the purpose of Form T1229?

A: Form T1229 is used to calculate and report deductions for resource expenses and depletion allowance.

Q: Who needs to file Form T1229?

A: Individuals or corporations engaged in resource activities in Canada need to file Form T1229.

Q: What are resource expenses?

A: Resource expenses include costs related to exploring, developing, and bringing natural resources into production.

Q: What is depletion allowance?

A: Depletion allowance is a deduction that allows taxpayers to recover the cost of natural resources over time.