This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7227

for the current year.

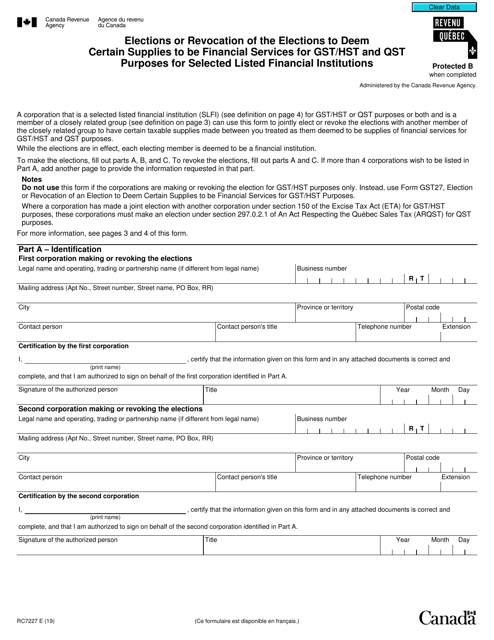

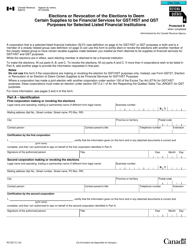

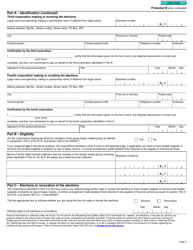

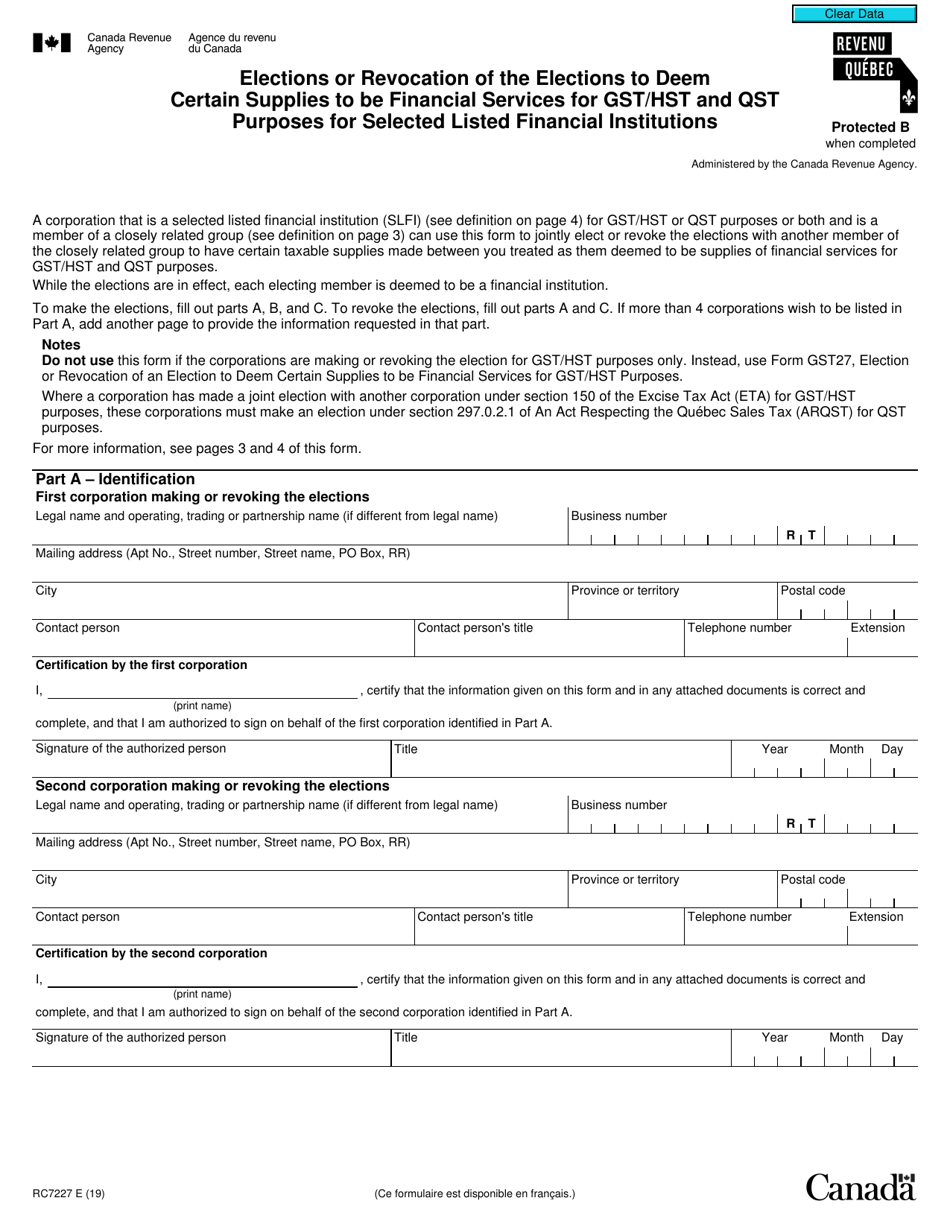

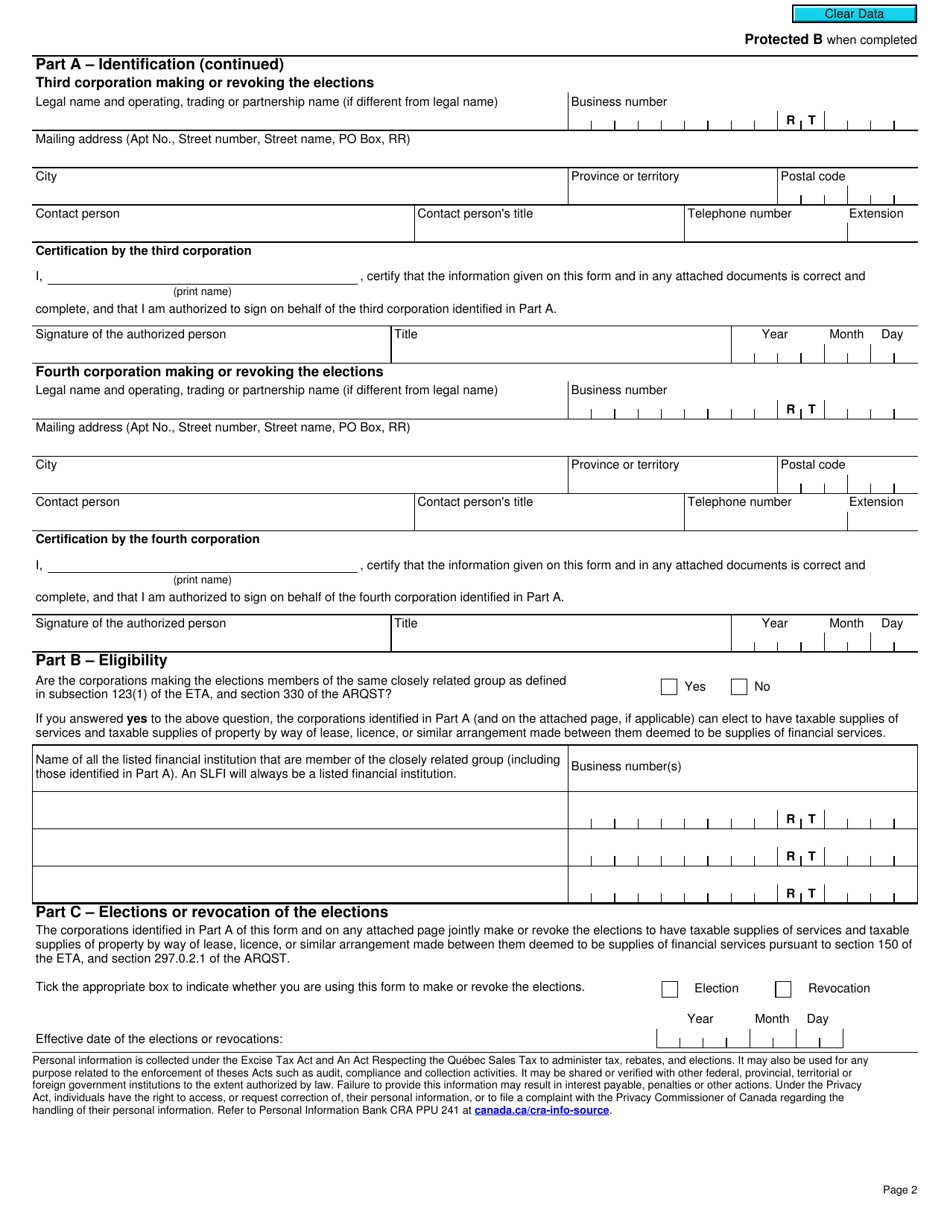

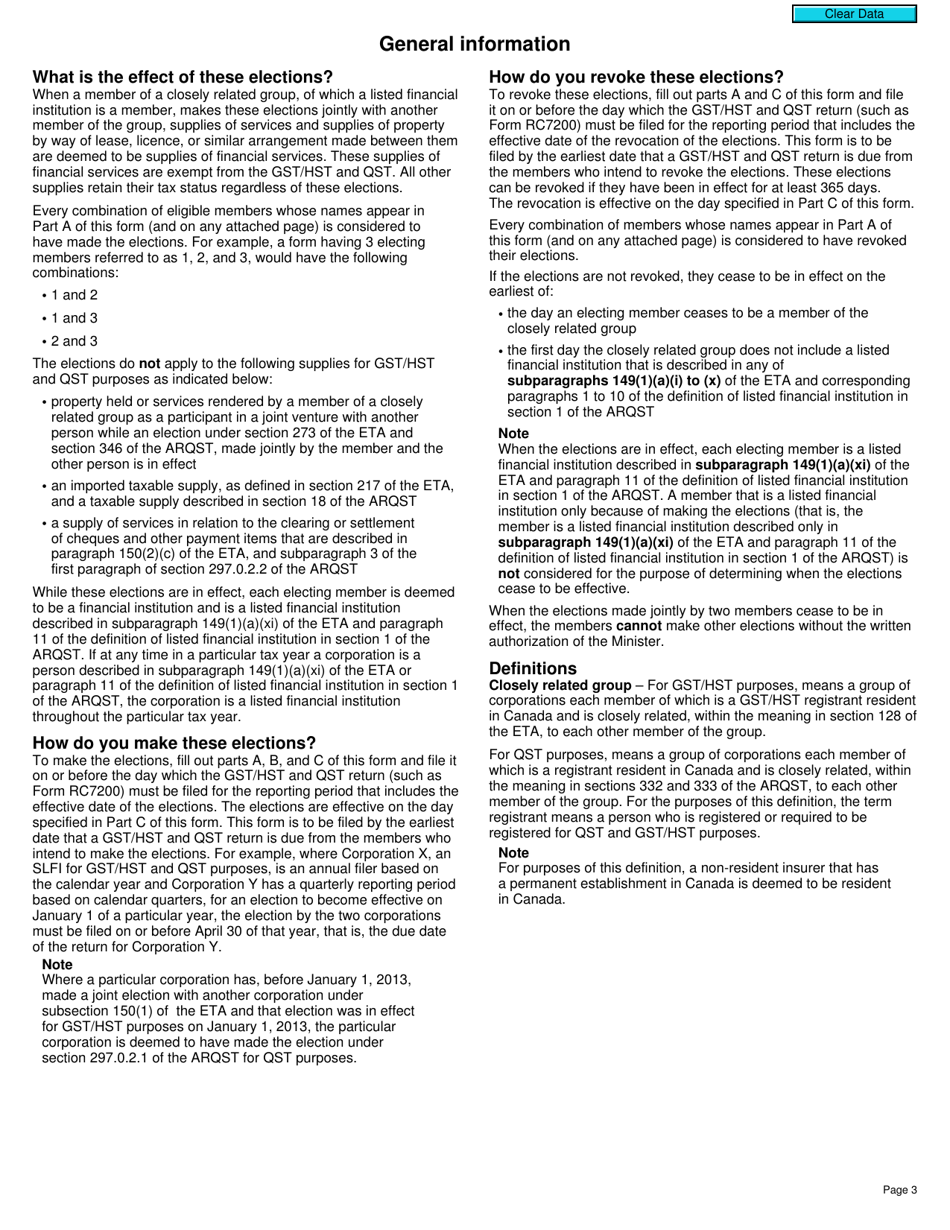

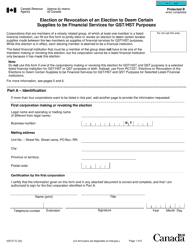

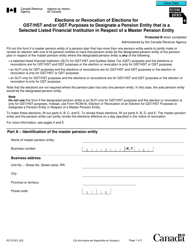

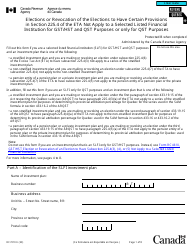

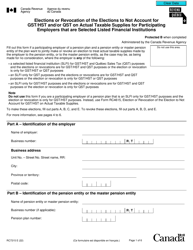

Form RC7227 Elections or Revocation of the Elections to Deem Certain Supplies to Be Financial Services for Gst / Hst and Qst Purposes for Selected Listed Financial Institutions - Canada

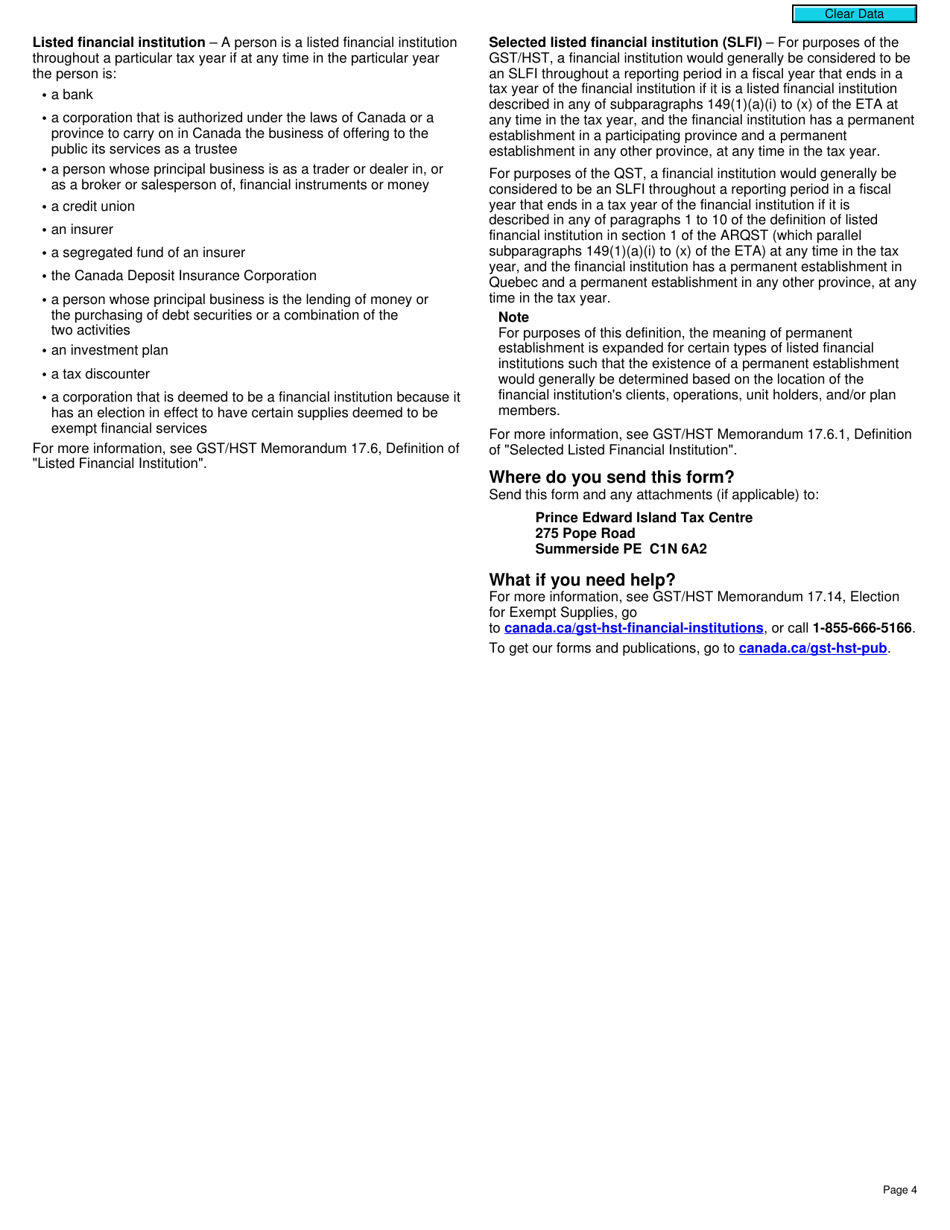

Form RC7227 Elections or Revocation of the Elections to Deem Certain Supplies to Be Financial Services for GST/HST and QST Purposes for Selected Listed Financial Institutions - Canada is used for elections or revocations of elections by selected listed financial institutions to treat certain supplies as financial services for GST/HST and QST purposes.

The form RC7227 Elections or Revocation of the Elections to Deem Certain Supplies to Be Financial Services for GST/HST and QST Purposes for Selected Listed Financial Institutions is filed by the selected listed financial institutions in Canada.

FAQ

Q: What is the Form RC7227?

A: Form RC7227 is a form issued by the Canada Revenue Agency (CRA).

Q: What is the purpose of Form RC7227?

A: The purpose of Form RC7227 is to elect or revoke the election to deem certain supplies to be financial services for GST/HST and QST purposes.

Q: Who is required to file Form RC7227?

A: Selected listed financial institutions who want to elect or revoke the election to deem certain supplies to be financial services for GST/HST and QST purposes are required to file Form RC7227.

Q: What are the GST/HST and QST purposes?

A: GST/HST stands for Goods and Services Tax/Harmonized Sales Tax, and QST stands for Quebec Sales Tax.

Q: Are there any penalties for not filing Form RC7227?

A: Yes, there may be penalties for not filing Form RC7227 or not complying with the election or revocation of the election.

Q: Can I make changes to the election after filing Form RC7227?

A: No, once you have filed Form RC7227, you cannot make changes to the election.

Q: What should I do if I need assistance with Form RC7227?

A: If you need assistance with Form RC7227, you can contact the Canada Revenue Agency or consult a tax professional.