This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC96

for the current year.

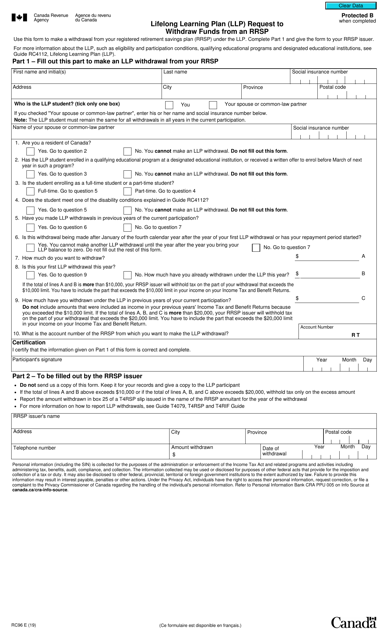

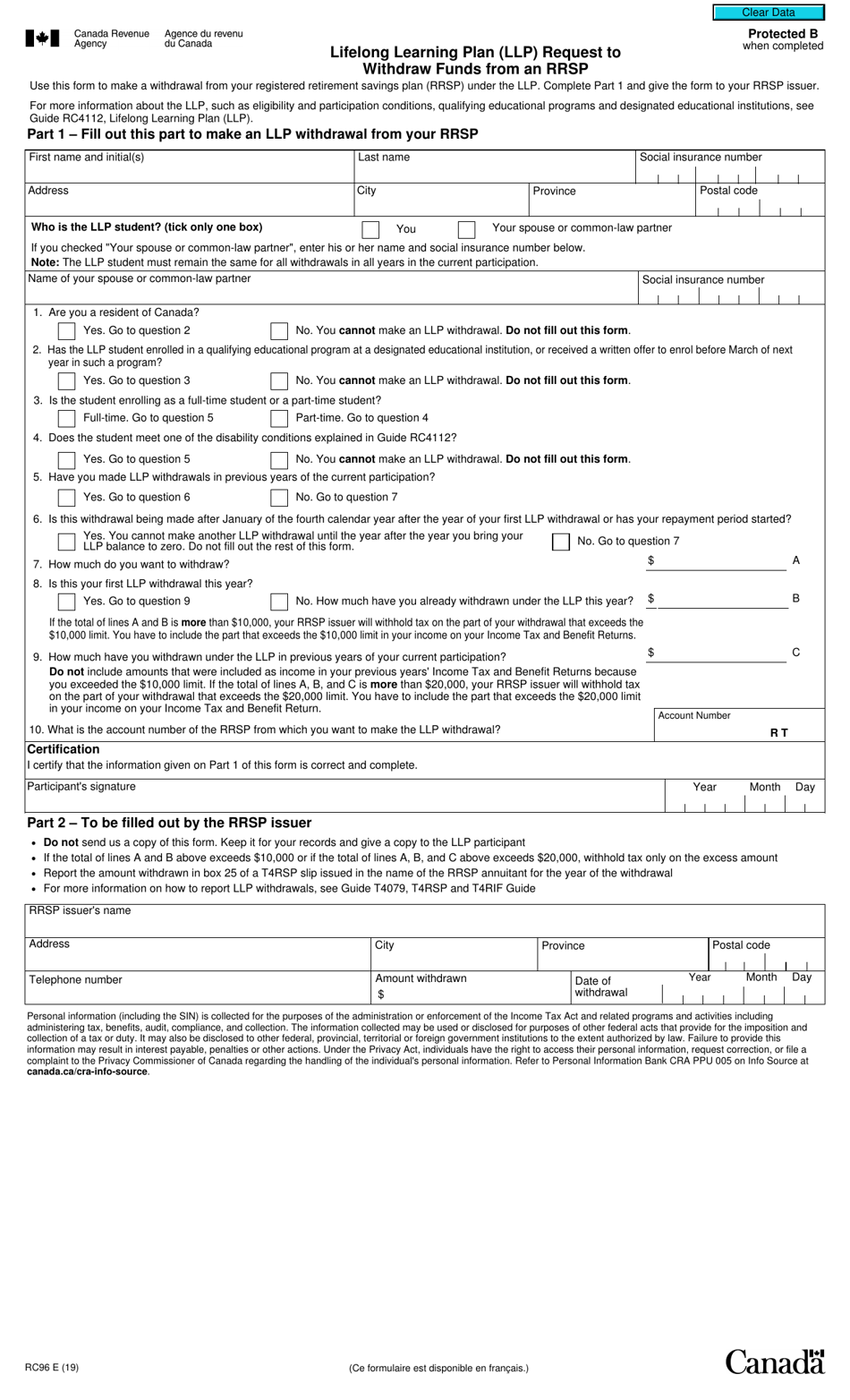

Form RC96 Lifelong Learning Plan (LLP ) Request to Withdraw Funds From an Rrsp - Canada

Form RC96 Lifelong Learning Plan (LLP) Request to Withdraw Funds from an RRSP is used in Canada to request a withdrawal of funds from a Registered Retirement Savings Plan (RRSP) for the purpose of financing lifelong learning or education expenses. This withdrawal is made under the Lifelong Learning Plan (LLP) which allows individuals to take out funds from their RRSPs on a tax-free basis to support their education.

The individual who wants to withdraw funds from their RRSP under the Lifelong Learning Plan (LLP) in Canada will file the Form RC96.

FAQ

Q: What is Form RC96?

A: Form RC96 is a form used in Canada to request a withdrawal of funds from a Registered Retirement Savings Plan (RRSP) under the Lifelong Learning Plan (LLP).

Q: What is the Lifelong Learning Plan (LLP)?

A: The Lifelong Learning Plan (LLP) is a program in Canada that allows you to withdraw funds from your RRSP to finance full-time education or training for yourself or your spouse or common-law partner.

Q: Who can use the Lifelong Learning Plan (LLP)?

A: Canadian residents who have an RRSP and are enrolled in a qualifying full-time education or training program, or have a spouse or common-law partner who is enrolled, can use the Lifelong Learning Plan (LLP).

Q: Why would someone use the Lifelong Learning Plan (LLP)?

A: The Lifelong Learning Plan (LLP) allows individuals to withdraw funds from their RRSP on a tax-deferred basis to finance their or their spouse's education or training, providing a way to fund higher education without incurring immediate tax liabilities.

Q: How do I complete Form RC96?

A: To complete Form RC96, you will need to provide your personal information, RRSP details, and the amount you wish to withdraw. The form also requires a signature and should be submitted to the financial institution holding your RRSP.