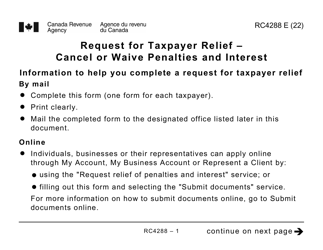

Form RC4288 Request for Taxpayer Relief - Cancel or Waive Penalties and Interest - Canada

Fill PDF Online

Fill out online for free

without registration or credit card

What Is Form RC4288?

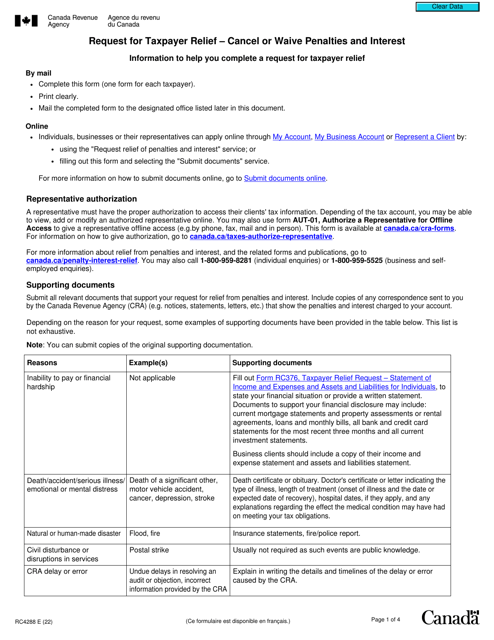

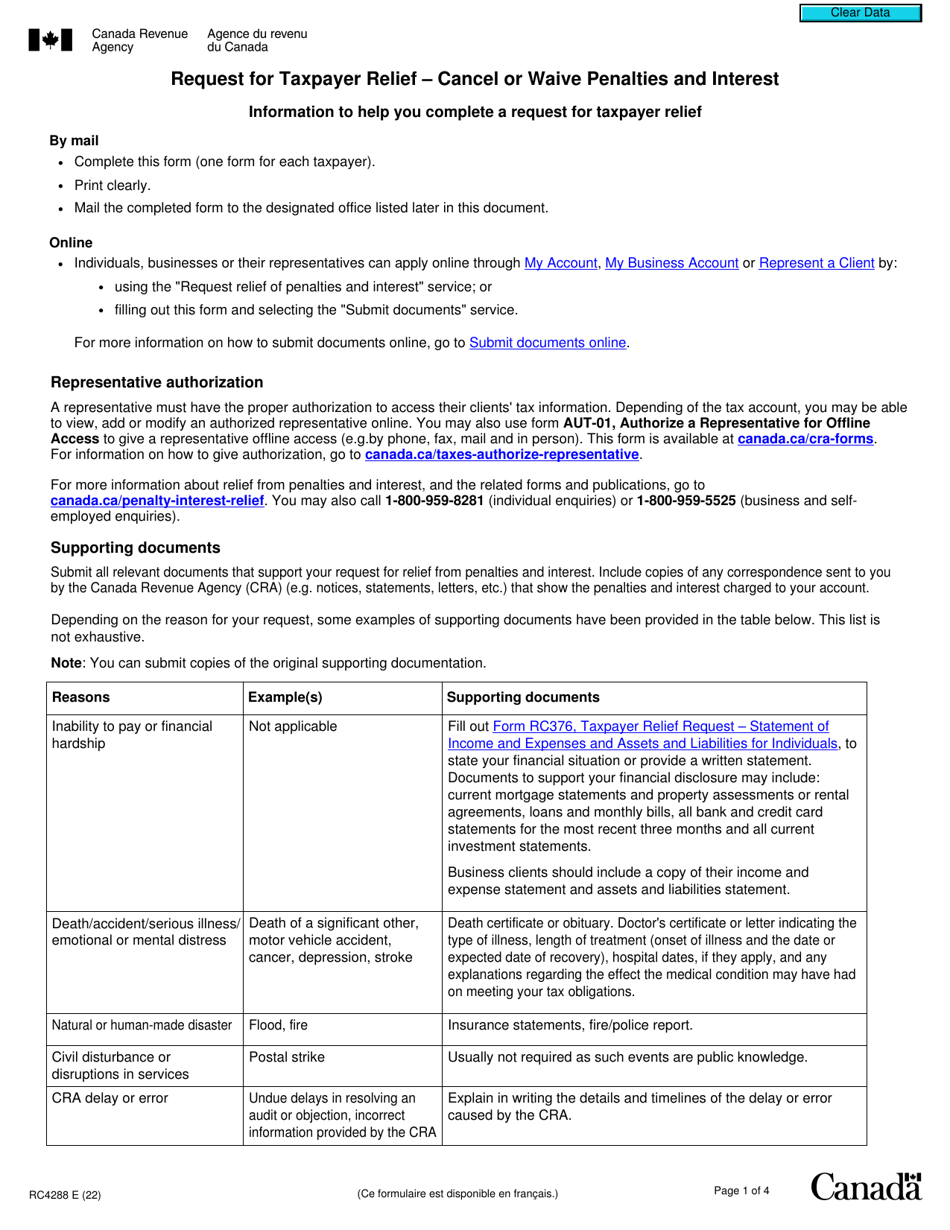

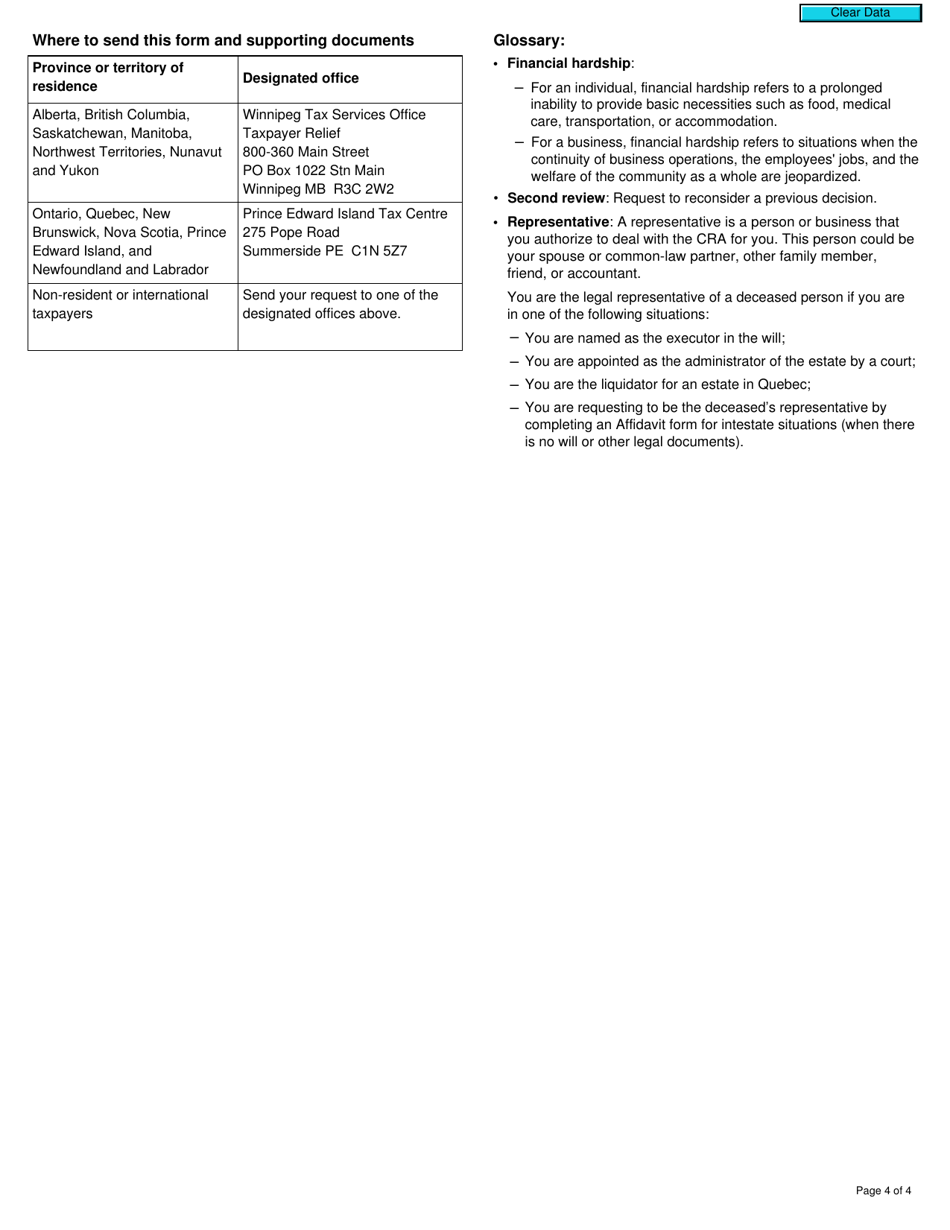

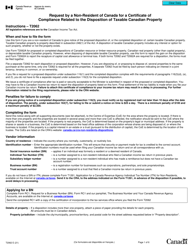

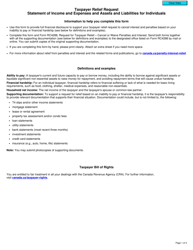

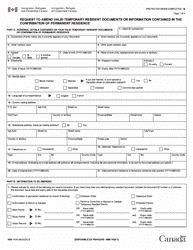

Form RC4288, Request for Taxpayer Relief - Cancel or Waive Penalties or Interest , is the supporting documentation a person will need to submit when they are unable to pay their annual taxes due to extenuating circumstances. There are multiple reasons that can qualify for this exemption, but if you are filing a claim due to financial hardship you will need to fill out a different supporting document.

Alternate Name:

- Taxpayer Relief Form.

The Taxpayer Relief Form is issued by the Canadian Revenue Agency (CRA) and was last updated on January 1, 2022 . An RC4288 fillable form is available for download through the link below.

Taxpayer Relief Form Instructions

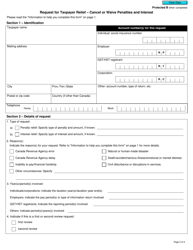

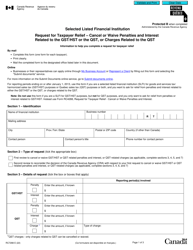

To complete Form RC4288 you will want to include the following information:

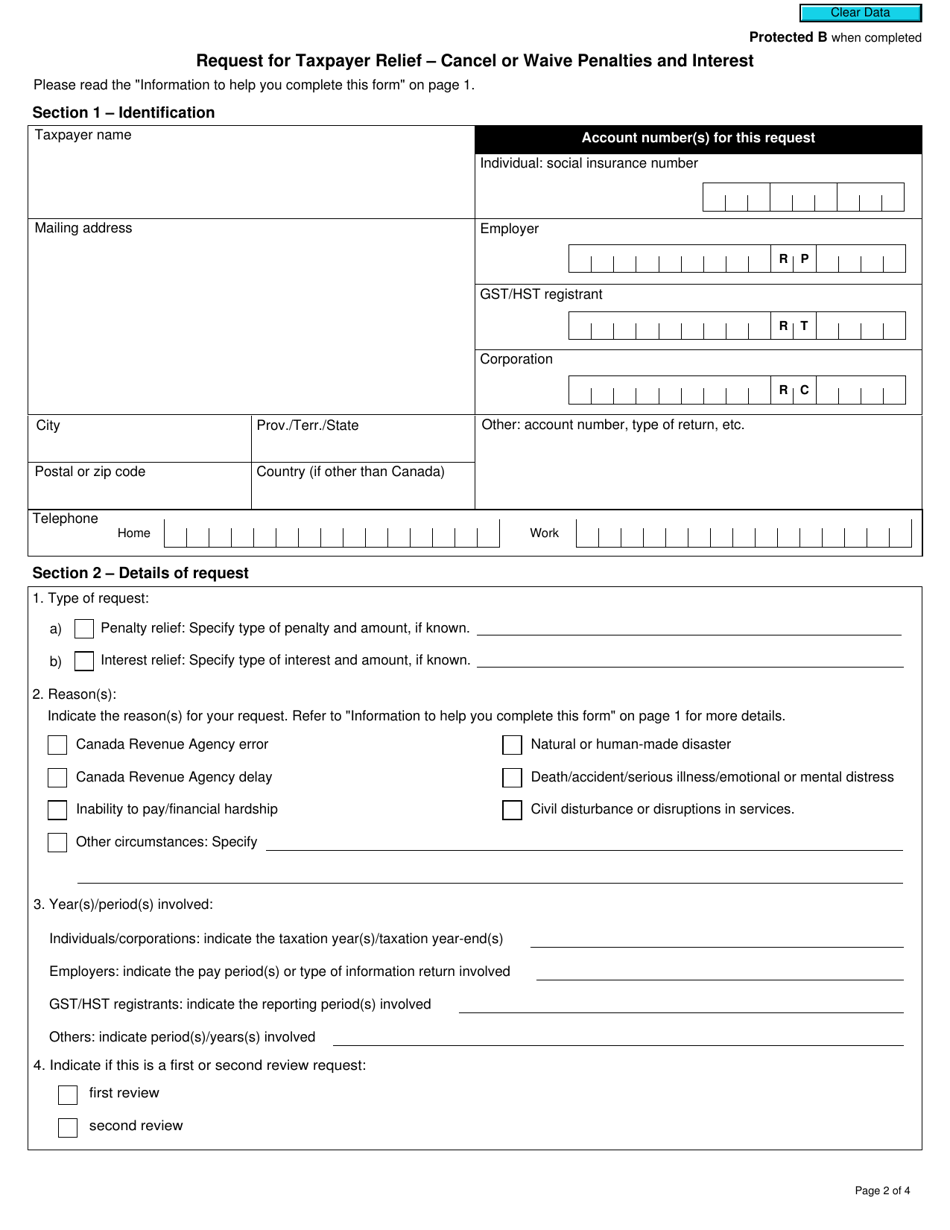

- The taxpayer's identification information including name, mailing address, telephone number, social insurance number, your employer's information, and the type of tax return you would normally file. This section will also ask for identification numbers for a GST/HST registrant, corporation, and employer, which will be used as part of the review process depending on the type of relief requested.

- Details of the request including the request type (whether it is interest or penalty relief), the reasons you are submitting the request, the years or periods you are claiming the relief for, and if this will be for a first or second review.

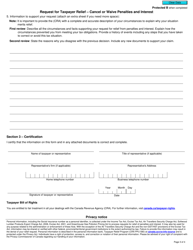

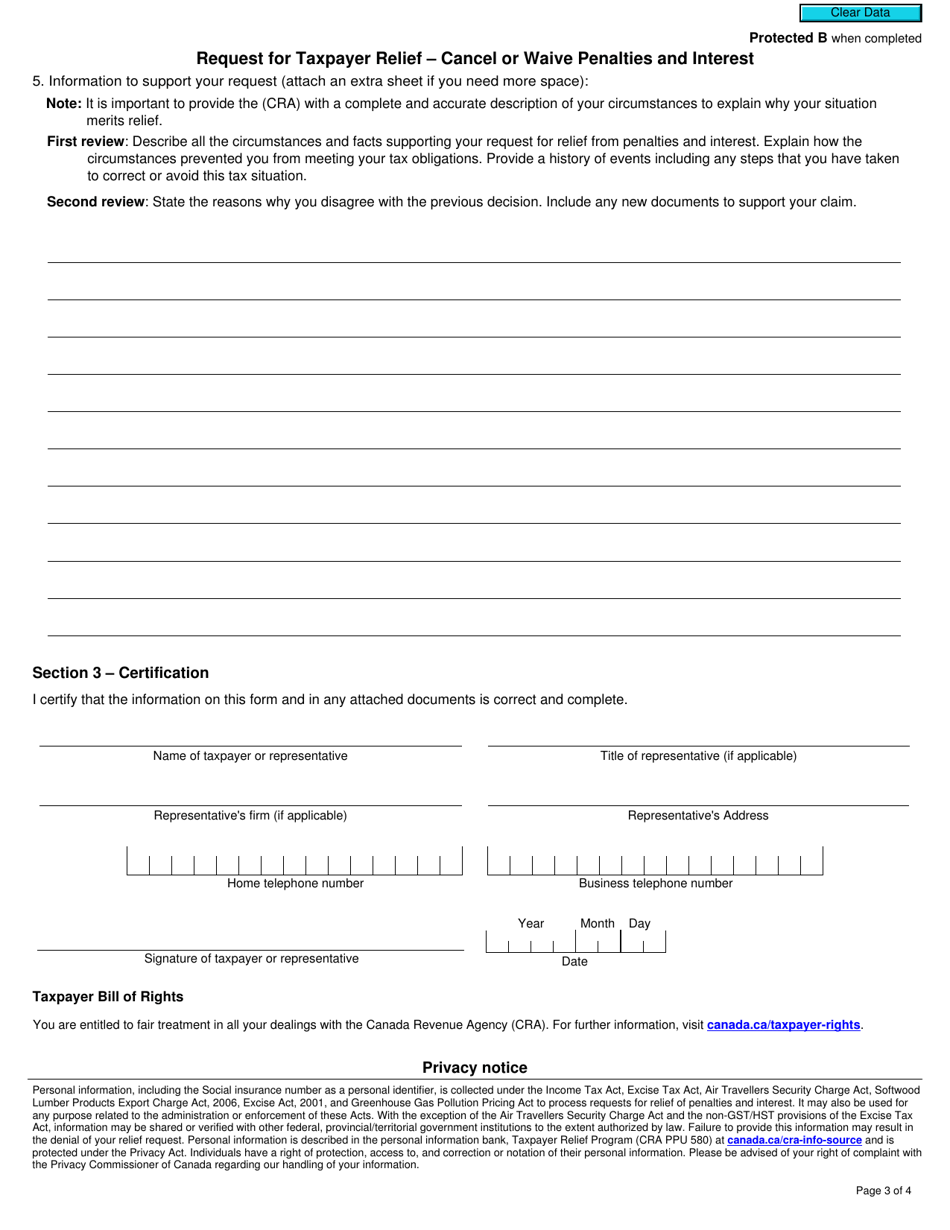

- The final section will ask you to write in your own words what circumstances led you to complete a Taxpayer Relief Form and why you believe your situation deserves an exemption. If this will be the first review you are seeking, you will be asked to include a history of events that have created your financial hardship and any measures you have since taken to try to rectify the issues. You will want to be thorough in your explanations to avoid an unfavorable review and to state your case accurately.

- If you seek a second review you will need to explain why you do not agree with the decision made and provide new documentation that can better support your claim.