This version of the form is not currently in use and is provided for reference only. Download this version of

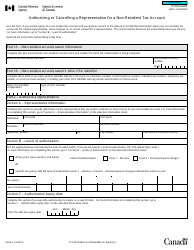

Form RC243 Schedule B

for the current year.

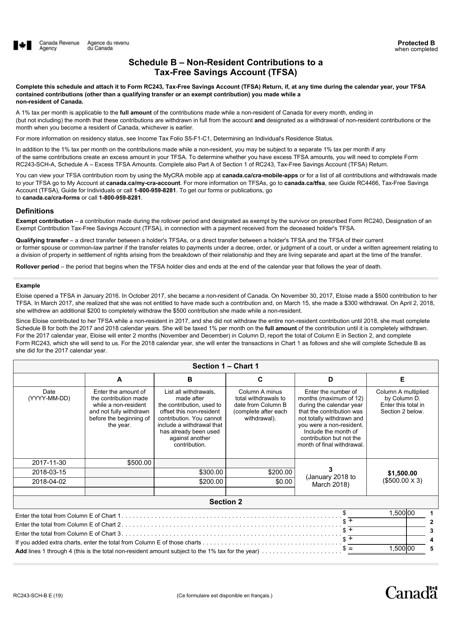

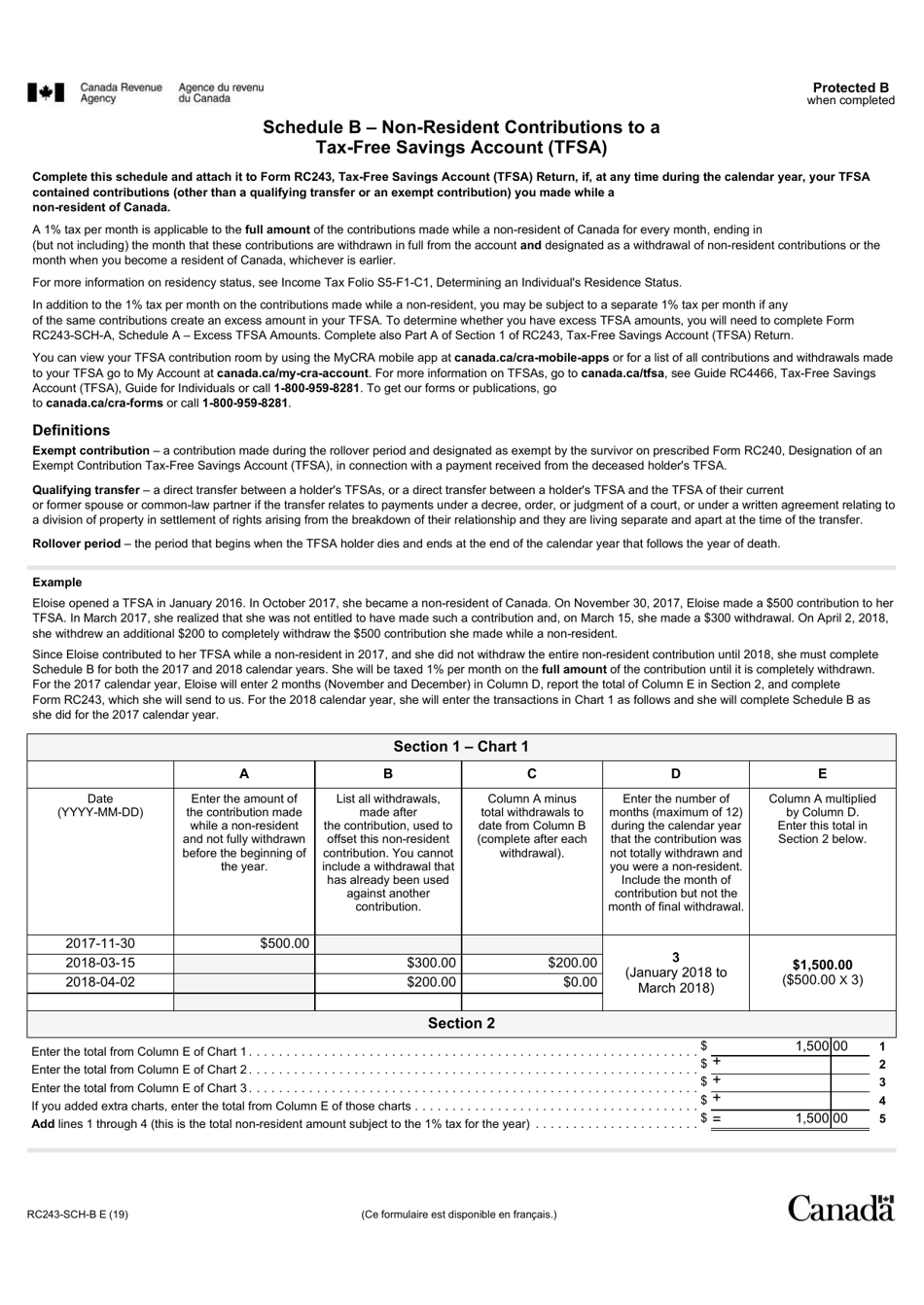

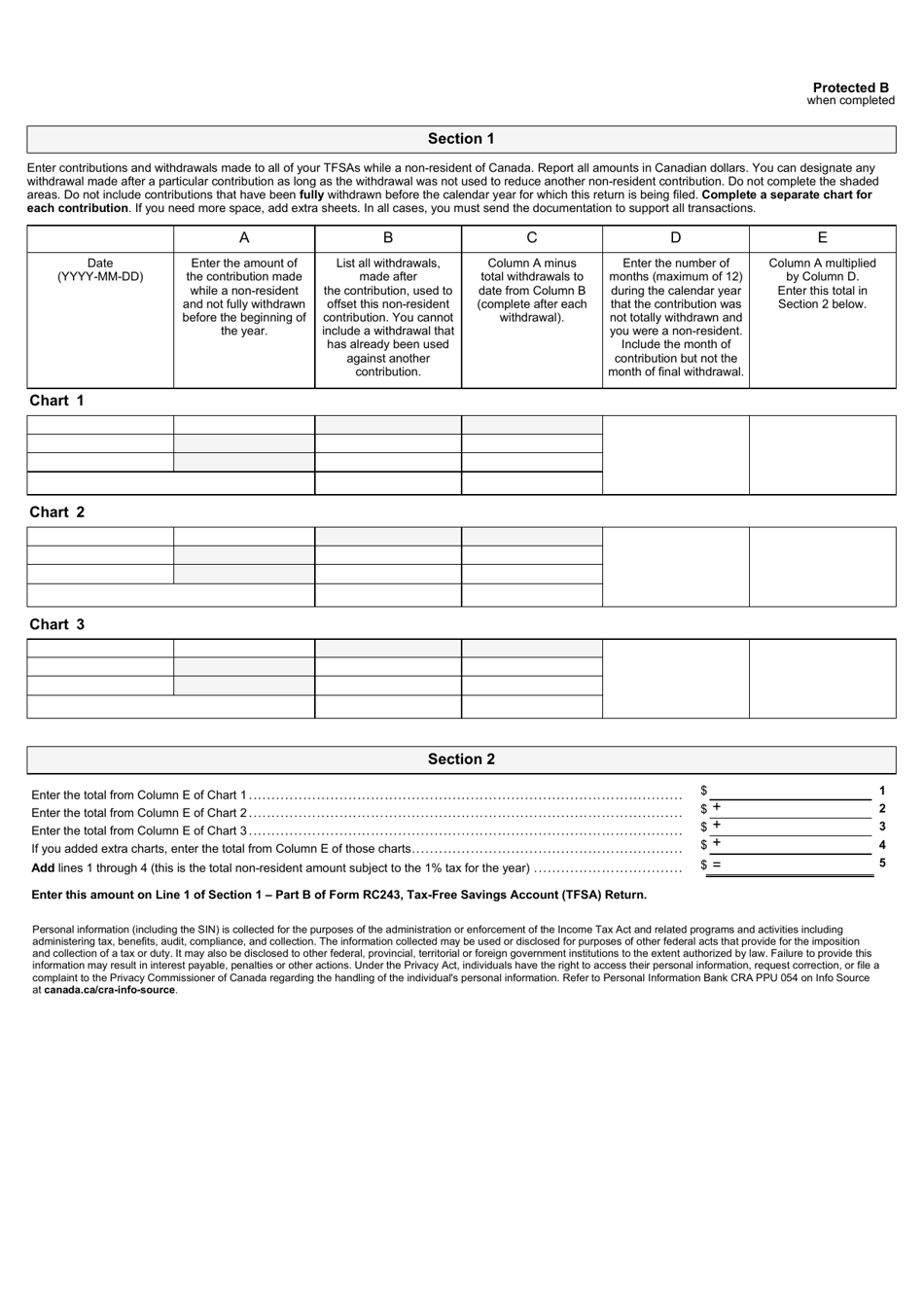

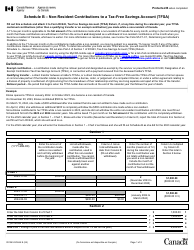

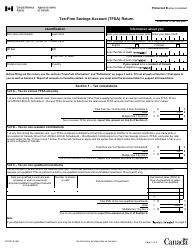

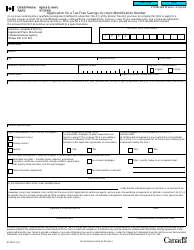

Form RC243 Schedule B Non-resident Contributions to a Tax-Free Savings Account (Tfsa) - Canada

Form RC243 Schedule B is used by non-residents of Canada to report contributions made to a Tax-Free Savings Account (TFSA) in Canada. It is used to calculate the over-contribution amount and any related penalties or taxes that may be owed.

FAQ

Q: What is RC243 Schedule B?

A: RC243 Schedule B is a form used in Canada for reporting non-resident contributions to a Tax-Free Savings Account (TFSA).

Q: Who needs to fill out RC243 Schedule B?

A: Non-residents of Canada who have made contributions to a TFSA need to fill out RC243 Schedule B.

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a savings account in Canada that allows individuals to earn investment income tax-free.

Q: What information do I need to provide on RC243 Schedule B?

A: You need to provide information about your TFSA contributions, including the year of contribution, amount contributed, and the name of the financial institution where the TFSA is held.