This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1198

for the current year.

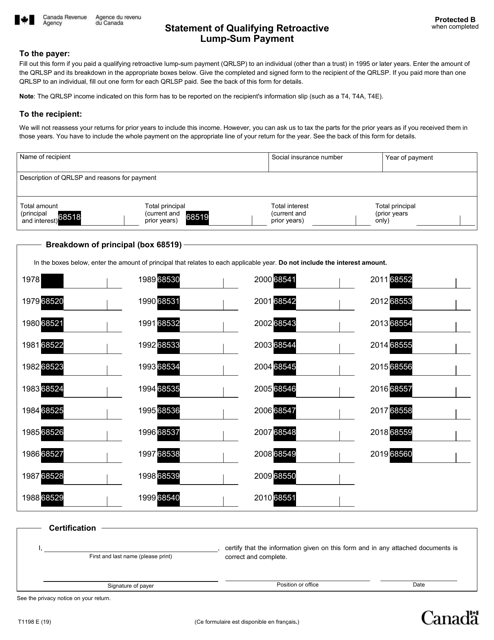

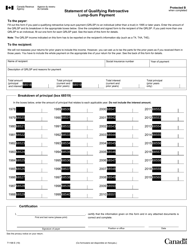

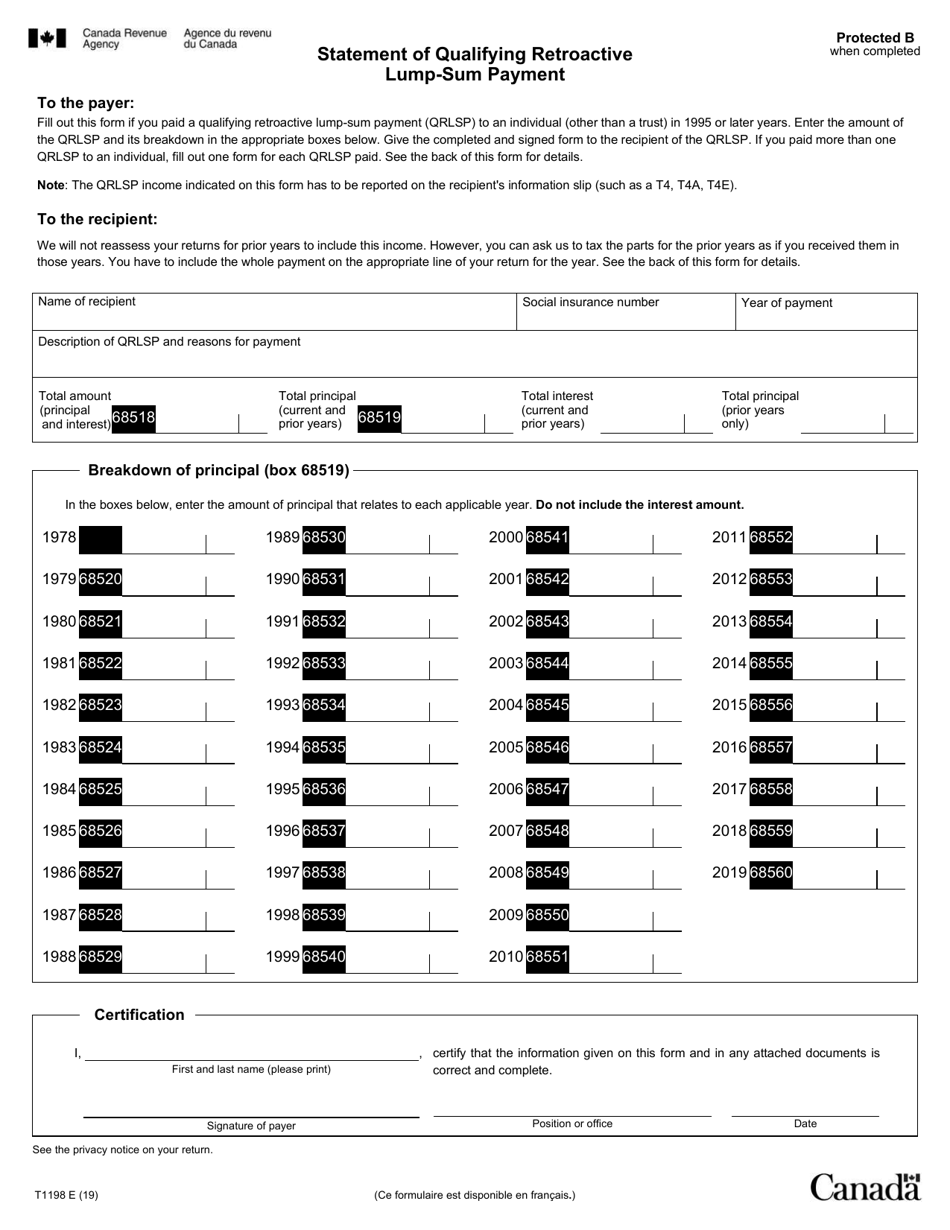

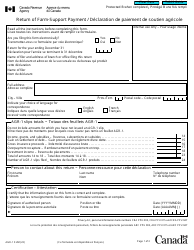

Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment - Canada

Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment in Canada is used to report the tax treatment of a lump-sum payment that is received in a year, but relates to a previous year or years. It is used to calculate the applicable tax on the retroactive payment separately from your current year's income.

The individual receiving the qualifying retroactive lump-sum payment files the Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment in Canada.

FAQ

Q: What is a Form T1198?

A: Form T1198 is the Statement of Qualifying Retroactive Lump-Sum Payment.

Q: What is a qualifying retroactive lump-sum payment?

A: A qualifying retroactive lump-sum payment is a payment received in a single tax year that includes amounts for previous years.

Q: Why do I need to fill out Form T1198?

A: You need to fill out Form T1198 if you received a qualifying retroactive lump-sum payment and want to allocate the payment to previous years to reduce your tax liability.

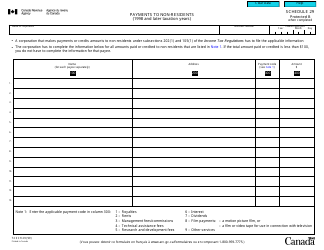

Q: How do I complete Form T1198?

A: You need to provide information about the payment, including the amount and the years to which it relates. You may need to consult tax documents or contact the payer for the necessary information.