This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1036

for the current year.

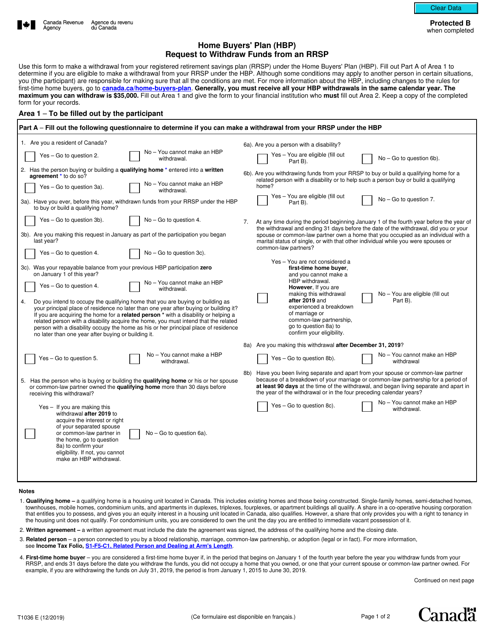

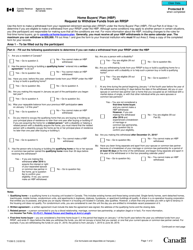

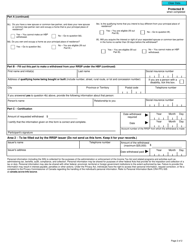

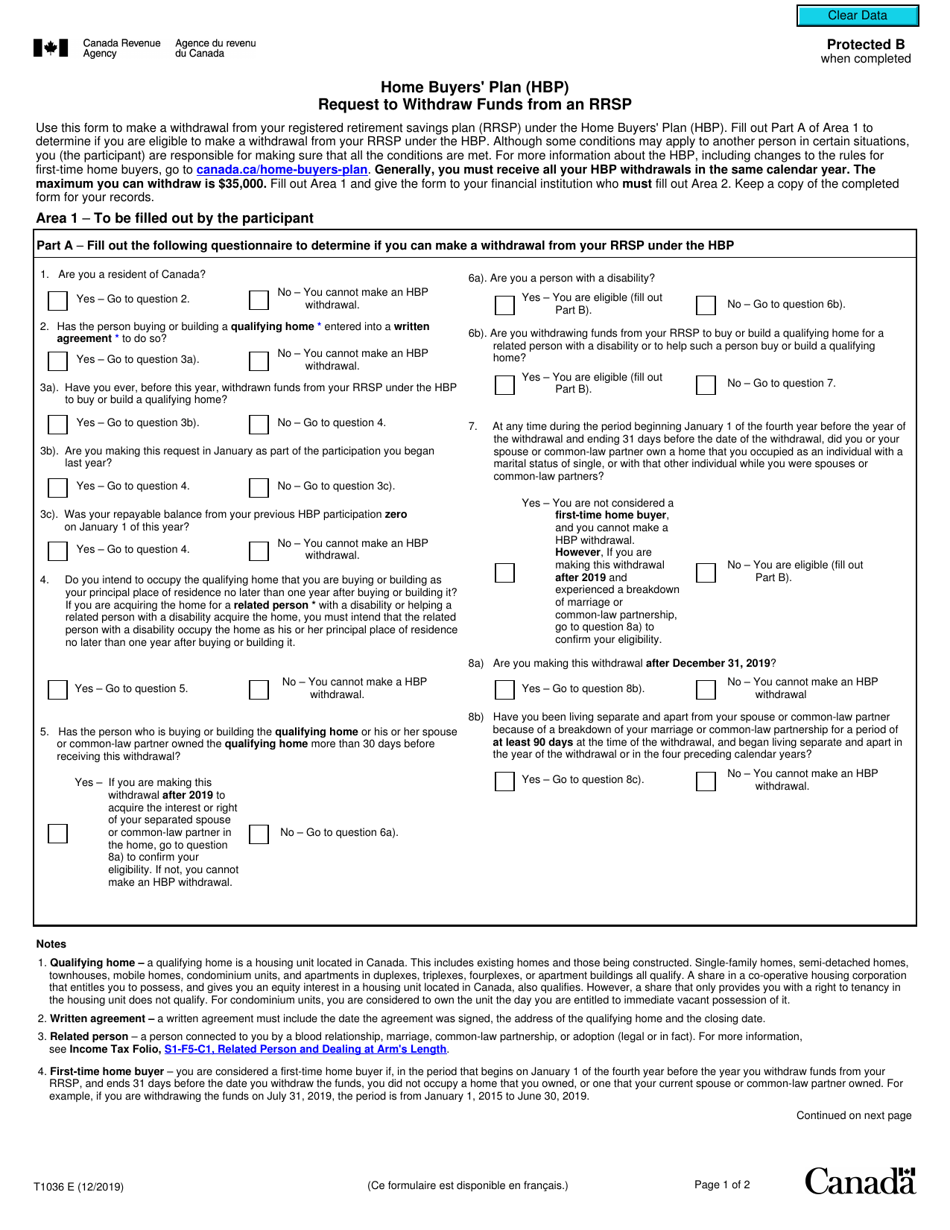

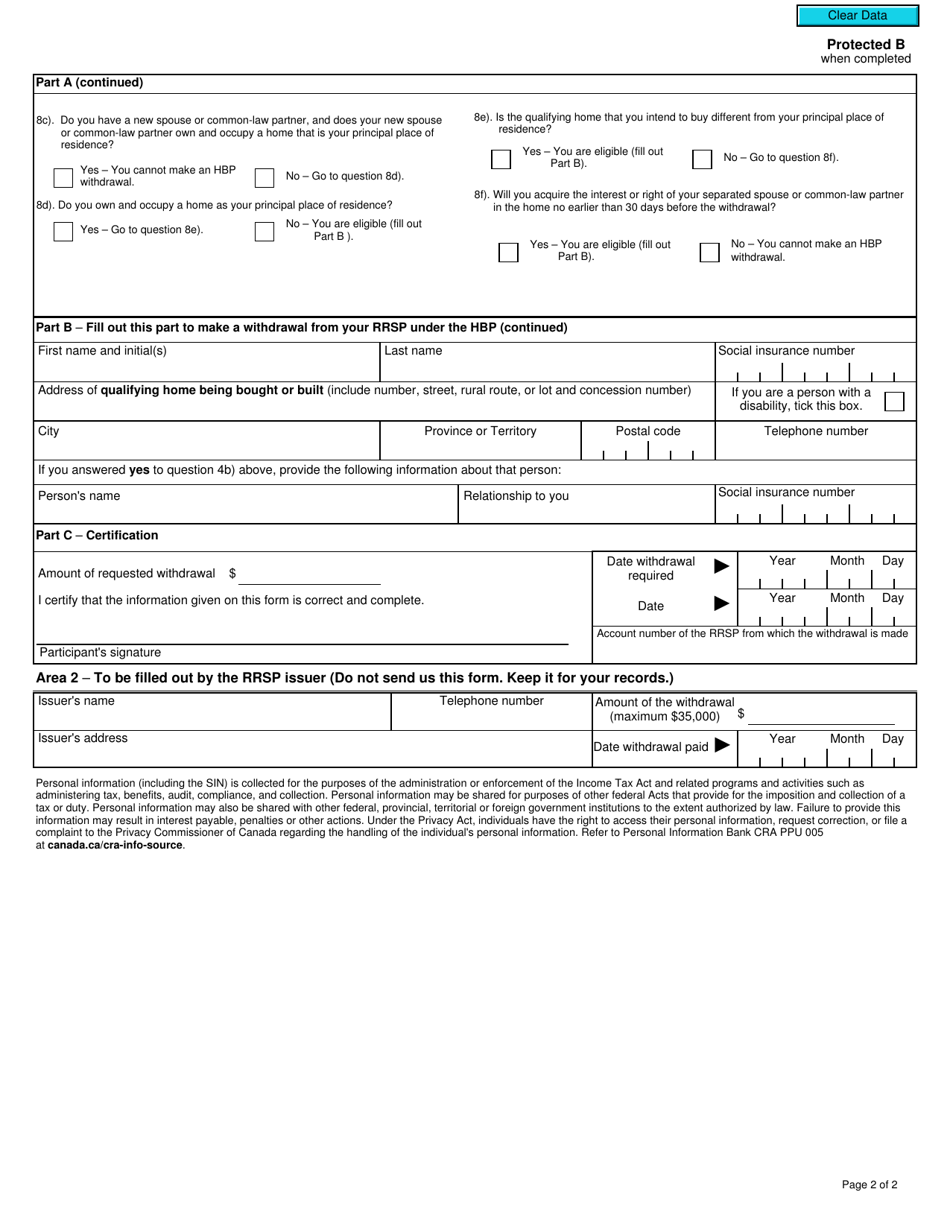

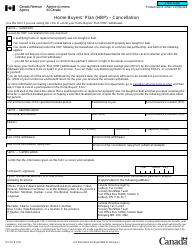

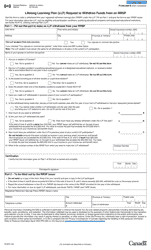

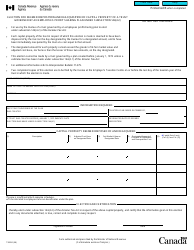

Form T1036 Home Buyers' Plan (Hbp) Request to Withdraw Funds From an Rrsp - Canada

Form T1036 Home Buyers' Plan (HBP) Request to Withdraw Funds From an RRSP is used for the Home Buyers' Plan in Canada. This form is used to request a withdrawal from an RRSP (Registered Retirement Savings Plan) for the purpose of purchasing a home.

The taxpayer who wishes to withdraw funds from their RRSP under the Home Buyers' Plan (HBP) files the Form T1036 in Canada.

FAQ

Q: What is Form T1036?

A: Form T1036 is a form used in Canada to request the withdrawal of funds from an RRSP (Registered Retirement Savings Plan) under the Home Buyers' Plan (HBP).

Q: What is the Home Buyers' Plan (HBP)?

A: The Home Buyers' Plan (HBP) is a program in Canada that allows individuals to withdraw funds from their RRSP to buy or build a qualifying home.

Q: How do I complete Form T1036?

A: To complete Form T1036, you need to provide your personal information, RRSP details, and information about the home you intend to buy or build. You must also sign the form.

Q: Can I withdraw funds from my RRSP under the Home Buyers' Plan (HBP)?

A: Yes, if you meet the eligibility criteria, you can withdraw funds from your RRSP under the Home Buyers' Plan (HBP) to buy or build a qualifying home.

Q: What are the eligibility criteria for the Home Buyers' Plan (HBP)?

A: To be eligible for the Home Buyers' Plan (HBP), you must be a first-time homebuyer, have a written agreement to buy or build a qualifying home, and be a resident of Canada.

Q: Is there a maximum amount I can withdraw under the Home Buyers' Plan (HBP)?

A: Yes, there is a maximum amount you can withdraw under the Home Buyers' Plan (HBP). As of 2021, the maximum withdrawal limit is $35,000.

Q: What are the repayment requirements for the Home Buyers' Plan (HBP)?

A: If you withdraw funds from your RRSP under the Home Buyers' Plan (HBP), you must repay the withdrawn amount back into your RRSP over a period of 15 years.

Q: What happens if I do not repay the withdrawn amount under the Home Buyers' Plan (HBP)?

A: If you do not repay the withdrawn amount under the Home Buyers' Plan (HBP), it will be included in your taxable income for the year and subject to taxes.

Q: Can I participate in the Home Buyers' Plan (HBP) more than once?

A: No, you can only participate in the Home Buyers' Plan (HBP) once in your lifetime.