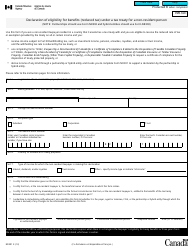

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1213

for the current year.

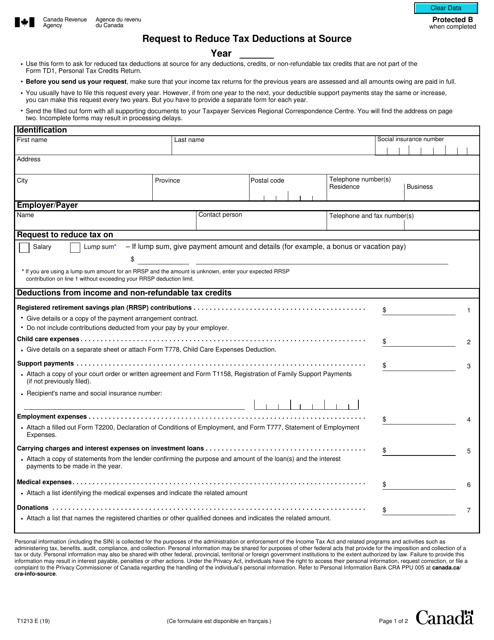

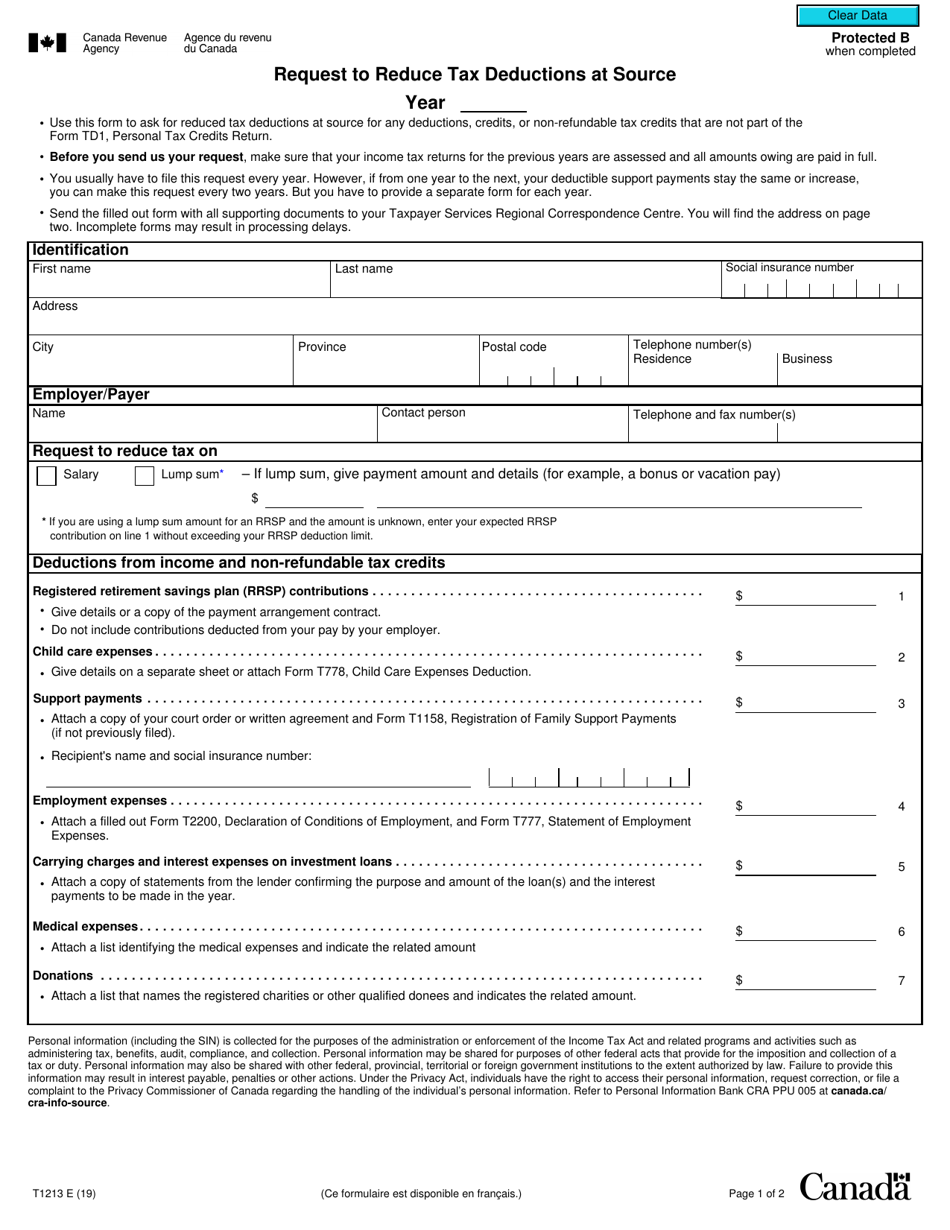

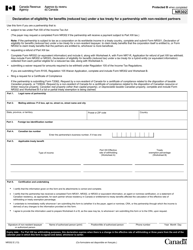

Form T1213 Request to Reduce Tax Deductions at Source - Canada

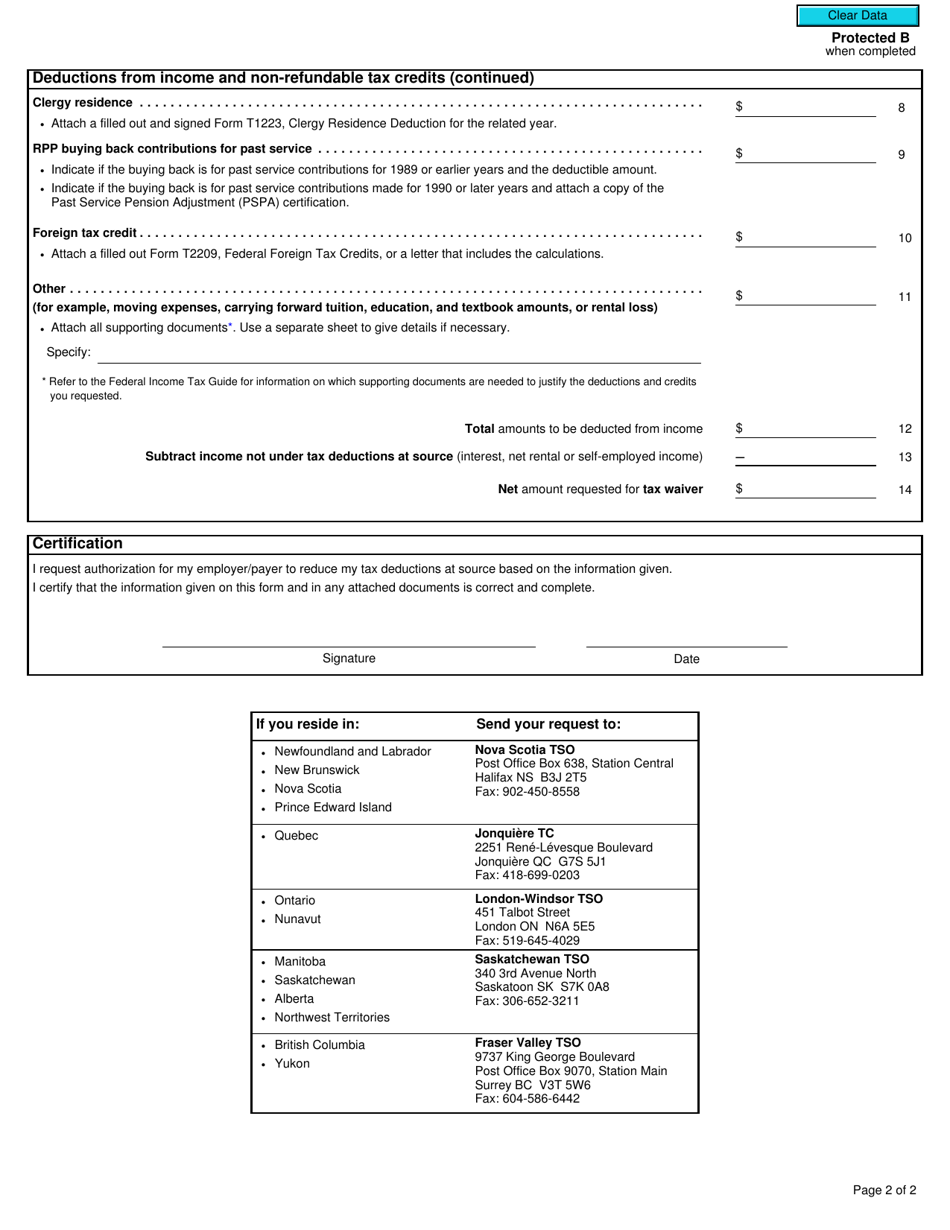

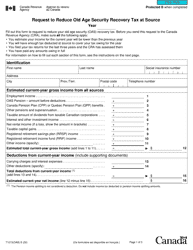

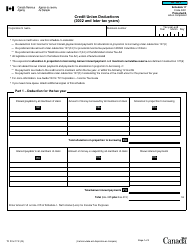

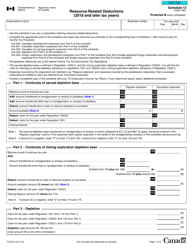

Form T1213, known as the Request to Reduce Tax Deductions at Source, is used in Canada to claim certain tax deductions or credits in advance. By submitting this form to the Canada Revenue Agency (CRA), individuals can request to have their tax deductions reduced at source, which means less tax will be withheld from their income throughout the year. This can provide financial relief by allowing individuals to receive more take-home pay rather than waiting for a tax refund at the end of the year.

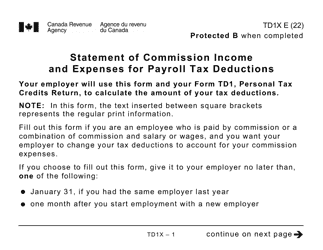

An employee files the Form T1213 Request to Reduce Tax Deductions at Source in Canada.

FAQ

Q: What is Form T1213?

A: Form T1213 is a request form used in Canada to ask the Canada Revenue Agency (CRA) to allow you to reduce the amount of tax deducted from your income at source.

Q: Why would I need to use Form T1213?

A: You would need to use Form T1213 if you have eligible deductions or credits that will reduce the amount of income tax you owe, and you want to receive the tax relief throughout the year instead of waiting until you file your income tax return.

Q: What deductions or credits can I request on Form T1213?

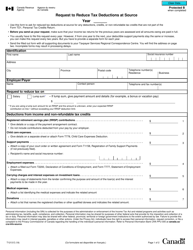

A: You can request deductions or credits such as RRSP contributions, child care expenses, support payments, employment expenses, charitable donations, and tuition fees.

Q: When should I submit Form T1213?

A: It is recommended to submit Form T1213 at least 6 to 8 weeks before the start of the period in which you want the reduced deductions to be effective.

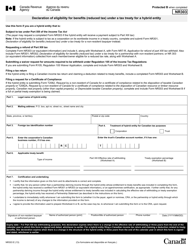

Q: What happens after I submit Form T1213?

A: After you submit Form T1213, the CRA will review your request and either approve or deny it. If approved, you will receive a letter of authority which you can provide to your employer or payer to reduce the tax deducted from your income.

Q: Do I need to submit Form T1213 every year?

A: Yes, you need to submit Form T1213 every year if you want to continue receiving the reduced tax deductions.

Q: Can I make changes to my Form T1213 request during the year?

A: Yes, you can make changes to your Form T1213 request if your circumstances change during the year. You will need to submit a new Form T1213 with the updated information.

Q: Can Form T1213 be used for provincial tax deductions?

A: No, Form T1213 is used only for federal tax deductions. If you want to reduce your provincial tax deductions, you will need to contact your provincial tax authority.