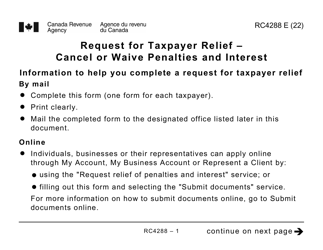

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4288

for the current year.

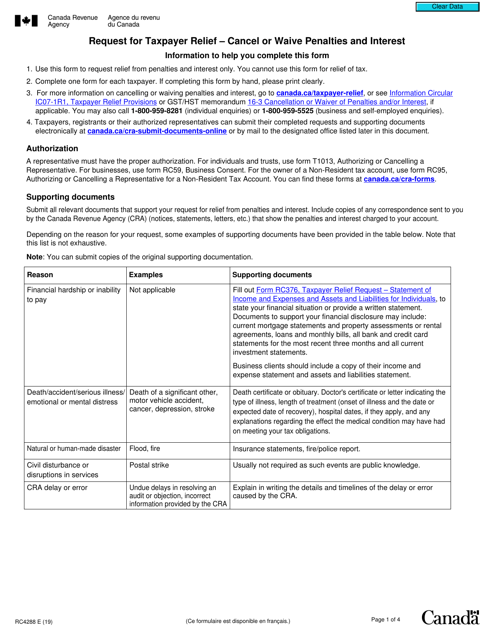

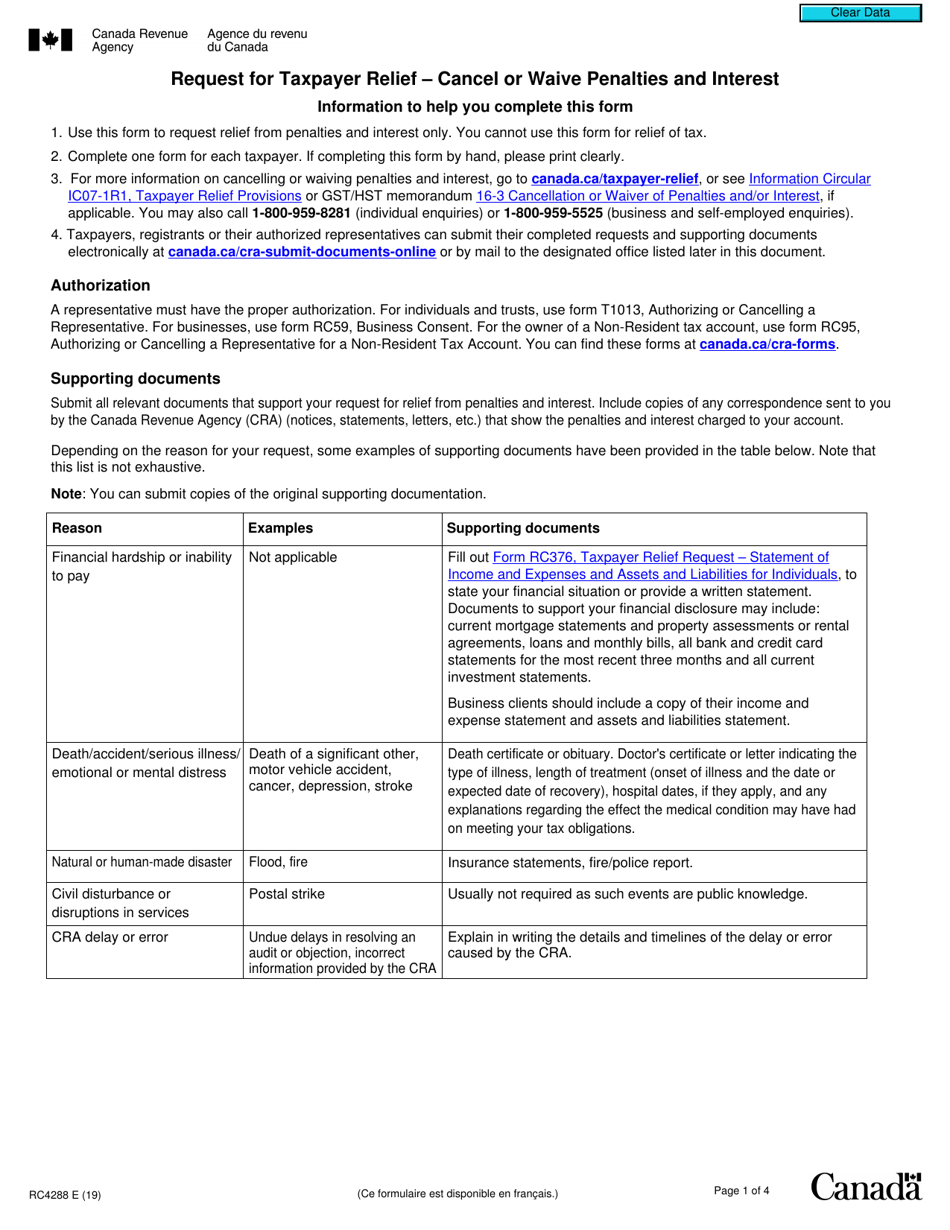

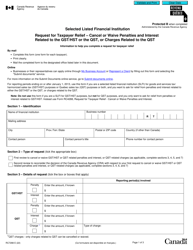

Form RC4288 Request for Taxpayer Relief - Cancel or Waive Penalties or Interest - Canada

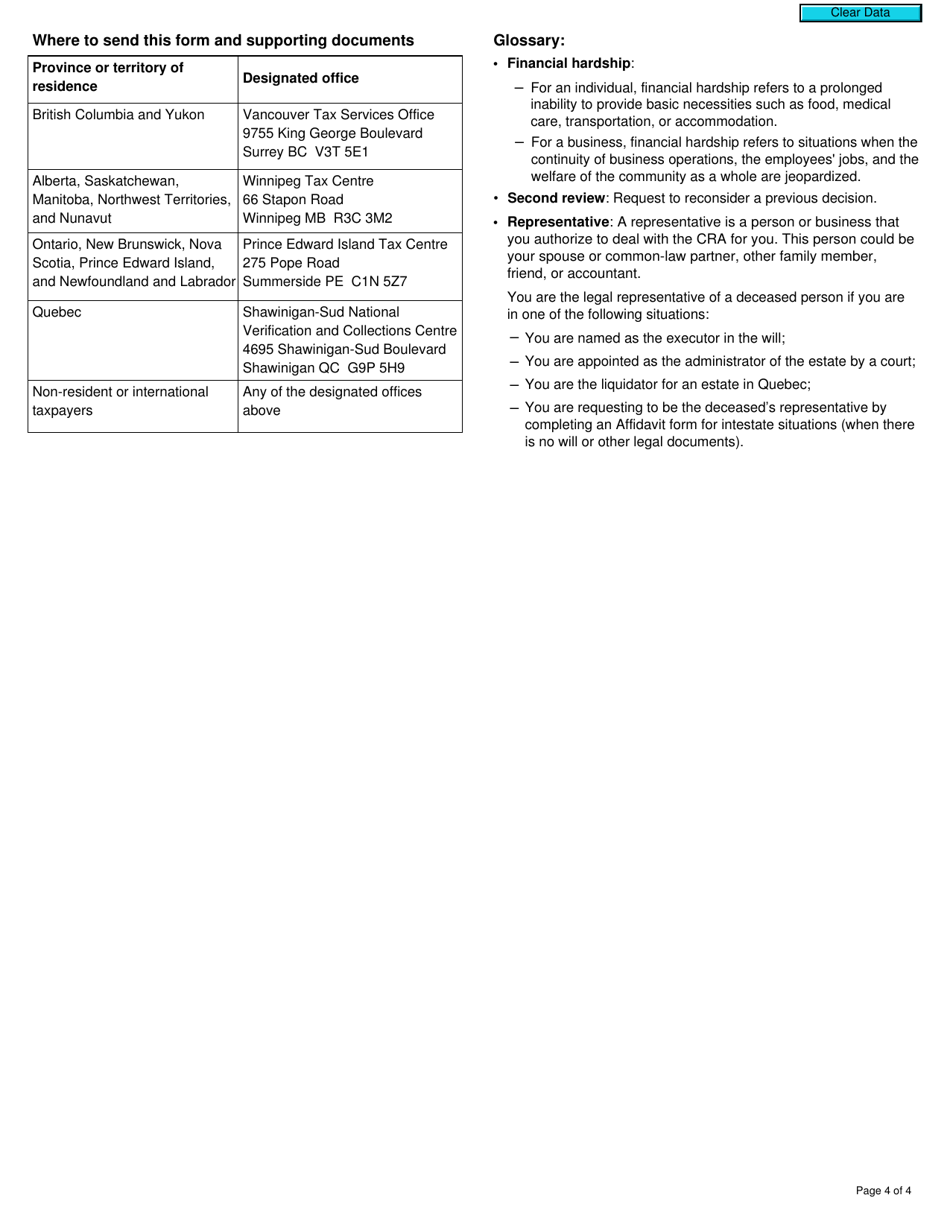

Form RC4288, also known as "Request for Taxpayer Relief - Cancel or Waive Penalties or Interest," is used by taxpayers in Canada to request relief from penalties or interest that have been applied to their tax accounts by the Canada Revenue Agency (CRA). This form allows taxpayers to explain their circumstances and provide supporting documentation, which the CRA considers when deciding whether to grant relief.

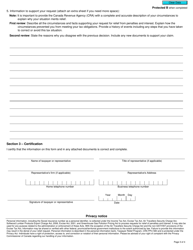

The individual taxpayer or their authorized representative can file the Form RC4288 Request for Taxpayer Relief in Canada.

FAQ

Q: What is Form RC4288?

A: Form RC4288 is a form used in Canada to request the cancellation or waiver of penalties or interest.

Q: What is the purpose of Form RC4288?

A: The purpose of Form RC4288 is to request relief from penalties or interest that have been assessed by the Canada Revenue Agency.

Q: Who can use Form RC4288?

A: Any taxpayer in Canada who believes they have a valid reason for the cancellation or waiver of penalties or interest can use Form RC4288.

Q: What kind of penalties or interest can be canceled or waived?

A: Penalties or interest related to late filing, late payment, or other non-compliance issues may be considered for cancellation or waiver.

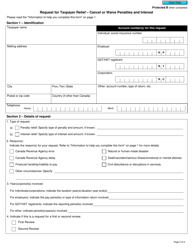

Q: How do I complete Form RC4288?

A: The form requires you to provide your personal and contact information, details of the penalty or interest being requested for cancellation or waiver, and the reason why you believe relief should be granted.

Q: Is there a fee for submitting Form RC4288?

A: No, there is no fee for submitting Form RC4288.

Q: What happens after I submit Form RC4288?

A: Once your form is received, the Canada Revenue Agency will review your request and notify you of their decision in writing.