This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST71

for the current year.

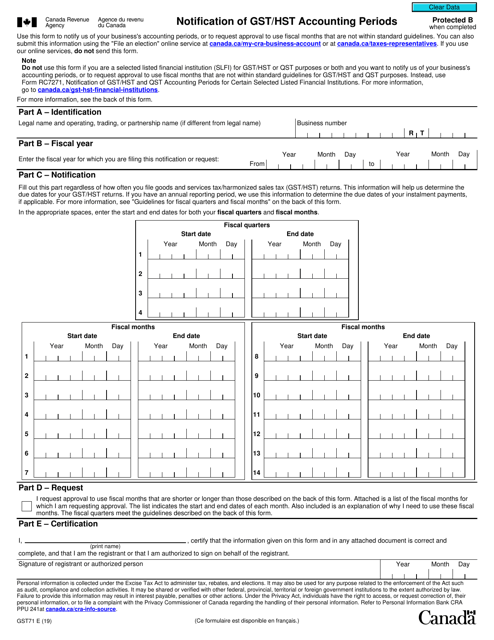

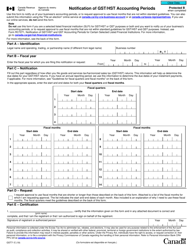

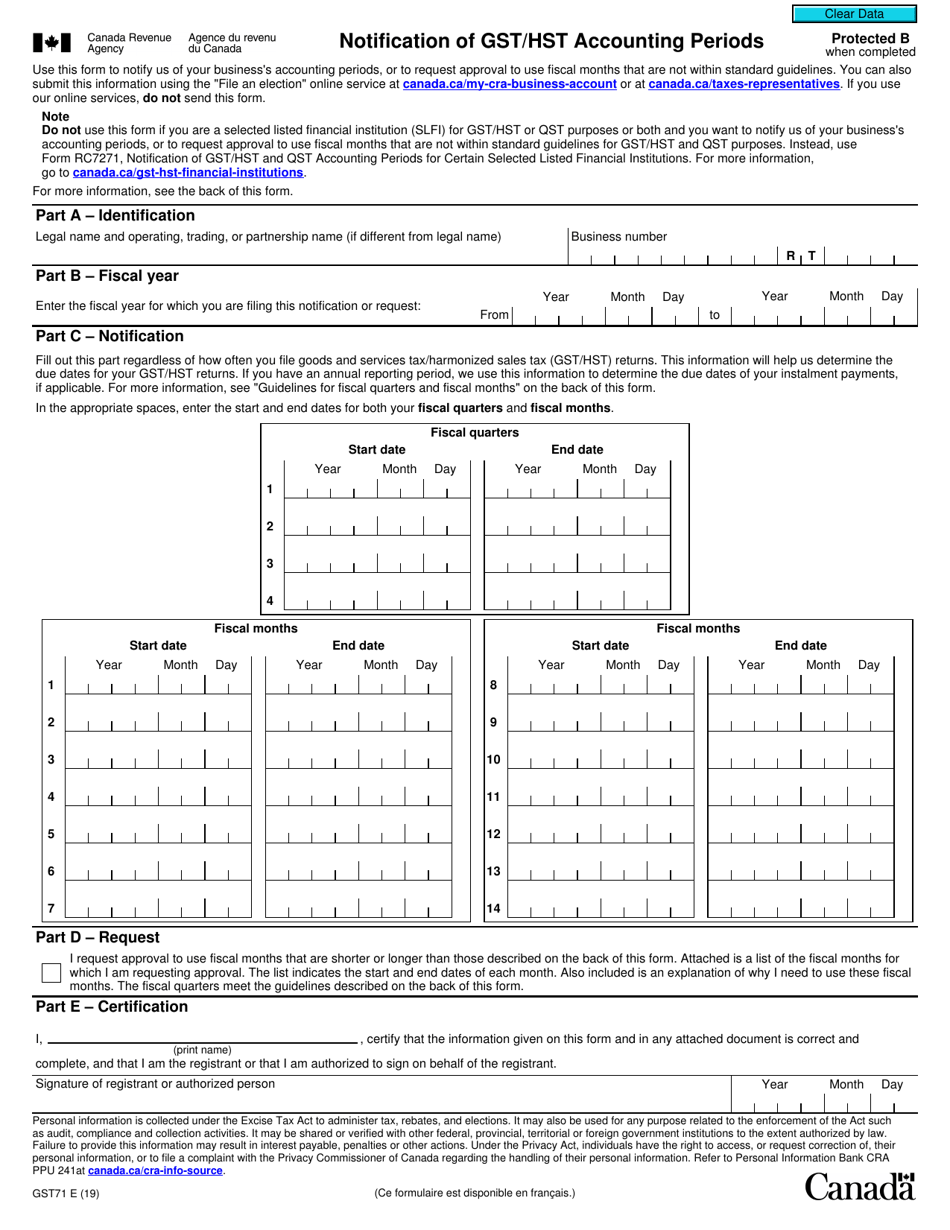

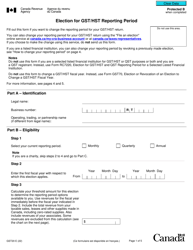

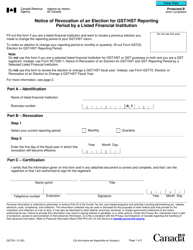

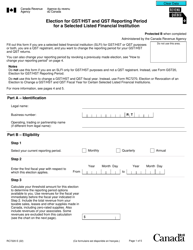

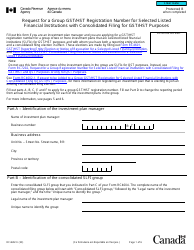

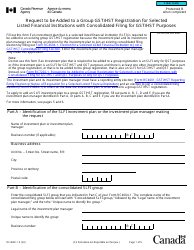

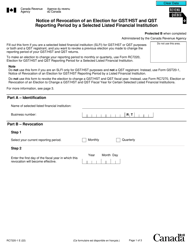

Form GST71 Notification of Gst / Hst Accounting Periods - Canada

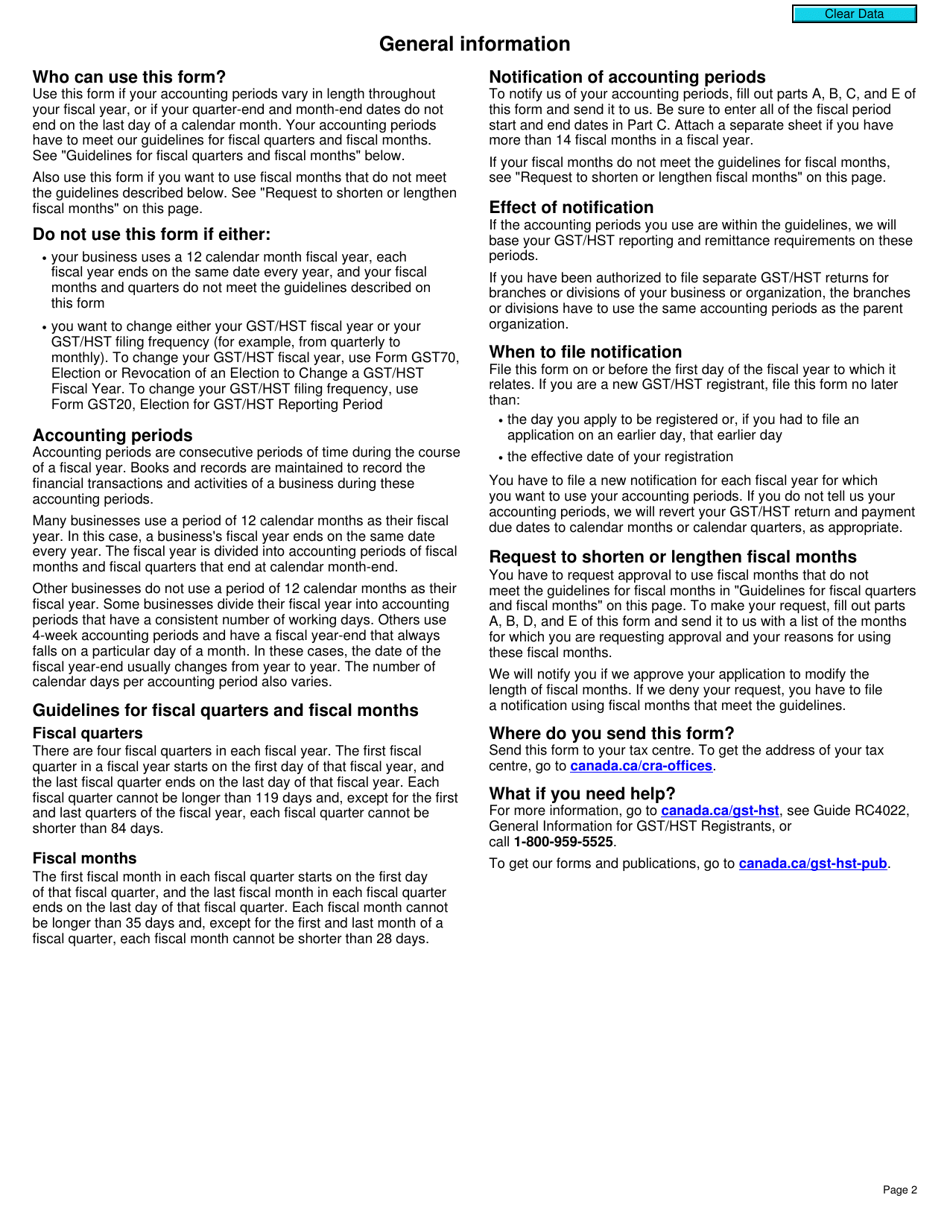

Form GST71 Notification of GST/HST Accounting Periods in Canada is used to inform the Canada Revenue Agency (CRA) about changes in the reporting period for Goods and Services Tax (GST) or Harmonized Sales Tax (HST). It is typically used when a business wants to change the frequency of reporting and remitting GST/HST.

The Form GST71 Notification of GST/HST Accounting Periods in Canada is filed by businesses registered for Goods and Services Tax (GST) or Harmonized Sales Tax (HST) in Canada.

FAQ

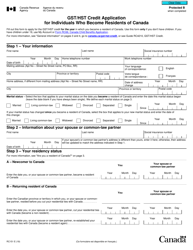

Q: What is GST/HST?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax. They are consumption taxes applied in Canada.

Q: What is form GST71?

A: Form GST71 is the Notification of GST/HST Accounting Periods. It is used by businesses registered for the GST/HST to notify the Canada Revenue Agency (CRA) about their reporting periods.

Q: Who needs to file form GST71?

A: Businesses registered for the GST/HST in Canada need to file form GST71 to inform the CRA about their reporting periods.

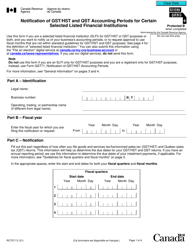

Q: What information is required on form GST71?

A: Form GST71 requires businesses to provide their business number, legal name, and fiscal year-end, among other details.

Q: How often do I need to file form GST71?

A: Businesses registered for the GST/HST in Canada need to file form GST71 whenever there is a change in their reporting periods or fiscal year-end.

Q: What happens if I don't file form GST71?

A: Failing to file form GST71 or providing false information can result in penalties imposed by the Canada Revenue Agency (CRA). It is important to comply with the reporting requirements.

Q: Is form GST71 applicable only to businesses?

A: Yes, form GST71 is specifically designed for businesses registered for the GST/HST in Canada. It is not applicable to individuals.

Q: Are there any fees associated with filing form GST71?

A: No, there are no fees associated with filing form GST71. It is a free form provided by the Canada Revenue Agency (CRA).