This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1090

for the current year.

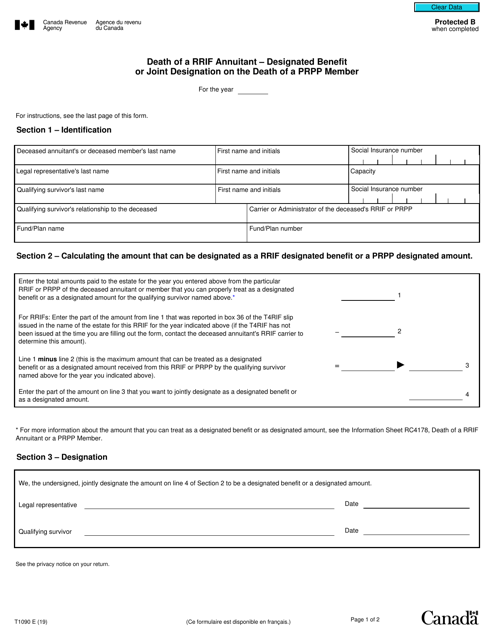

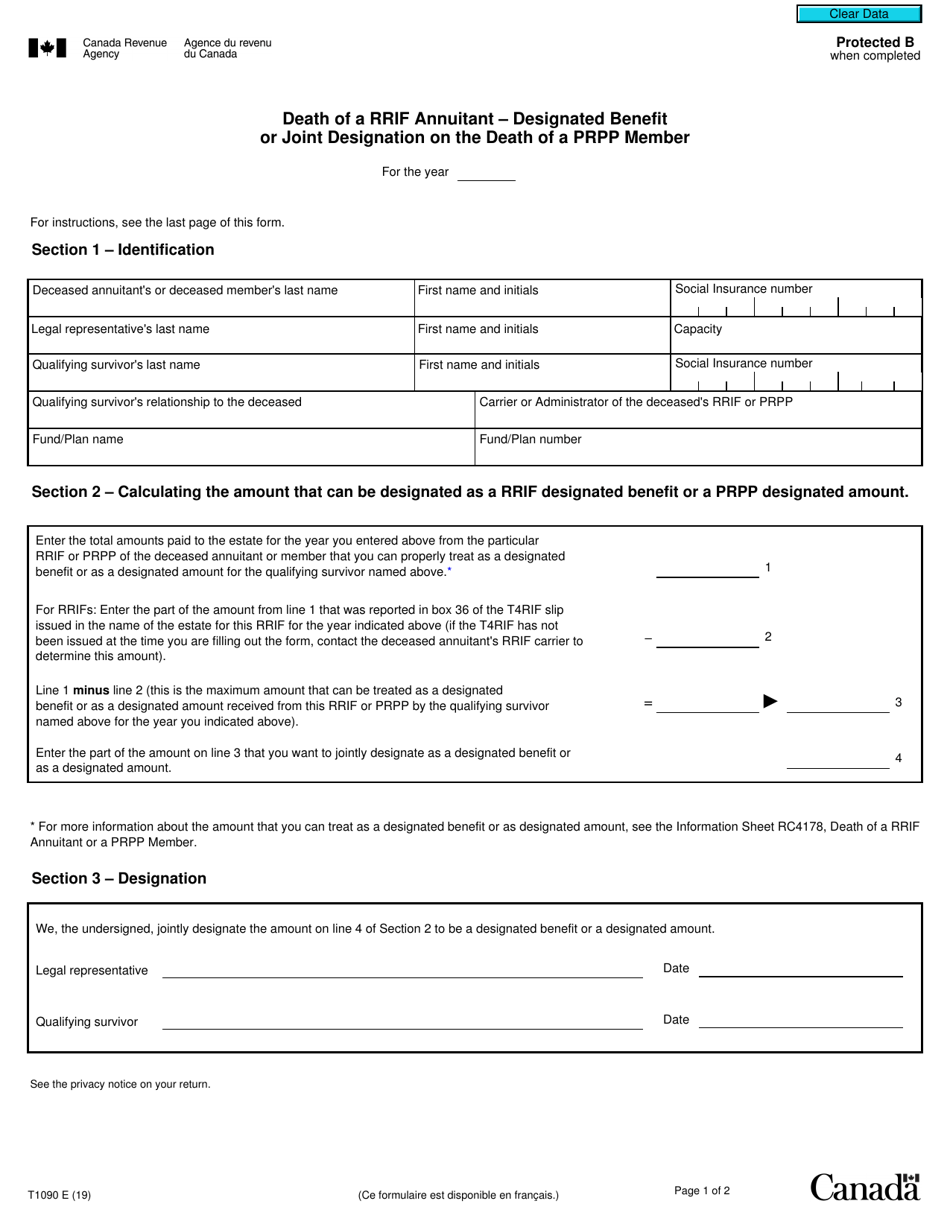

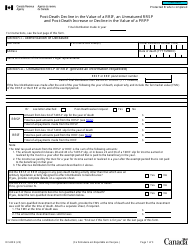

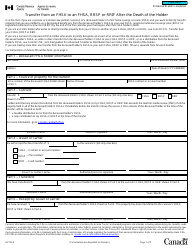

Form T1090 Death of a Rrif Annuitant - Designated Benefit or Joint Designation on the Death of a Prpp Member - Canada

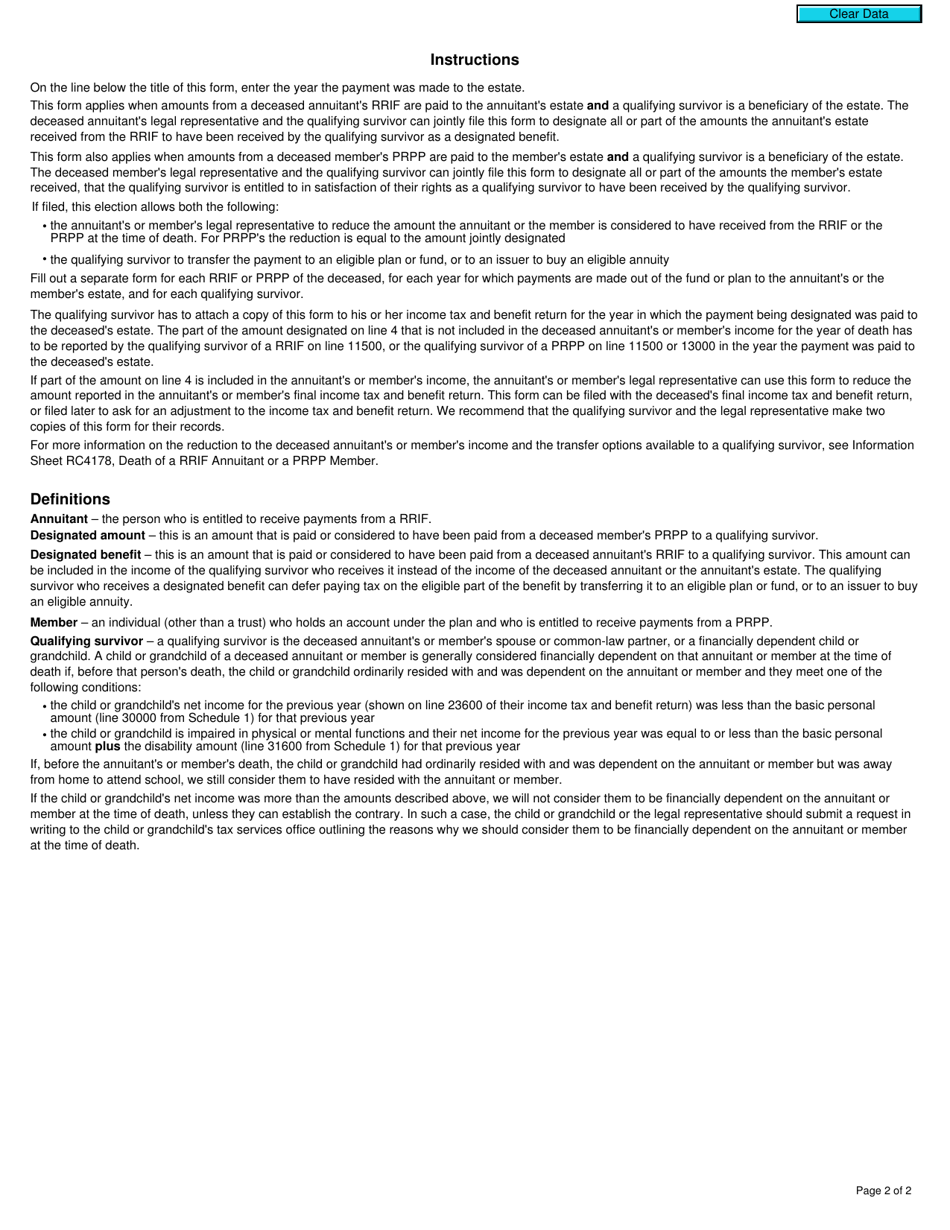

Form T1090, Death of a RRIF Annuitant - Designated Benefit or Joint Designation on the Death of a PRPP Member, is used in Canada to report the death of a Registered Retirement Income Fund (RRIF) annuitant. This form is used to designate a beneficiary or joint annuitant to receive the remaining funds in the RRIF upon the annuitant's death.

In Canada, the T1090 form for the death of a RRIF annuitant with designated benefit or joint designation is typically filed by the deceased person's beneficiary or their legal representative.

FAQ

Q: What is Form T1090?

A: Form T1090 is a form used in Canada to report the death of a RRIF annuitant or the death of a PRPP member with a designated benefit or joint designation.

Q: What is a RRIF annuitant?

A: A RRIF annuitant is an individual who has a Registered Retirement Income Fund (RRIF) and receives income from it.

Q: What is a PRPP member?

A: A PRPP member is an individual who participates in a Pooled Registered Pension Plan (PRPP).

Q: What is a designated benefit or joint designation?

A: A designated benefit or joint designation refers to the beneficiary or joint-spouse who will receive the funds after the death of a RRIF annuitant or PRPP member.

Q: Why is Form T1090 used?

A: Form T1090 is used to report the death of a RRIF annuitant or PRPP member with a designated benefit or joint designation for tax and administrative purposes.