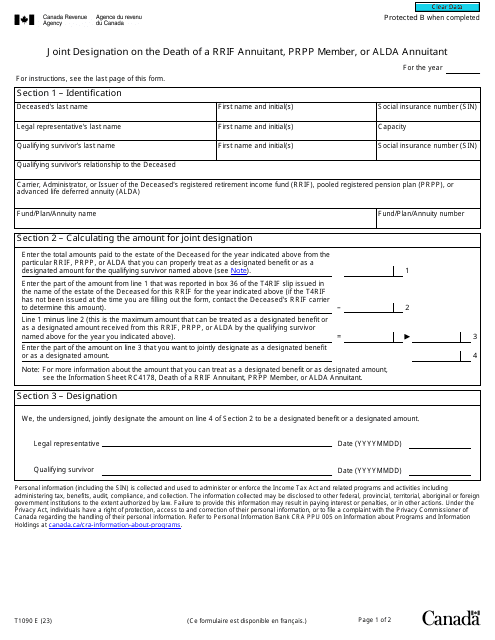

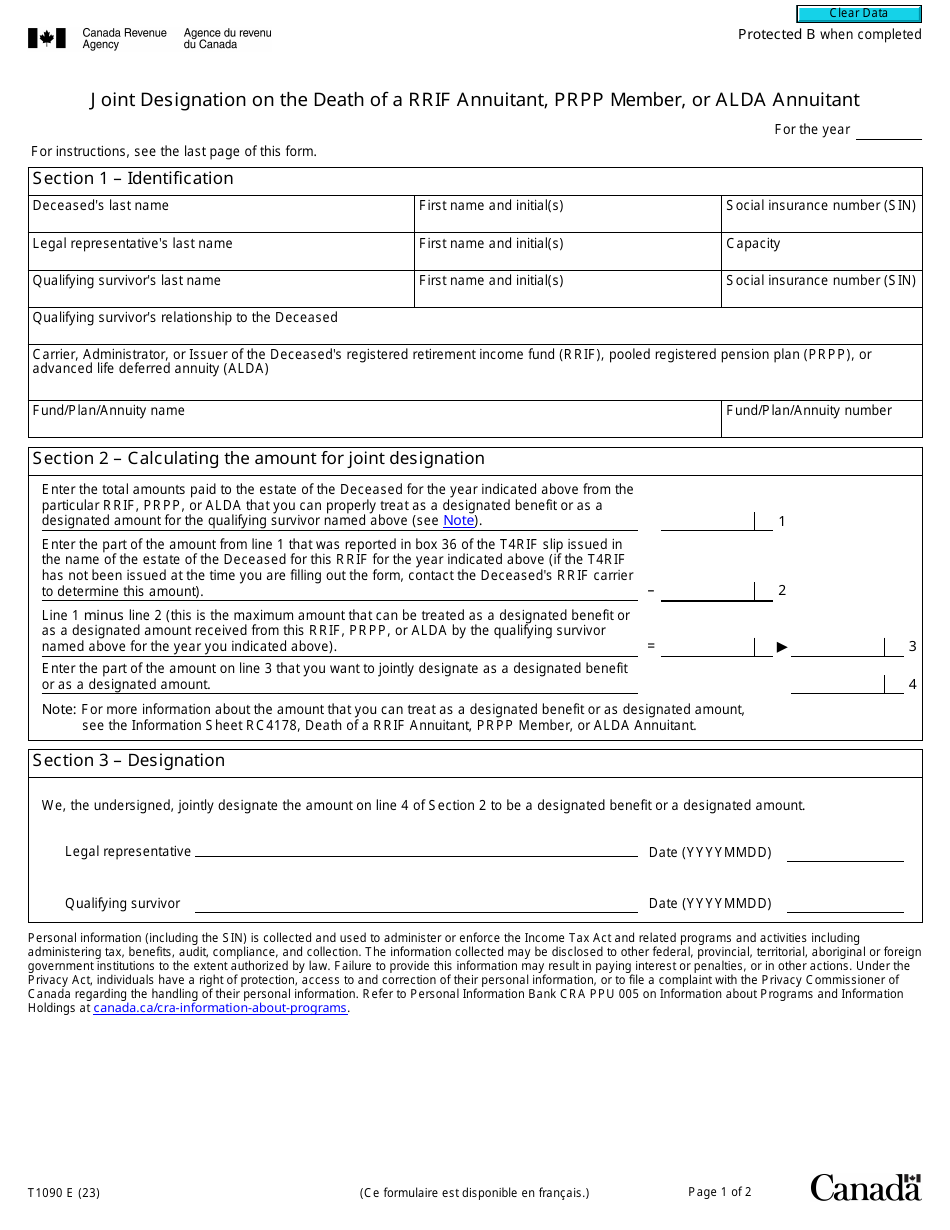

Form T1090 Joint Designation on the Death of a Rrif Annuitant, Prpp Member, or Alda Annuitant - Canada

Form T1090 Joint Designation on the Death of a RRIF Annuitant, PRPP Member, or ALDA Annuitant in Canada is used for designating a joint beneficiary to receive the funds in the event of the annuitant's death.

In Canada, the Form T1090 Joint Designation on the Death of a RRIF Annuitant, PRPP Member, or ALDA Annuitant is filed by the beneficiary or the executor of the deceased's estate.

Form T1090 Joint Designation on the Death of a Rrif Annuitant, Prpp Member, or Alda Annuitant - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1090?

A: Form T1090 is a joint designation form used in Canada for the designation of beneficiaries upon the death of a RRIF annuitant, PRPP member, or Alda annuitant.

Q: Who can use Form T1090?

A: Form T1090 can be used by individuals in Canada who are RRIF annuitants, PRPP members, or Alda annuitants.

Q: What is the purpose of Form T1090?

A: The purpose of Form T1090 is to designate beneficiaries to receive the proceeds upon the death of a RRIF annuitant, PRPP member, or Alda annuitant.

Q: Do I need to use Form T1090 for all RRIF annuitants, PRPP members, or Alda annuitants?

A: Yes, it is recommended to use Form T1090 for all RRIF annuitants, PRPP members, or Alda annuitants to ensure proper designation of beneficiaries.

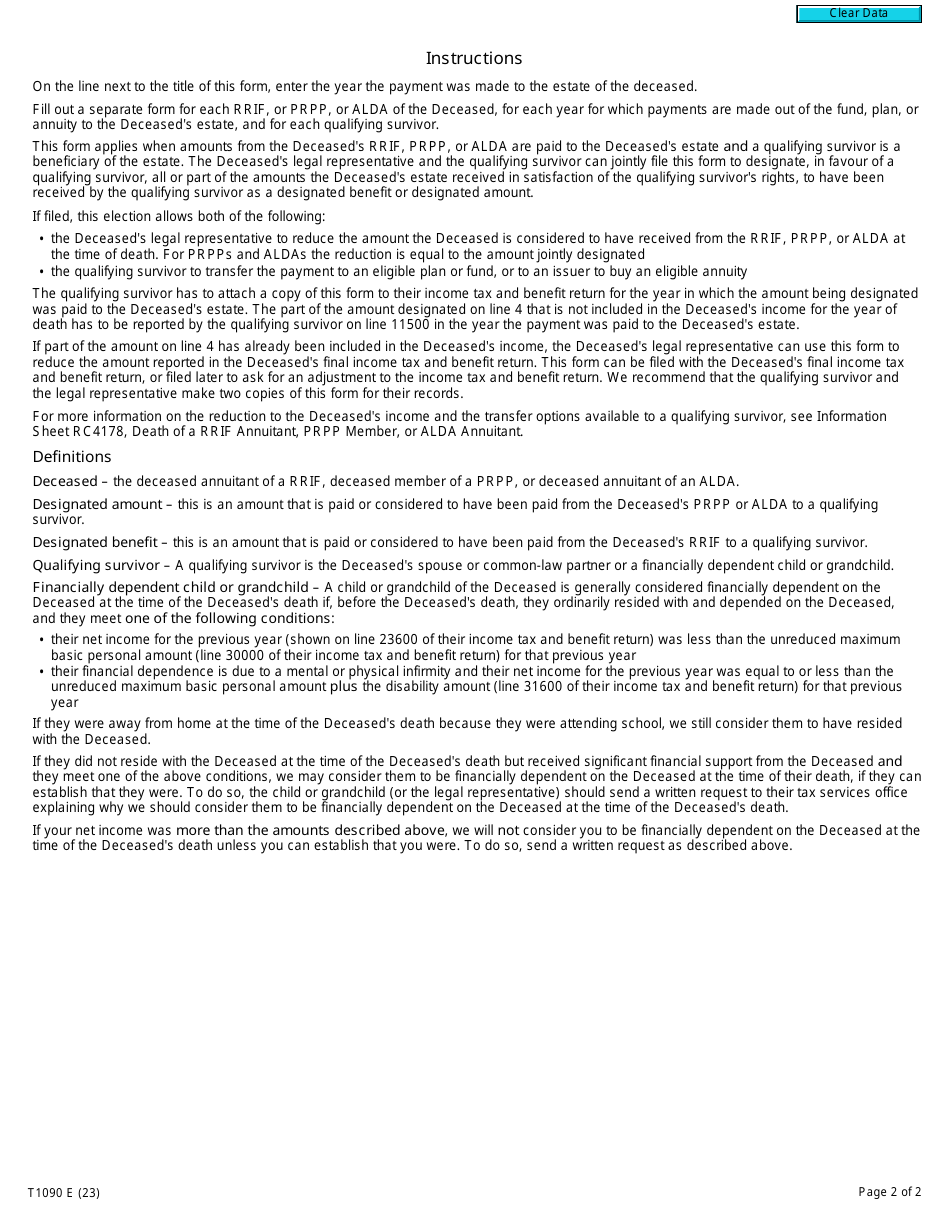

Q: Are there any deadlines for submitting Form T1090?

A: There are no specific deadlines for submitting Form T1090, but it is important to update beneficiary designations as necessary to reflect changes in personal circumstances.

Q: Can I make changes to my beneficiary designation after submitting Form T1090?

A: Yes, you can make changes to your beneficiary designation at any time by submitting a new Form T1090 with the updated information.