This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7270

for the current year.

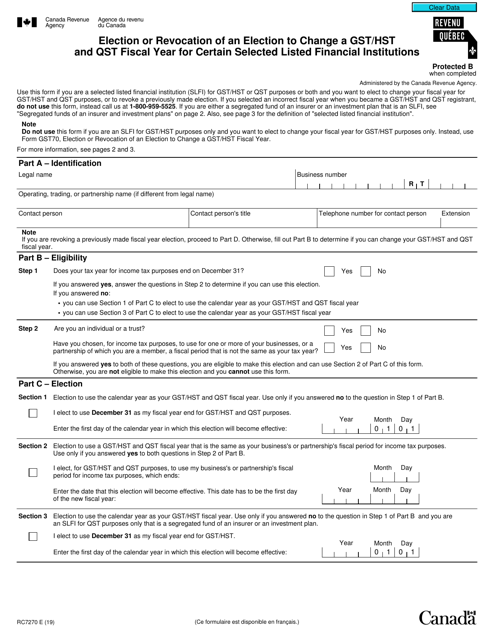

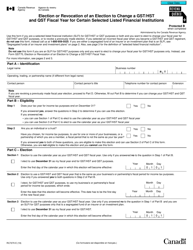

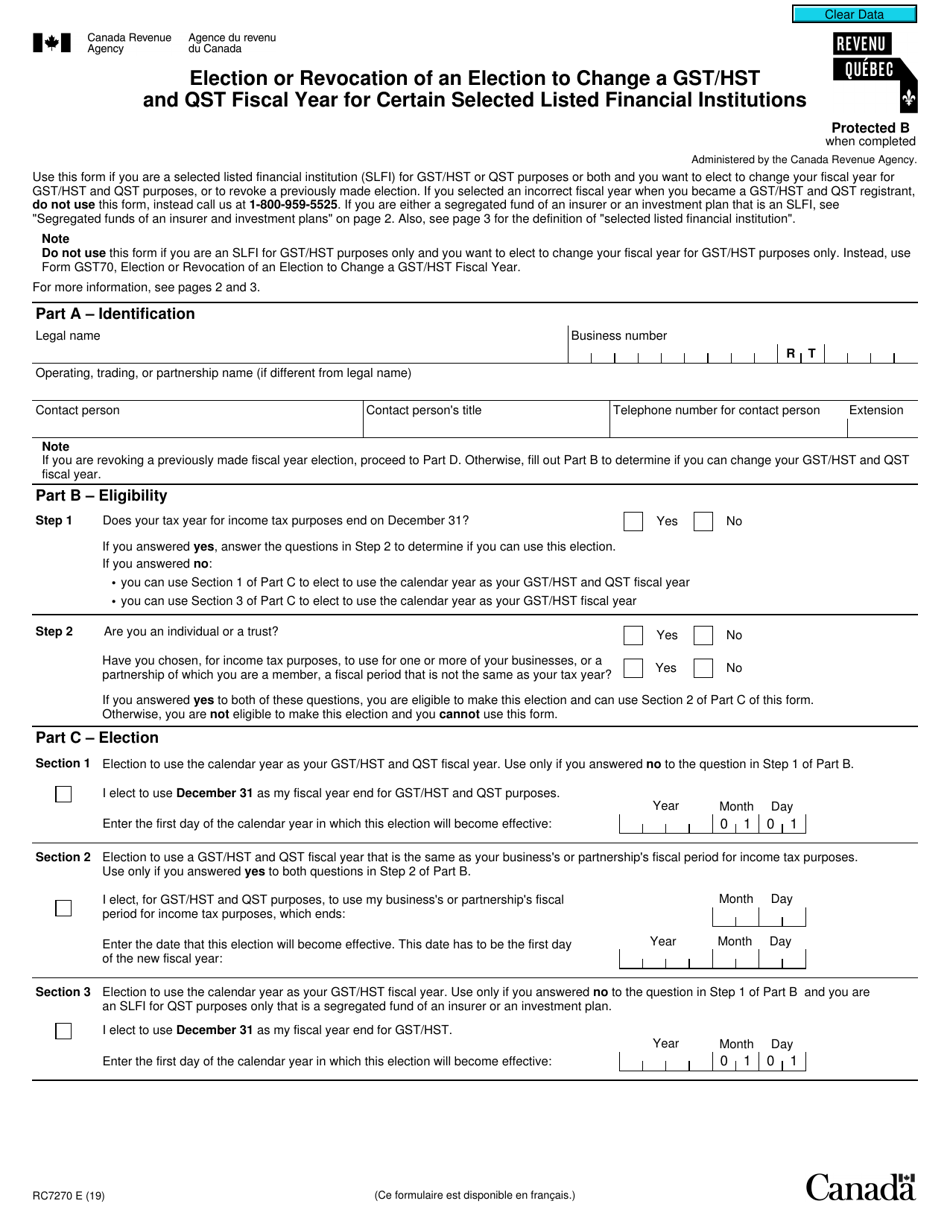

Form RC7270 Election or Revocation of an Election to Change a Gst / Hst and Qst Fiscal Year for a Selected Listed Financial Institution - Canada

Form RC7270 Election or Revocation of an Election to Change a GST/HST and QST fiscal year for a Selected Listed Financial Institution in Canada is used to make an election or revoke an existing election to change the fiscal year for reporting and remitting GST/HST and QST (provincial sales tax) for specific financial institutions listed by the government. This form allows these institutions to align their reporting period with their business operations.

The Form RC7270 Election or Revocation of an Election to Change a GST/HST and QST fiscal year for a selected listed financial institution is filed by the selected listed financial institution itself.

FAQ

Q: What is Form RC7270?

A: Form RC7270 is a form used in Canada for electing or revoking an election to change the GST/HST and QST fiscal year for a selected listed financial institution.

Q: What is the purpose of Form RC7270?

A: The purpose of Form RC7270 is to allow a selected listed financial institution in Canada to elect or revoke an election to change their GST/HST and QST fiscal year.

Q: Who needs to use Form RC7270?

A: Selected listed financial institutions in Canada that want to change their GST/HST and QST fiscal year need to use Form RC7270.

Q: How do I complete Form RC7270?

A: To complete Form RC7270, you need to provide your business information, indicate the type of election or revocation, and provide the necessary details as requested on the form.

Q: Is there a deadline for submitting Form RC7270?

A: Yes, there is a deadline for submitting Form RC7270. The deadline is generally within 90 days of the beginning of the fiscal year for which the election or revocation applies.

Q: Are there any fees associated with Form RC7270?

A: There are no fees associated with submitting Form RC7270 to the CRA.

Q: What should I do if I make a mistake on Form RC7270?

A: If you make a mistake on Form RC7270, you should contact the CRA to request a correction or provide additional information.