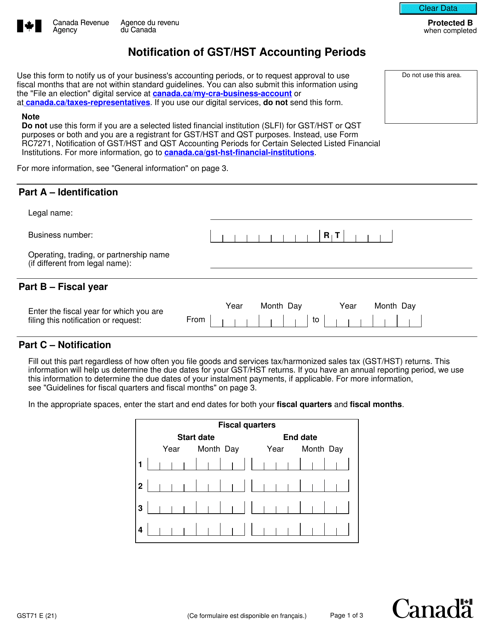

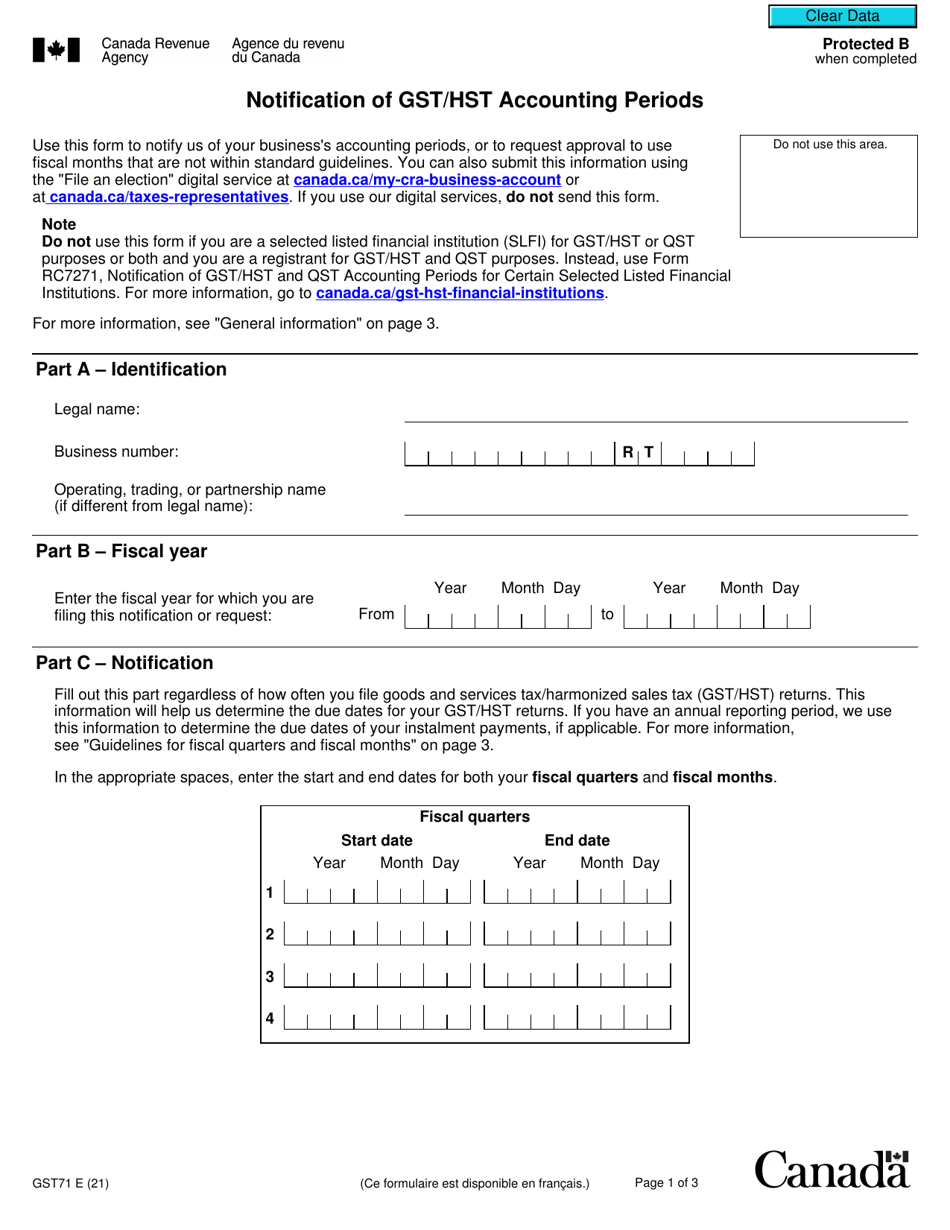

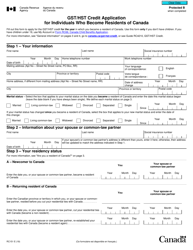

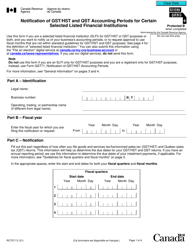

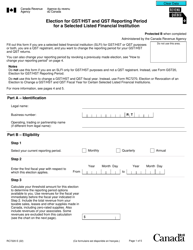

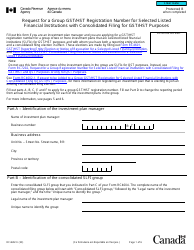

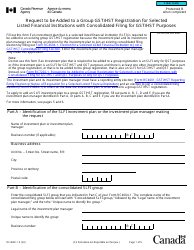

Form GST71 Notification of Gst / Hst Accounting Periods - Canada

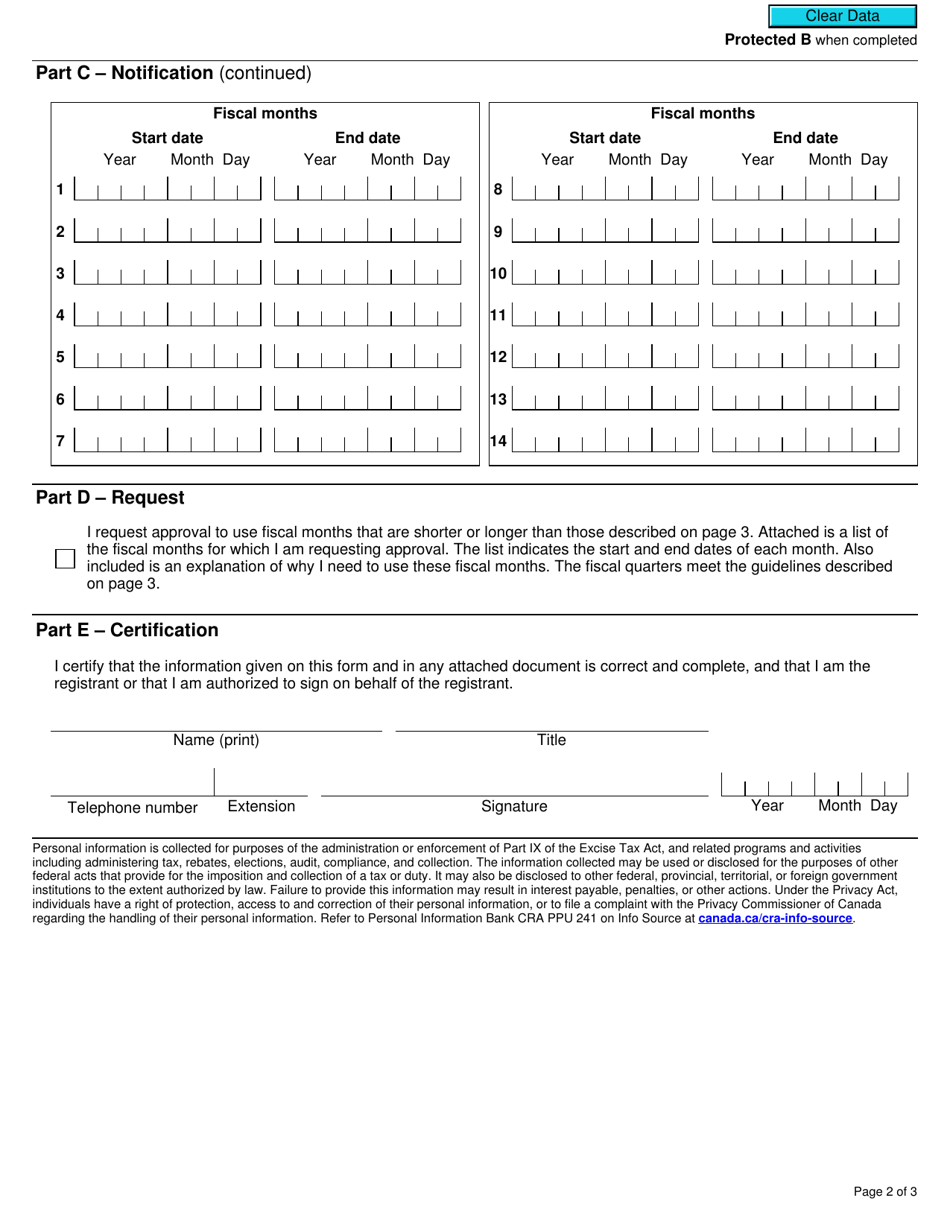

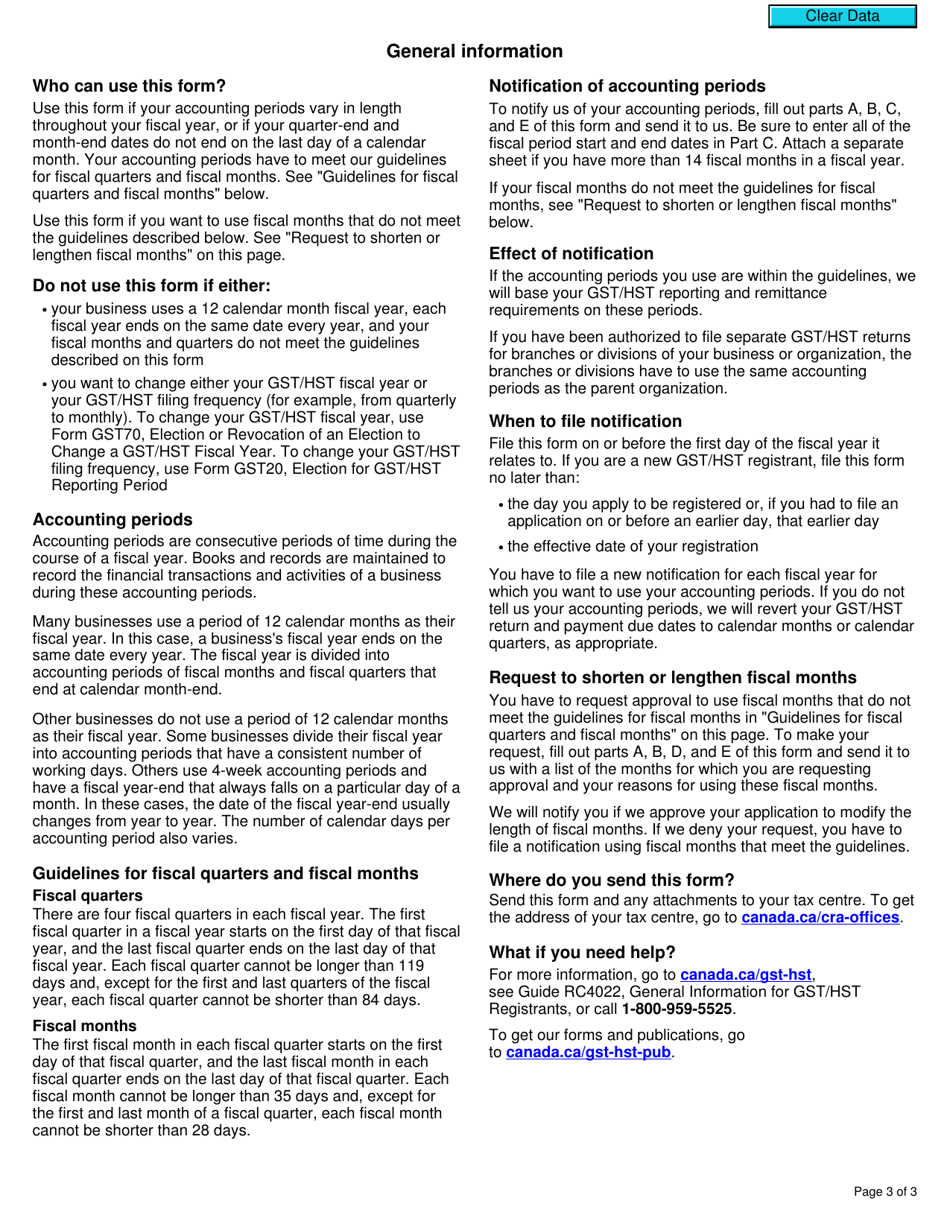

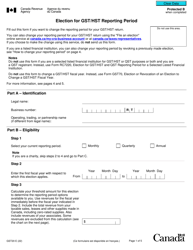

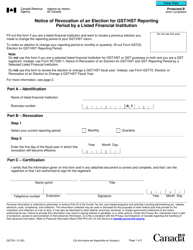

Form GST71, Notification of GST/HST Accounting Periods, in Canada is used by businesses to inform the Canada Revenue Agency (CRA) about their selected fiscal periods for reporting and remitting Goods and Services Tax (GST) or Harmonized Sales Tax (HST) amounts. This form helps the businesses to establish their reporting frequency and helps the CRA in administering the GST/HST program.

The Form GST71 Notification of GST/HST Accounting Periods in Canada is filed by businesses that are registered for the Goods and Services Tax/Harmonized Sales Tax (GST/HST).

Form GST71 Notification of Gst/Hst Accounting Periods - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST71?

A: Form GST71 is a notification form used in Canada to report GST/HST accounting periods.

Q: What is GST/HST?

A: GST (Goods and Services Tax) and HST (Harmonized Sales Tax) are consumption taxes imposed in Canada.

Q: When should Form GST71 be filed?

A: Form GST71 should be filed when there is a change in GST/HST accounting periods.

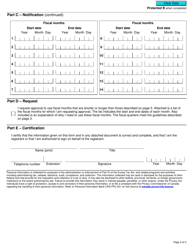

Q: What information is required on Form GST71?

A: Form GST71 requires the taxpayer's contact information, business number, and details about the change in accounting periods.

Q: Is there a deadline for filing Form GST71?

A: Yes, Form GST71 should be filed within 28 days of the change in accounting periods.