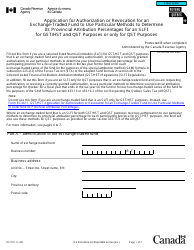

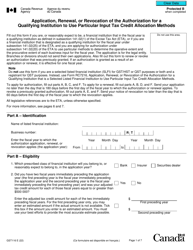

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4611

for the current year.

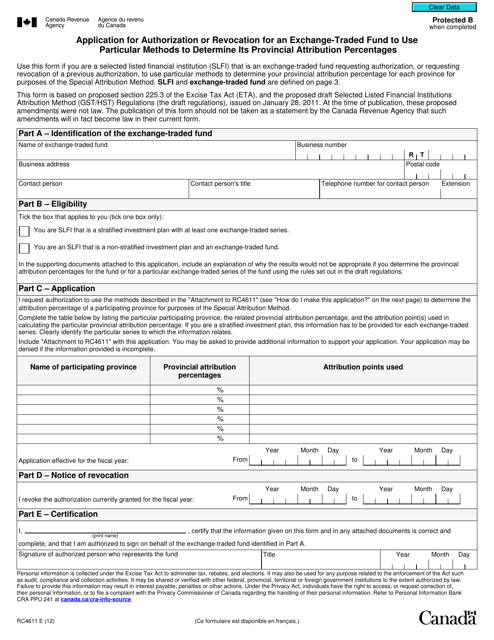

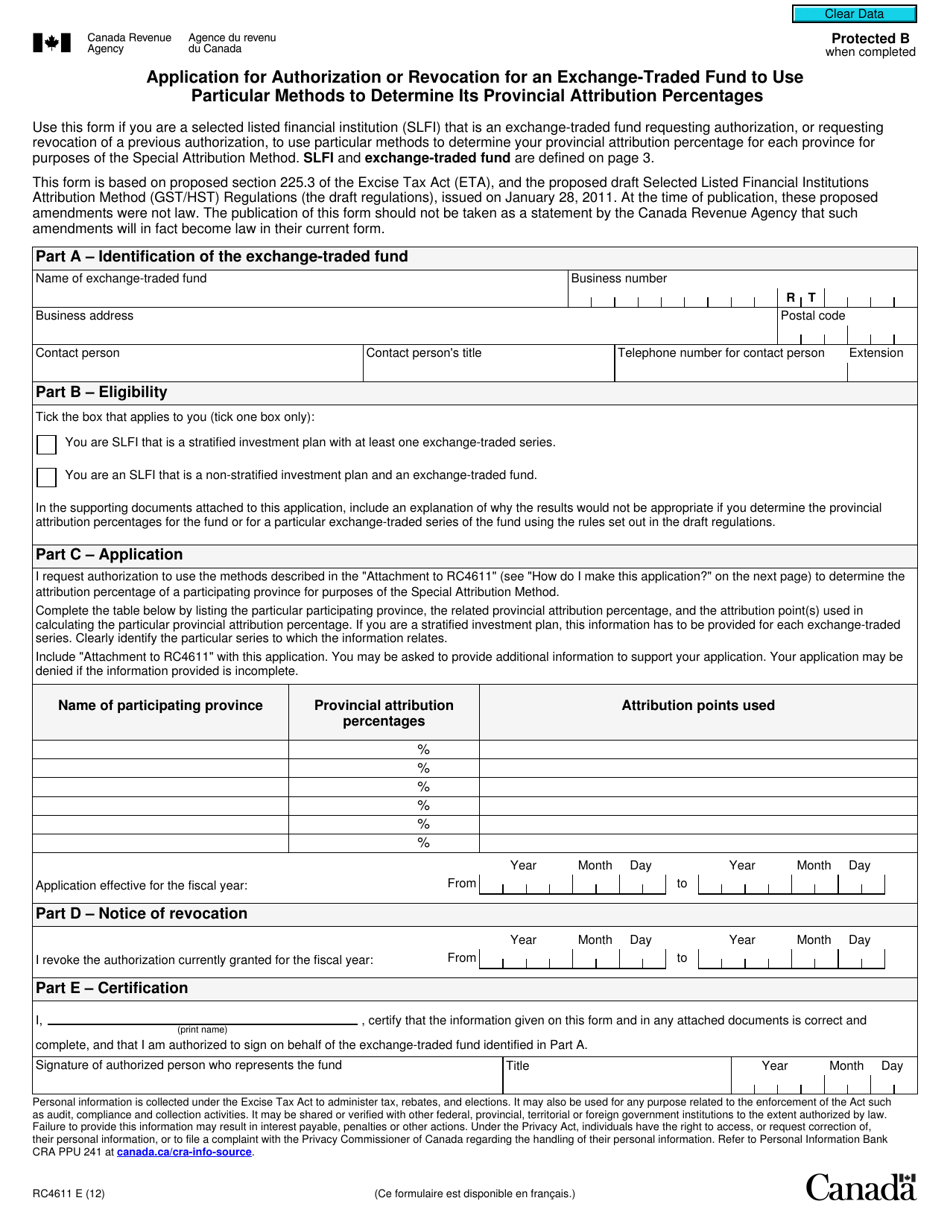

Form RC4611 Particular Methods to Determine Its Provincial Attribution Percentages - Canada

Form RC4611 "Particular Methods to Determine Its Provincial Attribution Percentages" is a document used in Canada for determining the percentage of income that is attributed to each province or territory for tax purposes. It provides guidance on the specific methods to calculate and allocate income based on the taxpayer's residency and the location of their business activities.

FAQ

Q: What is the RC4611?

A: RC4611 is a document issued by the Canada Revenue Agency (CRA) that provides information on how to determine the provincial attribution percentages for Canadian taxpayers.

Q: What are provincial attribution percentages?

A: Provincial attribution percentages are the percentages used to allocate income between provinces for tax purposes.

Q: Why are provincial attribution percentages important?

A: Provincial attribution percentages are important because they help determine how much income should be allocated to each province for tax purposes.

Q: Who should use RC4611?

A: RC4611 should be used by Canadian taxpayers who have income from multiple provinces and need to determine how to allocate that income for tax purposes.

Q: What is the purpose of RC4611?

A: The purpose of RC4611 is to provide guidance on how to determine the provincial attribution percentages for taxpayers with income from multiple provinces.

Q: Can I use RC4611 for US tax purposes?

A: No, RC4611 is specific to Canadian tax purposes and cannot be used for US tax purposes.

Q: Are provincial attribution percentages the same for all provinces?

A: No, provincial attribution percentages can vary depending on the specific rules and regulations of each province.

Q: What if I have questions about RC4611?

A: If you have questions about RC4611, you can contact the Canada Revenue Agency (CRA) for assistance.