This version of the form is not currently in use and is provided for reference only. Download this version of

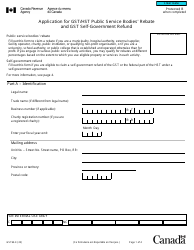

Form GST31

for the current year.

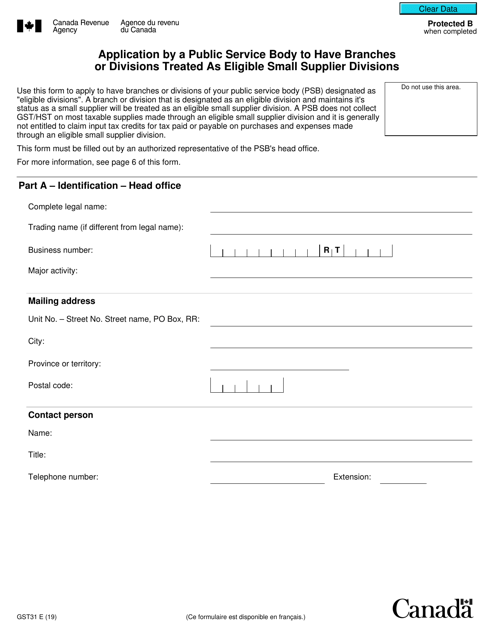

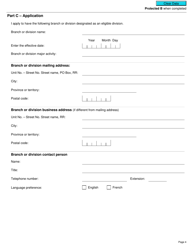

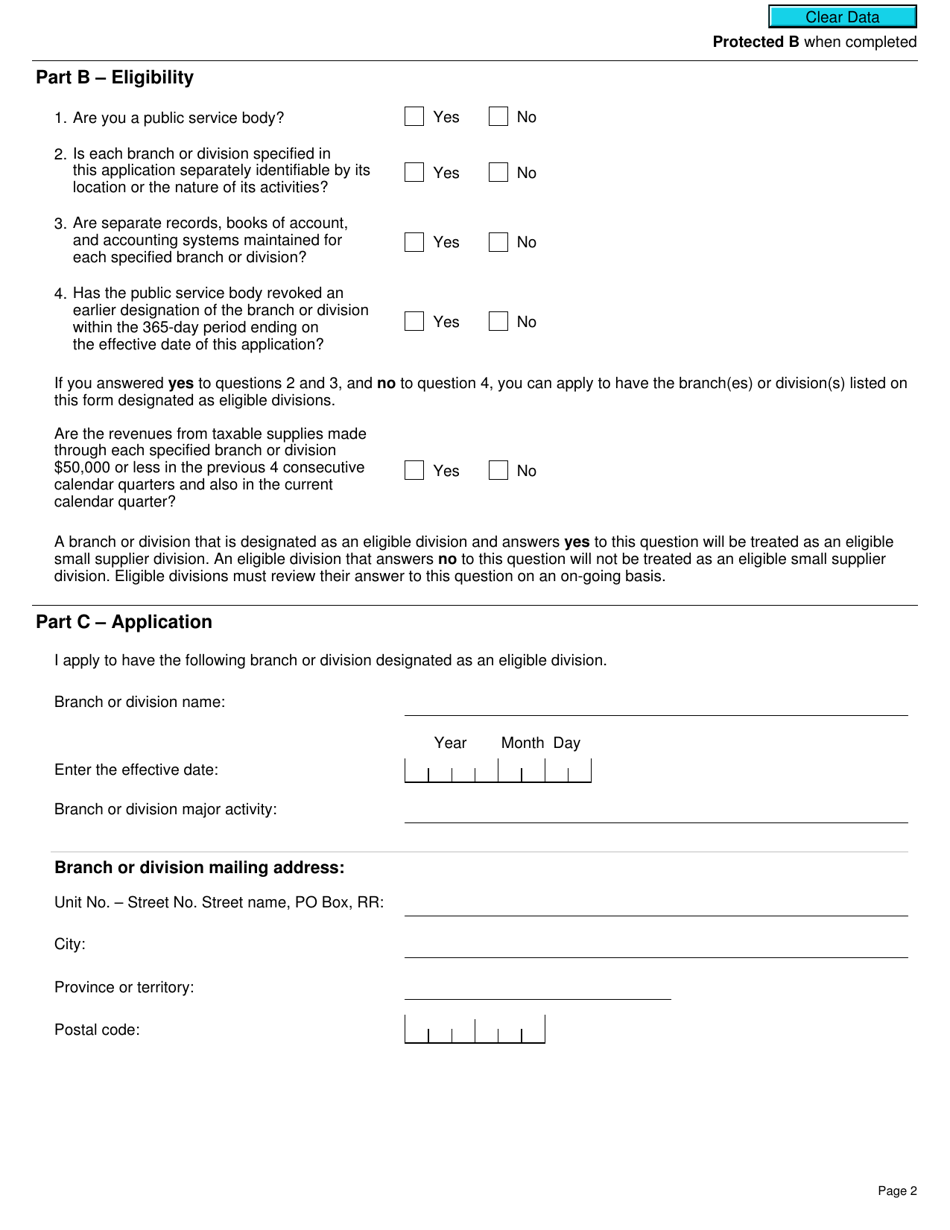

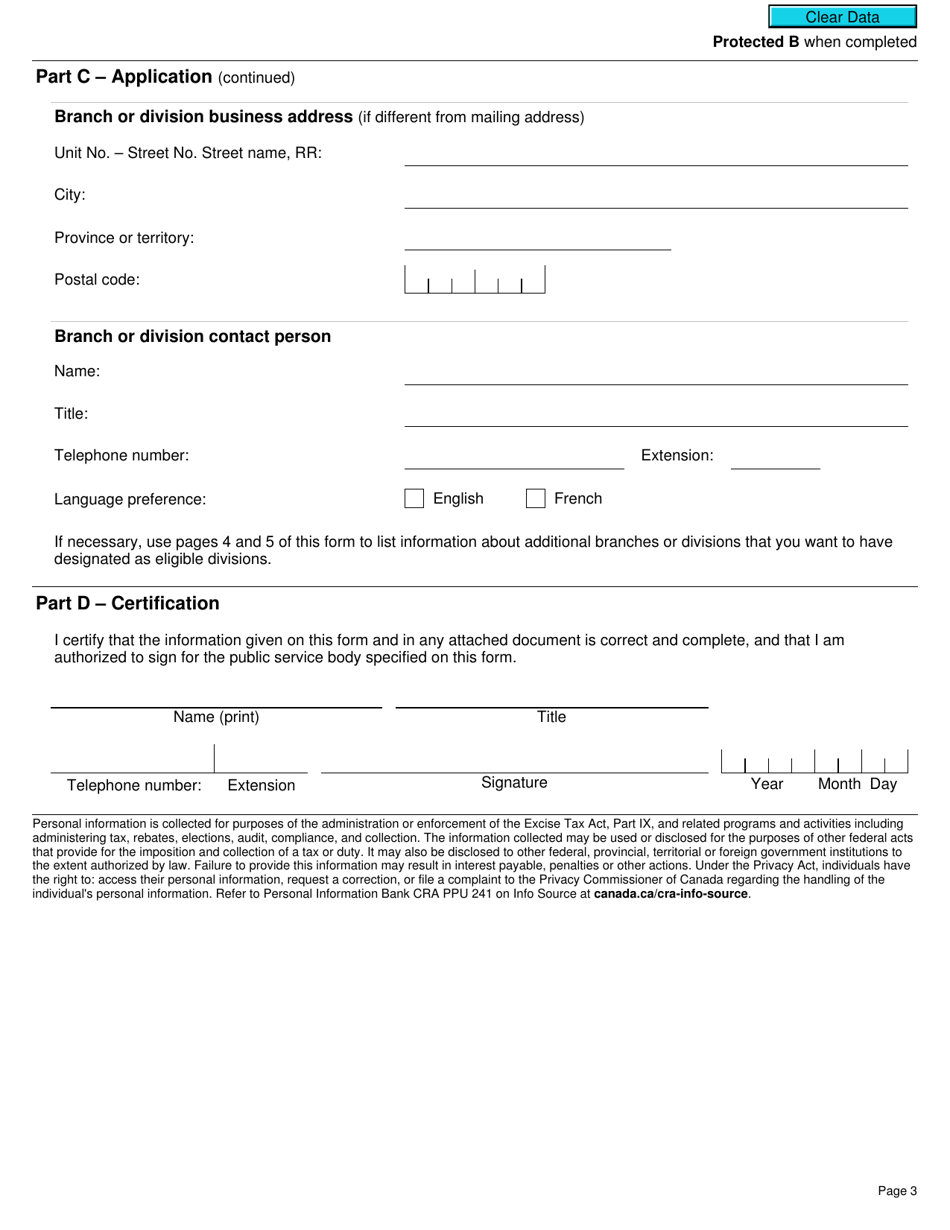

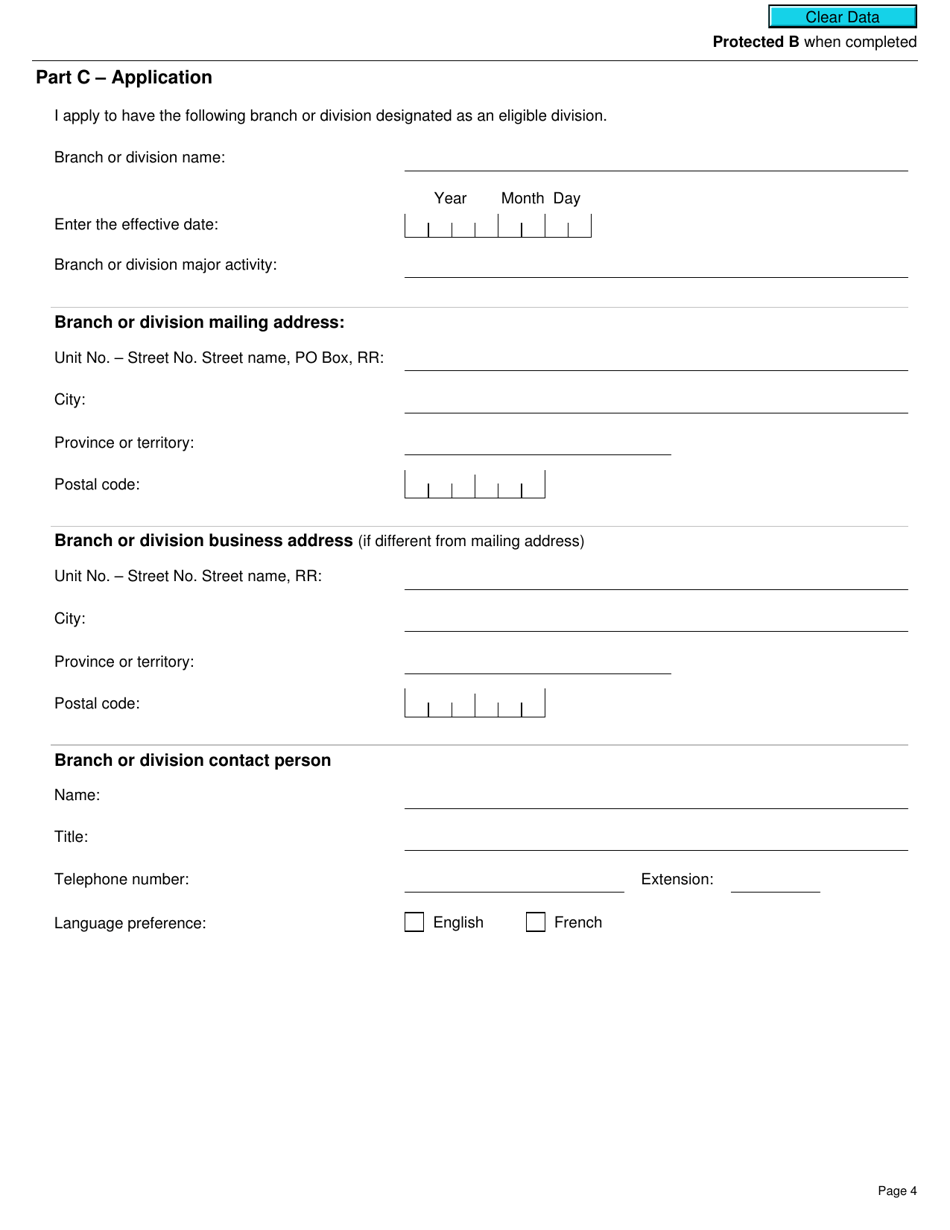

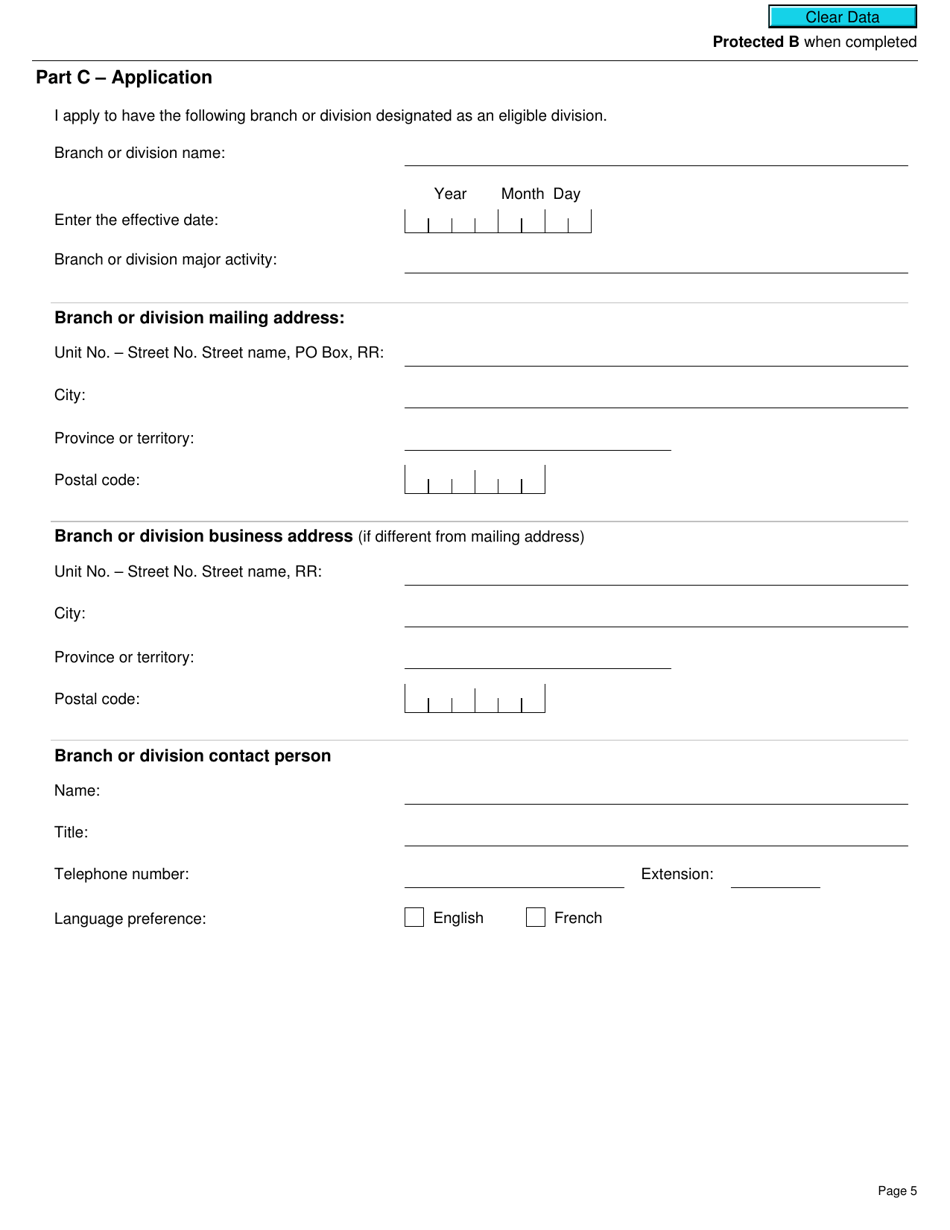

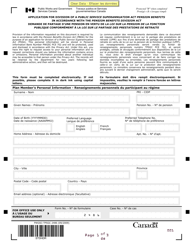

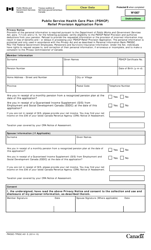

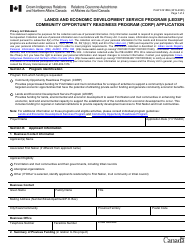

Form GST31 Application by a Public Service Body to Have Branches or Divisions Designated as Eligible Small Supplier Divisions - Canada

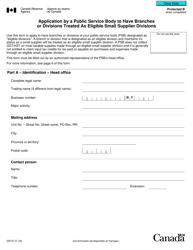

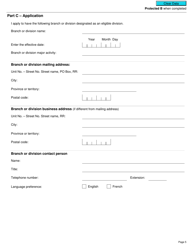

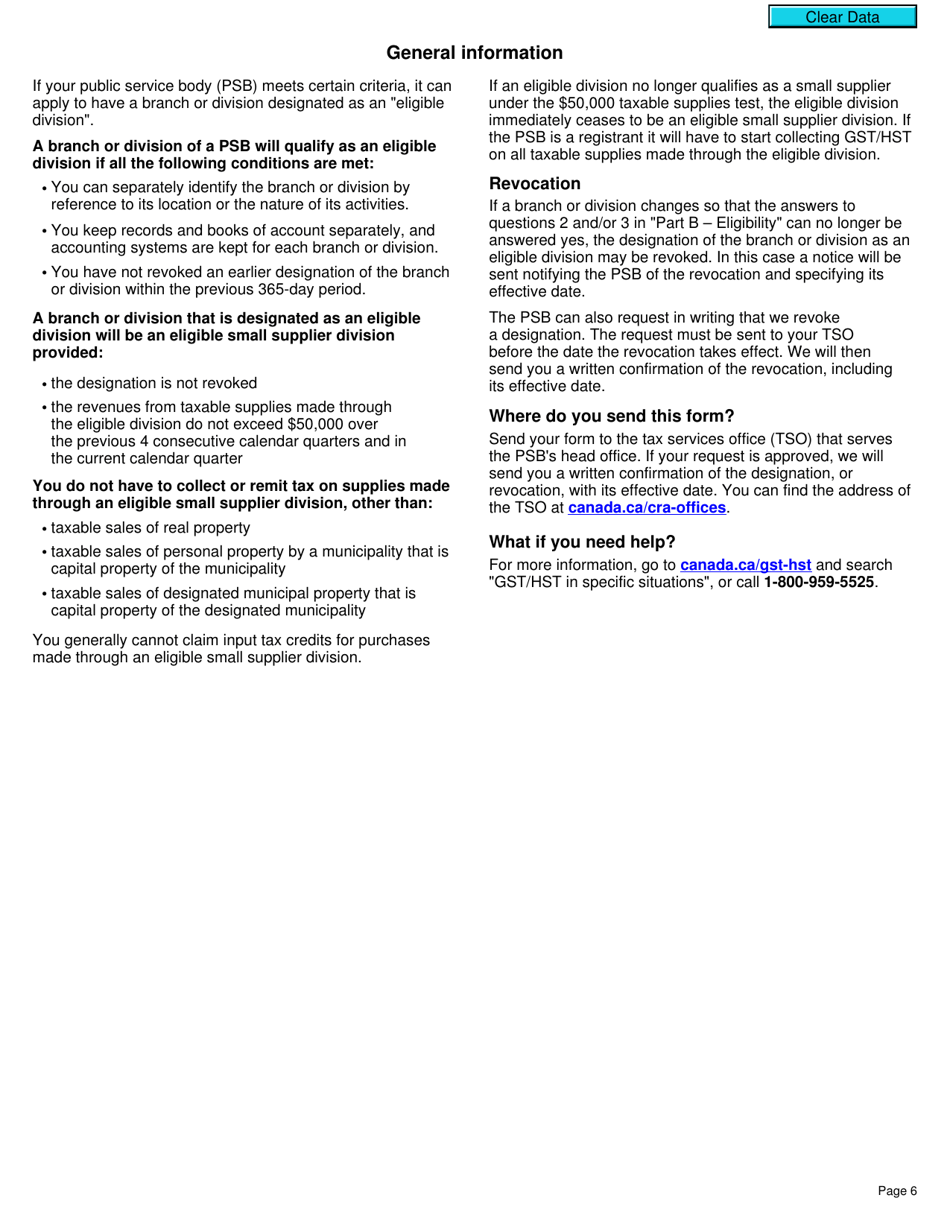

Form GST31 Application by a Public Service Body to Have Branches or Divisions Designated as Eligible Small Supplier Divisions in Canada is used by public service bodies to apply for the designation of their branches or divisions as eligible small supplier divisions. This designation allows those branches or divisions to be treated as separate entities for GST/HST purposes and exempts them from certain reporting requirements.

The Form GST31 Application is filed by a public service body in Canada to have branches or divisions designated as eligible small supplier divisions.

FAQ

Q: What is GST31?

A: GST31 is an application form in Canada for a Public Service Body to have its branches or divisions designated as eligible small supplier divisions.

Q: What is a Public Service Body?

A: A Public Service Body refers to government bodies, municipalities, universities, charities, and other similar organizations in Canada.

Q: What are eligible small supplier divisions?

A: Eligible small supplier divisions are branches or divisions of a Public Service Body that meet certain criteria to be treated as small suppliers for GST/HST purposes.

Q: Why would a Public Service Body apply for eligible small supplier divisions?

A: A Public Service Body may apply for eligible small supplier divisions to exempt those divisions from collecting and remitting GST/HST, if their annual taxable supplies are below the small supplier threshold set by the government.

Q: What is the purpose of the GST31 application?

A: The purpose of the GST31 application is to request the designation of branches or divisions of a Public Service Body as eligible small supplier divisions for GST/HST purposes.

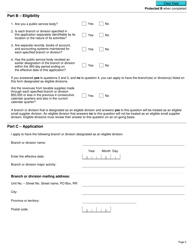

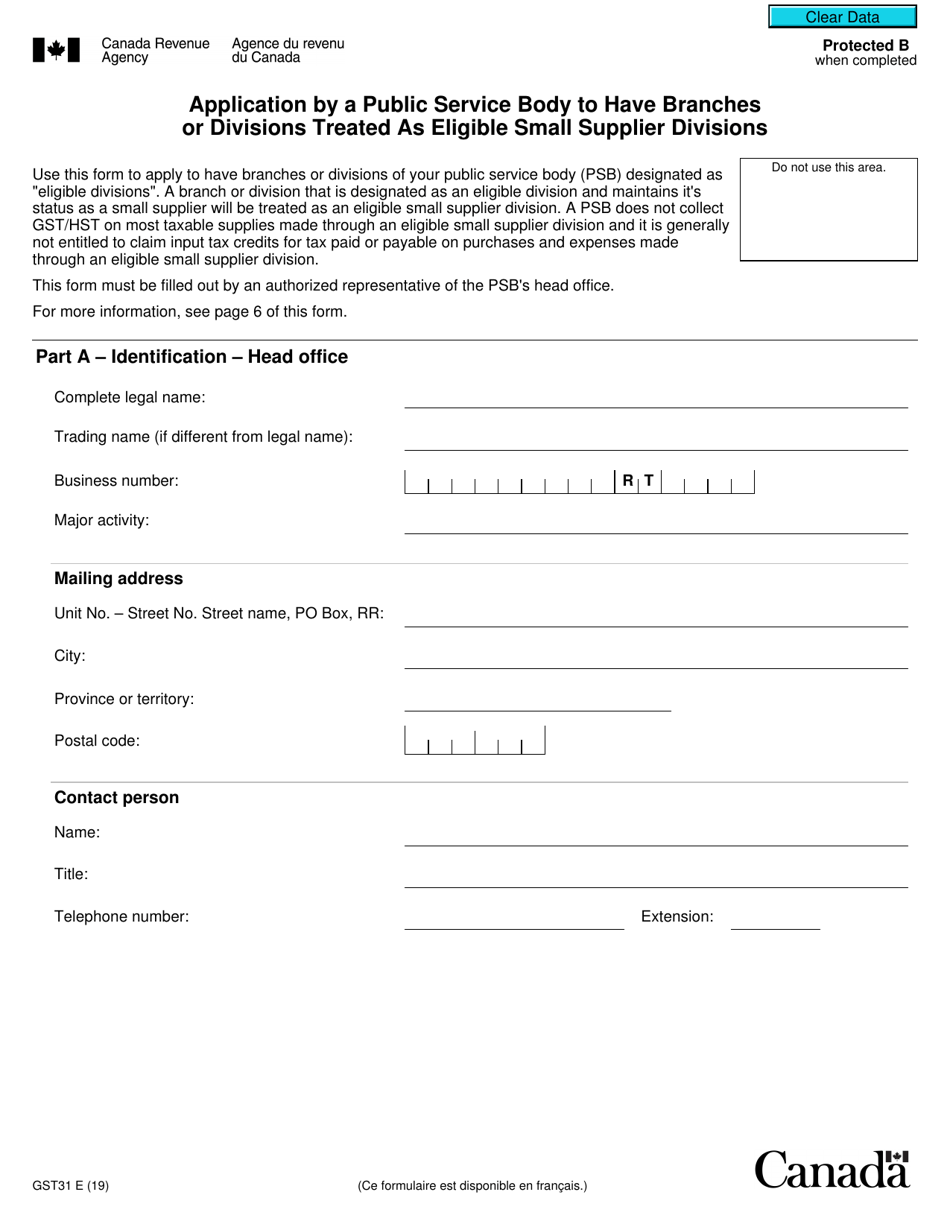

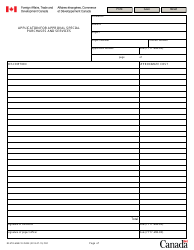

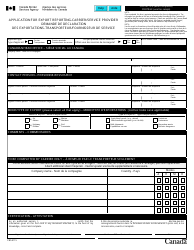

Q: What information is required in the GST31 application?

A: The GST31 application requires information about the Public Service Body, its branches or divisions, and their eligibility criteria.

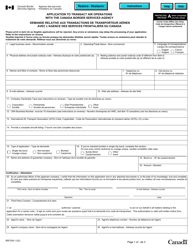

Q: Who can submit the GST31 application?

A: The GST31 application can be submitted by an authorized representative of the Public Service Body.

Q: What happens after submitting the GST31 application?

A: After submitting the GST31 application, the Canada Revenue Agency will review the application and notify the Public Service Body of the decision.

Q: Is there a fee payable for the GST31 application?

A: No, there is no fee payable for the GST31 application in Canada.