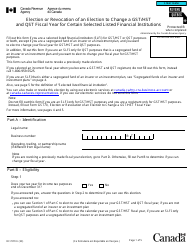

This version of the form is not currently in use and is provided for reference only. Download this version of

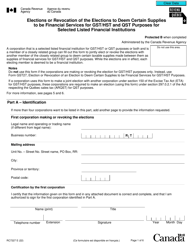

Form RC7222

for the current year.

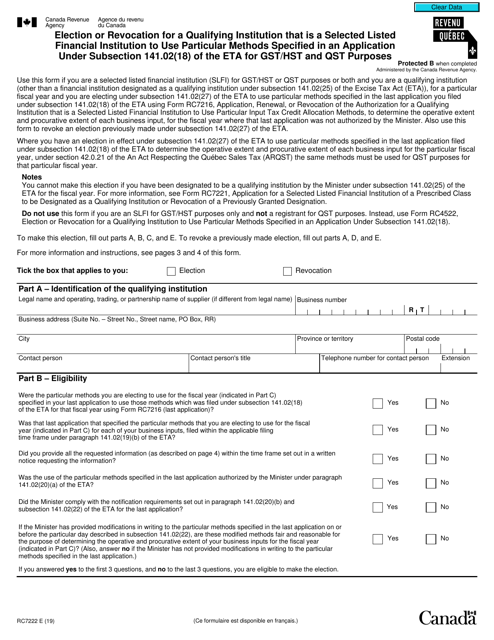

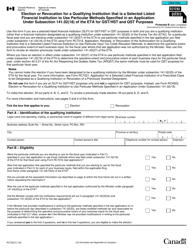

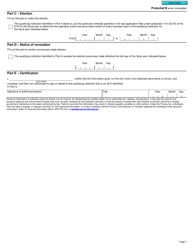

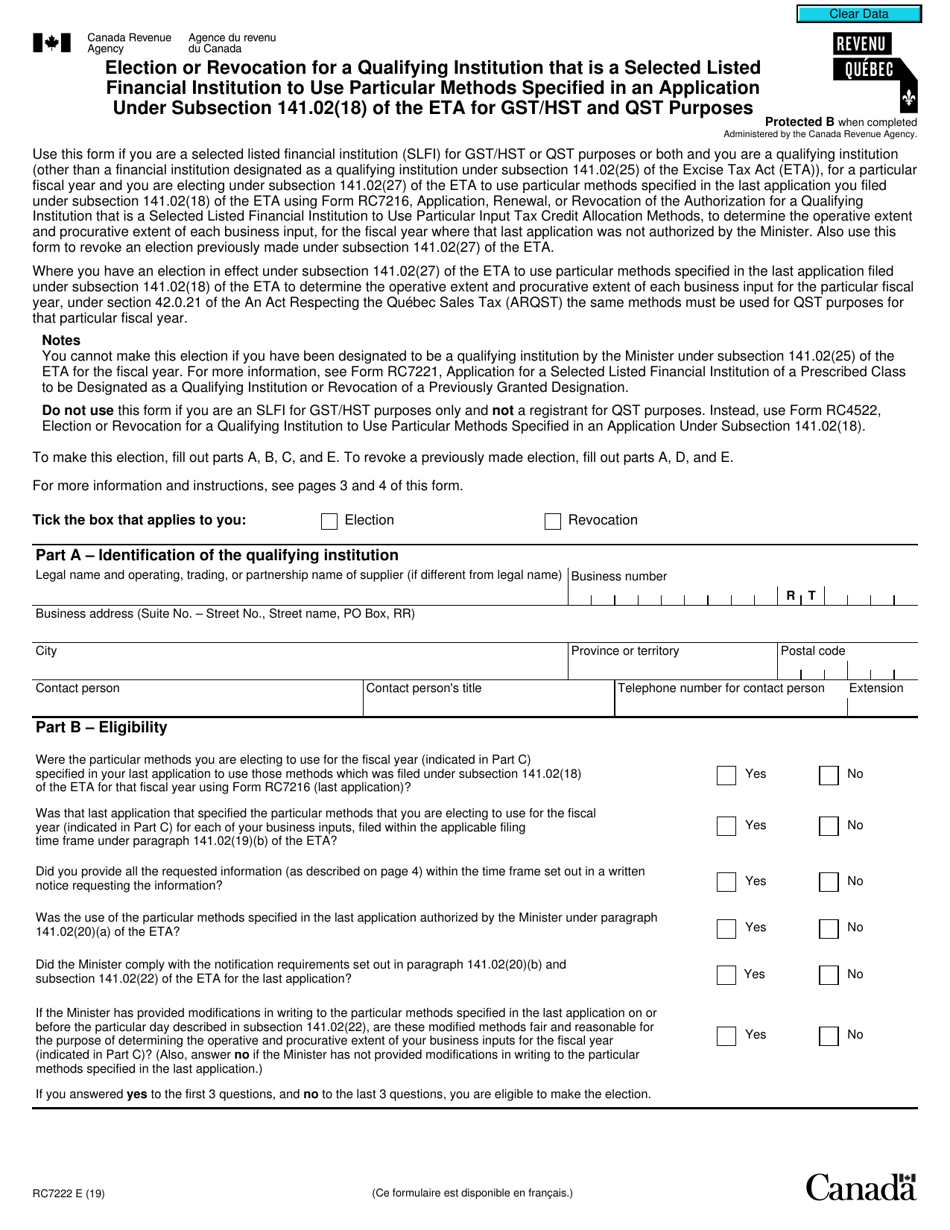

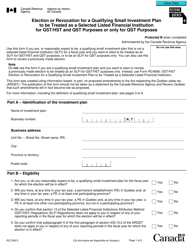

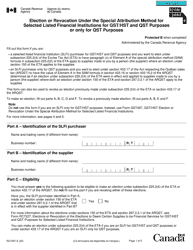

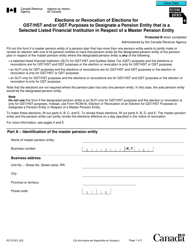

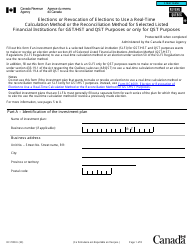

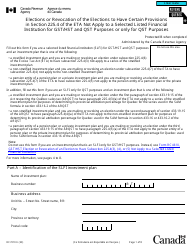

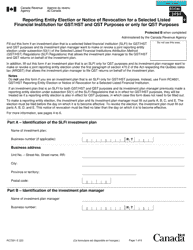

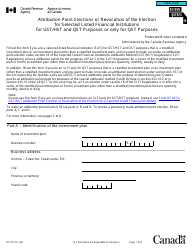

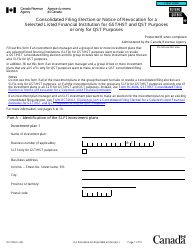

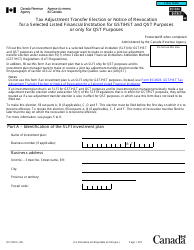

Form RC7222 Election or Revocation for a Qualifying Institution That Is a Selected Listed Financial Institution to Use Particular Methods Specified in an Application Under Subsection 141.02(18) of the ETA for Gst / Hst and Qst Purposes - Canada

The Form RC7222 is used in Canada by qualifying institutions that are selected listed financial institutions to elect or revoke their choice to use specific methods specified in an application for GST/HST and QST purposes. This form helps the institution indicate their preferred method for calculating Goods and Services Tax (GST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST).

The Form RC7222 is filed by a qualifying institution that is a selected listed financial institution in Canada to elect or revoke the use of particular methods specified in an application under subsection 141.02(18) of the ETA for GST/HST and QST purposes.

FAQ

Q: What is Form RC7222?

A: Form RC7222 is used to elect or revoke the use of particular methods specified in an application for GST/HST and QST purposes in Canada.

Q: Who can use Form RC7222?

A: Qualifying institutions that are selected listed financial institutions can use Form RC7222.

Q: What is the purpose of Form RC7222?

A: The purpose of Form RC7222 is to elect or revoke the use of particular methods specified in an application under subsection 141.02(18) of the ETA for GST/HST and QST purposes.

Q: What is GST?

A: GST stands for Goods and Services Tax, which is a value-added tax in Canada.

Q: What is HST?

A: HST stands for Harmonized Sales Tax, which is a combined federal and provincial sales tax in certain provinces in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax, which is a provincial sales tax in Quebec, Canada.

Q: Who should I contact if I have questions about Form RC7222?

A: If you have questions about Form RC7222, you should contact the Canada Revenue Agency (CRA) for assistance.