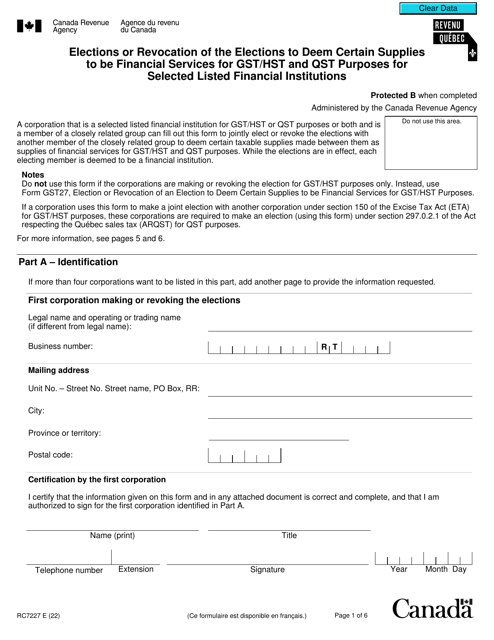

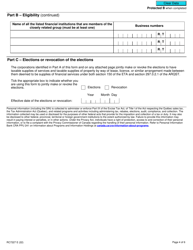

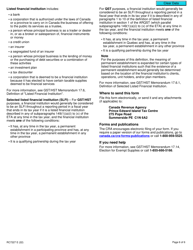

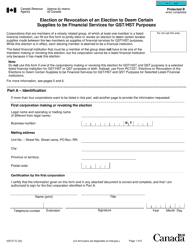

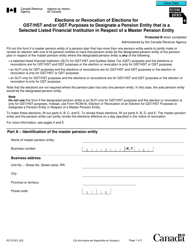

Form RC7227 Elections or Revocation of the Elections to Deem Certain Supplies to Be Financial Services for Gst / Hst and Qst Purposes for Selected Listed Financial Institutions - Canada

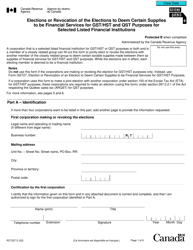

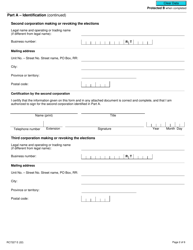

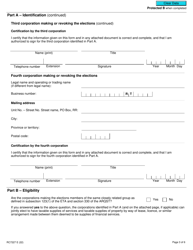

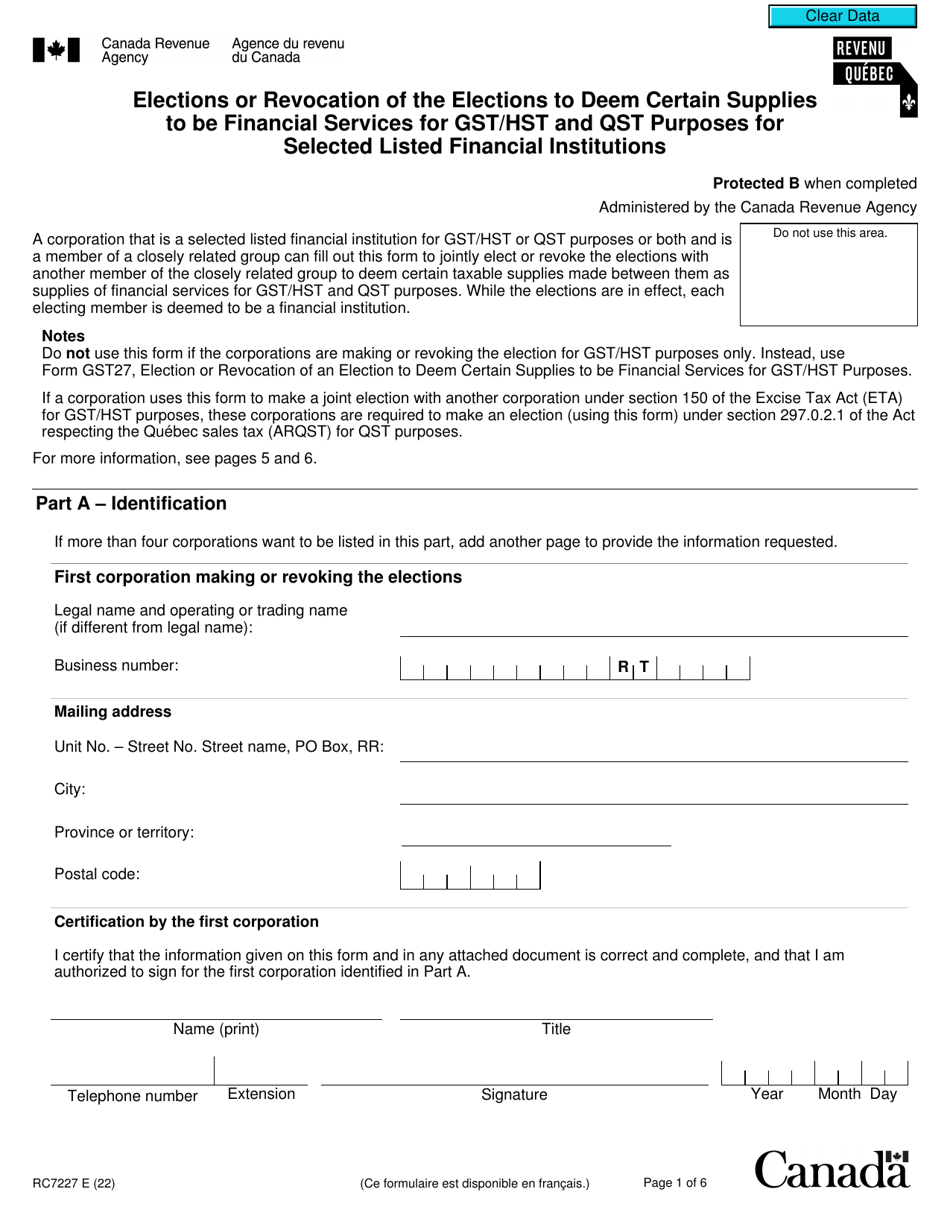

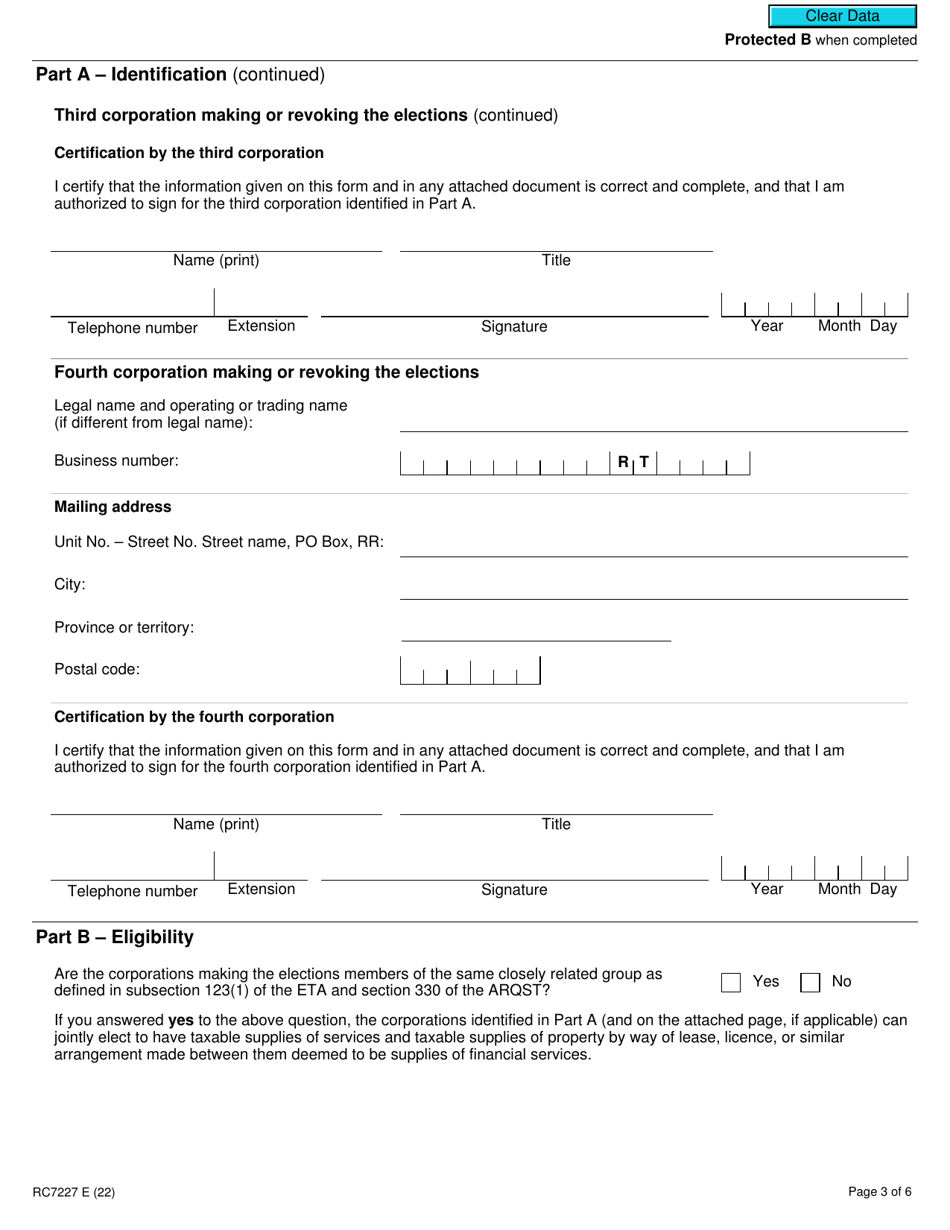

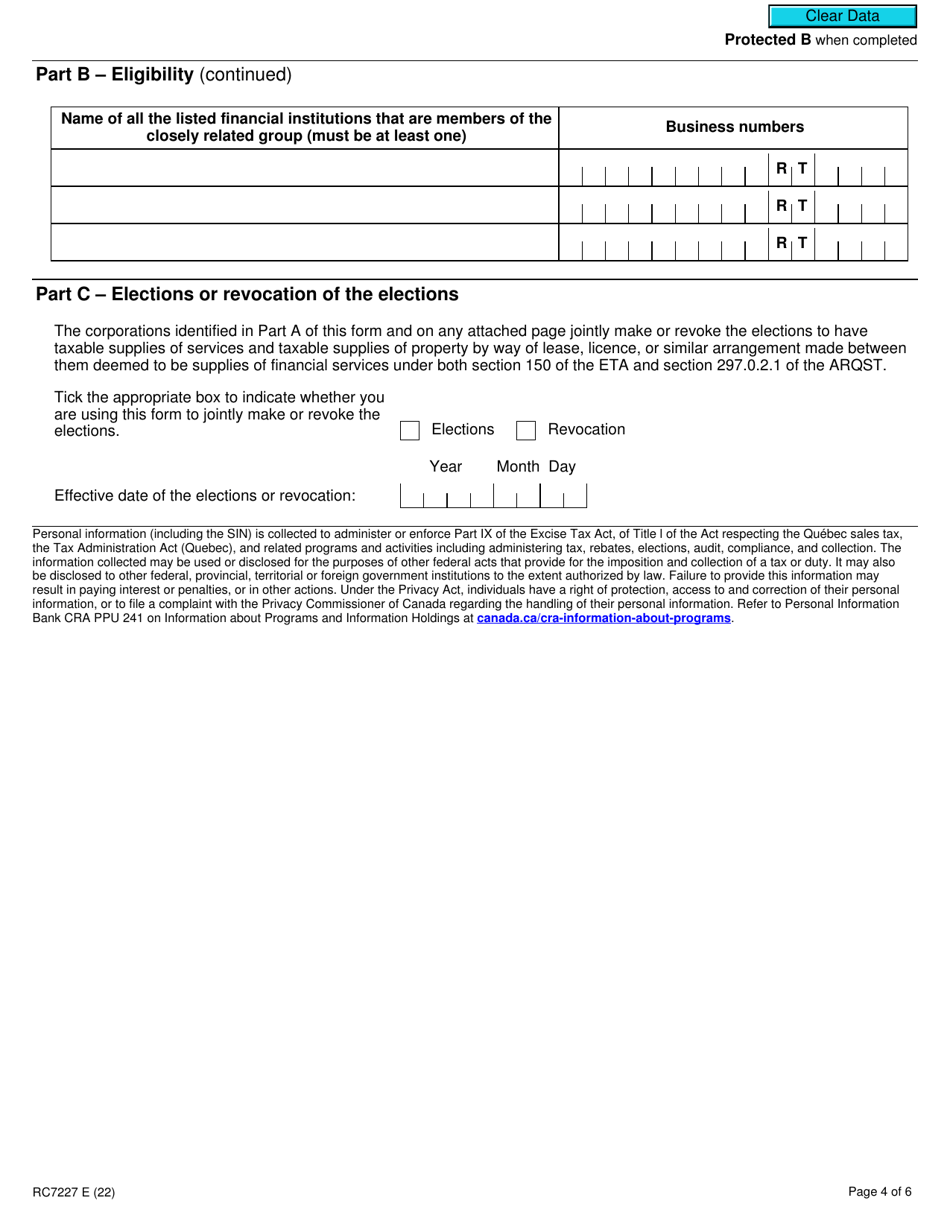

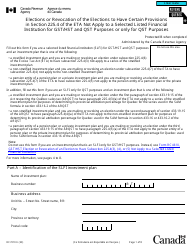

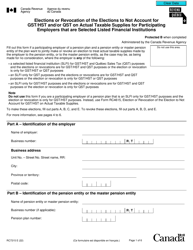

Form RC7227 Elections or Revocation of the Elections to Deem Certain Supplies to Be Financial Services for GST/HST and QST Purposes for Selected Listed Financial Institutions - Canada is used for making or revoking elections to treat certain supplies as financial services for GST/HST and QST purposes by selected listed financial institutions in Canada.

The selected listed financial institutions in Canada are responsible for filing the Form RC7227 for elections or revocation of the elections to deem certain supplies to be financial services for GST/HST and QST purposes.

Form RC7227 Elections or Revocation of the Elections to Deem Certain Supplies to Be Financial Services for Gst/Hst and Qst Purposes for Selected Listed Financial Institutions - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC7227?

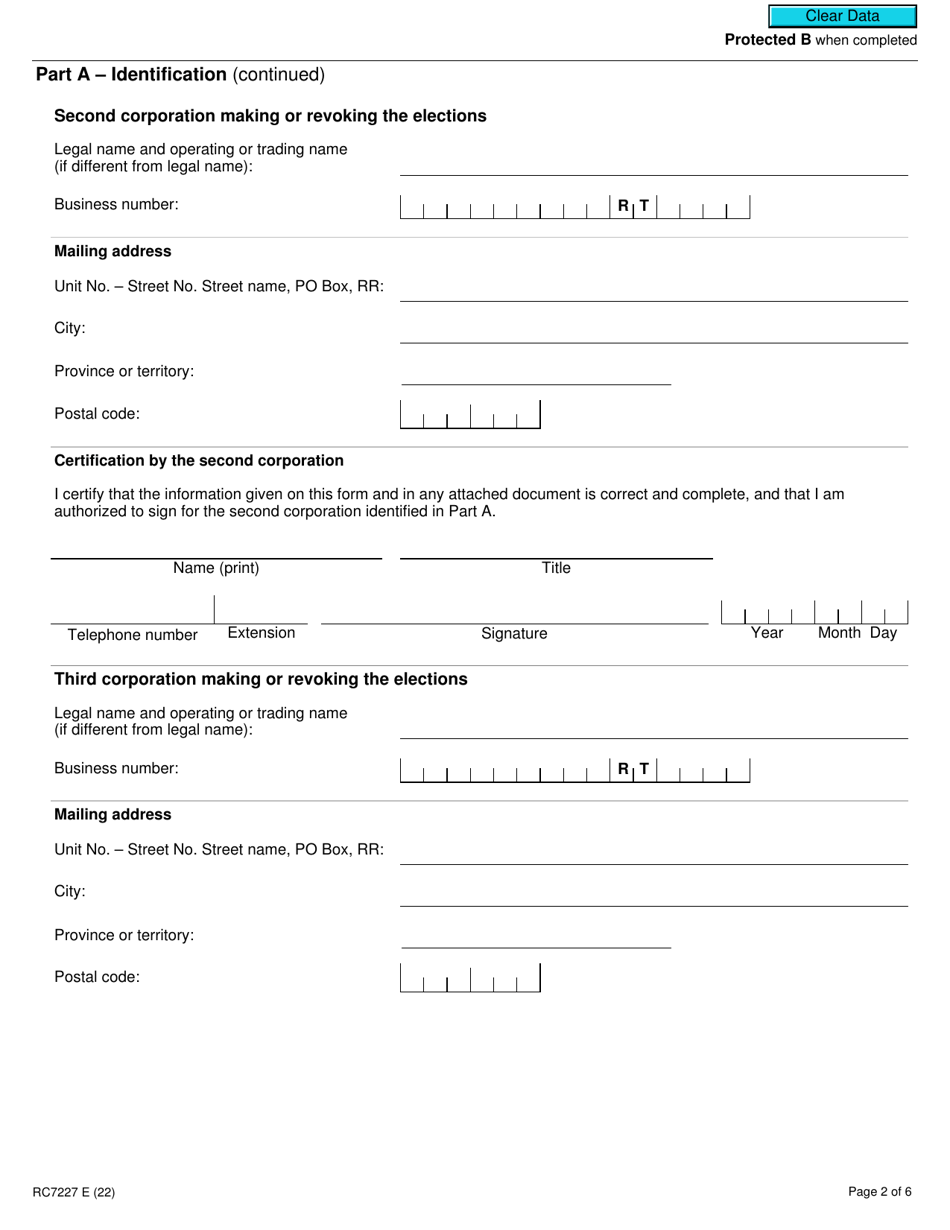

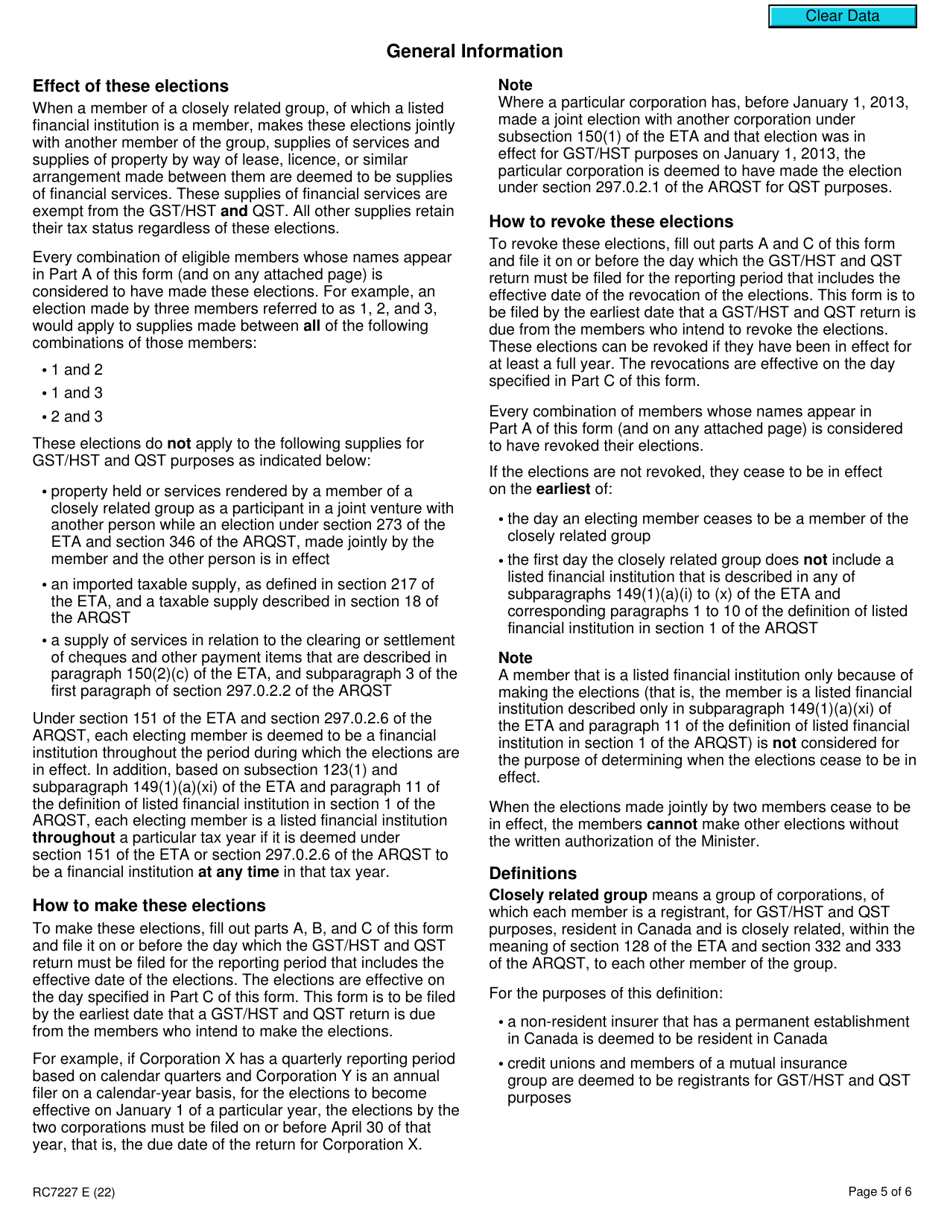

A: Form RC7227 is used for elections or revocations of the elections to deem certain supplies to be financial services for GST/HST and QST purposes for selected listed financial institutions.

Q: Who uses Form RC7227?

A: Selected listed financial institutions use Form RC7227.

Q: What is the purpose of Form RC7227?

A: The purpose of Form RC7227 is to make an election or revoke an election to deem certain supplies to be financial services for GST/HST and QST purposes.

Q: What are financial services for GST/HST and QST purposes?

A: Financial services for GST/HST and QST purposes include services related to loans, credit or charge cards, deposits, investments, and insurance.

Q: What is an election?

A: An election is a formal choice made by a selected listed financial institution to deem certain supplies it makes to be financial services for GST/HST and QST purposes.

Q: Can an election be revoked?

A: Yes, an election can be revoked by a selected listed financial institution.

Q: Who should I contact for more information about Form RC7227?

A: You can contact the Canada Revenue Agency (CRA) for more information about Form RC7227.