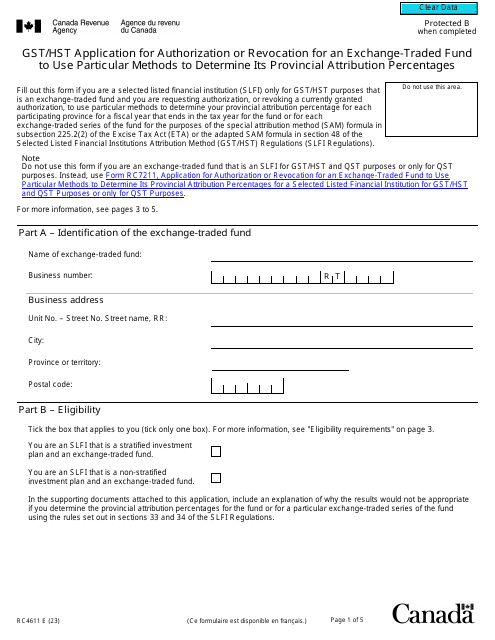

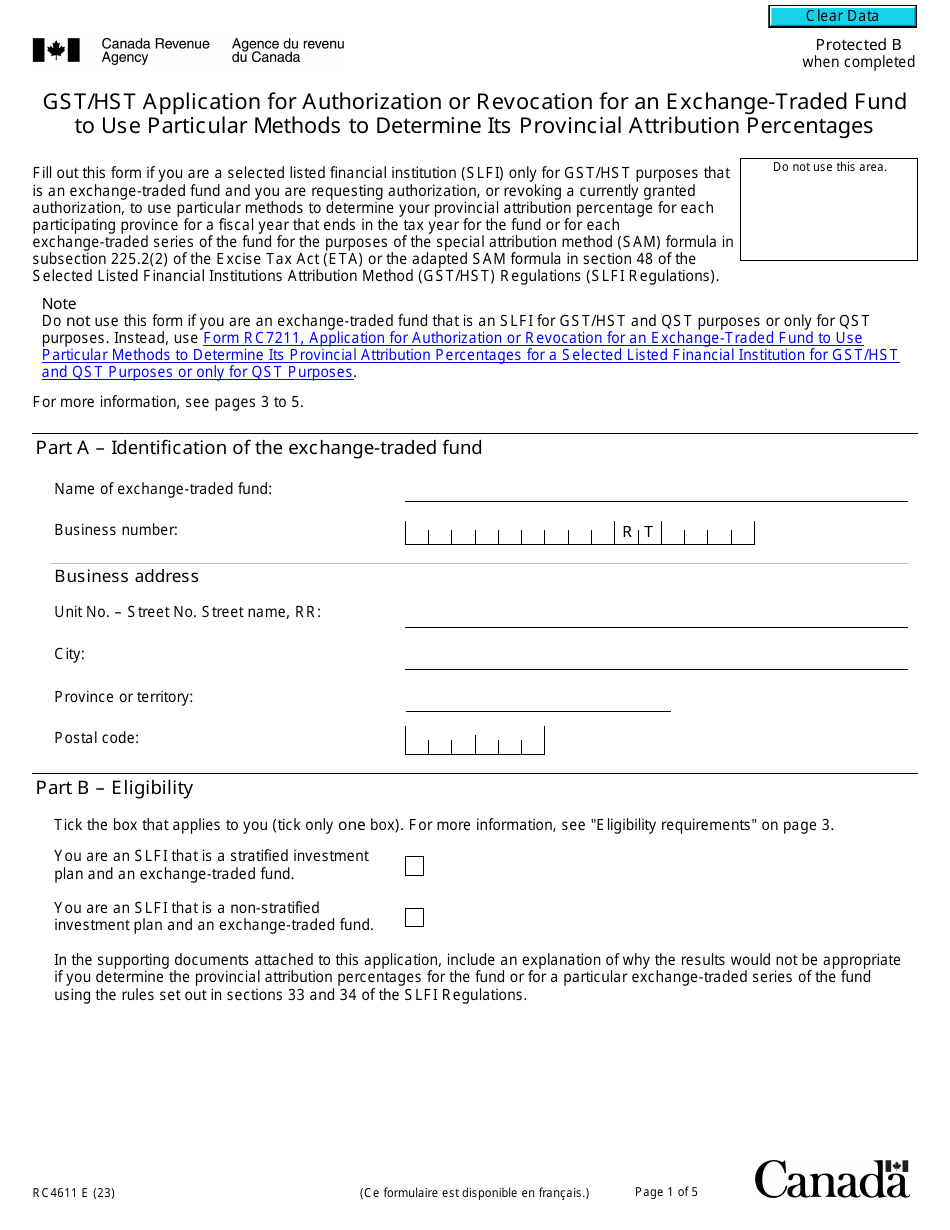

Form RC4611 Gst / Hst Application for Authorization or Revocation for an Exchange-Traded Fund to Use Particular Methods to Determine Its Provincial Attribution Percentages - Canada

The Form RC4611 Gst/Hst Application for Authorization or Revocation for an Exchange-Traded Fund to Use Particular Methods to Determine Its Provincial Attribution Percentages in Canada is used for requesting authorization or revocation to use specific methods to determine the provincial attribution percentages for a GST/HST (Goods and Services Tax/Harmonized Sales Tax) registered exchange-traded fund.

The Form RC4611 GST/HST Application for Authorization or Revocation for an Exchange-Traded Fund to Use Particular Methods to Determine Its Provincial Attribution Percentages in Canada is filed by the exchange-traded fund itself.

Form RC4611 Gst/Hst Application for Authorization or Revocation for an Exchange-Traded Fund to Use Particular Methods to Determine Its Provincial Attribution Percentages - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC4611?

A: Form RC4611 is the GST/HST application for authorization or revocation for an Exchange-Traded Fund (ETF) to use particular methods to determine its provincial attribution percentages.

Q: What is GST/HST?

A: GST/HST stands for Goods and Services Tax/Harmonized Sales Tax. It is a value-added tax collected on most goods and services in Canada.

Q: What is an Exchange-Traded Fund (ETF)?

A: An Exchange-Traded Fund, or ETF, is a type of investment fund that is traded on stock exchanges, similar to stocks.

Q: What is provincial attribution percentage?

A: Provincial attribution percentage is a method used to determine the allocation of GST/HST paid or collected by an ETF among different Canadian provinces.

Q: Why would an ETF need to use particular methods to determine its provincial attribution percentages?

A: An ETF may need to use particular methods to determine its provincial attribution percentages in order to comply with GST/HST regulations and accurately allocate taxes among different provinces.